How do you know that you really know your clients?

Knowing their favorite hobby, rattling off a list of their ten grandchildren, or having a postcard from their most recent vacation are all great—but those facts aren’t going to help you create a more tailored portfolio strategy.

Knowing a client’s goals and investment perspective are necessary when you help them plan for their financial future, but it’s equally important to prove you’ve done the legwork to truly “know your client” in the event of an audit.

Showing that you’ve taken the time to gauge their appetite for risk and have planned accordingly will go a long way to ensuring you’ve done the work required of your firm

We’re excited to announce that you can now complete a client Risk Tolerance Assessment directly from Orion Planning (formerly Advizr). This new feature makes it simple to set a solid foundation for your planning and investment management, with your client’s risk profile at its core.

Here’s how you can put risk front and center in your workflows, and what our methodology and approach to risk management looks like.

The Risk Tolerance Assessment

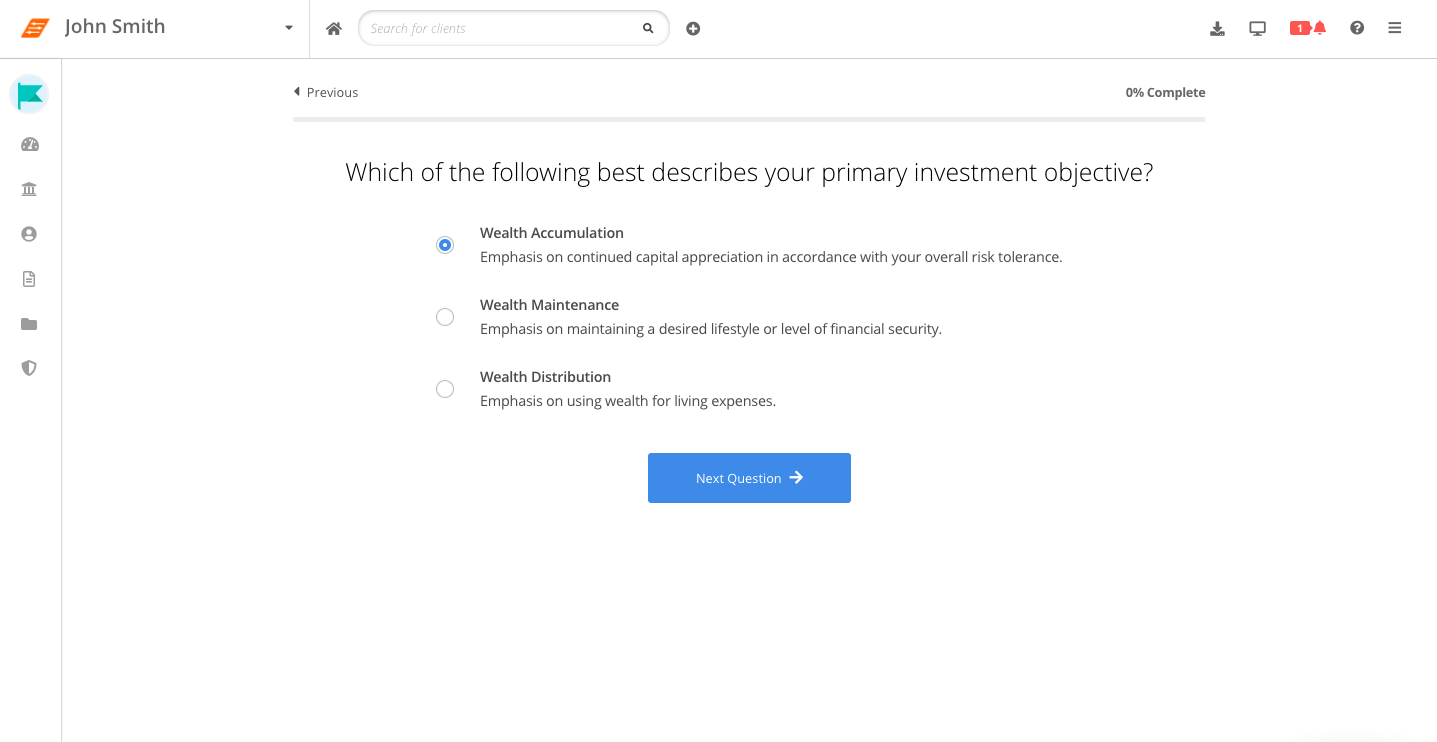

The Risk Tolerance Assessment is a short, seven-question process that can act as the foundation of your portfolio construction process.The questions focus on an investor’s time horizon for continuing to invest in the stock market, while also assessing psychological factors like comfort with potential highs and lows of possible portfolios, and their ability to handle financial emergencies.

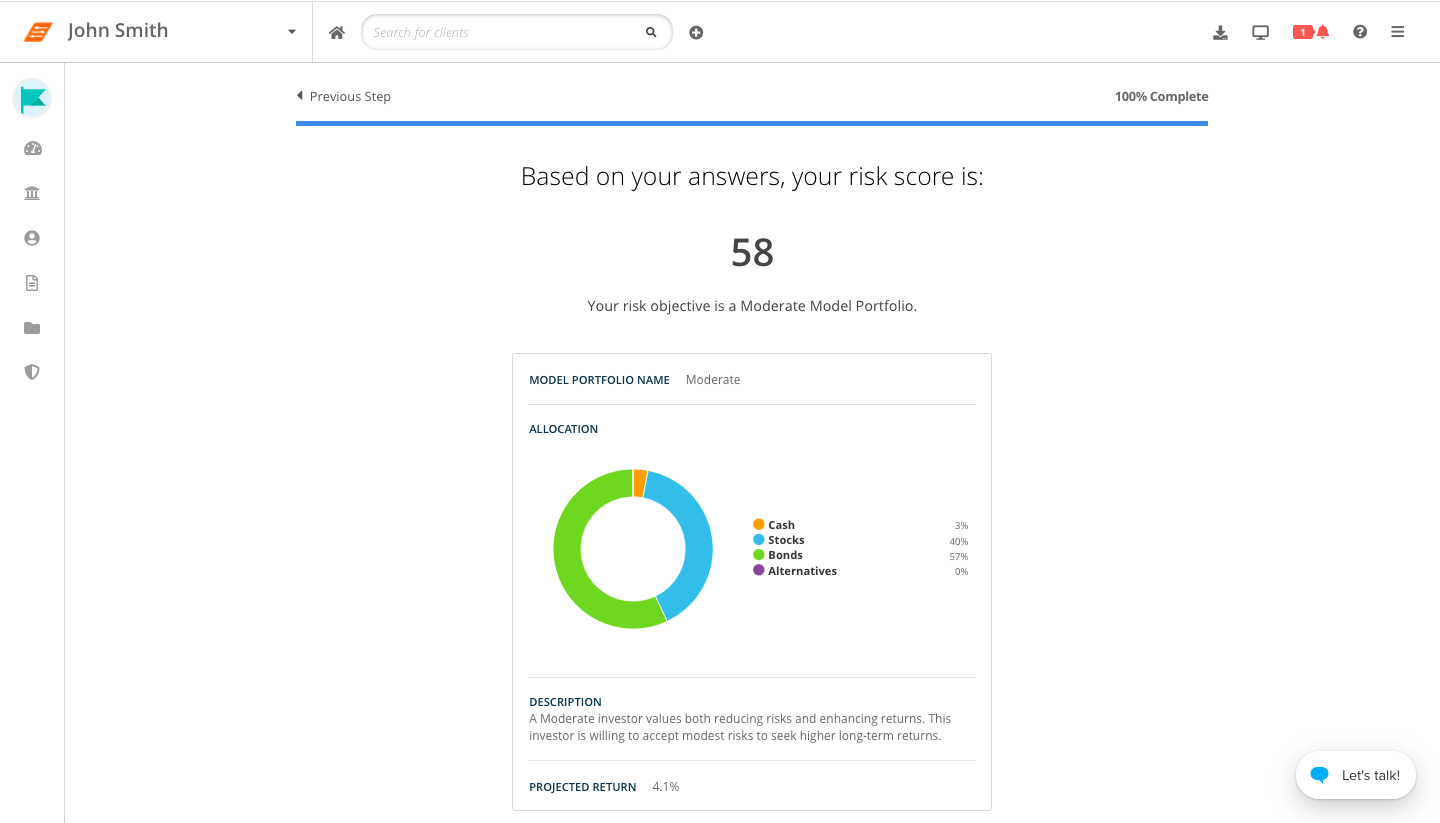

A client's risk is scored on a scale of 0 to 100, with 100 being the highest-risk portfolio available.

Once a client’s risk tolerance has been determined, Orion Planning matches the client with the most appropriate model from your current model list.

Here’s what the setup process looks like in Orion Planning:

Implementing the Risk Tolerance Assessment in Orion Planning

In order to match a client with the most appropriate model, Orion Planning will look at the model portfolios in your Settings page.Orion Planning will automatically divide the number of models you have by the maximum score of 100 to determine your risk bands.

It’s important that you order your models appropriately, from most conservative at the top of the list to most aggressive at the bottom of the list.

How to Access Orion Planning

If you have already finished the financial planning training course, you can start using the Risk Tolerance Assessment right away.If you have yet to sign up for access to Orion Planning, what are you waiting for? Click here to get started.

Not working with Orion yet? Let’s talk about how unifying your risk management, financial planning, and investment management in one comprehensive platform can help you improve your business!

| 0449-OAS-2/25/2020 |