Services and software are built on the idea of personalization. Netflix offers you new shows based on ones you already like, Starbucks lets you craft your own drink combinations, and the stores we shop at send us emails with alerts on items similar to the last one purchased. One of the reason brands like Netflix are so popular is because they become tailored to you and your habits.

Orion is also built on personalization, and you can enhance your reporting and client experience when you use the new Orion Portfolio Groups feature.

Our previous release introduced Portfolio Groups as a grouping option maintained in the ‘Edit Household’ screen. With the latest release, we are extending this grouping functionality to our Client Portal and Portfolio View!

Do you want to be able to have multiple groups of accounts inside of one Household? Portfolio Groups provides functionality for you to create multiple groups inside of a Household for a greater reporting experience.

In today’s post we’ll look at how to create Portfolio Groups and examine the advantages to using them.

Creating a Portfolio Group

How to set up a Portfolio Group

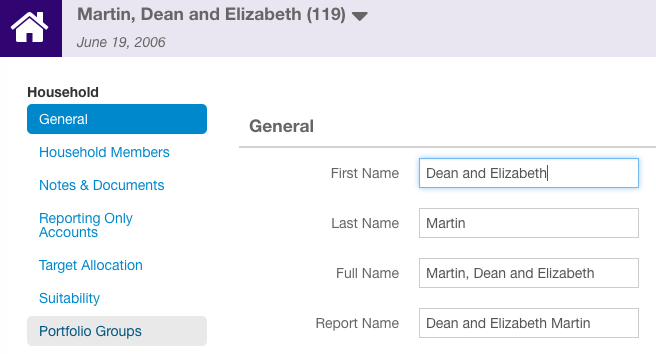

Start off by opening an Orion Connect app that lets you edit Households, and find one you want to edit.Inside of the Household Editor, on the left side, you will now see “Portfolio Groups” option. This new feature allows you to create a “new group” inside of group maintenance as a “Reporting” group, “Composite” group, or even both.

When creating these groups, you will now be able to assign any Account in that Household to the group or groups, meaning you can make multiple groups—and as many as you need.

Note: If you don’t see a Portfolio Groups option, your database admin can add this privilege to the appropriate roles by enabling read, edit, and delete rights as a record privilege under “Portfolio” inside of that record privilege.

Why to Use Portfolio Groups

We created Portfolio Groups based on feedback from our advisors wanting to ‘bucket’ accounts in groups together. Many of the development items we pursue we receive directly from advisor input.The most common scenario in which you’ll find Portfolio Groups useful is when you want to group similar accounts together. You might want to group all of a Household’s retirement accounts into a group, all of the education plans into a group, and all of the taxable accounts into a group.

You will then have the ability to view these groups based on how you allocate a portfolio into these buckets, while also diving into the allocation and diversification of each group.

Portfolio Groups gives you increased flexibility in viewing and reporting on subgroups within a client Household so you can find and present the exact criteria you’re looking to showcase.

Portfolio Groups in the Client Portal, Mobile App, and Portfolio View

Through the seamless integration of Portfolio Groups in Eclipse and Orion Connect, you can access Portfolio Groups in our Client Portal, Portfolio View, and also through the Orion Mobile App.This allows for Portfolio Groups to be synced automatically across platforms when an update is made and removes any manual intervention for users. In addition, you can separate accounts in the same household into separate groups and can trade and report on the groups.

Your clients also reap the benefits of this integration by being enabled to view their accounts in the Portfolio Group groupings when they log into the Client Portal. This can help your clients gain a better understanding of how their retirement accounts are allocated and performing with the click of a few buttons.

If you have any questions about how to setup and use Portfolio Groups, please log into Orion Social to chat with our SME Reporting Team.

0810-OAT-3/20/2023