Contribution from Nolan Mauk, Investment Research Analyst, Orion

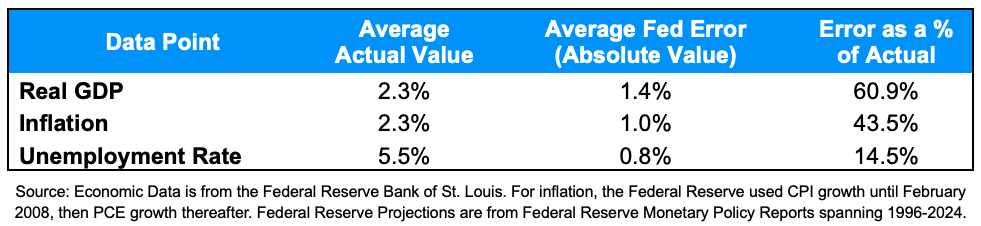

Given the current attention and scrutiny surrounding the Federal Reserve, our team recently set out to examine the Fed’s historical economic projections to determine whether they could be relied upon for making investment decisions. In our research, we found that the Fed has historically been an unreliable forecaster of economic data, and their projections should not be treated as actionable investment. This figure highlights the Fed’s historical inaccuracies on an absolute basis since 1996:

In an uncertain time in the U.S. regarding the future of the political landscape and the strength of the economy, those looking to the Fed for an idea of where we’re heading may find themselves with a refreshed sense of optimism. As of their last report in July, the Fed is currently projecting stable real GDP growth of around 2%, in line with historical averages, stable unemployment around 4%, and steadily falling inflation – down to its target of 2% in 2026. These projections paint the picture of a resilient economy and a brilliant Federal Reserve masterfully controlling both ends of its Dual Mandate – a tall order to fill.

In light of the upcoming election, this led us to a more specific inquiry – how do these projections fare in election years compared to non-election years, and could there be an inherent bias tied to the political climate?

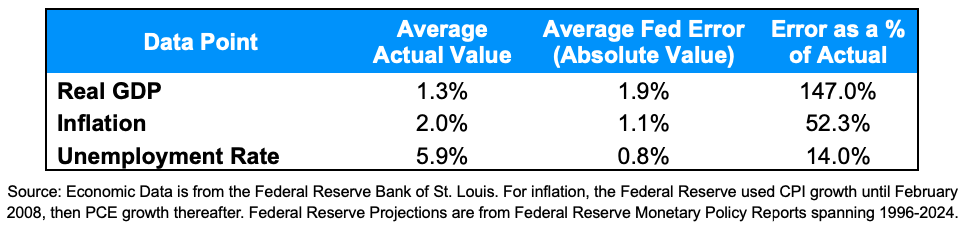

Since the Board of Governors, including the Chairman, of the Fed are appointed by the President and confirmed by the Senate, it’s reasonable to suggest that it may be in the FOMC’s best interest to paint a favorable picture of the economy during election season in hopes that voters will favor the incumbents as a result. But is there any merit to this? It appears there may be. The figure below examines the same data as the previous figure, but only in election years:

The Fed’s projections are less accurate overall on an absolute basis across all economic data points in election years than in non-election years. What’s most interesting, however, is the directions of these errors. GDP growth projections are consistently biased higher while unemployment is consistently biased lower, not only displaying inaccurate forecasts, but also displaying forecasts seeking to paint a more favorable economic environment.

In non-election years, however, the Fed has tended to set the bar lower for itself and for the government, underestimating real GDP growth and overestimating inflation and unemployment on average.

Keep in mind Fed projections come out in February and July with the Monetary Policy Reports, and the actual data points are realized at the end of that year. On average, in election years, the Fed has overestimated annual real GDP growth by 0.78%. As a percentage of the average actual real GDP growth in election years (1.3%), this is a 59.3% overestimation error, compared to a 4% underestimation error average in non-election years. The Fed has also tended to overestimate unemployment in non-election years (by an average of 0.19%) and underestimate it in election years (by 0.23%), allowing the economy to appear healthier than is the case heading into the election. The subtle pressures on the Fed from the political climate in election years have historically created an optimistic bias in their projections.

While we believe these are interesting findings, we also believe that investors should be wary not to get caught up in the stresses and noise that surround the U.S. election cycle and Fed projections. Historically, it has been as difficult for the Fed to predict the future as it is for anyone else, and their projections have empirically proved unreliable. Investors who get caught up in these short-term macroeconomic outlooks may have the urge to deviate from their long-term plan, which may cost them down the road. Meanwhile, investors with resilient portfolios designed to withstand all market cycles will have an easier time staying disciplined and diversified when the noise is telling them differently.