Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- One could argue that over the past few years the primary concern for US investors – even more so than trade and tariffs; fiscal and monetary policy uncertainty (would the One Big Beautiful Bill Act pass, would government shutdowns upend the economy, would the Fed cut rates) and geo-political risk (Israel / Iran; US / Iran and Ukraine / Russia) – was over a stock market dominated and driven by a handful of large cap technology companies that would inevitably and unfortunately fall from favor and pull the S&P 500 sharply lower (we are of course referring to the Magnificent 7, which at its peak represented nearly 40% of that bellwether index).

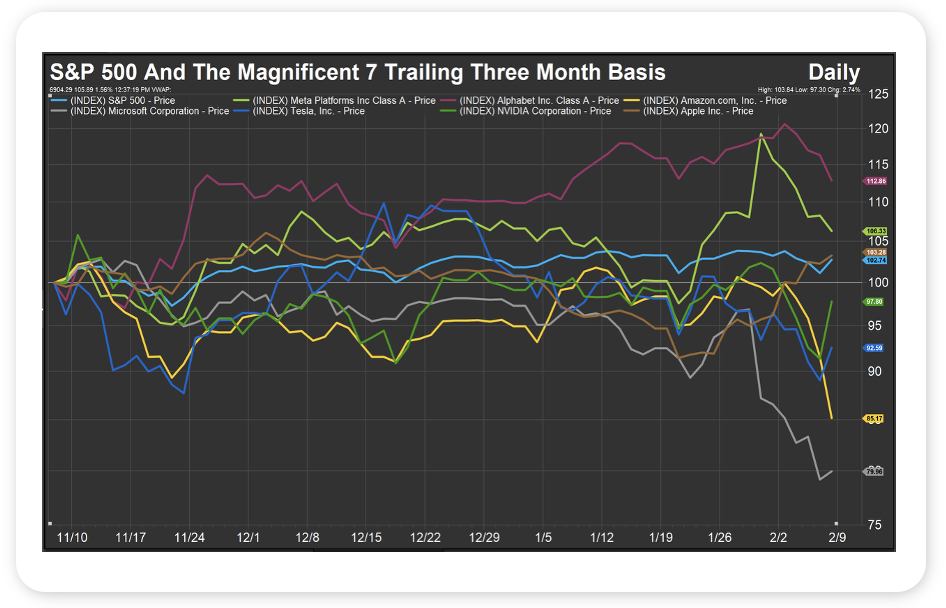

- Yet, as we take pen to paper, four of the Magnificent 7 – Microsoft, Nvidia, Tesla, and Amazon – have fallen over the prior three months while the S&P 500 has traded up by 2.7%, just shy of Apple’s 3.3% gain (see chart; through 2/6/2026). Now, three months might not a trend make and we are not rooting against the Magnificent 7 specifically or large cap US tech stocks generally, but it seems to us that US equity returns have broadened out beyond the stocks that contributed so much to the bull market that kicked off in 2022. To put a finer point on things, since early November, the Russell 1000 Growth Index is off 3.8%, while the Russell 1000 Value Index is up 10.3% and the Russell 2000, the benchmark for US small cap stocks, is up 10%.

- An optimistic take on recent performance trends is that even as much of US large cap tech moves lower, the broad market is being propelled higher as other styles and sectors, including materials and industrials, and smaller companies catch a bid, which should both make for a healthier and more durable bull market (as more stocks participate in it) and speak to a more optimistic outlook for the overall economy (as a rising economic tide lifts more boats).

It's been a volatile few weeks for the market, and while the Magnificent 7 could still be the catalyst for a broad and deep sell off, for now the US bull market marches on, propelled, it seems, by the “The Forgotten 493.”

Source: FactSet, February 6, 2026

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets were choppy, with the S&P 500 finishing roughly flat after a sharp midweek selloff and a strong Friday rebound. Weakness was concentrated in technology and software, while other parts of the market continued to show strength, extending the rotation that has defined early 2026.

Performance leadership remained diversified. Small caps and value stocks each gained more than 3% on the week, and emerging markets also advanced. Small caps, value, and EM are now roughly tied as the leading equity segments YTD at just over 7%.

The temporary government shutdown ended early in the week. Manufacturing data stood out in a positive way. The ISM Manufacturing Index moved back into expansion territory at 52.6, its highest reading since 2022. While trade policy uncertainty remains a headwind, a return to expansion is a constructive signal for an industry that has struggled for several years.

The 10Y Treasury yield fell as low as 4.16% during the equity selloff before rebounding above 4.20% as markets recovered.

This Week

With the shutdown resolved, key data returns to the calendar. The delayed employment report will be released Wednesday, with expectations for the unemployment rate to hold at 4.4%. CPI and retail sales will also be released, putting labor conditions, inflation, and consumer health back at the center of the conversation within a short window.

Earnings stay in focus, particularly in software. Several names that were hit hard last week report earnings, including Robinhood, AppLovin, Coinbase, and Shopify. Given recent price declines, results and guidance could matter more than usual.

The broader takeaway remains intact. Beneath headline volatility, market breadth is improving, leadership is rotating, and pullbacks are being met with repositioning rather than panic. For long-term investors, last week was another reminder that short-term swings matter far less than staying disciplined through them.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.