With rising interest rates, soaring inflation, global unrest, and other concerns, clients are understandably worried about the impact this perfect storm of market and economic challenges might have on their current investments and their future financial goals.

And in spite of how ultimately effective it may be in the long term, advice to just “stay invested” won’t alleviate the rising concerns being continuously stoked by media outlets and political campaigns.

Today’s advisor needs a more robust toolkit to inspire the kind of impactful client conversations that keep investors comfortable and confident in their investment strategies in spite of what’s going on in the world externally.

And doing so could have a bigger effect than strengthening current client relationships — it could also help advisors attract and retain more business.

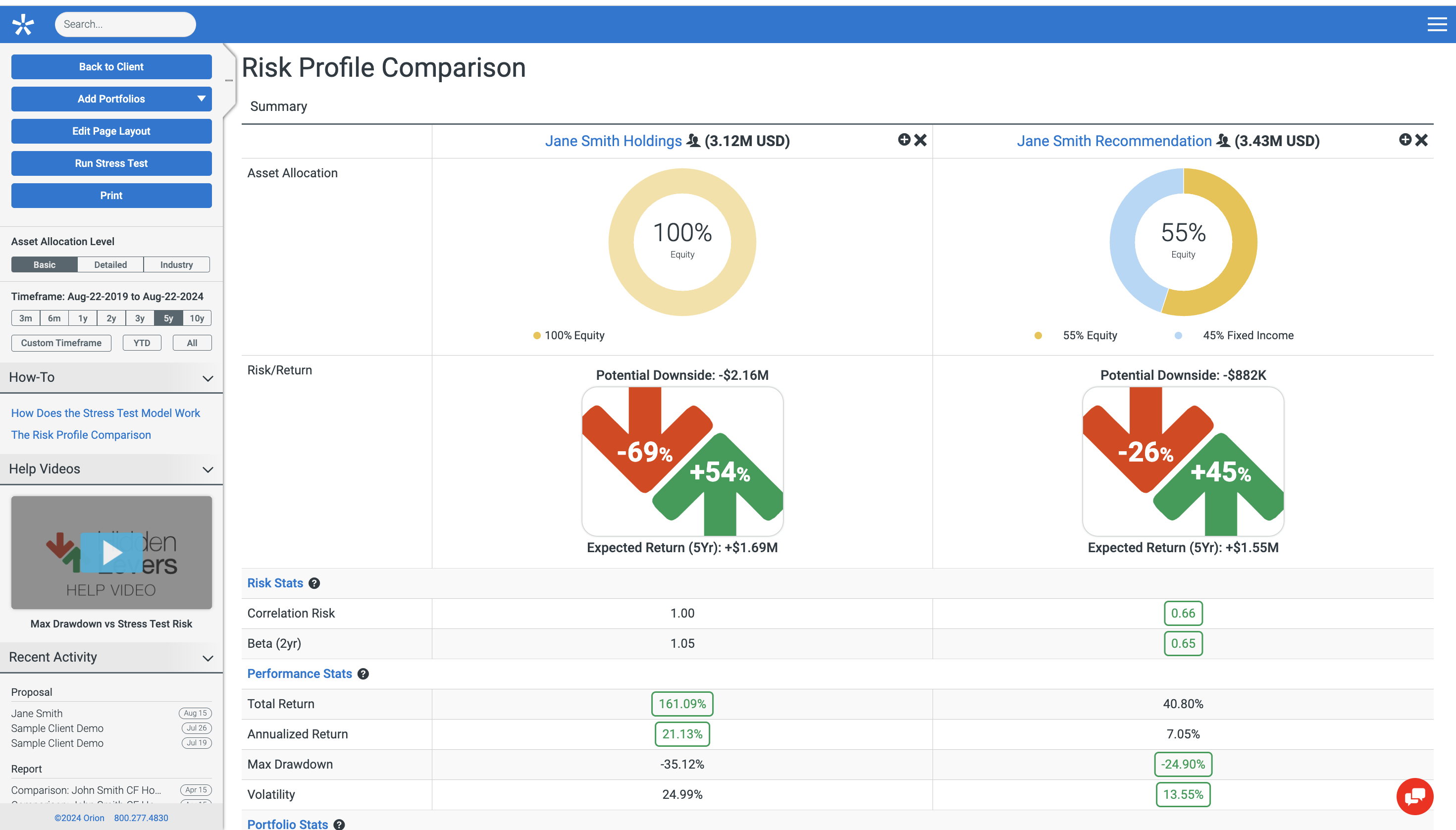

Enter financial risk analytics. A few years ago, Orion acquired HiddenLevers, a next-gen financial risk analytics and stress testing platform that we brought fully under the Orion umbrella as Orion Risk Intelligence.

And while financial risk analytics may not seem immediately apparent as a growth strategy, it can be a significant differentiator for both client experience and prospect engagement, enabling advisors to turn our current uncertain environment into a catalyst for business development.