There's been no shortage of headlines around the Federal Reserve lately. Political pressure, soft economic data, and sharp economic moves have put the central bank back in focus.

President Trump recently threatened to fire the Fed chair before walking the comment back. It's a reminder that political pressure on the Fed is not new. But it's also worth noting that the Fed chair can only be removed for cause, not for policy disagreement.

And the institution's independence remains critical to maintaining investor confidence in the Fed's dual mandate of maintaining price stability and maximum employment.

It's also worth noting that monetary policy decisions are not driven one hundred percent by the Fed chair Powell, but rather by the twelve-person Federal Open Market Committee or the FOMC.

So removing Powell from his seat would likely be nothing more than a political spectacle rather than having really any impact on policy.

That being said, GDP came in negative this morning, a surprise contraction in economic growth. While this negative print was heavily skewed by massive import activity to front run US tariffs. This negative growth has markets once again questioning whether the Fed has already waited too long to continue cutting interest rates.

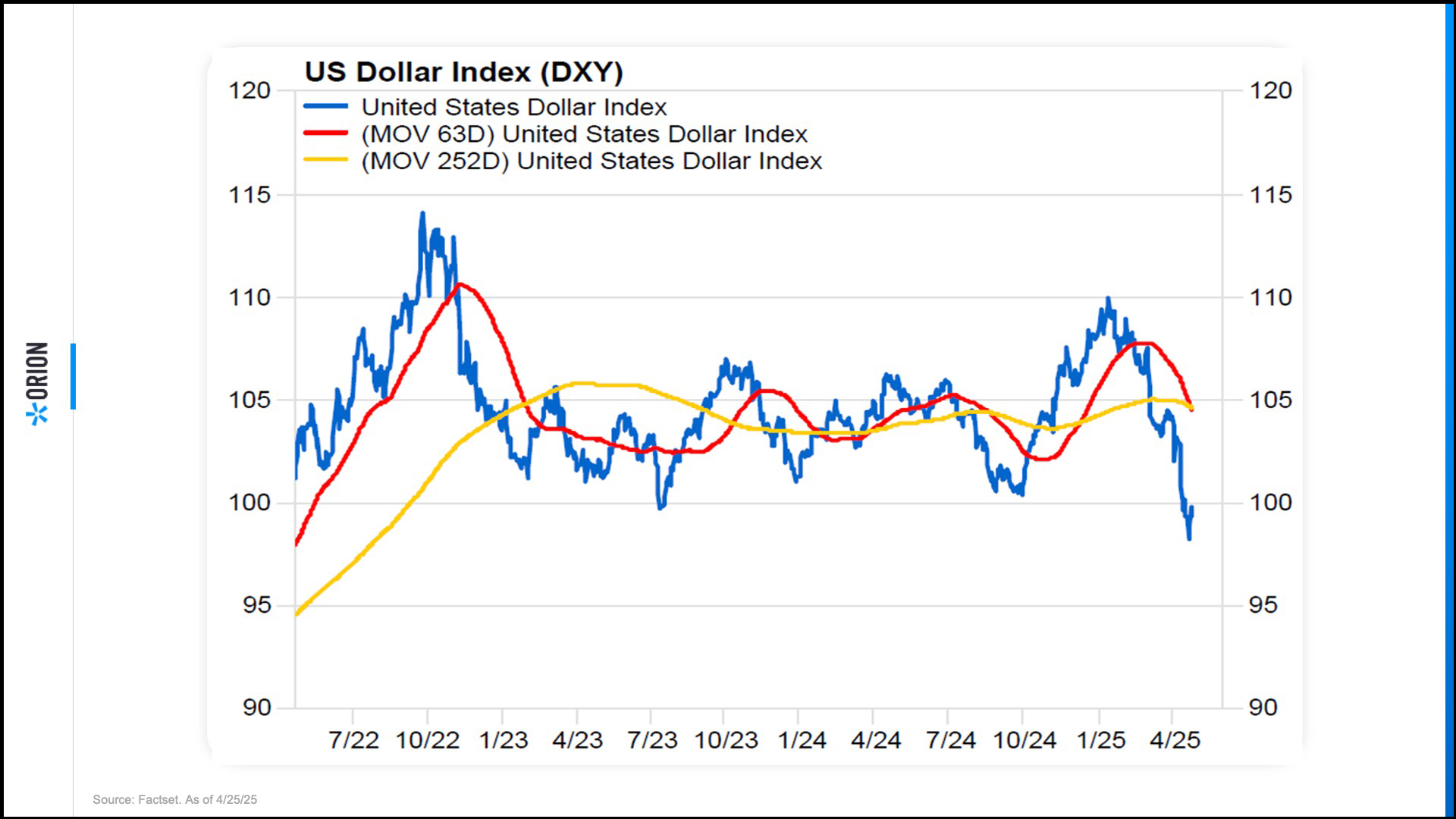

The bond market certainly reacted as yields began falling on the front end of the curve this morning, which is a typical sign that investors expect weaker growth and possibly a Fed rate cut sooner than previously thought. We're also seeing that in the US dollar. Take a look at this chart on the US dollar index. You can see the dollar has rolled over quite dramatically in 2025, falling sharply below its short-term moving average and hitting multi-year lows.

Apart from geopolitics, this move ties to interest rate expectations.

When the Fed is hiking, the dollar tends to rise as global investors seek higher yields and dollar denominated assets. But when the market starts pricing and cuts like it is now, the opposite happens.

The dollar weakens and capital starts flowing elsewhere.

Shifts can ripple through global markets.

A weaker dollar can be a tailwind for international stocks, commodities, and even emerging markets.

For investors, the key is not to overreact to headlines, whether political or economic.

The market will continue to adjust to expectations, but the long-term game remains the same. Stay disciplined, stay diversified, and focus on fundamentals.