Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- One concern confronting investors is our budget deficit…more specifically the fear that as we continue to borrow vast amounts of money, interest rates must rise to incent the incremental lender to buy our bonds, and that higher rates will weigh on stock market multiples as well as consumer and corporate borrowing and spending. And the concern seems a valid one, as the US is expected to run a deficit of 6% of GDP – or $1.9 trillion – this fiscal year.

- I have never been a big fan of debt – my parents lived through the Great Depression and always stressed to me the need to live within my means – and I would like to see this great country of ours get its financial house in order. That written, I am not that worried about the impact of the deficit on the US economy or risk assets over the near-term if for no other reason than just about every other important economy in the world has its hand out as well.

- Consider – while keeping in mind that these are broad estimates – China is running a budget deficit of 9% of GDP; India 4.4%; Japan, 4.6%; the UK 4.6% and even Germany, long known for its fierce aversion to debt, 2.3%. As to what is driving these deficits, it is mostly increased spending on social programs as populations age and increased spending on infrastructure and defense as the geo-political backdrop remains unsettled, along with a reluctance to raise taxes (all conditions that are present in the US). I do recognize that the absolute amounts being borrowed by these nations vary as the sizes of their economies vary, but I believe the general point holds…that since all of the world’s leading economies are engaging in deficit spending, they will all, at the margins, be able to borrow on terms more favorable than if one or more were paragons of fiscal virtue, running budget surpluses and reducing outstanding debt…said differently, all of these countries benefit from the fact that none of them are in really great shape from a balance sheet point of view.

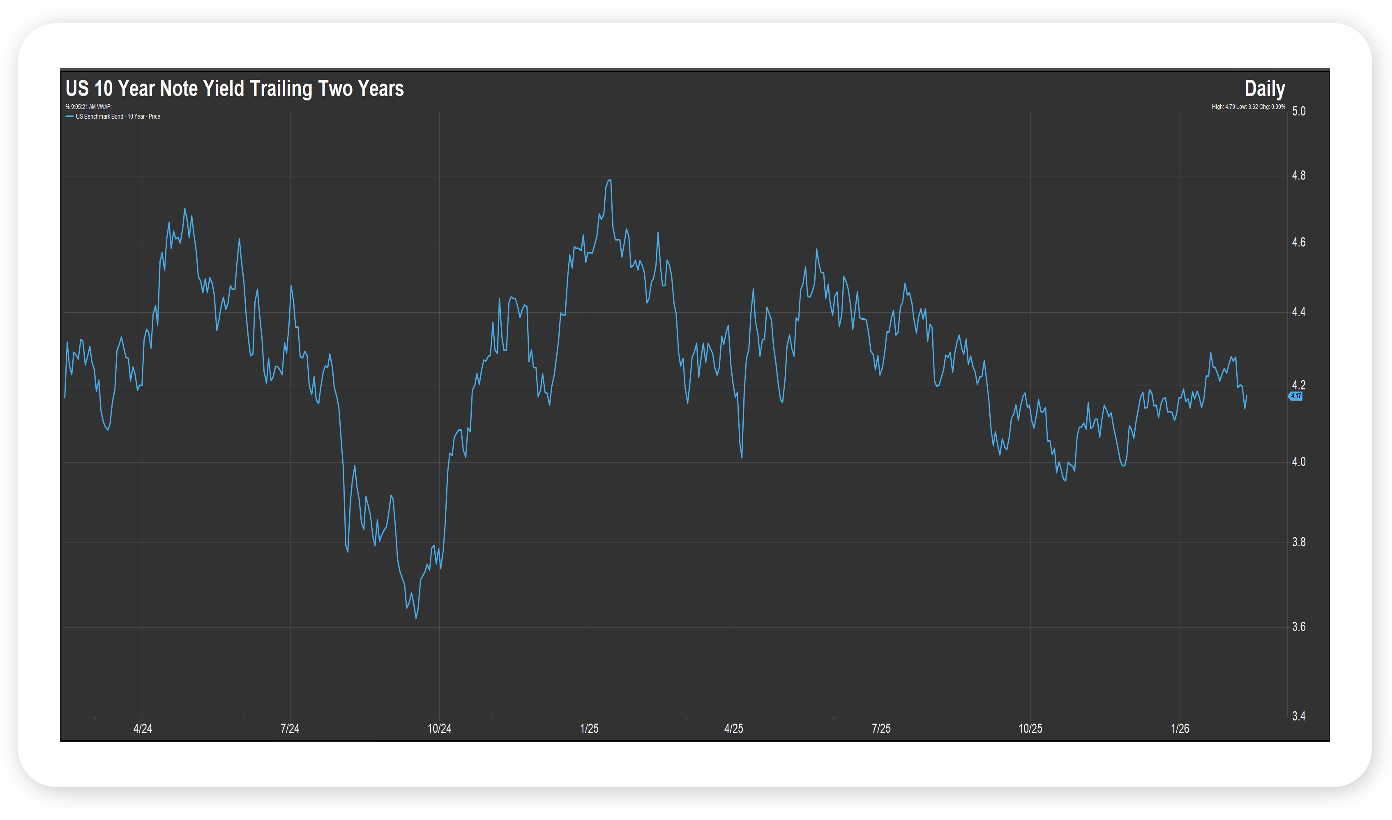

- We think that benign backdrop for ongoing US borrowing is best represented by the yield on the US 10 Year Note, which sits at 4.17%, unchanged over the past two years (see chart). The bond market seems to have little interest in holding our country to account for its fiscal profligacy, while ongoing deficit spending should prove stimulative to the economy – ours and the world’s – this year.

Source: FactSet, February 12, 2026

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

U.S. equities continued to struggle, led by weakness in technology. All seven members of the Magnificent Seven are now negative YTD, and the S&P 500 sits roughly flat for the year while the NASDAQ is down about 2%. The shift in leadership has been notable, with value, small caps, and international equities outperforming.

Bond markets responded to equity weakness. The 10Y Treasury yield dropped from 4.21% to 4.06%, lifting bond prices. Early in 2026, bonds are also outperforming U.S. equities.

The annual nonfarm payrolls revision reduced prior payroll estimates by nearly 900,000 jobs. While that adjustment meaningfully lowers the estimate of 2025 job growth, current labor conditions remain stable. January payrolls rose 130,000, and the unemployment rate ticked down to 4.3%.

Inflation continued to ease. CPI rose 0.2% in January and is now up 2.4% year over year, only modestly above the Fed’s 2% target. Both headline and core inflation are near their lowest twelve-month readings since the inflation spike began nearly five years ago.

This Week

It is a heavy week for economic data, much of it concentrated on Friday. Fourth quarter GDP, the Fed’s preferred inflation gauge PCE, and several housing releases will all be published. Many of these reports were delayed due to last fall’s government shutdown.

Further cooling in PCE, following last week’s softer CPI, could meaningfully influence rate expectations for the remainder of the year. Markets currently assign a 90% probability of a hold at the March 18 Fed meeting.

Growth expectations have moderated slightly. The Atlanta Fed GDPNow estimate for Q4 GDP now stands at 3.7%, down from 4.2% last week. The first official estimate will be released Friday.

Earnings season continues, with Walmart headlining this week’s reports. Blended Q4 earnings growth is tracking at 13.2%, which would mark a fifth consecutive quarter of double-digit earnings growth if sustained.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.