-

Earnings season has begun. Less than 10% of companies have reported earnings so far, and while the early reports have generally exceeded expectations for both revenues and earnings, the blended earnings expectation for the S&P 500 is -6.5%. If that number holds (though the actual number will most likely be better), it will mark the largest earnings decline reported by the index since Q2 2020. Notable companies reporting this week include leading tech (like Tesla and Netflix) and financial (like Goldman Sachs and Bank of America). On the latter, it should be noted that some financials (like JPMorgan) reported better than expected results late last week. Let’s hope that continues.

-

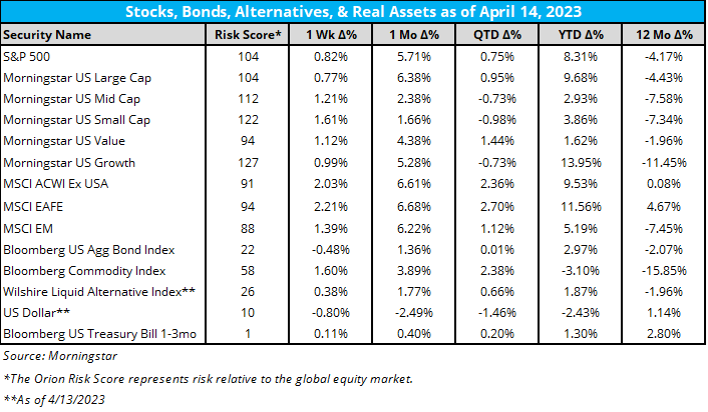

Regarding over-all performance last week:

- The overall market had modest gains last week led by small caps and international stocks.

- Bonds had slight losses on the week but are holding onto a ~3% gain on the year.

- YTD, growth stocks are still leading gains, but developed international and EAFE stocks seem to be catching up fast to take the lead for YTD performance.

- Developed international is the only equity class with a positive gain over the last 12 months.

-

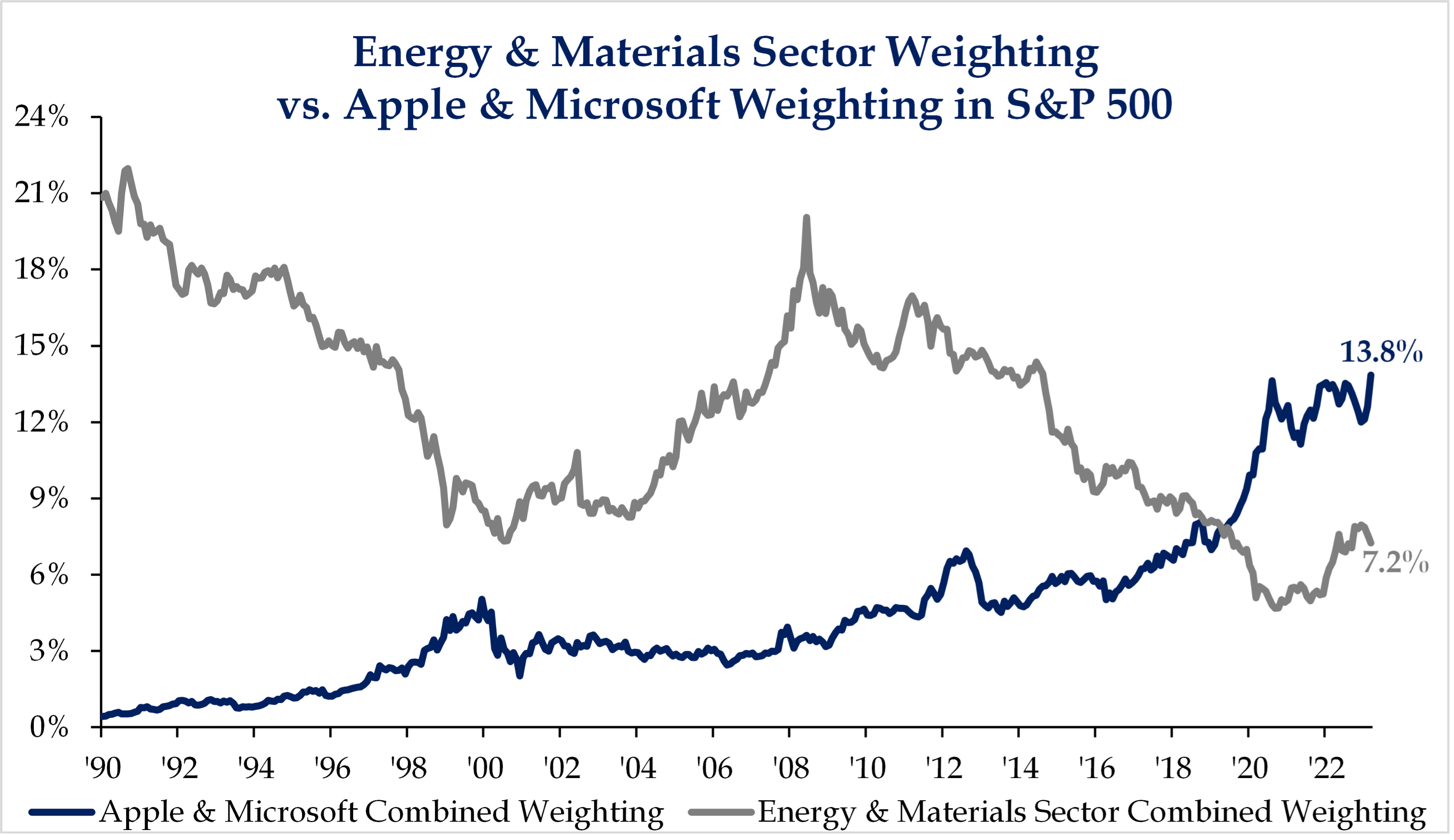

According to Strategas, “Apple and Microsoft (7.6%+6.2%=13.8%) are roughly double the weights of the entire Energy and Materials sectors combined (4.6%+2.6%=7.2%).” That’s amazing if you ask me.

-

More from Strategas: “Given our view that inflation is likely to remain sticky and that higher long-term interest rates may pose a risk to longer-duration stocks in the Technology sector, we wonder whether this current market feature is sustainable. "

Source: Strategas Securities, LLC

-

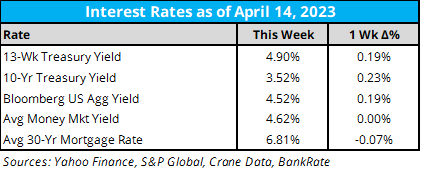

As for key interest rates last week:

-

Despite positive news on inflation, Treasury yields rose again last week.

-

-

We’re 16 days out from the next Fed interest rate decision, and as of now, according to the CME Fed Watch tool: (which has arguably been of the key charts to watch this year)

-

At a current target range of 475-500, the market is pricing about a 20% chance of a pause in the hiking cycle and an 80% chance of another 25 basis-point increase at the May Fed meeting.

-

A few notes on the Fed and the economy from Orion Strategic Partner Belle Haven Investments:

-

By relying on backward-looking data, the Fed is essentially “driving down the street looking out the rearview mirror.” (Analogy courtesy of Dave Rosenberg from Rosenberg Research). They are focusing on where we’ve been, not on where we’re going, and it is only a matter of time until a crash occurs.

-

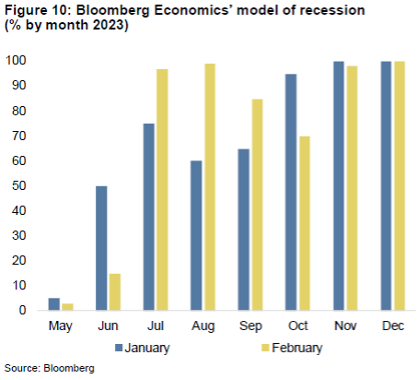

Even though the substantial actions by central banks seem to have eased some concerns about the financial system in the past two weeks, we would warn against complacency. Bloomberg Economics’ model of recession estimates the probability of a recession has been pushed forward to July instead of December (Figure 10). Regardless of whether a recession starts in July or December, we are just beginning to see the cascading effects of higher rates.

-

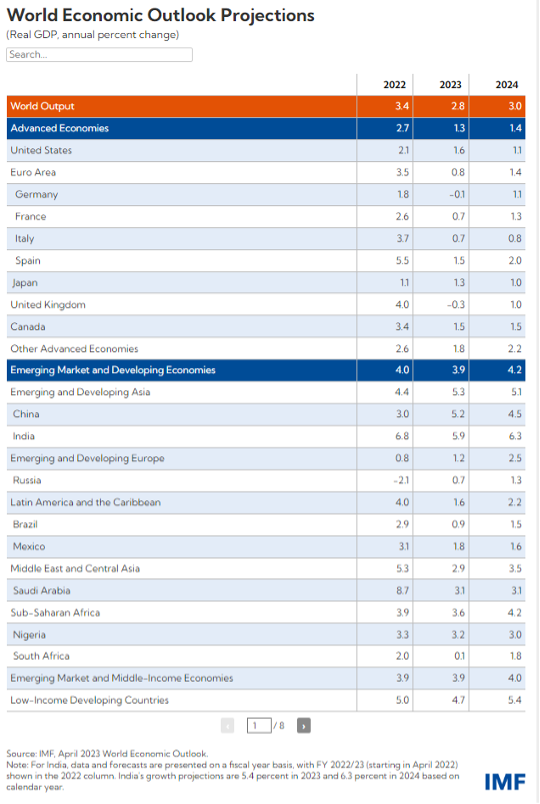

- As for growth prospects around the world, the U.S. is mired in 1-2% growth for 2022-2024. Emerging and developing countries are at 4%. Data from the IMF.

- Last week was packed with economic data releases:

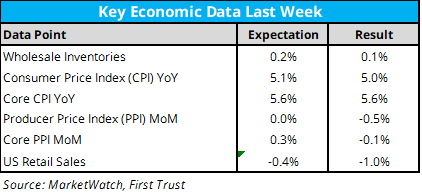

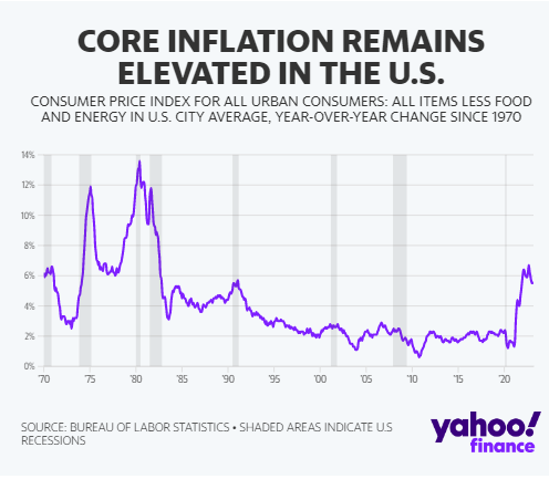

- The Consumer Price Index (CPI) came in at 5.0% year over year, slightly below the consensus expectations of 5.1%. Core CPI (excludes food and energy) , rose 5.6% over the last year, in line with consensus expectations.

- While inflation moderated in March, according to First Trust, “inflation was more of a problem than the headline suggests.” Prices were held down by larger reductions in energy prices, but shelter and food prices rose at over 8% each on an unadjusted year over year basis (Page 9 of CPI release).

- The Producer Price Index was expected to see no change in March, but surprised analysts with a 0.5% monthly reduction. Declines were led by a 6.4% reduction in energy prices. According to First Trust, this was the largest monthly decrease in PPI since the “shutdown-induced price plummets” in early 2020. FT sees this as a sign that the effects of the recent large reductions in M2 money supply are starting to roll through the economy.

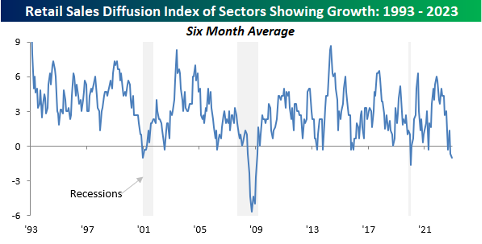

- US Retail Sales also came in well below expectations, declining a full 1% in March. In total, eight out of thirteen retail categories saw monthly declines. Year over year, retail sales are up only 2.9% which represents the slowest 12-month rate since June 2020 (of the first few releases after shutdown).

- Core inflation may not be falling as fast as it was, but it’s clearly stalled and hopefully starting to fall. Nonetheless, 2% core (like we’ve had for years) still looks a long way away.

- And another note on retail sales from Bespoke Investments:

- “The weaker breadth in this month’s report has also moved our six-month diffusion index down to ominous levels. At the current reading of –1, the diffusion index is the lowest since April 2020, and while there have been other periods since the early 1990s when this reading briefly dipped into negative territory outside of a recession, it has never been this negative outside of a recession.”

Source: Bespoke Investments

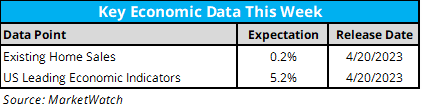

- Here is the economic data calendar for this week:

- We have a lighter week for economic data this week. Notably, we’ll get the releases on existing home sales and the US Leading Economic Indicators Index.

- Though the data releases are light, we will hear speeches from five different Fed presidents and four Fed governors throughout the week. We hope to hear more indications of the Fed’s next steps scattered across these speeches.

- We’re back in earnings season! While we are still very early with only 6% of S&P 500 companies having reported, it was a strong start with 90% of companies reporting a positive earnings surprise. Here are the highlights from the week’s Earnings Insight from Factset:

- Earnings Scorecard: For Q1 2023 (with 6% of S&P 500 companies reporting actual results), 90% of S&P 500 companies have reported a positive EPS surprise and 63% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -6.5%. If -6.5% is the actual decline for the quarter, it will mark the largest earnings decline reported by the index since Q2 2020 (-31.6%).

- Earnings Revisions: On March 31, the estimated earnings decline for Q1 2023 was -6.7%. Three sectors are reporting higher earnings today (compared to Mar. 31) due to positive EPS surprises.

- Earnings Guidance: For Q1 2023, 80 S&P 500 companies have issued negative EPS guidance and 27 S&P 500 companies have issued positive EPS guidance.

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Cryptocurrency prices jumped again last week, with Bitcoin rising 8.5%, breaking above $30,000 for the first time since June of 2022. Ethereum climbed 14%, breaking above $2,000 and nearing $2,100. Solana soared 20% and Avalanche added 10%.

- The so called “Shanghai” upgrade to the Ethereum blockchain went live last week. The upgrade unlocks nearly $35 Billion worth of Ether, and despite the potential for selling pressure of these unstaked tokens, Ethereum surged on the news. Solana launched a crypto-based phone, the “Saga”, and it will cost $1,000. FTX is now mulling the possibility of restarting the exchange. Apple approved Uniswap’s wallet app for iOS. WisdomTree and T. Rowe price are amongst the traditional financial firms testing Avalanches blockchain subnet for trading and execution.

- Van Eck is liquidating the Digital Asset Mining ETF (DAM) on April 24th. This is despite being up 138% YTD! The ETF only has about $2 million in assets.

Further Insights

- A great quote from James Clear’s Weekly 3-2-1 newsletter (which we highly recommend you subscribe to): Sign-up

- "Speed is perpetually undervalued. Asking that person out today means you get to live more of your life with them and less of your life waiting. Starting your business today means you begin learning immediately and have more time to figure out what works. Go fast. The future is never guaranteed, and the right time may never come."

- Bonus quote from one of the greatest investors this century: “The way to maximize outcome is to concentrate on process.” Seth Klarman

- On this week’s Orion's The Weighing Machine podcast we talk to the President of new OPS partner Liberty One, Ben Pahl. Rusty, Robyn, and Ben take a broad view of financial advisory services as well as some tips for income investing strategies.

- This month’s Weighing The Risks deals with the hidden implications of massive global debt with Phil Toews, the president and CEO of Toews Asset Management. Felipe and I covered a lot of this ground in a recent TWM podcast, but this time we explore different scenarios on how this could play out in the financial markets, including stocks, bonds, and real assets.

- Toews Asset Management is one of the many tactical strategies (i.e, strategies that can dramatically change their asset allocations and portfolio risk depending on market conditions) on OPS. In fact, while the industry’s assets are only about 1% classified as tactical*, OPS’s AUM is about 17% tactical. Tactical isn’t just for behavioral reasons (which is a good enough reason for many), it also helps protect against sequence risk.

- Did you know that only about 20% of people are NOT confident about their financial futures? That is likely too pessimistic according to Morningstar.

- Summary: I know not why Americans are so pessimistic about their financial futures. Some speculate it’s because the country has lost its moral path. Others blame a culture of negativity caused by warring politicians and/or the isolating effects of technology. Whether those theories are correct is a topic for massive studies, not a 1,000-word column. But I do know that in doing so, the people are almost certainly wrong. One needn’t be a table-pounding capitalist or a blind apologist for all things American to accept the fact that for 250 years, the nation’s economic system has always found a way to move.

- Want to know more about ChatGPT? Check out these resources from money manager/financial writer Whitney Tilson:

- 28-minute video: Complete ChatGPT Tutorial – [Become A Power User in 30 Minutes].

- More color commentary: op-ed in the Wall Street Journal by the authors of The Age of AI: And Our Human Future – Henry Kissinger (former secretary of state and White House national security adviser), Daniel Huttenlocher (dean of the Schwarzman College of Computing at the Massachusetts Institute of Technology), and Eric Schmidt (former CEO of Google): ChatGPT Heralds an Intellectual Revolution

*Source: Morningstar

1091-OAS-4/18/2023