- With the strong performance in the stock market last Friday, the S&P 500 came within basis points of being in a new bull market (as defined by a gain of 20%+ off the price lows). The S&P 500 and NASDAQ also hit new highs for the year Friday. Volatility (as measured by the VIX) also snapped its streak of readings above 15 that went back to February 2020. One would guess that investor enthusiasm should be on full boil, but by some measures it’s still mired in an extended negative streak (more on that later). Additionally, leading into Monday morning, the NIKKEI gained over 2% and broke 32,000 for the first time since 1990. 1

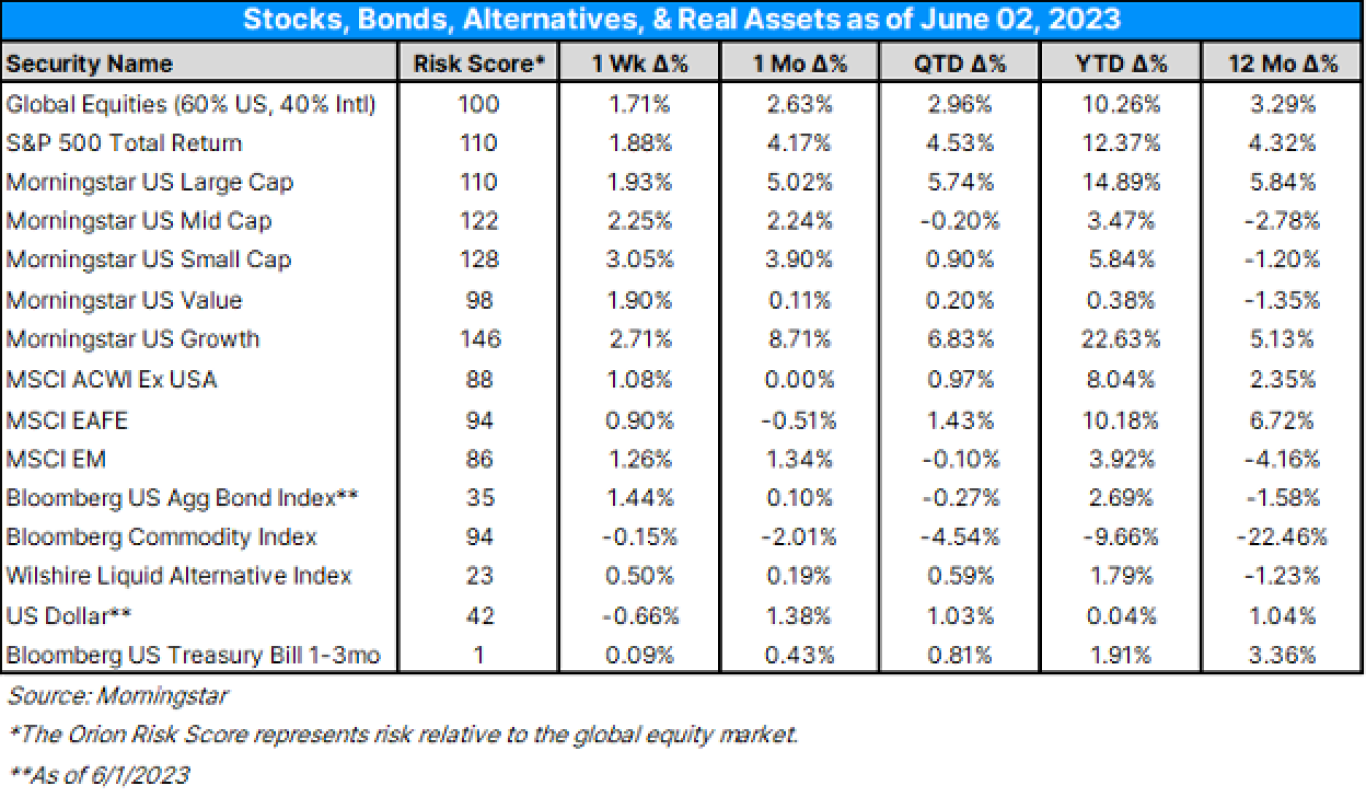

- As for performance last week:

- The overall global equity market was up nearly 2% last week. Gains were more dispersed than we’ve seen in recent weeks with all market caps and styles posting solid gains. 1

- YTD, domestic growth stocks are still leading the charge with a nearly 23% gain and are up over 5% over the last 12-months, rebounding off a turbulent 2022. 1

- Developed international stocks are also holding strong, resulting in a solid year so far for broadly diversified portfolios.

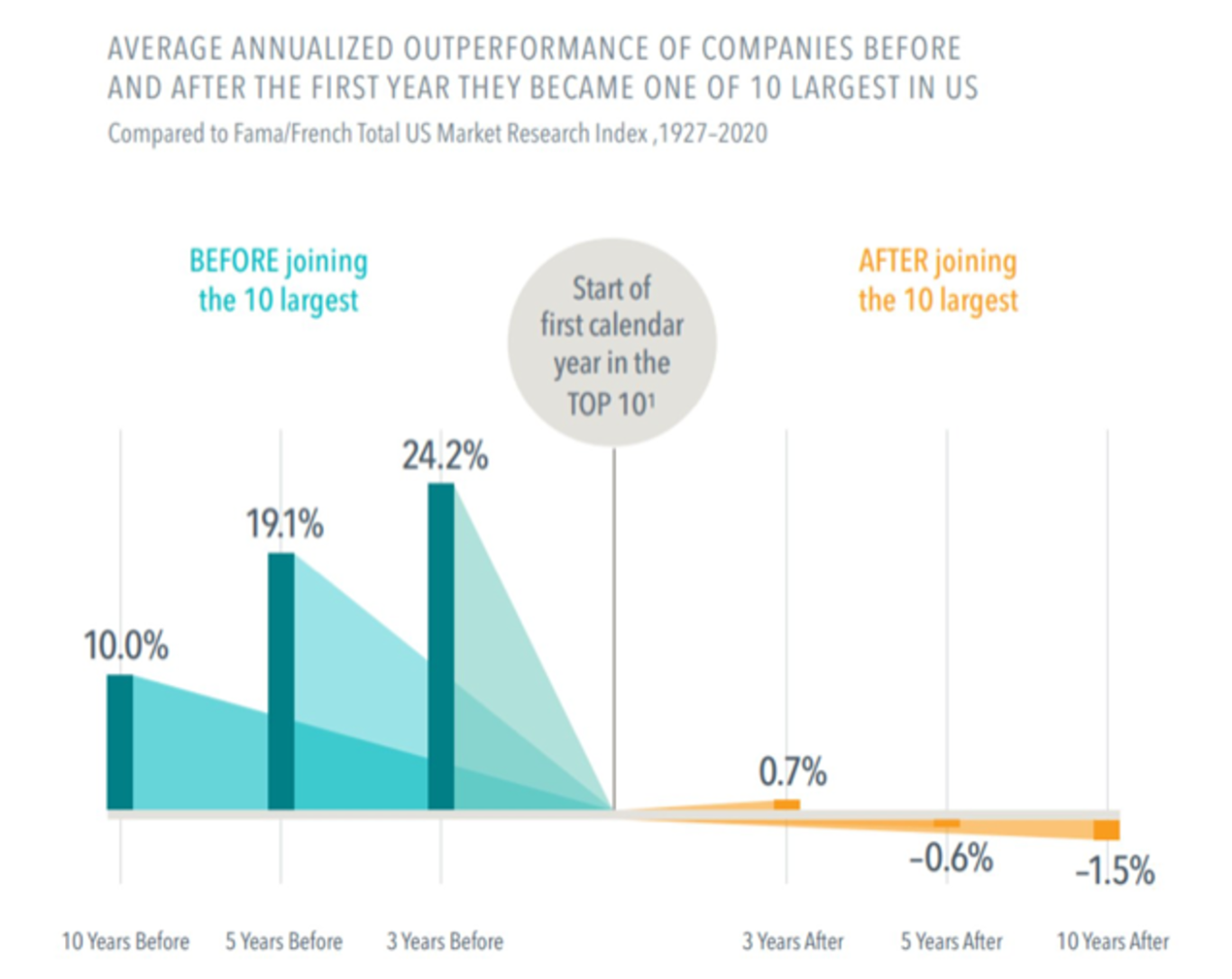

- “The last thing you want is the big market cap stocks” – Meb Faber

- There’s been plenty of discussion about the size of many of the top companies in the US, such as NVIDIA’s pop in market cap to nearly $1T a few weeks ago. However, joining the Top 10 largest companies in the US may be an indicator of lower future returns. According to this chart from DFA, the 10-year annualized return for companies after joining the Top 10 is -1.5%.

Source: DFA

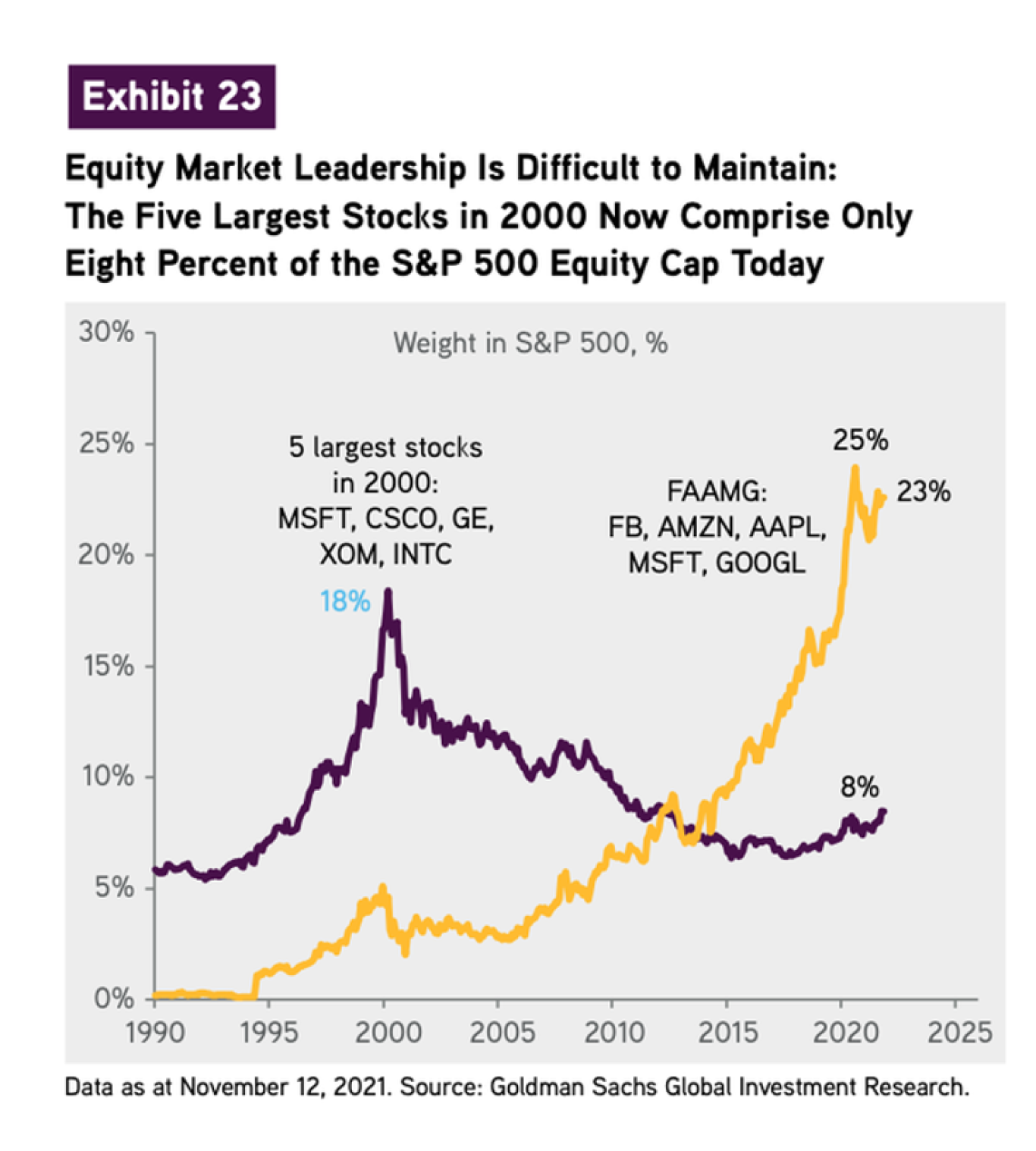

- And for more historical evidence, check out the returns of the Top 5 S&P 500 stocks in 2000 compared to FAAMG stocks.

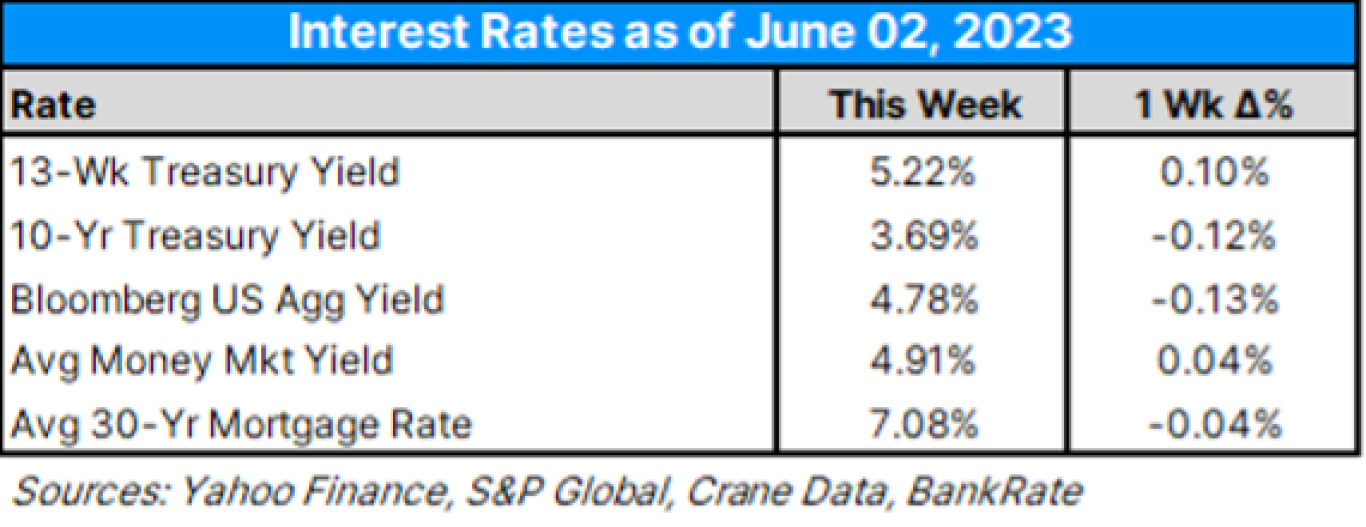

- As for key interest rates last week:

- As homebuyers have adjusted to higher mortgage rates, and inventories remain low, demand has been on the rise for homes again, which is driving up prices.

- “The challenges posed by current mortgage rates and the continuing possibility of economic weakness are likely to remain a headwind for housing prices for at least the next several months,” -Craig Lazzara

- We’re now 9 days out from the next interest rate decision, and as of now, according to the CME Fed Watch tool:

- The market is now pricing a 75% chance of no interest rate increase next week. This seems to be in line based off interviews with Fed governors and the recent jobs report.

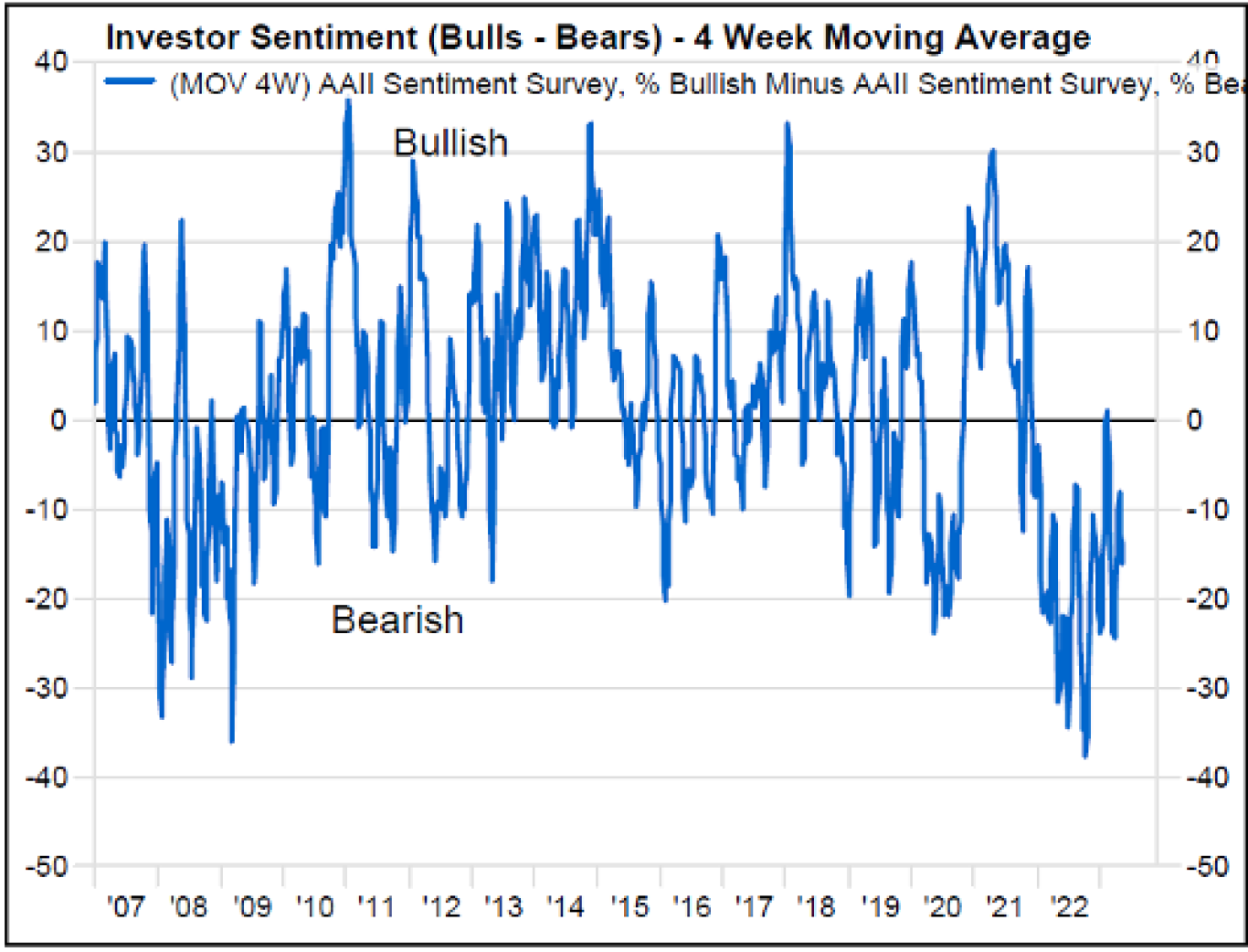

- The AAII sentiment survey has remained net bearish for some time now. As we see this as a contrarian indicator of future market returns, this negative sentiment could be correlated with the strong returns we’re seeing in the markets. A few interesting stats from the recent reading:

- Since 1987, the average 1-week Bull-Bear spread is +6% (2023 average is -13%)

- Since 1987, the median 1-week Bull-Bear spread is +7% (2023 median is -14%)

- In 1869 weeks (from 07/24/87 through 5/25/23), there has been a net bullish read 1,179 times (63% of the time)

- Since the beginning of 2023, there has been a net bullish read only 2 of 22 weeks (9% of the time)

- Since the beginning of 2022, there has been a net bullish read only 3 of 74 weeks (4% of the time)

- Excluding 2022/23, in the 1795 weeks with data, there has been a net bullish read 1,176 times (66% of the time)

- Also, we are now at 15 straight weeks of negative sentiment:

- 44 weeks starting 4/22

- 34 weeks during COVID

- 22 weeks during 1990

- 15 weeks (current)

Source: AAII sentiment survey

- The Atlanta Fed GDPNow Forecast Tool is setting estimated Q2 2023 GDP at 2.0% (up 0.1% from last week), as of 6/1/2023.

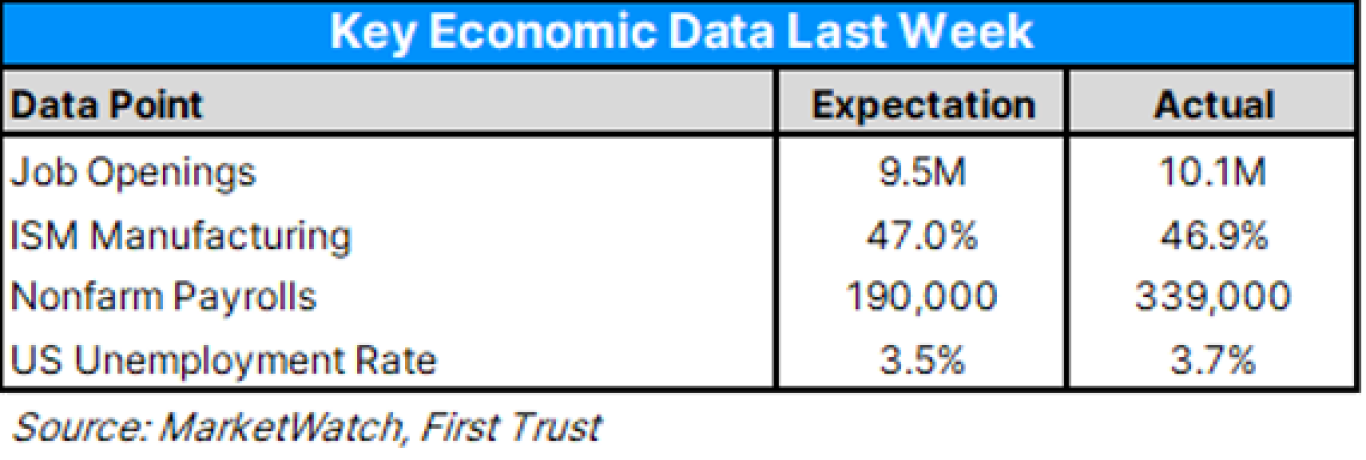

- The economic data calendar last week:

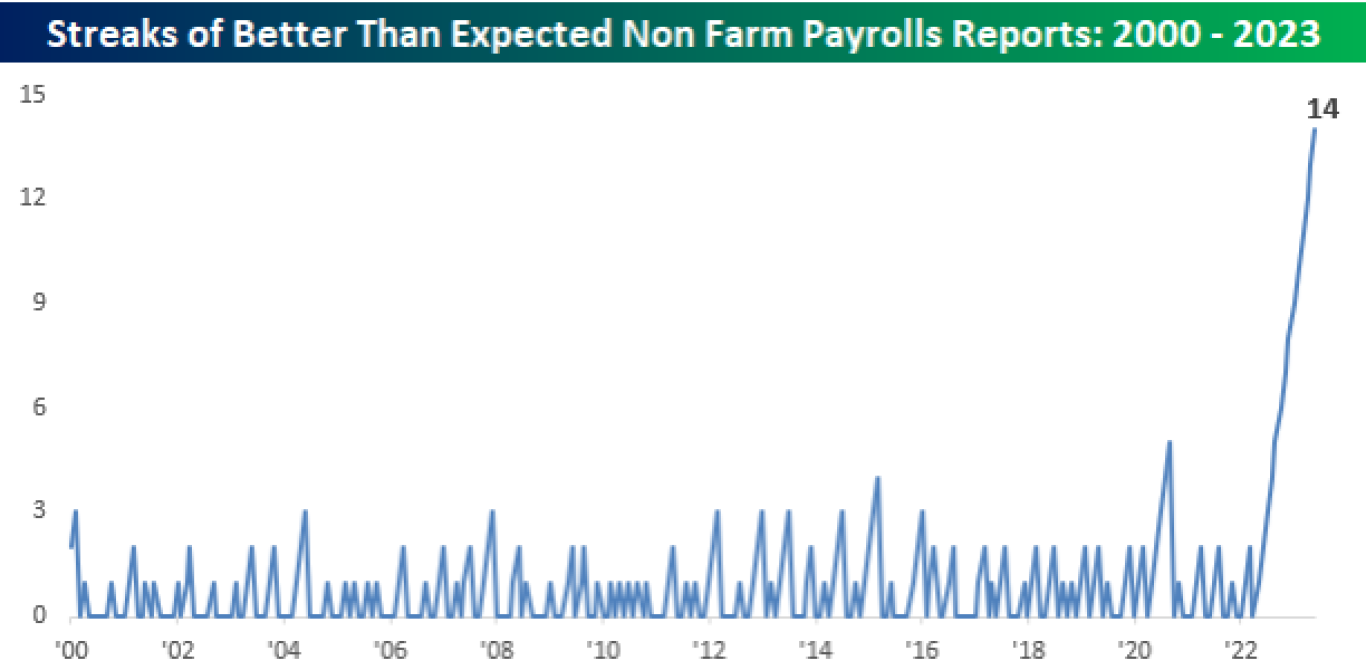

- Nonfarm payrolls continued their upside surprises last week, now at 14 weeks in a row. This is by far the longest streak we’ve seen since the beginning of the century. According to First Trust, this was also one of the largest divergences between expectation and result since the beginning of the pandemic.

Source: First Trust

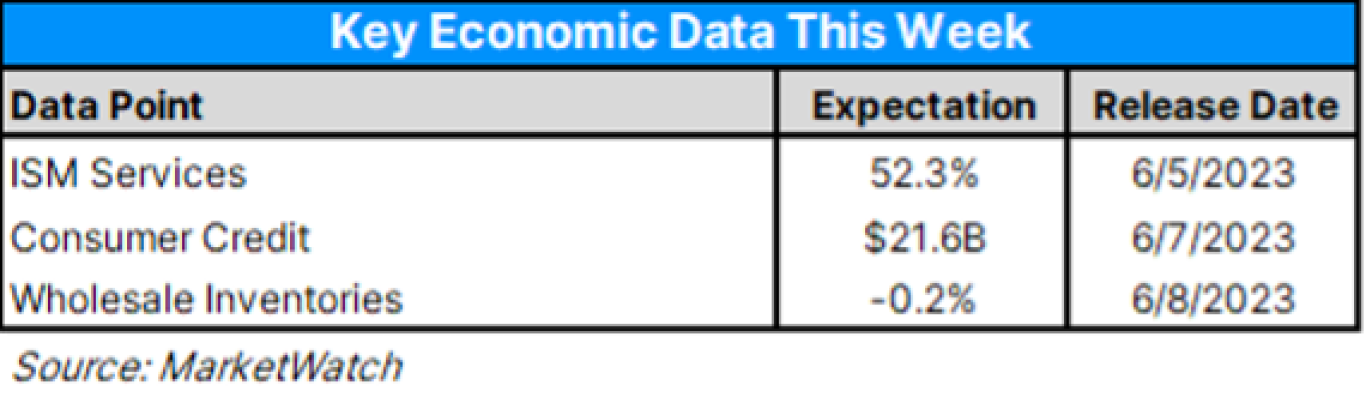

- Here is the economic data calendar for this week:

- As we wrap up earnings season, here’s this week’s Earnings Insight from Factset:

- Earnings Scorecard: For Q1 2023 (with 99% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS surprise and 75% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -2.1%. If -2.1% is the actual decline for the quarter, it will mark the second straight quarter that the index has reported a decline in earnings.

- Earnings Guidance: For Q2 2023, 66 S&P 500 companies have issued negative EPS guidance and 44 S&P 500 companies have issued positive EPS guidance.

- For all of CY 2023, analysts predict earnings growth of 1.2%

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Cryptocurrency prices were mixed last week, with Bitcoin declining 1.6% to near $27,000, and Ethereum rising 2.7% to just over $1,900. Solana, Tron, and Litecoin all jumped more than 6%. 2

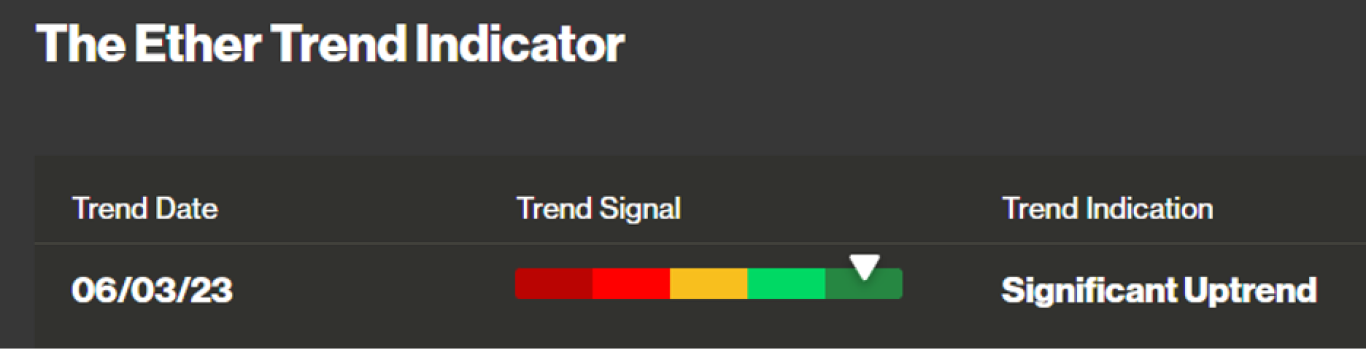

- Clarifying crypto regulation may be coming to Texas, including energy consumption for miners and consumer protections for exchanges. While the Bitcoin blockchain continues to experience higher fees, blamed on the use of ‘ordinals’, Bitcoin miners stand to benefit. For example, Marathon digital mined 77% more Bitcoin in May than in April (the stock is up 195% YTD and held in nearly every digital asset ETF). The Avalanche network (an Ethereum competitor) hit 1 million monthly active users for the first time. I had previously mentioned the Bitcoin Trend Indicator, there is also one published for Ethereum. While Bitcoin’s trend has cooled some, Ethereum remains in the green.2

- No new digital asset ETF news.

Source: CoinDeskIndices

- “Making money in the market requires two things: a non-consensus opinion and being right.” Another quote that Dr. Daniel Crosby got out of ChapGPT but is often attributed to George Soros.

- Speaking of Orion Chief Behavioral Officer, Dr. Daniel Crosby, Orion’s full lineup of Be-Fi materials is now available for Wealth Management Clients and will be turned on by default via Orion Planning. Those tools include:

- 3D Risk Profile

- BeFi20

- Protect, Live, Dream

- On this week’s Orion's The Weighing Machine podcast Robyn and I talk to Alex Oxenham from Hilton Capital Management. With a combined knowledge of debt and equity markets and successfully institutionalizing Hilton's research and investment process, Alex talks about Tactical Income strategies, how they work, and how to incorporate them into investment portfolios.

- Hat tip to Jeroen Kraaienbrink on LinkedIn for sharing the 10 principles of strategic leadership:

- Distribute responsibility

- Be honest and open about information

- Create multiple paths for raising and testing ideas

- Make it safe to fail

- Provide access to other strategists

- Develop opportunities for experience-based learning

- Hire for transformation

- Bring your whole self to work

- Find time to reflect

- Recognize leadership development as an ongoing practice

- Orion is leading the way with the most finalist awards (8), in the WealthManagement.com 2023 Industry Awards. Here’s the full list of finalists.