There have been many restrictions placed on the normal rhythms of life in response to the COVID-19 pandemic. The interactions we typically take for granted such as going to restaurants, spending time with friends, working out at the gym, and traveling on vacation have all been curtailed in an effort to tame the pandemic. Of all the things absent right now the one I seem to miss as much as anything is getting my haircut! With my head of hair growing more unruly every day, accompanied by my somewhat constant griping, my wife suggested that she could cut it. While my wife is extremely accomplished in her own right, she doesn’t have any experience as a barber or hairdresser. We thought, “how hard could it be?” So, prior to her embarking on the task I decided to turn to google for some instruction on cutting your own hair. What I found was a version of haircuts gone bad and advice that cutting hair requires real expertise especially since a bad haircut can take months to fix.

The lines between knowing about, knowing how, and being an expert can often become blurred and lead to negative consequences. Of course, the same holds true for financial advice and all the areas of expertise it entails. While a bad haircut can be fixed over a few months with relative ease and patience the effects of less than expert financial advice can last a lifetime.

To better understand the distinctions, the CFA Institute defines four different levels of knowledge as:

Awareness: Cognizant that the topic exists and aware that it could have impact on the client

Understanding: Basic knowledge of the topic, its ramifications, and impact on other areas of financial planning

Detailed understanding: Strong working knowledge of the topic and most of its ramifications

Expert: In-depth knowledge of the topic and all the ramifications

While financial advisors generally possess expertise, or at least a strong working knowledge, in one or more of the components of financial advice, the breadth of knowledge encompassing comprehensive advice make it difficult for any one person to be expert in it all. Even when an individual possesses a multitude of expertise it is difficult to be an “expert” on everything at the same time when one’s attention is divided among too many things.

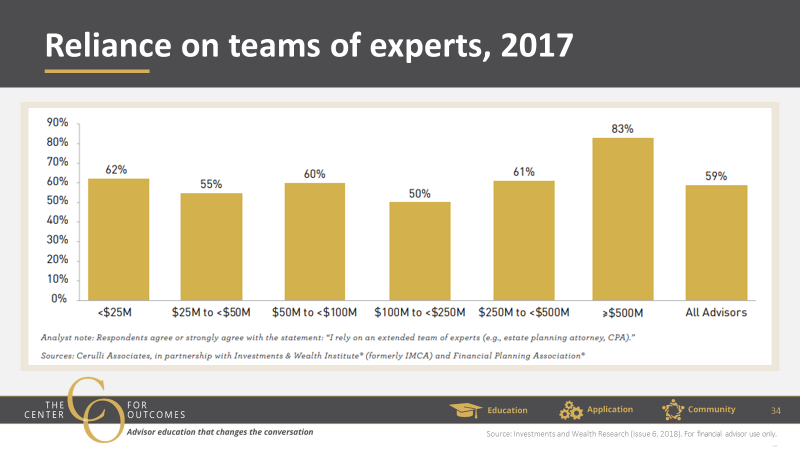

It could be fair to assume this is why the most successful advisors rely on an extended team of experts (CEG Worldwide).

The concept of focused expertise is why, at Brinker Capital, our attention is on investment management. Our work is done for and with financial advisors because we recognize the invaluable expertise financial advisors bring to their clients.

Clients are best served with focused expertise which inherently requires a team of experts including strategic partners to focus on their specific task, portfolio managers, insurance specialists, trust attorneys, and the like. All of these individuals are led by a financial advisor who is aware of or understands all facets of financial planning yet focuses their attention and expertise on understanding their client’s values, goals, and aspirations. In doing so, they can build a plan that integrates their team of experts, putting the right people in the right place at the right time.

The consequences of a bad haircut can be resolved in a relatively short period of time yet the effects of less than expert financial advice can last a lifetime. The reliance on strategic partners for expertise is not a sign of weakness but instead an acknowledgement of the importance of the task at hand.

The views expressed are those of Brinker Capital and are not intended as investment advice or recommendation. For informational purposes only. Brinker Capital, a registered investment advisor.

Tagged: Tom Rieman, practice management, financial advice, COVID-19