-

Advisor Tech

-

-

Recommended

-

-

Wealth Management

-

-

Recommended

-

-

Who We Serve

-

Who We Serve

-

Individuals

- Financial Advisors

- Business Owners

- Chief Compliance Officers

- Chief Operations Officers

- Chief Technology Officers

FirmsRecommended

- Resources

-

Resources

-

Learn

Customize at Scale. Add Revenue. Click Once.

Manage tax-efficient, personalized portfolios at scale through the only tech-enabled solution that gives you proposal generation, trading and reporting in one place. From tax-loss harvesting and tax transitioning to ESG, easily offer high-value, professionally managed portfolios customized according to the unique needs, values and goals of your clients — and save up to 46 hours per high-net-worth account every year.¹

Direct Indexing Done Right

Direct Indexing Done RightCreate Truly Personalized Client Portfolios

Add value to client returns, reduce taxes, and scale your practice, saving up to 46 hours per high-net-worth account, per year.¹

Deliver Flexible, Tax Efficient Strategies

Access proactive and ongoing tax loss harvesting, tax-effective transitions, and set capital gains budgets.

Customize the Investing Experience

Align portfolios with your client’s personal needs or beliefs, including ESG, SRI, and faith-based screening, concentrated positions and meet sector/industry preferences.

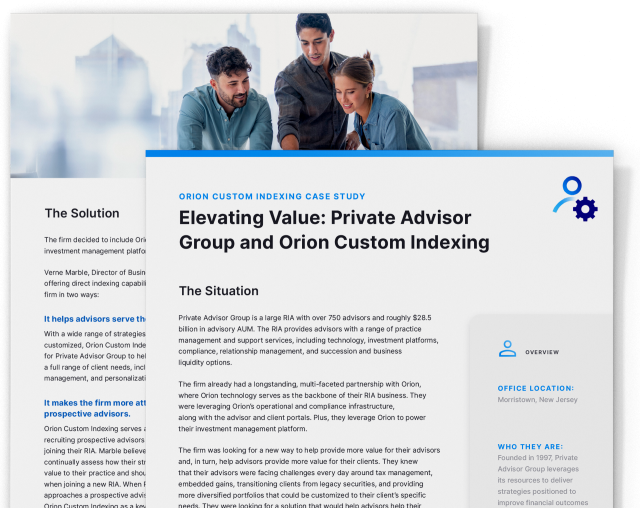

Grow Your Business

Partner with CFA Credentialed Portfolio Managers to optimize and monitor client portfolios on a continuous basis at a lower cost. Attract high-net-worth clients by delivering proactive tax management, ultimately growing your bottom line.

Streamline to Scale

Streamline trading and reporting by implementing Orion Custom Indexing via a sleeved account at the custodian of your choice. Eliminate the need for time consuming processes through ongoing tax-loss harvesting and optimize against benchmark indexes.

Be Part of the$800 Billion

Opportunity²Easily offer high-value, tax-efficient portfolios that are customized according to the unique needs, values and goals of your clients with the only solution that brings together everything you need to tap into a bigger opportunity.

Nominated for Best Technology Provider, Direct Indexing by the Wealthies.³

Set Your Firm Apart

How it Works

Learn MoreStart with the selection of a target investment mandate that aligns most closely with your client’s values, goals, and objectives. With an objective established, we customize your portfolio for tax transitions, tax management, security restrictions, and environmental, social and corporate governance restrictions.

Unlock Tax Opportunities

Learn MoreExplore how tax loss harvesting enables you to use holdings that are experiencing declines to offset the capital gains tax from those that are experiencing gains.

Customize in a Click

Learn MoreSave time and streamline trading, reporting, and account maintenance by implementing custom indexing when you leverage Orion's premier technology suite.

Tech that Gives You the Edge

Learn MoreScale your practice with the power of Orion’s Custom Indexing technology, including generating a customized proposal in under five minutes. Our solution is the only one out there that combines proposal generation, trading, and reporting all in one.

See it in Action

Watch NowForget what you know about traditional direct indexing and watch our webinar to see the disruptive power of Orion’s new Custom Indexing Advisor Tool in action. You’ll walk away empowered to provide clients with the personalization that they crave.

90%

of investors agree that taxes can eat at their portfolio the same way volatility can.⁴

79%

of investors believe their advisor should be focused on minimizing their tax obligations.⁴

46

Hours saved per high-net-worth account, per year, with Orion Custom Indexing.¹

Free Resource: Whitepaper

Free Resource: WhitepaperDirect Indexing: Delivering Personalization at Scale

Direct indexing has typically been limited to large portfolios due to the time, complexity and costs involved. That time is over. Learn about the technology evolution driving this movement and access insights from top advisors.

In this whitepaper, you’ll learn how to leverage direct indexing technology to:

- Bring scale to your operations

- Differentiate your firm

- Better serve and attract clients

Introducing Orion Advantage

Introducing Orion AdvantageOne Integrated UX. One Agreement. All the Power of Orion.

Orion Custom Indexing is now part of the Orion Advantage Stack, the newest way for you to seamlessly connect all the tools you need to propel productivity, delight your clients, and grow your firm.

Start Adding New Revenue

Customization driven by you. Expert guidance and support from us. All fueled by one of the top All-in-One Software Programs by market share among advisors.⁵

Dig DeeperRelated Content

¹Source: Proprietary Orion data, as of 7/28/2023.

²Source: Cerulli Associates Projects Direct Indexing Assets to Top $800 Billion by 2026 While Outpacing Growth of ETFs, Mutual Funds, and SMAs, Cerulli, 2022.

³Source: WealthManagement.com Announces 2025 Industry Awards Finalists, WealthManagement.com, 2025.

⁴Source: Orion Research, July 2021. Orion’s Research Initiative maintained a +/- 2.9% margin of error among consumer investors across generations and a +/- 3.8% error rate among Financial Advisors. A mixed methodology was applied that included a robust base of more than 2000 constituents in the online surveys and dozens of in-depth interviews on the topic.

⁵Source: T3/Inside Information Advisor Software Survey, 2025. Orion holds the #1 market share for CRM, Portfolio Management/Reporting Tools, and Portfolio Design Solutions. Orion also ranks in the Top 3 [by market share] for All-In-One Software, Trading and Rebalancing, TAMP, and Risk Intelligence.Orion Portfolio Solutions, LLC, an Orion Company, is a registered investment advisor.

Custom Indexing offered through Orion Portfolio Solutions, LLC a registered investment advisor.

Custom Indexing is an invest strategy wherein a portfolio is managed to mimic an index or other portfolio, while taking into account the tax position, holdings, and individual investing preferences of a client. The performance of a portfolio using custom indexing may vary significantly from the target index (referred to as tracking error or tracking difference), and this variance may increase with greater customization within a portfolio.

Tax-loss Harvesting is a process by which securities trading at unrealized losses are sold to realize a taxable loss. Proceeds from the sales are then used to reinvest in alternate securities to maintain market exposure. Tax-loss Harvesting can be used as a strategy to offset realized gains from other investments and/or carried forward to later calendar years to offset future taxable gains.

This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation, and the particular needs of any specific person. This material does not constitute any representation as to the suitability or appropriateness of any security, financial product or instrument. There is no guarantee that investment in any program or strategy discussed herein will be profitable or will not incur loss. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended and should understand that statements regarding future prospects may not be realized. Investors should note that security values may fluctuate and that each security's price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not a guide to future performance. Individual client accounts may vary.

Orion has not compensated Verne Marble from Private Advisor Group specifically or directly for this testimonial but they could from time to time receive gifts or entertainment as part of our normal business relationship or their firm may participate in marketing or administration support agreements with Orion. None of these occurrences are in place in order to compensate Verne Marble for the supplied statements.

1695-R-25169

-

-

-