Happy Monday! Last week the overall US market was down just over 2%, but some parts of the market finished higher, including Value stocks, particularly Small Cap Value stocks, which were up nearly 2% last week. While I would argue that the current impressive bull market just needs a bit of a breather and a pause to refresh, the laundry list of reasons for recent market weakness includes Evergrande (Chinese real estate), US debt ceiling, US tax hikes, the timing of Fed taper, rising yields, etc.

- Last week the winning streak of positive calendar month gains was finally snapped. The S&P 500 broke a seven-month winning streak and finished the month down by nearly 5%. Other TV benchmarks such as the Dow and the NASDAQ also had their worst months of the year so far. Ten of the 11 S&P 500 sectors suffered losses in September. Energy was the lone gainer, up nearly 10% in September. Value beat Growth and Small Caps beat Large Caps. The average stock in the overall US market was down less than 3%.

- Last week Ten Year Treasury Yields initially moved higher, then moved lower to essentially close unchanged at 1.47%. At one point, the 10-year was at 1.57% last week, its highest level since June 17, 2021. Yields bottomed on August 4 at 1.12%. As of this writing, yields are now at 1.49%.

- Given the recent rise in longer-term interesting rates, according to Flow Traders, US mortgage rates recently topped 3%. Flow Traders also noted that rental prices in the US are skyrocketing, with the median national rent for a one-bedroom climbing 11% since March 2020. Something to note as rents eventually flow into inflation data.

- Inflation data did come out last week, and the latest inflation data ran at a fresh 30-year high in August due to supply chain disruptions and extraordinarily high demand. The core personal consumption expenditures price index, which excludes food and energy costs and is the Federal Reserve’s preferred measure of inflation, increased 0.3% for the month and was up 3.6% from a year ago. The monthly gain was slightly higher than the 0.2% estimates and the annual forecast of 3.5%. That’s the highest since May 1991 and reflects the inflationary pressures that Fed Chairman Jerome Powell said that he finds “frustrating.” Others at the Fed are likely thinking the same thing. According to a report from TD Ameritrade, even the Fed’s expectations of U.S. inflation have been rising. In the statement following the recent FOMC meeting, Fed officials saw core inflation at 3.7% in 2021, up from its estimate of 3% in June. Powell also said in his remarks to Congress that inflation could stay higher for longer, particularly if supply chain issues persist.

- Even though the storm cloud of potentially higher inflation and interest rates won’t go away, I believe the outlook for the stock market looks mostly positive entering the last 3 months of the year. The COVID data, while still discouraging, is improving. Investor sentiment and expectations are low, and thus setting the stage for positive surprises and above-average market gains. The fourth quarter also tends to be the best quarter of the year for the stock market. According to the research firm Strategas, “strong performance begets strong performance.” As they wrote last week, during the first nine months of this year, the S&P 500 returned nearly 16%. Since 1950, there have been 22 other years where the S&P’s return in the first nine months has been greater than this year. In all but two of those years, the S&P was positive during the fourth quarter with an average return of nearly 5%. The bottom line here is that in years where performance starts strong, it historically ends strong.

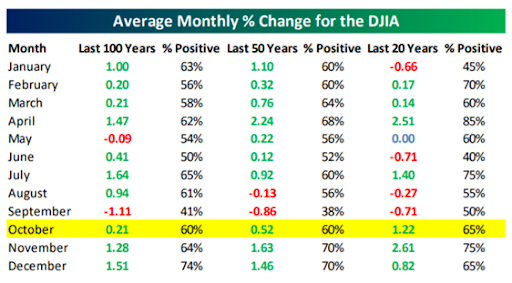

- One positive for the market, of course, is that September is over. It’s remarkable how the seasonals seem to matter most years. As for the seasonals moving forward, the story is good. Below is a table of average monthly returns for the Dow Jones Industrials (Bespoke Investments, September 2021). In short, the odds are good for more gains. Over the last 20 years, October on average has been the third-best month of the year in terms of an average gain. Nothing is infallible, of course, but there are tendencies to respect.

- On the COVID front, the data continues to improve, and the news flow was good last week given the positive trial results from Merck (MRK) regarding its oral anti-viral COVID treatment. The thought of being able to simply pop a pill to significantly reduce the chances of an adverse reaction to COVID would be a big step in returning to normal.

- Another positive is the relatively cautious investor/advisor sentiment. This is typically a leading indicator for future above-average market returns. As we’ve noted on the Monthly OPS Flows Webinar, we are NOT seeing excessive bullish sentiment. Also as mentioned in this space in recent weeks, investor sentiment is decidedly more bearish than bullish of late according to the latest AAII Sentiment Survey. Lastly, the “meme stock” fad might be fading. Online trading firm Robinhood’s popularity is fading, as its app downloads, a proxy for account openings, fell 78% in the third quarter compared with the second, said JPMorgan analysts. That compares with a drop of around 50% for Binance, Coinbase, and other crypto apps that also rode the retail trading trend. Daily active users also plunged 40% during the period, compared with 23% for crypto peers and 30% for Schwab.

- Regarding potential market-moving news flow this week, the major economic news will be Tuesday's ISM Services report and Friday's Non-Farm Payrolls. That will give investors plenty of time to focus on negotiations in Washington over reconciliation and the debt ceiling.

- Though interest in crypto assets trading is down a bit, prices aren’t. Bitcoin prices rose over 10% last week. As of this writing, Bitcoin is at $48k. Ethereum is just under $3300.

- The 230th edition of The Old Farmer’s Almanac is out, and they say it is going to be a very cold winter, warning that most Americans should prepare for a "Season of Shivers" with "positively bone-chilling, below-average temperatures across most of the United States. This coming winter could be one of the longest and coldest that we’ve seen in years. Of note, natural gas prices have been on fire of late. Though natural gas prices did slip toward the end of last week, they were still up nearly 10% last week, and at one point prices were up over 50% in just over a month. Living in a cold-weather state, let’s hope those gains are transitory!

- As they say, beauty is in the eyes of the beholder. Related to that point is another short fascinating piece from the self-described grumpy German Joachim Klement in his recent article “Social interaction gets you a better deal”. Given that we are all consumers, and we’re all also in sales, there are multiple nuggets in this article with the biggest being the importance of face-to-face interactions.

- And remember, people like us more than we think!

- Here’s a Big Number for you. 42%. The largest percentage of participants, 42%, in Transamerica's 2021 Retirement Survey identified "outliving my savings and investments" as their biggest retirement fear. Not bad health. Not dementia. No, the greatest retirement fear workers currently have is running out of money in retirement. An admitted ignorance of how to invest for retirement is part of the reason for that fear. Read Horizon Investment's Big Number Report.

- “Money goes where money grows.” Stocks are now at a 70-year high as a share of household financial wealth. Equity holdings now make up about half of the $109.2 in financial assets held by US households. This is due to a combination of increased savings, increased valuations in the market, as overall increased investment in the markets. We don’t believe this is a signal to sell out but extends the narrative of cautious optimism in the markets for the rest of the year.

- There are now multiple studies out there that women are typically better investment managers and advisors. Here’s yet another one, though it points how exactly which type of investors are most likely to panic: MIT Study Finds Older Men Most Likely To Panic.

- This week’s Orion’s The Weighing Machine podcast was a real treat for me, interviewing the industry legend Jeremy Siegel from WisdomTree. We talked about his Market Outlook Presentation at the Orion Ascent conference, including some extra goodies he didn’t present on the main stage, including what he thinks is the biggest risk to the economy/markets. Siegel’s presentation at Ascent was very popular – let’s hope this podcast is as well! By the way, late last week Siegel had an updated market outlook, which included increased concerns about inflation.

- On the topic of podcasts, BeFi (behavioral finance) expert and tactical money manager Felipe Toews was recently interviewed on Orion’s Chief Behavioral Finance Officer Daniel Crosby’s podcast Standard Deviations. It was a great conversation on market drawdowns and how advisors and investors should prepare for them – and more!

- Here’s an “Awesome” picture for this week. It’s a picture taken in Malaysia a few years ago. It’s really awesome.

- For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or benjamin.vaske@orion.com.

- Thanks for reading and have a great week!

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.