After a long cycle of deliberation and speculation, President Trump announced on January 30th that he has chosen former Fed Governor Kevin Warsh as his nominee to be the next Chairman of the Federal Reserve Board of Governors. While Trump applied public pressure on Jay Powell towards the end of his term, we find it to be an important point that he never moved against Powell, which is supportive of the Fed’s relationship with the executive branch over the next few years as well as the likelihood of Warsh’s confirmation. Warsh’s confirmation hearing is not yet scheduled, but Powell’s term expires May 15th. As we move into a new era, let’s look at Warsh’s background, the market’s reaction to his nomination, and what we’re expecting moving forward.

Warsh Bio/Background

- Warsh graduated from Stanford University before attending Harvard Law School. He is not a PhD economist, but brings Wall Street experience to the position, joining the likes of Jerome Powell and Paul Volcker in that regard. Warsh worked at Morgan Stanley early in his career before joining the Bush administration as an economic advisor.

- Warsh was nominated to the Federal Reserve Board of Governors in 2006 at the age of 35, making him the youngest member of the board in history at the time. He worked under Ben Bernanke through the Great Financial Crisis. There he became known for his hawkish stance on inflation relative to his peers and his great concern with Bernanke’s quantitative easing policy, which greatly expanded the size of the Fed’s balance sheet over the next several years.

- After his time with the Fed, Warsh notably joined legendary investor Stanley Druckenmiller’s firm as an advisor and worked with him for many years. Treasury Secretary Scott Bessent also spent a significant amount of time working for Druckenmiller, meaning two of the leading monetary and fiscal policymakers in the U.S. share a similar pipeline. In response to public concern about Warsh’s hawkish view during the financial crisis, Druckenmiller said recently, “The branding of Kevin as someone who’s always hawkish is not correct. I’ve seen him go both ways.”

- Especially given his hawkish past, critics of Warsh question his conviction in his recently dovish sentiment, wondering if his change in sentiment was a way of campaigning for the position of Fed Chair.

Market Reaction

- At the time of the announcement, markets were split between Warsh and BlackRock Global Fixed Income CIO Rick Reider as potential candidates. Warsh is viewed as the more hawkish of the two, and, regardless of the truth behind that sentiment, markets reacted accordingly.

- The U.S. dollar, which has been in decline for over a year as rates have come down, spiked nearly 1% on 1/30 after the news.

- The sentiment of a stronger-than-expected dollar moving forward posed a threat to the dollar debasement trade turned behavioral FOMO trade on gold and silver, which had pushed the metals into parabolic growth over the past few months. These trades aggressively unraveled on 1/30: gold dropped over 11% and silver dropped over 31% in one day – its largest single-day drop since 1980.

- While long-term structural tailwinds persist for gold and other metals, this pullback deflated much of the “irrational exuberance” that may have taken shape in the space. The metals have since recovered mildly from the selloff.

- While long-term structural tailwinds persist for gold and other metals, this pullback deflated much of the “irrational exuberance” that may have taken shape in the space. The metals have since recovered mildly from the selloff.

- Equities were off mildly but haven’t reacted strongly to the news, as Warsh’s nomination did not disrupt any prevalent equity themes.

What Kind of Fed Chair will Warsh Be?

- Warsh believes we’re in the early stages of a productivity boom driven by AI. If strong real growth continues and is boosted by an increase in productivity, the economy would have much more room to run before inflation would start to become a concern, potentially supporting more dovish policy in the short term. President Trump has made it clear that he expects rate cuts from his nominee, and the increasing likelihood that Powell will not be cutting through the end of his term makes it easier for Warsh to cut rates when he takes the seat.

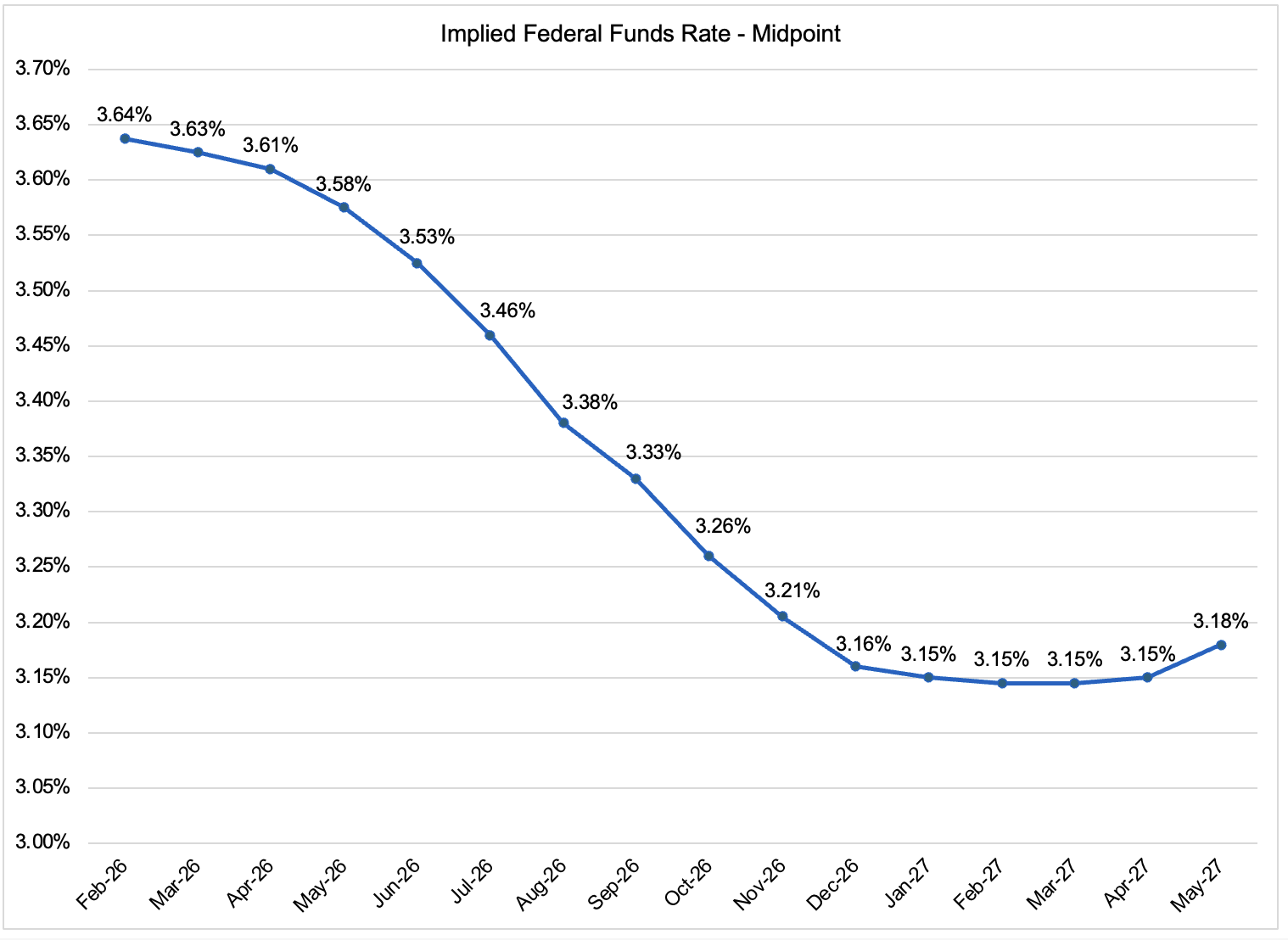

- Futures markets continue to see two 25bps cuts in 2026 as the base case, which would leave the target range at 3.00%-3.25%. As of this writing, the market appears to see that range as close to neutral, as 2027 futures don’t imply any additional cuts early next year.

Source: CME Group, as of February 4th, 2026

- It is widely reported that Warsh supports shrinking the Fed’s balance sheet and returning the Fed’s relationship with fixed income markets to a longer-term equilibrium after 15+ years of heavy intervention. This means selling Treasury securities back into the market, which tightens financial conditions and reduces central-bank supplied liquidity. However, he will certainly feel pressure not to deliberately cause a yield spike at the long end of the curve, as housing affordability and the debt are two key issues the administration is wrestling with as midterms are approaching. This means that if Warsh wants to remove central bank demand for Treasuries, he must source it from somewhere else, and financial deregulation may be the answer. By loosening restrictions, private banks can be a liquidity source for markets in the Fed’s absence.

Bottom Line

While the Chairman of the Fed doesn’t have the authority to dictate monetary policy on his own, we will be interested to see how Warsh seeks to sway the Board of Governors, especially early in his term. Expected rate cuts in his first few meetings, the possibility and impact of balance sheet reduction, and the potentially correlated banking deregulations that may result will be near-term policies to keep an eye on.