When you’re planning for goals that a client might not reach until years from today, projections are important.

One of the best projection tools an advisor can have in their planning toolkit is the Monte Carlo simulator.

While planning is inherently an ambiguous process—no one can see the future, after all—the Monte Carlo simulation was designed with ambiguity in mind as it runs hundreds, even thousands, of simulations to find the likelihood of a given plan’s success rate.

What is a Monte Carlo Simulation?

First, a little history: The origin of the Monte Carlo simulation.Every financial plan is an attempt to control risk and uncertainty by establishing the known elements of a client’s financial life, and using those to gauge success in the future.

The Monte Carlo simulation runs multiple times using random variables to attempt to figure out the probability of success given a set of inputs. In its most basic form for financial planning, the Monte Carlo takes a client’s current assets, expected savings, and time horizon to analyze likely asset growth to support the client’s desired income at a certain age in the future.

Where did the name come from? Turns out that its inventor, Stanislaw Ulam, enjoyed games of chance. Monte Carlo was a popular casino in Monaco. The name fit, and it stuck.

How a Monte Carlo Simulation Improves Financial Planning

Monte Carlo simulations can be beneficial for helping clients to understand the likelihood of reaching their desired financial goals in the future, but they aren’t predictors of success. It’s important that any conversation that includes a Monte Carlo analysis emphasizes that while the calculations may point to success now, time and variables may change.Over time, investor behavior will have a large impact on the final result. A client who begins to spend more because of overconfidence in their plan only sets themselves up for future failure. A Monte Carlo used to assure clients of success no matter what is clearly the wrong approach.

But that said, this isn’t the time to throw out the good with the bad.

A Monte Carlo simulation can improve financial planning by giving advisors an opportunity to demonstrate, with real data, why a plan may or may not be likely to result in what a client wants.

Financial planning is both an art and a science, and Monte Carlo simulations can bring the science part to the forefront for advisors who may need to gently guide investors toward a more realistic goal, or a better set of financial behaviors.

Monte Carlo Analysis in Financial Planning Software

Monte Carlo analysis can look different in different financial planning software, and the various calculations behind the scenes might look a little different too.When you’re looking to add financial planning software to your advisory firm, get into the details and ask the providers you’re reviewing to explain their assumptions so you can know with certainty what you’re showing to clients when you run a Monte Carlo simulation.

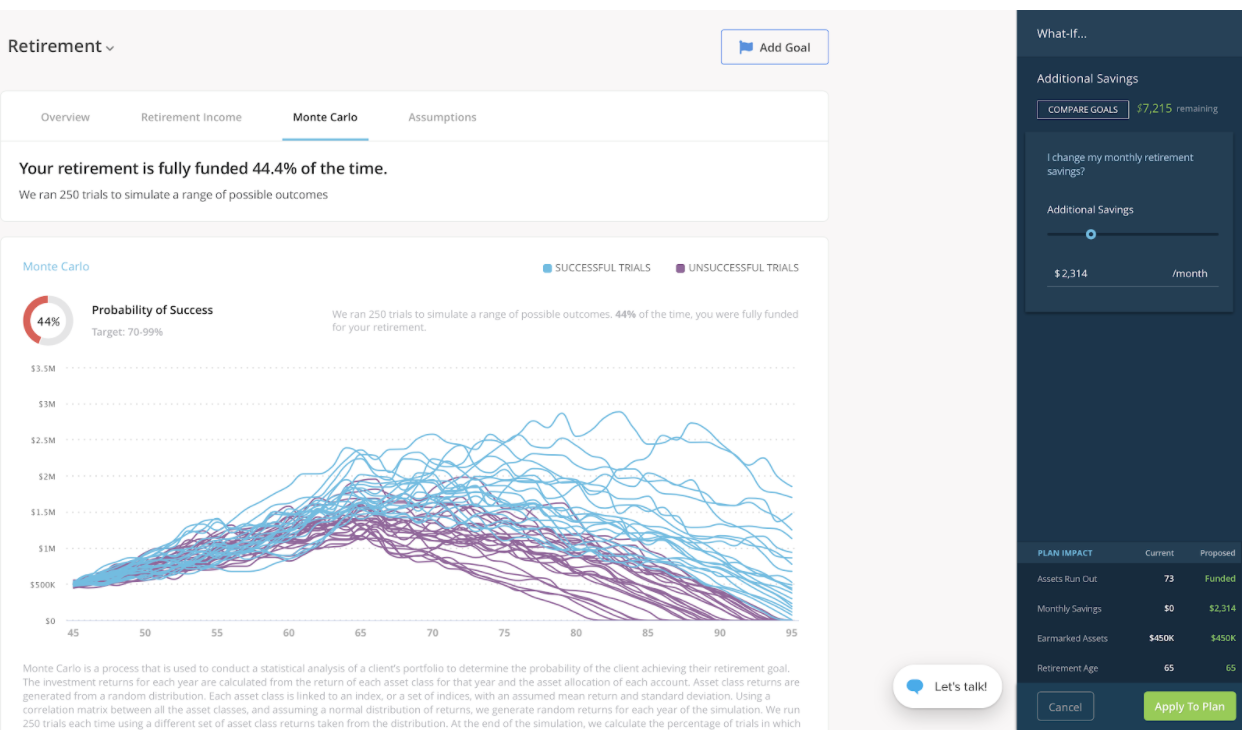

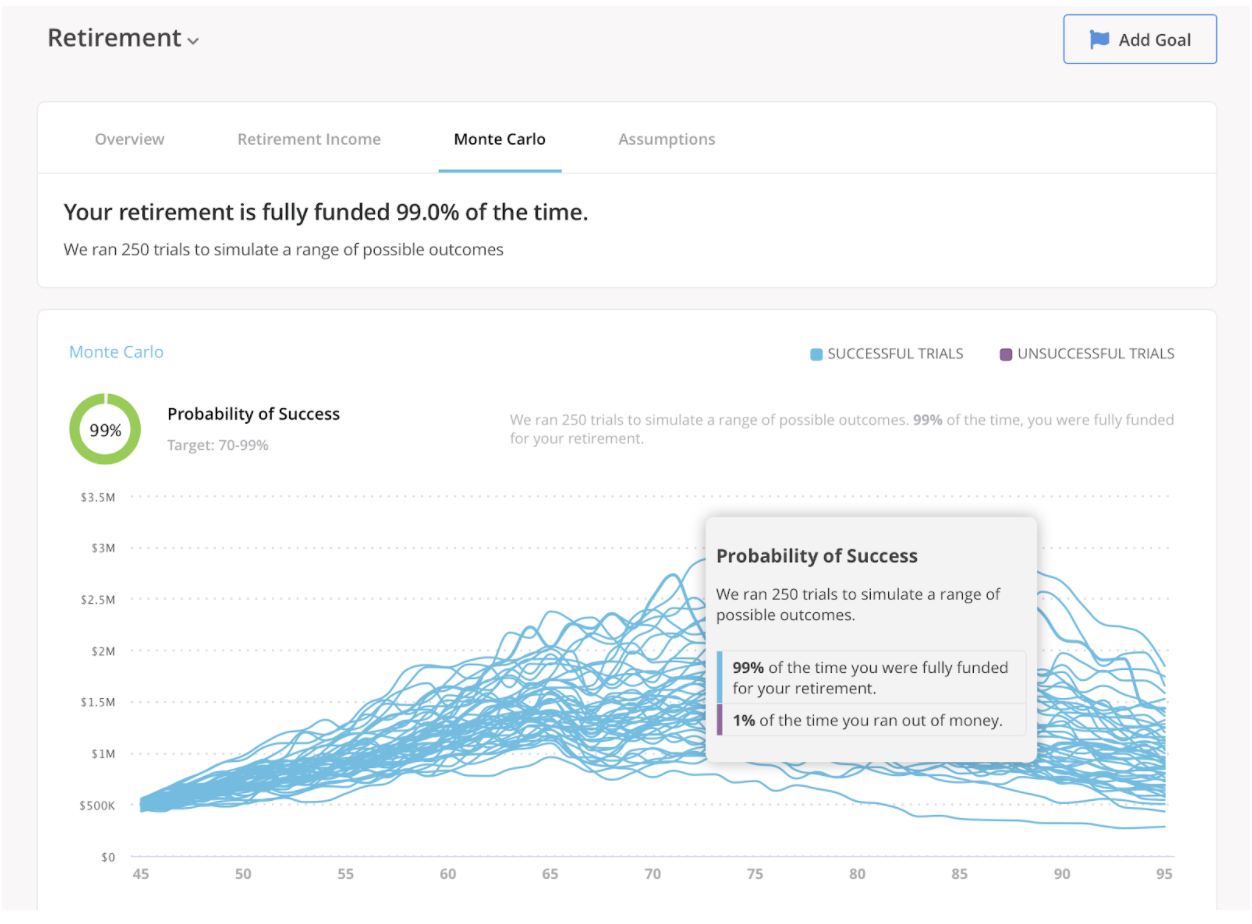

When you use the Monte Carlo simulation in Orion Planning, you get a full explanation of the assumptions we’re using each time you run a report. You also have full control over assumptions with a set of “What If” settings to tweak inputs like savings rates.

More than simply looking at if a client has money at the end of a given timeframe, the Orion Monte Carlo simulation puts a focus on instances where a client might run out of money.

Longevity risk is real for many investors, especially mass affluent clients, and by using this type of analysis, you can have better conversations with clients about the risks and behavior they need to be aware of as they work toward their financial goals.

Put your plan into action. Click here to schedule your personal demo of Orion Planning today.

0547-OAT-02/17/2021