-

Advisor Tech

-

-

Recommended

-

-

Wealth Management

-

-

Recommended

-

-

Who We Serve

-

Who We Serve

-

Individuals

- Financial Advisors

- Business Owners

- Chief Compliance Officers

- Chief Operations Officers

- Chief Technology Officers

FirmsRecommended

- Resources

-

Resources

-

Learn

Move Your Book

with ConfidenceWe'll Handle the Heavy Lifting

Our dedicated onboarding team makes moving your business to Orion Portfolio Solutions simple, secure, and stress-free — so you can stay focused on your clients.

30-45

DaysNumbers of days we provide

dedicated advisor training.14

MonthlyThe number of book moves

we complete each month.How We Move Your Business to Orion

— Step by StepStep One

Initial Discovery and Planning

You’ll meet with your regional consultant to clarify your business goals and create a customized transition roadmap.

Step Two

Dedicated Advocate and Training

Your dedicated Onboarding Advocate introduces you to the Orion Portfolio Solutions platform and coordinates hands-on training.

Step Three

Book Move and Account Setup

We assist in moving your book of business and setting up your accounts — helping to ensure a smooth, secure, and timely transition.

Step Four

Graduate to Service Team

Once your onboarding transition is complete, you’ll be connected with your dedicated Service Team to support your ongoing success.

Why Advisors Choose OPS

for Growth and ScaleStreamline, scale, and deepen client relationships with:

- Access to a curated list of UMA, SMA, and HNW managers.

- Ongoing institutional-grade due diligence.

- On-demand and personalized reporting capabilities.

- Orion Planning Behavioral Finance tools: BeFi20, 3D Risk Questionnaire, PulseCheck, and Protect, Live, Dream (PLD).

- Custom fee schedules and payout dashboards. Scalable tax transitioning and tax-loss harvesting.

Free Resources

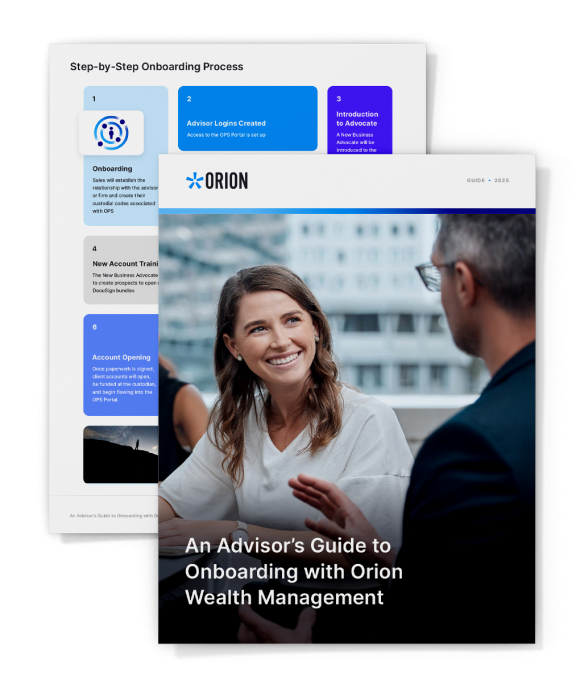

Free ResourcesOrion Wealth Management Onboarding Guide

Download our step-by-step guide for a deeper dive into the process and best practices.

Event

Fear-Free Transitions: How Advisors Move to Orion with Confidence

July 15, 2025 | 10:00 AM (CST)Learn MoreThinking about moving your book to Orion — but worried about the process? You’re not alone. Many advisors hesitate to switch platforms because of the unknowns: repapering, client disruption, and the fear of getting stuck mid-transition.

Join us for this 20-minute session where you’ll hear how Orion helps make transitions smoother, simpler, and more supported. We’ll walk through our proven onboarding approach and show you how we tailor the experience whether you’re starting small or bringing over your full book.

Smooth, Stress-Free Onboarding

from the StartYou don’t have to do it alone. From tailored training to full-service book moves, our onboarding team will guide every step of your transition to OPS — with a focus on speed, accuracy, and your long-term success.

Orion Portfolio Solutions, LLC, an Orion Company, is a registered investment advisor.

Custom Indexing, offered through Orion Portfolio Solutions, LLC, is an investment strategy wherein a portfolio is managed to mimic an index or other portfolio, while taking into account the tax position, holdings, and individual investing preferences of a client. The performance of a portfolio using custom indexing may vary significantly from the target index (referred to as tracking error or tracking difference), and this variance may increase with greater customization within a portfolio.

Tax-loss Harvesting is a process by which securities trading at unrealized losses are sold to realize a taxable loss. Proceeds from the sales are then used to reinvest in alternate securities to maintain market exposure. Tax-loss Harvesting can be used as a strategy to offset realized gains from other investments and/or carried forward to later calendar years to offset future taxable gains.

Orion Behavioral Finance ("Orion BeFi") is the branding name of various tools and services related to behavioral finance offered by Orion Advisor Solutions, Inc. and its subsidiaries. Orion BeFi tools are crafted to help investors and their financial advisors integrate behavioral psychology research into their investment decisions. Orion BeFi tools and services do not provide investment advice.

1739-R-25175

-

-

-