Hope your brackets are holding strong! The weekend flushed out any remaining perfect brackets – lots of upsets!

Over the weekend, UBS agreed to purchase Credit Suisse. This is another step towards restoring some confidence in the global banking system, but the Fed may now be stuck between a rock and a hard place as they work to soften banking issues while simultaneously continuing their fight against persistently high inflation. To state the obvious, there will be a lot of attention on Wednesday’s Fed meeting.

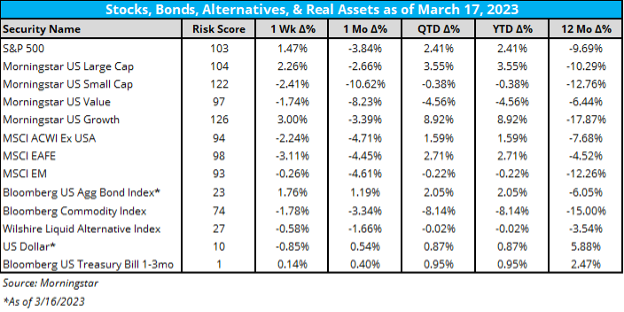

Regarding over-all performance last week:

- The S&P 500 was up over 1% on the week and is up over 2% on the year (Morningstar, Mar. 2023).

- Gains are being led by large caps and growth stocks, which are up 4% and 9% year-to-date, respectively (Morningstar, Mar. 2023).

- International stocks were down over 2% last week but are still up nearly 2% year-to-date (Morningstar, Mar. 2023).

- Commodities are lagging at -9% year-to-date and liquid alternatives are flat (Morningstar, Mar. 2023).

(Click on the chart to see a larger view)

How much do regional banks make up the small cap and small cap value indices? Glad you asked – because we asked Brinker Capital Portfolio Manager Michael Hadden that very same question and within minutes he gave this response:

- “About 10% for the broader indices. Russell 2000 value the most significant closer to 20%. ETFs have drifted slightly lower given the market action.”

From John Authers in Bloomberg on March 14, 2023 regarding bank runs:

- “Brian Stelter has written a very interesting piece for The Atlantic on the moral and practical difficulties of reporting on bank runs (and I don’t just say this because he mentions me). And for the most uplifting financial panics I could find, here are the bank-run scenes from Mary Poppins and It’s A Wonderful Life.”

From Ben Carlson’s A Wealth of Common Sense newsletter on March 19, 2023:

- “History is chock-full of panics, crises, crashes, ups, downs and the unexpected.”

Deeper Dive

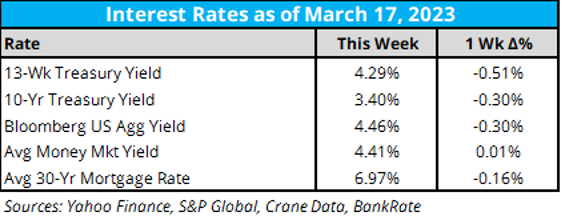

As for key rates last week:

- Interest rates were making large moves last week based off growing recession and banking crisis fears. The 2-year treasury had two days of 50+ basis point intraday changes including its biggest one-day decline since 1987 (MarketWatch, Mar. 2023).

- Last Monday’s 60 basis point decline notably exceeded the declines seen during the 2008 Financial Crisis, 9/11, and 1987’s Black Monday crash (MarketWatch, Mar. 2023).

- The 13-week treasury is down 50 basis points from the prior week, while the 10-year is down 30 basis points (Yahoo Finance, Mar. 2023).

- Bond yields also declined, but the average money market yield remained steady (Yahoo Finance).

- The European Central Bank also increased their benchmark rate by 50 basis points last week (Bankrate, Mar. 2023).

For the changing market-based expectations of what the Federal Reserve will do with short-term rates, here is the handy-dandy CME Group Fed Watch tool:

- This data went haywire for a short time while the market digested last week’s Consumer Price Index (CPI) data, with the odds of a 25-basis point increase peaking at around 90%+ Wednesday (CME Group, Mar. 2023).

- However, as of Sunday, the odds of a 25-basis point increase at Wednesday’s meeting is down to 62%, leaving a 38% chance of no Fed Funds increase at all (CME Group, Mar. 2023).

Strategas provided charts on March 14, 2023 on the dramatic change in expectations regarding Fed policy: “Fed Fund Futures Before & After Lehman’s Collapse” and “Fed Fund Futures Before & After Silicon Valley’s Collapse”.

Hat tip to money manager/market commentator Whitney Tilson, who found a short analysis on the current banking situation tweeted by @michaeljburry, who was made famous in the book and movie “The Big Short”: “This crisis could resolve very quickly. I am not seeing true danger here.”

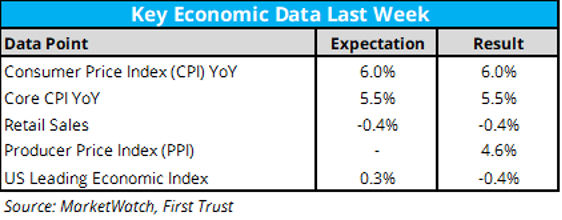

Economic data last week:

- February CPI came in at the expected rate of 6.0% (First Trust, Mar. 2023). According to First Trust, the main driver of February’s increase in CPI was housing rents, which overall make up about 1/3 of the index (First Trust, Mar. 2023). Real average hourly earnings are down 1.3% over the last year (First Trust, Mar. 2023).

- In contrast to the CPI report, the Producer Price Index (PPI) declined by 0.1% in February (First Trust, Mar. 2023). Energy prices declined 0.2% and food prices fell 2.2% (the prices for chicken eggs fell by a whopping 36% in February!) (First Trust, Mar. 2023)

- The decline in retail sales was led by declines in autos and restaurants and bars, with eight out of 13 categories seeing February declines (First Trust, Mar. 2023).

A nice chart titled “Gimme Shelter” is provided in Bloomberg Opinion showing the impact of shelter prices on CPI (Mar. 2023).

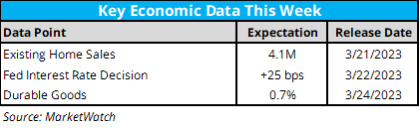

Here is the economic data calendar for this week.

- All eyes will certainly be on Wednesday’s interest rate decision. As we mentioned earlier, the market is currently pricing a 62% chance of a 25-basis point increase (CME Group, Mar. 2023).

Atlanta Fed's GDPNow projection (as of March 16, 2023) for first-quarter GDP is now at 3.2% (up 0.6% over the last week).

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Crypto prices surged last week as traditional financial institutions came under pressure. Bitcoin jumped more than 32% to near $28,000 (Decrypt, Mar. 2023). Ethereum climbed 18% to near $1,820 (CoinMarketCap, Mar. 2023). Many other tokens were up double digits, but few rivaled Bitcoins gains (CoinMarketCap, Mar. 2023).

- Macro headlines dominated markets last week, with Silicon Valley Bank collapsing, another crypto-focused bank (Signature Bank) shutting down, Credit Suisse coming under pressure, and CPI data showing continued high inflation but directionally positive (Galaxy Research, Mar. 2023). All eyes this week will be on the Fed’s FOMC meeting (Galaxy Research, Mar. 2023). Bitcoin transaction data surged last week to the highest level in nearly a year, as the market continues to unthaw (Blockworks, Mar. 2023). A date has been set for the next Ethereum upgrade, on April 12 there will be two updates that will enable staked Ethereum to be withdrawn (Galaxy Research, Mar. 2023).

- No new digital asset news last week.

Additional Resources

Check out the chart of Bitcoin returns since 2010 tweeted by Charlie Bilello of Creative Planning on March 10, 2023.

“History is largely a history of inflation, usually inflations engineered by governments for the gain of governments.” – Friedrich August von Hayek (Wikipedia, Mar. 2023).

When it comes to understanding the markets, Michael A. Gayed tweeted a meme on March 12, 2023 that says, “Stop glorifying people over cycles”. His point being, instead of listening to gurus, understand that the markets (and relative performance within the markets) cycle.

On this week’s Orion's The Weighing Machine podcast we talk to “The Inflation Guy” Mike Ashton about his latest thoughts on inflation, tips on constructing portfolios in this environment of higher inflation/interest rates, and some of the lessons he’s learned over the last 30 years. Mike has been on TWM before, and his podcasts have been popular – and for good reason, inflation is not likely to get back to 2% for a while.

Here’s an interesting and controversial article on Thrillest from February 24, 2023: “All 50 States, Ranked by Their Beauty."

On the Barking Up the Wrong Tree site from March 2023: “New Neuroscience Reveals 6 Secrets That Will Increase Your Attention Span."

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at orionportfoliosolutions.com/blog.

0835-OPS-3/21/2023

Orion Portfolio Solutions, LLC, an Orion Company, is a registered investment advisor.

Orion Portfolio Solutions, LLC d/b/a Brinker Capital Investments under the parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.