As 2025 beckons, investors may be contemplating how to best allocate their portfolios for the monetary, economic, and geopolitical landscape that the new year may bring. With over $7 trillion sitting in cash and money markets globally, it seems many investors remain in a “wait-and-see” mindset.

In our view, investors should position their portfolios to benefit under the majority of economic outcomes. Below we outline four potential scenarios for the U.S. economy and the prospective outlook for the three major asset classes under each scenario.

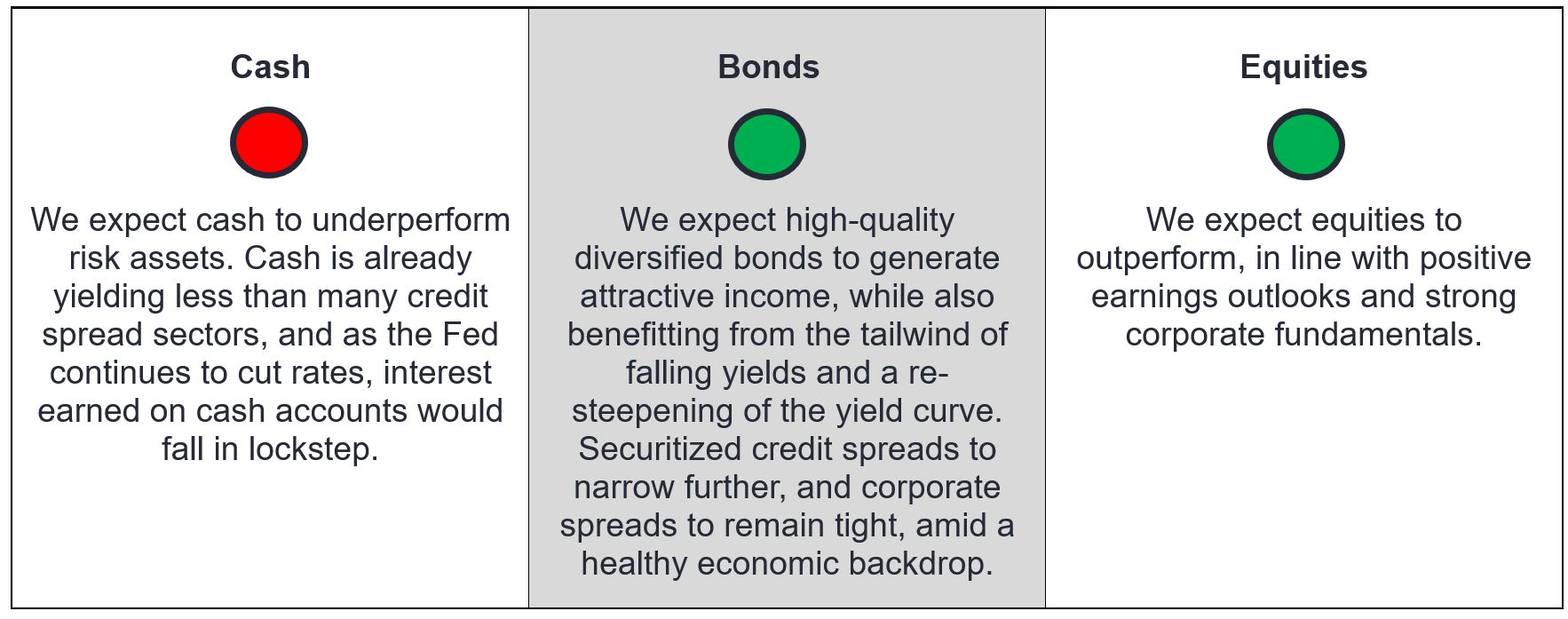

1. Soft-landing scenario

Key characteristics: Inflation continues its downward trend back to the Federal Reserve’s (Fed) 2% target, labor market tightness eases without a dramatic rise in the unemployment rate, and while economic growth begins to taper, the U.S. economy continues its growth trajectory.

Anticipated Fed response: We would expect the Fed to cut interest rates gradually as the economy and inflation continue to cool and the labor market comes back into balance. Expect the federal funds rate would be close to the Fed’s terminal – or neutral – rate within 18-24 months. (The terminal rate is a subjective rate the Fed considers to be neither restrictive nor accommodative for the economy, currently estimated to be around, or slightly above, 3%.)

Likelihood: We consider the soft landing our base case for the U.S. economy over the next twelve months.

Exhibit 1: Soft landing – Potential outlook for major asset classes