Turn To Orion’s 2024 Election Microsite for Relevant, Unbiased and Actionable Content

In 85 days, Americans will choose the next President of the United States, 34 US Senators and 435 Members of the US House of Representatives.

All national elections are weighty affairs that serve as a mirror on America — where we think we are, where we think we should head, and how we think we should get there. And while it is easy to fall into hyperbole when discussing a national election, when one thinks about the world today, it is reasonable to conclude that the 2024 vote will prove more consequential than most — and that was even before the awful events of July 13th in Butler, Pennsylvania and President Biden’s decision to leave the race. Consider that the US remains very divided politically and socially; the US consumer continues to confront — and be discontented over — higher prices for many goods and services relative to the pre-pandemic period; Russia’s assault on Ukraine is unrelenting and the Middle East is in the throes of the most meaningful military conflict the region has seen in years, while US / China relations are increasingly confrontational and marked by an ever present specter of global competition.

Understandably, American investors are paying close attention to the upcoming vote and trying to discern what it might mean for our economy and markets. It is likely we are also all wondering how we can best navigate — intellectually and emotionally — what might prove to be a tumultuous campaign season. With that written, Orion is pleased to stand up its 2024 Election Microsite (https://orion.com/election-2024), our repository of proprietary and third-party content — economic, market, political and behavioral in nature — that seeks to put the upcoming election in context; speak to its impact on the economy and risk assets and provide strategies for keeping appropriately separate our nation’s very challenged political discourse and its still sound economic outlook.

And as it concerns the upcoming election and the outlook for the economy and markets, we would point out…

85 days remains a lifetime in politics, so we would take any poll data with a meaningful grain of salt (while also paying the closest attention to swing state polling)

As was the case in 2016 and 2020, the Presidential Election will likely come down to a handful of key states, including Pennsylvania, Michigan, and Wisconsin

If history is any guide, US markets could prove volatile from early fall through election day, but catch a bid once the votes are counted and we know who has come out on top on both ends of Pennsylvania Avenue

If we were gamblers, we would bet on a still divided Congress come November 5th, an outcome that should be welcomed by markets

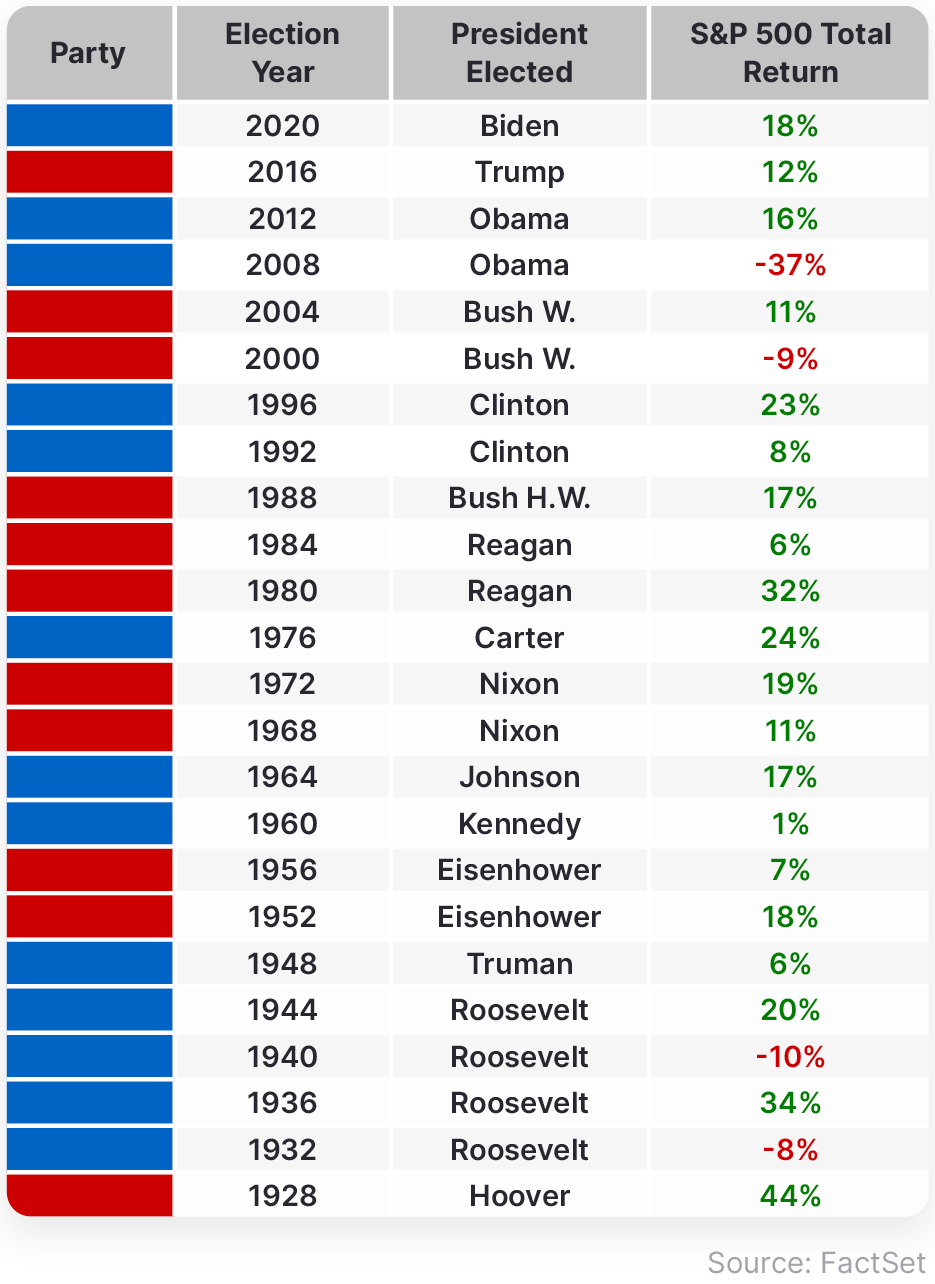

A datapoint worth hanging onto — especially during these difficult days – is that going back to 1928, there have been 24 Presidential Elections and the S&P 500 produced an above average annual return of 12% those years….

Why Do Stocks Rise in an Election Year?

Markets returned +12% on average during Presidential election years, dating back to 1928.

Incumbent presidents do everything in their power to stimulate economic growth.

Any meaningful policy changes are likely in the rearview mirror.

US recessions are infrequent, but historically tend to hit in year one of a presidential cycle.

Stocks have the chance to rally once the outcome is known.

Finally, if you want a pretty good predictor of what party will take the White House this November, you could do worse than consult the market. Since 1928, when the S&P 500 is positive in the 90 calendar days running into election day, the party that holds the White House has retained the White House 83% of the time. And as we take pen to paper, the S&P 500 is down -0.77% since 8/7/24, indicating that come November Donald Trump will be the 47th President of the United States.

We would encourage you and your clients to visit the site on a regular basis as we will be updating its broad content often, and the Orion Election Countdown Calendar daily. We hope you all find the site of value.