Whether your advisory firm prefers to put planning first, or if your history is steeped in managing unique fixed income and equity portfolios, all firms have one thing in common:

You have to update clients regularly on how their investments are performing and explain how that performance is impacting their ability to achieve their financial goals.

Just as every advisory firm has its own way of planning and its own beliefs about investing, it also has its own unique way of communicating with clients about performance.

When you work with Orion, you have the tools at your fingertips to guide your creative process and tell the story of a client’s investment performance in exactly the way you want to tell it.

Here’s how.

Best Practices for Communicating Investment Performance

It’s up to each individual advisor to decide how to discuss portfolio performance and how much emphasis to put on it during meetings, but the CFA Institute provides a few tips on communicating about performance from a best practices standpoint.Notably, the CFA Institute recommends using GIPS (Global Investment Performance Standards) so each advisor, regardless of firm, reports performance in a standardized way.

Orion’s platform offers the tools that advisors need to report using GIPS.

Outside of GIPS, the best way for advisors to review performance is to do it in a comprehensive manner that clearly presents the information that’s most important to an advisor’s clients.

Creating Custom Performance Reports with Orion’s Report Builder

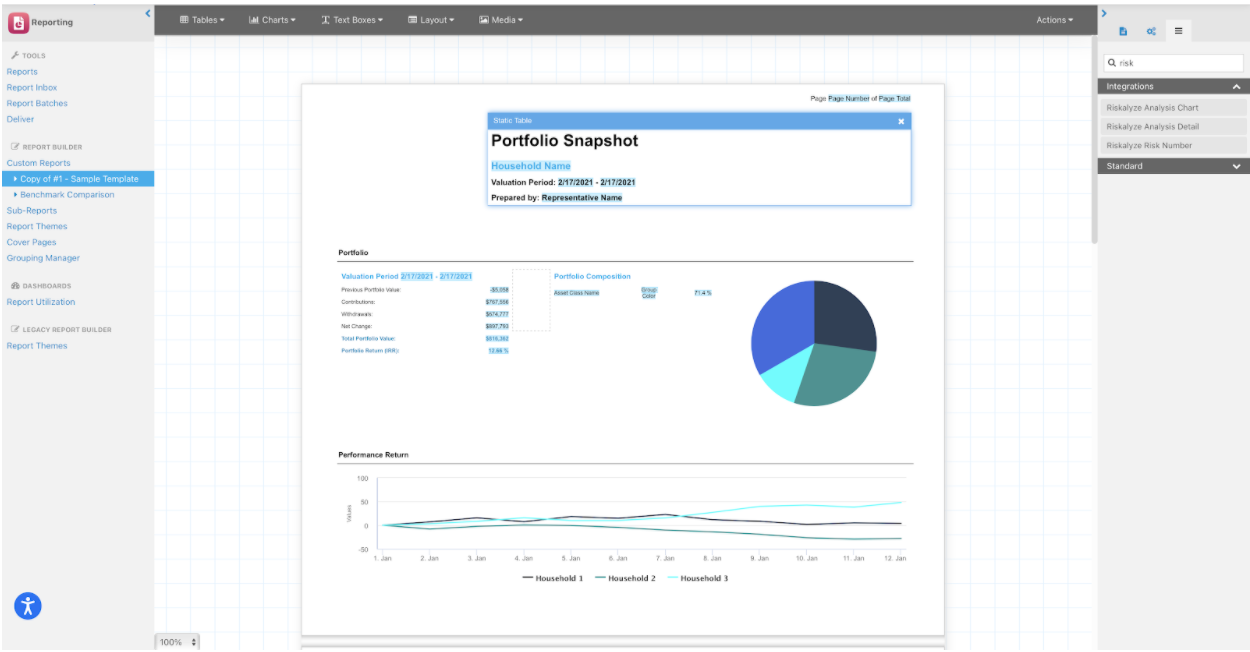

Every advisor needs the ability to be flexible and adapt at a moment’s notice.When you look for a platform that allows you to create custom investment performance reports, be on the lookout for how it can help you create what you need quickly with a completely customizable experience.

In real life, few things go exactly to plan.

Let’s say you walk into your next meeting with a client with a report in hand that you built just for them.

As your conversation progresses, though, they want to see some information you didn’t include on the original report. It might be fees, a different performance range, or maybe the risk associated with a certain asset.

In this situation, some advisors might have to say “I’ll get back to you” or pause the meeting for ten minutes while they dig around in their software to find the right information.

Using Orion’s Report Builder, a new report could be a few clicks away. Our filter search narrows the scope of displayed sub-reports. From there, simply drag and drop the sub-report to where you want to see it on the report preview.

In a matter of minutes, the conversation is back on track, and you’re on your way to creating a moment of trust that further cements your relationship with your client.

Being able to clearly communicate about investment performance with clients shouldn’t be a technological challenge. Schedule a demo of the Orion platform to see how easy and efficient it can be to create unique performance reports for your firm.

0664-OAT-02/25/2021