Do you know why most investors fire their advisors? According to a Morningstar survey, poor performance is not the top reason. Instead, it’s personal. Thirty-two percent of respondents cited sub-par financial advice and services as a reason to leave, while 21% pointed to the quality of the advisor-client relationship.¹

If the top drivers of client retention are related to your relationship-building skills, investing in tools that help you strengthen ties is a wise strategic move.

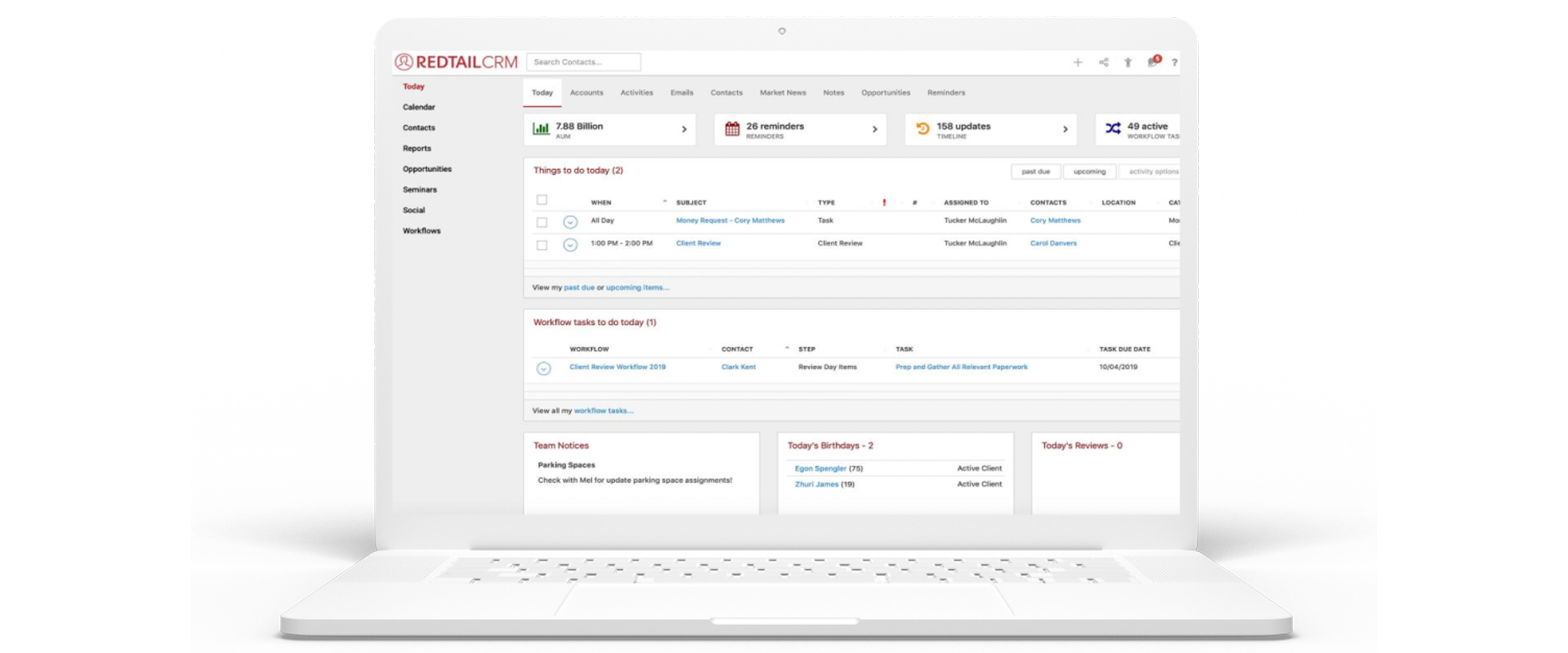

Enter client relationship management, or CRM, technology. A CRM can help you provide clients with the kind of personalized, meaningful advice and connection they seek.

And the support a CRM offers runs deep. It doesn’t only store contact information and financial vitals for your customers — a CRM can help you accrue a wealth of valuable personal information. As you learn and record more about each client’s life, you can uncover more creative and bespoke ways to engage with clients individually and as a group.

Let’s take a closer look at CRM capabilities and how you can put them to use for your advisory firm.