-

Advisor Tech

-

-

Recommended

-

-

Wealth Management

-

-

Recommended

-

-

Who We Serve

-

Who We Serve

-

Individuals

- Financial Advisors

- Business Owners

- Chief Compliance Officers

- Chief Operations Officers

- Chief Technology Officers

FirmsRecommended

- Resources

-

Resources

-

Learn

Orion Tech Release Highlights

Check out the latest Orion Tech Release Notes.

For our full Release Notes and Knowledge Articles, go to Orion Connect and open the Orion Support App.

April 2025

Advisor Portal: Hide the RTQ in Proposals (4/25)

Hide the Risk Tolerance Questionnaire Feature in Proposals

- Firms can now choose to show or hide the RTQ step in the proposal process

- Provides flexibility for firms that prefer not to include the RTQ

- This is a firm-wide setting that applies to all users within the tenant/database

1197-U-25114

Billing: Legacy Advisory Fee Report in Payout Dashboard (4/25)

Legacy Advisory Fee Report Now Available in Payout Dashboard

- The Advisor Desktop Advisory Fee Report is now available through the Payout Dashboard in Orion Connect.

- This allows firms to generate both PDF and CSV reports when processing rep payments, improving efficiency and streamlining access to critical payout details.

To enable the Legacy Report, navigate to: Orion Connect> Firm Profile > Option Information > Payout Dashboard Advisory Fee Report > Select Legacy Report from the dropdown.

To generate the report, ensure that a Rep Bill Entity payment is processed in Orion Connect > Billing > Payments.

1197-U-25114

Client Portal: Performance Bar Chart (4/25)

New Performance Bar Chart Card

- The New Performance Bar Chart Card in the client portal enables clients to visualize portfolio performance across groupings (e.g., asset category, asset class, account)

- Displays data in an easy-to-read bar chart format and is helpful for visual learners reviewing their portfolio

- It’s also customizable, and can be removed, resized, or rearranged on the page to match your firm’s narrative

How to get there: Orion Connect > Client Portal > Personal Finances > Performance Tab

1197-U-25114

Orion Learning Lab: New Courses in April

New Orion Learning Lab Courses in April 2025

- Core Concepts: Alternative Investment Platform (AIP)

- Core Concepts: Financial Planning

- Creating Custom Queries

- Orion Planning: Behavioral Finance Tools

Knowledge Article: Orion Learning Lab Overview

1197-U-25114

Reporting: Trends Moving to Live Data Model (4/25)

Trends Reporting Moving to Live Data Model

- The Trends app is shifting to a hybrid data model, with our largest cube moving to a live model due to vendor capacity limits.

- This change aims to reduce recent production incidents. Clients may notice slightly longer dashboard load times (2–5 seconds).

How to get there: Orion Connect > Trends

1197-U-25114

Trading: Large Trading Volume Workflow Warning (4/25)

New Large Trading Volume Workflow Warning

- Users will receive a popup notification when trade counts on the open Orders Grid exceed 50,000

- This popup displays best practices for navigating large trade day experiences

- Users will be able to dismiss this notification and prevent it from displaying again (During this session, if the user logs in and out, it will display again)

How to get there: Eclipse > Trades > Orders

1197-U-25114

March 2025

Advisor Portal: Enhancements to Proposal Allocation Bypass Options (3/7)

Enhancements to Proposal Allocation Bypass Options in Admin Screen

Firms can now control model allocation requirements in the proposal workflow before opening a new account. Under the setting "Require Proposed Account Allocation Before Opening New Account," choose from:

- Required – Users must allocate proposed accounts before setup.

- Disabled – Users cannot allocate proposed accounts before setup.

- Optional – Users can allocate or skip allocations before setup.

How to enable: Admin settings in Advisor Portal > Proposed Accounts > Minimums screen > See the new bypass options under ‘Require Proposed Account Allocation Before Opening New Account'.

0891-U-25085

Billing: New Payments Section in App (3/14)

New Payments Section in the New Billing App

Users with the Post Payments and Indirect Management Fee Adjustment privileges now have all Payments sidebar links enabled by default in the Billing app. This update removes the need for manual configuration, ensuring seamless access to key payment-related pages.

Post Payments Privilege: Users can access:

- Payments to Post

- Management Fees to Post

- Posted Payments

- Posted Payments by Batch

- Batch Status

Indirect Management Fee Adjustment Privilege: Users can access the Indirect Management Fee Adjustment page.

How to get there: Orion Connect > Billing app

0891-U-25085

Client Portal Mobile App: Enhanced Performance Visuals (3/28)

Enhanced Performance Visuals on Mobile

We’ve improved the performance screens in the Orion Wealth Management Portal mobile app with enhanced visuals and a more intuitive display.

These updates provide a clearer, more engaging view of performance data, making it easier to analyze on the go.

0891-U-25085

Financial Planning: Updated Historical Returns (3/21)

Updated 20-Year Historical Returns: 2005–2024

The historical return data now includes the last 20 years (2005–2024), giving you more accurate insights.

This ensures up-to-date market performance data, eliminating the risk of outdated historical returns.

You can now analyze long-term trends more effectively, leading to better financial planning and client outcomes.

Portfolio analysis and financial modeling are now more precise, helping you make informed projections with confidence.

How to get there: Orion Connect > Orion Planning > Application Settings > CMAs

0891-U-25085

Portfolio Interactions: New View Setting (3/28)

New Portfolio View Setting

A new setting has been added to all cards with multiple groupings and allocations.

This setting allows you to determine if the lower grouping’s allocation percentage should be that of the parent grouping or the entity selected in the tree.

By default, it is set to false to show the allocation of how the Portfolio View has always allocated groupings.

How to get there: Orion Connect > Portfolio View > any card with multiple groupings and allocation

0891-U-25085

Reporting: Enhanced Cash Flow Grouping (3/7)

Enhanced Cash Flow Grouping with Roll-Up Option

RB3 now offers improved cash flow reporting for firms billing on the same day as cash flows. Consolidate all 46 cash flow transaction types into a single entry per day, regardless of account splits.

This simplifies reporting and enhances readability. Each transaction type is either a positive or negative value, ensuring multiple same-day transactions of the same type are combined under one entry.

When Enabled (Roll-Up ON):

- Example: Contributions or distributions occurring on the same day across multiple accounts will be rolled up into a single row in the report.

When Disabled (Roll-Up OFF):

- Example: Contributions or distributions will be displayed as separate rows for each transaction, maintaining account-level granularity.

How to get there: Orion Connect > Reporting

0891-U-25085

Support: Orion Learning Lab (3/28)

Introducing the Orion Learning Lab

The Orion Learning Lab (OLL) is now live, providing a centralized hub for interactive training on Orion’s technology solutions. Designed for new users, OLL offers foundational courses to help you navigate key features and workflows with ease.

Key Benefits:

- Integrated training within the Support app for a seamless experience

- Interactive courses that enhance comprehension and retention

- A growing library of training materials, with more courses coming soon

How to get there: Orion Connect > Support App > Orion Learning Lab

Knowledge Article: Orion Learning Lab Overview

0891-U-25085

Trading: Enhanced YTD Gain/Loss Calculation (3/21)

Enhanced YTD Gain/Loss Calculation in Rebalancer Tools

- We’ve enhanced our rebalancer tools with more precise Year-to-Date (YTD) gain/loss calculations for better portfolio management.

- Open & pending orders are now factored into YTD calculations, preventing unexpected breaches of max gain limits.

- Canceled sleeve activity is now included, ensuring realized gains/losses are accurately reflected.

- These updates provide a more complete view of your portfolio’s gain budget, helping you stay within your max gain parameters with confidence.

0891-U-25085

February 2025

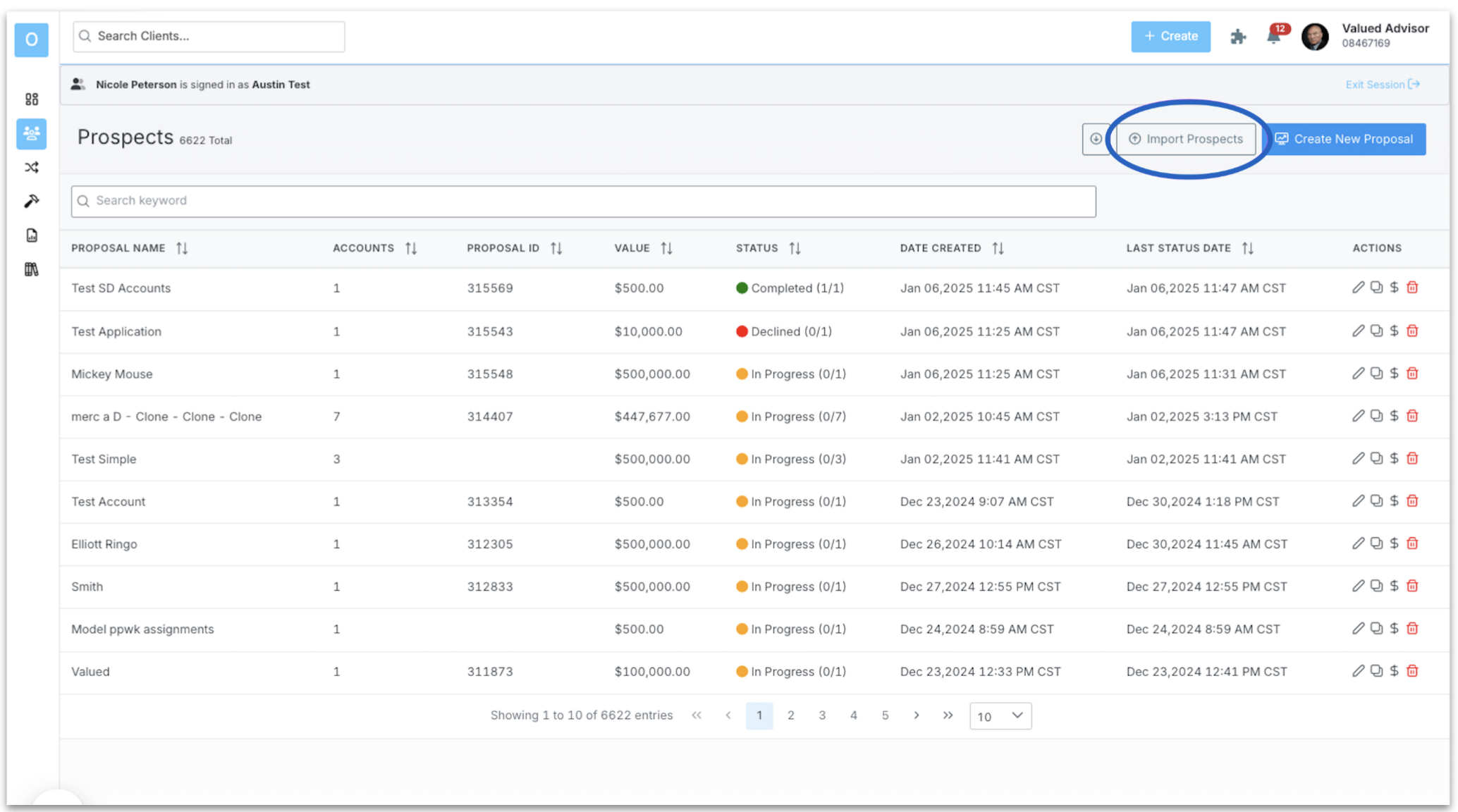

Advisor Portal: Hide Prospect Import (2/21)

Hide Prospect Import - New Option in Admin Screen

- This enhancement allows firms to display or hide the Import Prospects button on the Prospects screen.

- Previously, this button was a permanent option. After the release, a firm can decide to display this function or hide it altogether.

- Import Prospects is a button that allows a rep to mass import prospects from a template. It will default to display when released. Reach out to an SME to turn this functionality off.

How to enable: Reach out to the Advisor Portal SME Team who turns the experience on.

0549-U-25057

Billing: QE Dashboard Integration (2/14)

Billing App Integration with QE Dashboard

The QE Dashboard has been enhanced to integrate seamlessly with the new Billing app, promoting a modernized user experience for managing billing audits and generation wizards. Users will now benefit from streamlined navigation and improved workflows that direct them to the new Billing app for relevant actions.

Key Features & Enhancements

All hyperlinks in the Billing Audit section of the QE Dashboard will now redirect users to the corresponding pages in the new Billing app, instead of the old Billing Audit app:

- All Account Review: Redirects to Billing > Accounts > View All Active

- Missing Fee Schedules: Redirects to Billing > Accounts > Missing Fee Schedules

- Missing Payout Schedules: Redirects to Billing > Accounts > Missing Payout Schedules

- Paying Fee is Zero: Redirects to Billing > Accounts > Paying Fee is Zero

- Paying Fee is Indirect: Redirects to Billing > Accounts > Paying Fee is Indirect

- Paying Fee is Inactive: Redirects to Billing > Accounts > Paying Fee is Inactive

- Recurring Adjustments: Redirects to Billing > Adjustments > Account

- Credit Remaining: Redirects to Billing > Adjustments > Remaining Adjustments

- Review Billing Status: Redirects to Billing > Households > Active Households

Launch Billing Wizard from QE Dashboard

The Launch button in the Generation Wizards section now opens the Create Live Bill Instance Wizard in the Billing app, improving navigation and adoption of the new Billing app workflows.

Conditional Access to Billing Wizard Options

For Advisor-level users, the Run For options in the Create Live Bill Instance wizard will have conditional restrictions based on QE Dashboard completion:

If QE Dashboard is Not Completed:

- Options for "Run For" will be limited to:

- Households (Selected Only)

- Accounts

- Import Bills From List

- All other options will remain visible but disabled.

- If QE Dashboard is Completed: Full access to all "Run For" options in the wizard.

How to get there: Orion Connect > Quarter End Dashboard

0549-U-25057

Client Portal: Display Advisor Transaction Notes (2/9)

Ability to Display Advisor Transaction Notes in the Client Portal

- Add custom transaction notes in the client portal in situations where a client holds unique securities or an account with unique activity to communicate specific details around a transaction to your clients.

- Clients will now see a tooltip next to any transactions in the client portal that have advisor notes added to them. They can hover over the tooltip and read the advisor notes to understand the transaction better.

How to get there: Orion Connect > Client Portal > Personal Finances > Select Account > Transactions Tab

How to enable: Orion Connect > Client Experience > Portfolio > Show Transaction Notes

How to add transaction notes: Orion Connect > Portfolio Audit > Select Household or Account > View Transactions > Advisor Notes

0549-U-25057

Financial Planning: Enhanced Social Security Estimates (2/28)

Enhanced Social Security Estimates

- Ensures Social Security estimates align with the maximum allowable benefits set by the SSA, providing more accurate and realistic projections when using the "estimate" wand.

- Prevents overestimation by capping benefit estimates at the maximum Full Retirement Age (FRA) benefit for the year, correcting issues related to incorrect wage base calculations or future value adjustments.

- Enhances retirement planning by providing advisors with reliable benefit projections based on either the user’s specific earnings history or the SSA maximum, ensuring accuracy in financial plans.

- Helps advisors set proper client expectations by ensuring benefit estimates reflect actual SSA limits, reducing the risk of overestimated retirement income assumptions.

How to get there: Orion Connect > Orion Planning > Profile> Income > Add Income > Social Security > Estimate

0549-U-25057

Portfolio Interactions: Custodian Dashboard (2/7)

Custodian Dashboard Re-Design

- The Custodian tab in Portfolio View has a new look and feel.

- Access the same valuable, real-time data in an experience cohesive with the rest of the Portfolio View.

- New cards coming soon for gain loss and alerts.

How to get there: Orion Connect > Portfolio View > Custodian tab

How to enable: Requires the Schwab Integration privilege

0549-U-25057

Reporting: Billing Fee Schedule Minimum (2/14)

New Tag – Billing Fee Schedule Minimum

The new Billing Fee Schedule Minimum provides visibility into the minimum fee assigned to accounts within fee schedules. This tag enhances reporting capabilities by enabling users to include minimum fee details directly in their reports, formatted in dollars.

This data is pulled from the Minimum Fee field in Billing > Fee Schedules > Select Fee Schedule > Edit > Minimum Fee.

How It Works:

- Scenario 1: Minimum Fee Exists

- Given: The fee schedule assigned to the account in the report includes a minimum fee.

- When: The report is run.

- Then: The tag will populate the minimum fee value, formatted in dollars (e.g., $500.00).

- Scenario 2: No Minimum Fee Assigned

- Given: The fee schedule assigned to the account in the report does not have a minimum fee.

- When: The report is run.

- Then: The tag will return a blank value.

How to get there: Orion Connect > Reporting Apps > Actions > Data Library

0549-U-25057

Trading: Updated Rebalance Priority Logic (2/14)

Eclipse/Communities: TLH Alternates for Community Security Sets

We've updated the rebalance priority logic to simplify the process and improve trade accuracy. This change applies to single-account portfolios and multi-account portfolios with the same tax type.

What's Changing?

- Previously, when "Rebalance Priority Ranking" prioritized "Location Optimization," the system set location optimization to priority 1 for all assets but still ran the full optimization logic, adding unnecessary steps.

The New Approach

- Now, when "Location Optimization" is prioritized for portfolios with the same tax type, the system will set the rebalance priority to "Out of Tolerance." Remove location optimization steps from the rebalance logic and trade logs.

Benefits

- More Accurate Trades: Focuses on target allocations for better trade recommendations.

- Improved Performance: Streamlines the process by eliminating redundant steps.

Note: This change only applies to portfolios where all accounts share the same tax type. Multi-account portfolios with different tax types will follow the previous logic.

0549-U-25057

January 2025

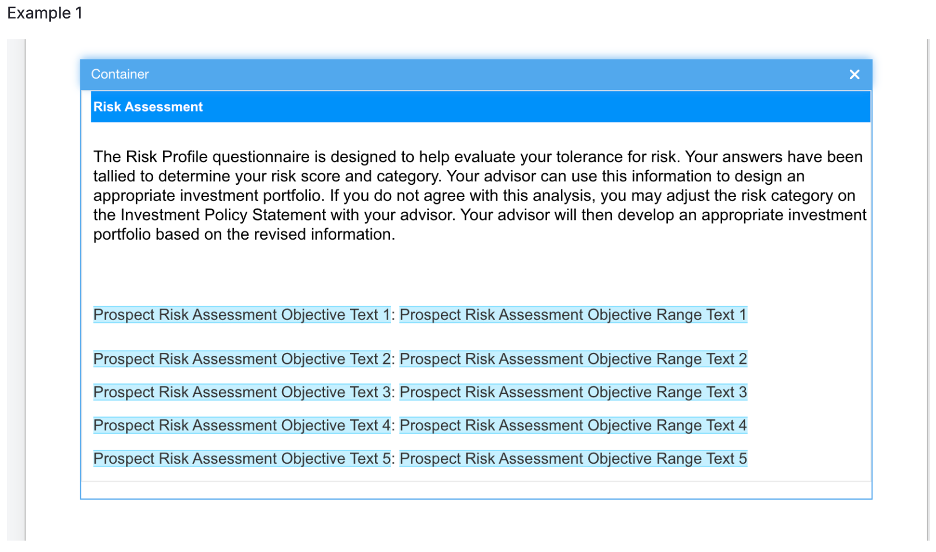

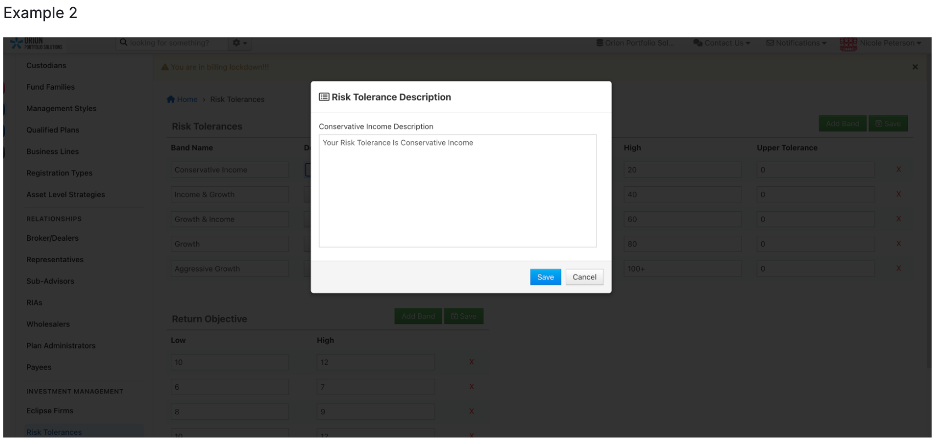

Advisor Portal: New Tag for Risk Tolerance Band Descriptions (1/10)

New Tag for Risk Tolerance Band Descriptions

- Previously, there were only tag options for each risk tolerance risk range and the numerical value of each range (Example 1). Now, there is a new tag for the description associated with each risk tolerance (Example 2).

This gives firms the ability to have the risk tolerance description live in one place and include the same description on any proposal sub-report

How to get there: (for Risk Tolerance Description) Orion Connect > Firm Profile > Risk Tolerances > Description button

(for the tag) Orion Connect > Reporting > Sub-Reports > Element Proposal > any sub-report

How to enable: Add the new tag labeled ‘Prospect Risk Assessment Objective Description Text 1-…5’ on any sub-report under the Element Proposal section.

0262-U-25028

Advisor Portal: Streamlined Options for New Account Opening (1/31)

Streamlined Options for Firms Opening New Accounts Without Proposals

- Firms now have the flexibility to decide if model selection and proposal generation are required, optional, or hidden when opening new accounts.

- This feature saves time and eliminates unnecessary steps for reps. Previously, reps had to complete account allocation setup in Advisor Portal to open a new account.

- With this update, firms can choose to:

- No change in the existing user experience: Require allocation setup.

- Restricted: Allow new account openings without allocation options.

- Non-Restricted: Allow reps to allocate accounts or skip allocation setup entirely.

How to enable:

Contact the Advisor Portal SME Team to activate this feature.0262-U-25028

Data Recon: Account Restriction Entity Option(1/10)

Account Restriction Entity Option Update via Custodial Files

Custodial processing now automatically updates select account restriction entity options for Fidelity, Schwab, and Pershing accounts based on custodian settings.

- Margin Agreement (True/False Checkbox)

- Option Level Agreement (Dropdown Options 1-4)

- Prime Brokerage (True/False Checkbox)

This enhancement eliminates the need to manually update this within the Orion system and ensures you can report on these accounts like your respective custodian.

How to get there: Orion Connect > Search for Account > Edit Account > Setting: Options > Account Type Restriction

How to enable: There is nothing you need to do. This is automatically enabled for you.

0262-U-25028

Financial Planning: Enhanced Tax Modeling (1/3)

Enhanced Tax Modeling and Itemized Deduction Updates

Improved Itemized Deduction Modeling with TCJA Expiry Scenarios

- Allows you to toggle between TCJA and pre-TCJA rules for accurate tax scenario modeling.

- Automatically adjusts calculations for SALT, mortgage interest, charitable contributions, medical expenses, and Pease Limitations.

- Provides flexibility and precision in illustrating the impact of potential tax policy changes.

Enhanced Tax Modeling UI for Pre- and Post-Retirement Scenarios

- There is a new post-retirement column to display itemized deductions for the first retirement year, updated annually unless overridden.

- Improves efficiency and accuracy for advisors modeling pre- and post-retirement tax outcomes.

Integrated Itemized Deductions in Tax Estimation

- Automatically applies the higher of standard or itemized deductions in each simulation year.

- Supports pre- and post-retirement deduction methods, incorporating medical expenses, SALT, mortgage interest, and inflation adjustments.

- Enhances accuracy by dynamically updating values and excluding fully amortized loans.

- Reduces manual effort while improving precision in client tax planning strategies.

How to get there: Orion Connect > Orion Planning > Profile > Taxes

How to enable:

- TCJA expiry modeling and itemized deduction updates are available by default.

Customize advanced tax menu features under Profile > Taxes > Advanced.

Knowledge Article: Tax Deductions Tool in Orion Planning

0111-U-25015

Portfolio Interactions: Privilege Requirement Updates (1/17)

Privilege Needed for Portfolio View Fee Schedule Card

- Due to the nature of the data on this card, the Fee Schedules privilege is now required for users to access the Fee Schedule card in Portfolio View.

- Firm admins with role assignment privileges will now need to add the Fee Schedules privilege (Read) to their user roles so that users can view this card or add it to a dashboard.

How to get there: Orion Connect > Add Card > Fee Schedule

How to enable: Fee Schedules privilege added to user role.

0262-U-25028

Reporting: Custom Indexing Reporting Updates (1/31)

New Integrated Sub-Report for Orion Custom Indexing Reporting

- Orion Custom Indexing users can now show clients the underlying details and weight of their custom Target Strategy in the Orion Custom Indexing (OCI) report.

- There is a new Orion Custom Indexing Target Strategy Details sub-report that can be added to the OCI report to display target allocation and weight % for the details within the Target Strategy assigned to an Account.

How to get there: Orion Connect > Reporting > Sub-Reports > Integrations > Orion Custom Indexing Target Strategy Details

How to enable: Reach out to the Orion Custom Indexing team

0262-U-25028

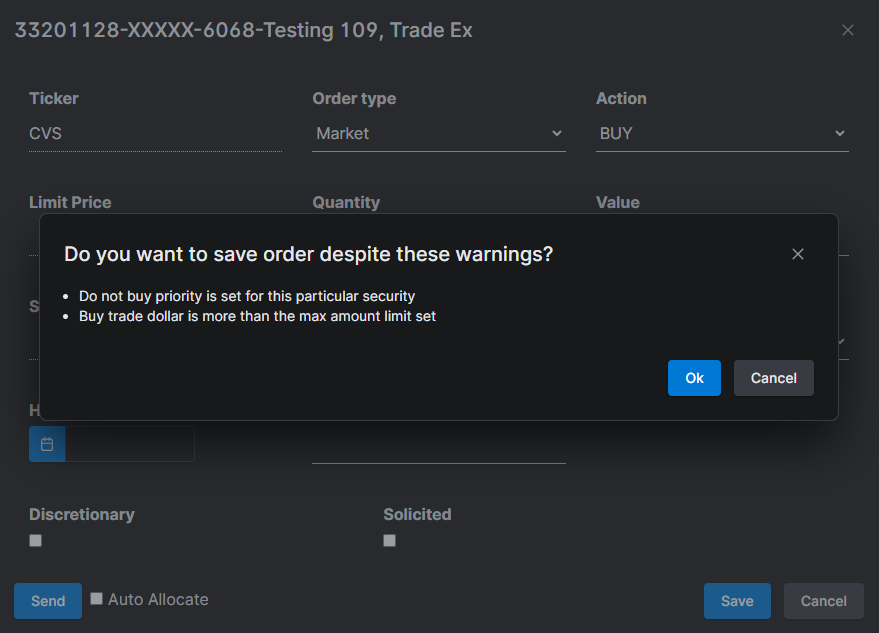

Trading: Order Editing (1/24)

Order Editing Restrictions Update

- Enjoy more flexibility when editing orders in Eclipse, especially for margin accounts and drawing sleeves "negative."

- Edit trades freely while receiving warnings to maintain trade integrity. A pop-up will appear for previously restricted trades, allowing users to proceed or revert changes.

- Examples include:

- Negative account value

- SMA account restrictions

- Trade-blocked accounts

- Short-term gain restrictions

- Selling positions not owned

How to get there: Eclipse > Orders > edit an order

0262-U-25028

December 2024

Advisor Portal: Automatic Display of Proposal Default Template (12/6)

Reps See the Proposal Default Template Automatically

This usability and efficiency enhancement helps save time for users when building their proposal output by automatically displaying the default template (if one exists) and the associated included and available pages when they reach the Proposal Output step.

- Prior to this change, a rep would have to select a template before any of the output pages would appear.

- After this change, when there is a default template selected in the firm’s internal Admin screen, that template will automatically populate for all reps when they arrive at the Proposal Output step in the workflow.

- Users will have all pages populate and the default template will populate without having to make any selection first.

- This saves the users a few clicks and provides a suggestion for which template to use that the firm’s administrator has set in the Admin screen.

How to get there: Advisor Portal > Create New Proposal > navigate to Proposal Output step

3107-OAT-12/4/2024

Trading: Eclipse Role Privilege Updates (12/6)

Eclipse Role Privilege Updates

- A new Reset Database Analytics privilege for the Firm Admin role type will control whether users can select Reset All In-Progress Analytics within the Analytics dropdown in the header, and Reset Analytics in the three dot menu on the Overview page.

- Previously, the Refresh Database Analytics privilege was available to all role types and is now limited to Firm Admins.

3107-OAT-12/4/2024

Trading: TLH for Alternate Securities (12/6)

Tax-Loss Harvesting: Improved Handling of Equivalency Logic for TLH Alternate Securities

Key Improvements

- TLH alternate securities are now recognized as equivalent to targeted securities immediately upon trade creation.

Prevents unintended liquidation of TLH alternates during subsequent trading.

Enhances portfolio accuracy and management.

What's Changing

- Equivalency between TLH alternates and targeted securities is established instantly upon TLH trade completion.

Example: A TLH trade from IBM to MSFT immediately marks MSFT as equivalent to IBM, maintaining intended positions in future trades.

If a TLH trade is deleted, the equivalent security relationship is also removed automatically.

How to get there: Eclipse > Manage Users > Roles

3107-OAT-12/4/2024

November 2023

Advisor Portal: Trailing Returns Ordering (11/8)

Trailing Returns Ordered from Shortest to Longest on Fact Sheets

We reordered trailing returns on Orion's fact sheets to display from shortest to longest for a more intuitive user experience.

- The new order is QTD, YTD, 1 Year, 3 Years, 5 Years, 10 Years, Since Inception

How to get there: Advisor Portal > Create Proposal > Proposal Step

How to enable: N/A

2845-OAT-11/6/2024

Advisor Portal: New Household Proposal Page (11/15)

New Household Page for Proposal Output

Tell a more effective story for prospects by using this new, optional proposal page that presents the overall household view of the proposed portfolio across multiple registrations or accounts.

- There is a new RB3 sub-report for the proposal output that displays the asset allocation in a table and pie chart for a client’s overall proposed portfolio. The name of the page is ‘Household Strategy Recommendation’.

- This sub-report outlines the account name, strategy, and amount in a table for each registration within an overall portfolio or household.

- It outlines the asset class by weight and amount in an associated pie chart.

How to get there: Advisor Portal > Clients (in left-hand navigation) > Prospects > proceed to Proposal step > Select the page titled “Total Portfolio Asset Allocation”

How to enable: Advisor Portal (login as Admin) > Proposal Output (in left-hand navigation) > click on Setting gear icon for the “Total Portfolio Asset Allocation” fragment > ensure the checkbox marked “Is Active” is blue with the checkmark and Save

2901-OAT-11/12/2024

Eclipse: Enhanced Cash Management (11/1)

Enhanced Cash Management for Raise Cash Tool

- Have more control over how excess cash is handled and greater flexibility in managing your cash positions in the Raise Cash tool.

- Enjoy more precise control over portfolio rebalancing during cash-raising operations, and the ability to align cash-raising activities with your specific investment strategy and risk tolerance.

- This update introduces a new preference called "Raise Cash - Include Excess Cash" with three options to suit your specific cash management needs:

No Excess Cash

- Raises only the amount you specify

- Does not touch any excess cash in your account

- Ideal when you want to maintain your current cash position while raising additional funds

All Excess Cash

- Uses all excess cash above your target towards your requested amount

- Applies to cash that is overweight (even if within tolerance) or out of tolerance

- Helps in balancing your portfolios cash position while raising cash

Excess Cash Above Tolerance

- Only uses excess cash if your cash position is both overweight AND out of tolerance

- If these conditions are met, it uses all excess cash above your target

- Provides a balanced approach, only tapping into excess cash when it significantly exceeds your set tolerances

How to enable: Eclipse > Firm, Team, Portfolio, or Account level preferences > search for “Raise Cash - Include Target Cash” and set your preference.

2784-OAT-10/30/2024

Redtail CRM: View Contact Change Source (10/30)

Ability to view from where a contact change derived

Redtail integrates with hundreds of 3rd party platforms. Often, Redtail users make an update in the context of one of those 3rd party platforms that affects a Redtail contact. It has traditionally been the case that users were only able to see that a change to the Redtail contact was made, not the source of that change. We have enhanced the contact timeline details so that you can now view the source of the change to a contact to enhance the visibility of changes to our users.

How to get there: While in a contact, select the “Timeline” option from the left navigation menu > Select an event to view the Timeline details > View the “Source” field to identify where the change to the contact was derived.

2901-OAT-11/12/2024

Trading: Add Public Views (11/8)

Eclipse - Add Public Views to Firm Action Items

Users assigned to a Firm Admin role type may begin adding publicly saved views from the Portfolios and Accounts grids to the Firm Action Items Dashboard in Eclipse.

- An “Add Saved View” button is in the Firm Action Items Dashboard, allowing you to add a public view directly from the dashboard. Selecting “Add Saved View” will put the dashboard into edit mode, and add a tile where you can choose Portfolios or Accounts, and then select the public view to add to the dashboard.

- The saved view dropdown on both the Portfolios and Accounts grids includes a link when a public view. Selecting “Add to Firm Dashboard” will add the selected public view to the Firm Dashboard.

- To assign public views to the firm dashboard, the user’s role must have privileges to create public views, and edit dashboard defaults.

How to get there: Eclipse > Firm Action Items > Add Saved View

How to get there: Eclipse > Portfolios > select a public saved view > select the saved view dropdown > Add to Firm Dashboard

How to get there: Eclipse > Accounts > select a public saved view > select the saved view dropdown > Add to Firm Dashboard

2845-OAT-11/6/2024

Trading: Eclipse - Sleeved Model Tolerance (11/27)

Eclipse Account Details and Portfolio Details Pages Updating to Popup Windows

Beginning November 27, 2024, the Model Tolerance tool in Eclipse will show sleeve strategy and sleeve level data for sleeved portfolios on the platform.

The Sleeve tab within Model Tolerance will include columns for:

- Suffix

Model Name

Current % and $

Target % and $

Difference % and $

Post % and $

The Sleeve Strategy level will include columns for:

- Sleeve Strategy Name

Current % and $

Target % and $

Difference % and $

Post % and $

How to get there: Eclipse > Portfolios > select a sleeved portfolio row > Analyze

2975-OAT-11/19/2024

Wealth Management Portal: Managed Account Performance (11/20)

Orion Managed Account Performance Details

- Viewing investment performance details within the context of various groupings is one of the most popular aspects of Orion users today. Now this information can be shown in the Orion WM Portal mobile application.

Before this change, advisers could only show clients on the mobile app performance at the household, account or portfolio group levels. Now advisers can customize which additional groupings they wish for clients to view in comparison to any applicable benchmarks (examples: asset class performance, asset category performance, model performance, etc)

This allows advisers to direct clients to the mobile application for convenience when viewing more detailed information about their portfolio’s performance.

How to get there: Orion Wealth Management Portal > Accounts > Managed Accounts > Return > View Performance Details

How to enable:

Orion Client Experience App > Settings > Portfolio > Performance Grouping Options > Choose Selections & Save

Orion Client Experience App > Settings > Portfolio > Asset Level Performance > Save3107-OAT-12/6/2024

October 2024

Advisor Portal: Proposal – Registration Title (10/25)

Money Market Trading in Eclipse

- The name of the registration wasn’t populating at the top of a blended fact sheet, making it difficult for advisors to know which blended fact sheet applied to which registration in a multi-registration proposal.

- We are updating the blended fact sheet so the registration name populates again.

How to get there: Advisor Portal > Clients > Prospects > Blended performance page on step 6 within proposal workflow

2717-OAT-10/22/2024

Compliance: Pre-Clearance UI Improvements (10/11)

Client Oversight: Pre-Clearance UI Improvements

When users go to the Preclearance alerts grid, filtering, sorting, and reporting will now be enabled and functional.

- Sort, filter, and group data points to refine searches.

- More options to export data.

- CSV, Excel, and Zip reporting are now all functional.

How to get there: Orion Connect > Orion Compliance > Client Oversight > Preclearance

2589-OAT-10/8/2024

Planning: Dynamic Navigation (10/18)

Dynamic Navigation from Overview to Accounts screen

- Client users in the mobile application will be able to expand the selected area of the Accounts widget when selecting on the Overview. This action will dynamically open the selected

- Accounts subcategory on the Accounts screen. This responsive behavior will create a more intuitive, interactive experience for mobile users.

How to get there: Orion Wealth Management Portal Application (iOS or Android) > Overview > select Accounts subcategory > expanded subcategory in Accounts screen

How to get there: Orion Wealth Management Portal Application (iOS or Android) > Overview > select Managed Accounts > Managed Accounts dashboard

How to enable: Orion Planning > select client > Name > configure access > enable Personal Finances > save.

2655-OAT-10/15/2024

Redtail: New Sample Workflow Templates (10/4)

Account Aggregation for Fidelity Accounts Now Available through Akoya

- Redtail CRM users who already have access to workflows now have access to a series of helpful workflow templates that act as a starting point for creating a wide range of workflows for you and your office.

- Once a workflow template is brought into a Redtail CRM database, all users within that database will have access to those workflow templates.

How to get there: To access the workflows, simply navigate to the Workflow Templates page by selecting the Manage Your Account option from the dropdown under your name and selecting the Workflow Templates option.

Once on the Workflow Templates page, select Template Library from the New Template dropdown in the top right corner of the page.

All of the available workflow templates will populate on the Import New Templates page.

How to enable: Once on the Import New Templates page, select the templates you’d like to download to create your own templates and select the Import button in the bottom right corner of the page.

Knowledge Article: Sample Workflow Templates

2535-OAT-10/2/2024

Reporting: New Reporting Privileges (10/4)

New Reporting Privileges

Easily specify a user's Report Tools experience by enabling or disabling these new Reporting privileges for certain roles:

Legacy Reports- Allows a user to utilize RB2 and Standard RB2 Reports

- These were previously included in the Reports privilege. Anyone who currently has the Reports privilege will have the Legacy Reports privilege enabled by default.

Report Theme Custom Styles- Allows the ability to apply CSS in report themes.Any administrator or advisor who currently has the Report Themes privilege enabled will have the new Report Theme Custom Styles privilege enabled by default.

Report Settings- Allows the ability to create and edit global report settings.- These options were previously included in the Report Builder- Advanced Editor privilege, and Report Settings is now its own separate privilege.

Anyone who currently has the Report Builder- Advanced Editor privilege will have the Report Settings privilege enabled by default.

How to get there: Manage Users > edit role > Privileges > Apps > Reporting- Legacy Reports

Manage Users > edit role > Privileges > Advanced > Reporting - Report Theme Custom Styles

Manage Users > edit role > Privileges > Records > Reporting - Report Settings

2535-OAT-10/2/2024

Trading: Eclipse Model Tolerance Updates (10/11)

Eclipse Model Tolerance Updates

Beginning October 11, 2024, the Model Tolerance tool within Eclipse will be enhanced to include the following updates:

- When a security or level of your model is out of tolerance, the Difference cell in the bottom grid section will be highlighted red for additional awareness. (GM in the screenshot below)

- When considering in or out of tolerance, Equivalent and Alternate securities will be aggregated with the targeted security. For example, WMT is the targeted security in a security set at 25% with a tolerance of +/- 5%, and current % of 5.51%. COST is an equivalent for WMT, and COST has a current % of 18.31%. When summing the current weightings (5.51% for WMT + 18.31% for COST), WMT will be considered within tolerance.

- In the Model Tolerance graph, equivalent and alternate securities will no longer be shown, but they will continue to show nested below the targeted security, with their corresponding tags in the bottom grid of Model Tolerance.

- Model Tolerance will show an account current holding dollar and percent values when no model is assigned.

How to get there: Eclipse > Portfolios > Select a portfolio with a model assigned > Analyze > Model Tolerance

How to get there: Eclipse > Accounts > Select an account with a model assigned > Analyze > Model Tolerance

How to get there: Eclipse > Orders > Select an order with a model assigned > Analyze > Model Tolerance

2589-OAT-10/8/2024

September 2024

Client Portal Mobile App: Enhanced Feedback Submission (9/6)

Enhanced App Feedback Submission: Upload Screenshots

We value the input we receive from advisors and end investors to improve our mobile application. Users can now upload one or several screenshots when submitting issues or suggesting improvements to our app’s functionality.

How to get there: Orion Wealth Management Portal > Menu > Tell Us About Your App Experience

How to enable: Automatically enabled for any adviser or client who is logged into our mobile application.

2263-OAT-9/4/2024

Compliance: Client Oversight (9/20)

Client Oversight — UI Changes

Continuing to enhance the user experience in Client Oversight

- Spacing, fonts, and colors are more consistent throughout the module.

- Tooltips are more concise and take up less space allowing the user to view key information.

How to get there: Orion Connect > Orion Compliance > Client Oversight

2397-OAT-9/17/2024

Eclipse: Add saved views to My Action Items (9/13)

Add saved views from the Portfolios and Accounts grids in Eclipse to My Action Items

On September 27, 2024, a new feature will allow you to add saved views from the Portfolios and Accounts grids in Eclipse to ‘My Action Items’ on your Eclipse Dashboard.

- Your saved view must include at least one filter applied through the Filters flyout on the grid.

- Add a saved view to your dashboard by selecting My Action Items > Add Saved View > Choose Portfolio or Account > select your saved view in the dropdown > Save

- You can also add a saved view to your dashboard through the Portfolios or Accounts grid. After choosing a view with at least one filter applied, click the Save or Update View button next to your saved view name, and choose Add View to Dashboard.

How to get there: Eclipse > Overview > My Action Items > Add Saved View

- How to get there: Eclipse > Portfolios > Save and Update View > Add View to Dashboard

How to get there: Eclipse > Accounts > All Accounts > Save and Update View > Add View to Dashboard

2331-OAT-9/11/2024

Financial Planning: Add Trusts as Estate Planning Beneficiaries (9/6)

New Billing App grids get cell range selection to support ‘Sum’ and ‘Average’ insights

All grids in the Billing app have been updated to allow you to select cells and dynamically gain additional insights on the data selected, including ‘Sum’ and ‘Average’.

- The new footer will only return the relevant information based upon the cell data you’ve selected.

- Select cell ranges across multiple columns to dissect that data in any way you need.

- Use familiar keyboard navigation to select cells

- Shift + Ctrl + Arrow Up or Arrow Down keys will select all cells above or below

- Shift + Ctrl + Arrow Left or Arrow Right keys will select all cells to the left or right

- Ctrl + A will select all cells on the grid

- A terminology adjustment was required for implementation. ‘Count’ previously reflected the total rows selected that you could act against. ‘Count’ will now reflect the amount of cells you have highlighted. ‘Selected’ has been added and will now represent the total number of rows the user has selected to interact with.

How to get there: Orion Connect > Billing App > any grid in the app

2263-OAT-9/4/2024

Trading: Add Saved Views to Eclipse (9/27)

Add Saved Views to Your Eclipse Dashboard

Add saved views from the Portfolios and Accounts grids in Eclipse to My Action Items on your Eclipse Dashboard.

- Your saved view must include at least one filter applied through the Filters flyout on the grid.

- Add a saved view to your dashboard by selecting My Action Items > Add Saved View > Choose Portfolio or Account > select your saved view in the dropdown

- You can also add a saved view to your dashboard through the Portfolios or Accounts grid. After choosing a view with at least one filter applied, click the Save or Update View button next to your saved view name, and choose Add View to Dashboard.

How to get there: Eclipse > My Action Items > Add Saved View

How to get there: Eclipse > Portfolios > Save and Update View > Add View to Dashboard

How to get there: Eclipse > Accounts > All Accounts > Save and Update View > Add View to Dashboard

2473-OAT-9/25/2024

August 2024

Cloud Data: Payout Rates and Schedules (8/16)

New Data Sets for Payout Rates and Schedules

Effortlessly review payout rates and schedules with these new data sets:

- vw_PayoutSchedule

vw_PayoutScheduleRates

vw_PayoutRate

vw_PayoutRateStructure

Orion Connect Views for these Data Points:

- Billing Audit → PayoutSchedules → General (includes all fields from UI list)

- Billing Audit → PayoutSchedules → Payout Rates

- Billing Audit → PayoutRates → General (includes all fields from UI list)

- Billing Audit → PayoutRates → Structure

Knowledge Article: Datashare - Payouts

Learn more about Payouts: How-To and Overview: Payout Rates & Payout Schedules

2071-OAT-8/14/2024

Communities: Proposal Data Packages (8/9)

Proposal Data Packages

We are excited to announce that Communities now offers Proposal Data Packages to our Communities Strategists! This new offering provides strategists with a comprehensive data set that includes information on participating firms that have run proposals for your Communities models. By leveraging this data, you can gain valuable insights into your clientele, enabling you to connect directly with those interested in your models and expand your subscriber base within the Communities platform.

- Key Features:

New Dashboard Functionality: Quickly view proposal generations with an intuitive dashboard.

Comprehensive CSV Export: Access detailed data sets on prospective clients who have run proposals against your Communities models.

How to get there: Communities > Dashboard > Proposals > Export

How to enable: Reach out to the Communities service team to learn how to opt into Proposal Data Packages

1997-OAT-8/8/2024

Compliance: Client Data (8/9)

Client Data — Accounts, Trades, Holdings

When users now go to the Client Oversight to import or review client data, they will now be met with a more streamlined experience. Client account, trade, and holdings data are now broken out into three separate tabs thy user can easily switch between.

- Three new sections on the Client Data tab in Client Oversight. (Accounts, Trades, Holdings)

- Users can toggle between each section and see data more easily instead of having to sift through all data points on one page.

- If a review or import takes place, users will spend less time searching for what they need.

How to get there: Orion Connect > Orion Compliance > Client Oversight > Client Data

1997-OAT-8/8/2024

Eclipse: Tax Loss Harvesting Swap Back (8/9)

Tax Harvesting Swap Back Short-Term Gain Threshold

We're excited to introduce a new feature that gives you more control over your Tax Loss Harvesting strategy. This update allows for smarter management of TLH alternates after the initial 30-day wash period.

Key Features:

- New Preference: "TLH Swap Back STG Threshold"

- Available at Firm, Team, Model, and Portfolio levels

- Set a maximum Short-Term Gain (STG) threshold in $ or %

Intelligent Liquidation Logic:

- Respects the 30-day wash period

- Evaluates short-term gains against your set thresholdD

- Delays TLH alternate liquidation if STG exceeds the threshold

- Automatically liquidates when: a) STG falls below the threshold, or b) The lot becomes long-term

- Proceeds with normal liquidation if no short-term gain exists

Special Handling for Model Equivalents:

- TLH alternates that are also model equivalents are not liquidated after 30 days

How It Works: After the wash period, the system checks your TLH alternates. If a short-term gain exists and exceeds your set threshold, liquidation is postponed. This helps minimize short-term capital gains while maximizing tax-loss harvesting benefits.

How to get there: Navigate to preferences at the firm, team, model, or portfolio level and look for the new "TLH Swap Back STG Threshold" option

1997-OAT-8/8/2024

Eclipse: Model Tolerance Updates (8/16)

Eclipse Model Tolerance Updates

- Enjoy a better user experience when referencing the Model Tolerance tool through Analyze on the Portfolios, Accounts and Orders grids.

- Excluded Cash Target and Excluded Cash Amount replaced the Set Aside Cash Target dollar amount currently shown in Model Tolerance. Using the radio button for Percent and Dollars will also update the excluded cash to show as a percent or dollar value.

- Non-targeted securities held in an account will include a tag so for you to easily identify these security types going forward. The tags and security type they apply to:

! Excluded security

* Unassigned security

~ Alternate security

- Equivalent security

How to get there: Eclipse > Portfolios > select an account with a model assigned > Analyze

How to get there: Eclipse > Accounts > select an account with a model assigned > Analyze

How to get there: Eclipse > Orders > select an account with a model assigned > Analyze

2071-OAT-8/14/2024

Eclipse: Model Deviation (8/30)

Model Deviation for Portfolios and Accounts in Eclipse

There are new columns to show model deviation in the Portfolios and Accounts grids in Eclipse, as well as the Portfolio and Account details pages. This allows you to see the overall deviation for a sleeve or portfolio at a specific model level.

- The new columns cover each level that you may use for models in Eclipse:

- Category Deviation

- Class Deviation

- Subclass Deviation

- Security Set Deviation

- New columns for Security Deviation and Sleeve Deviation are also available.

- Example of deviation is calculation:

How to get there: Eclipse > Accounts > All Accounts > Columns > search Deviation %

How to get there: Eclipse > Portfolios > Columns > search Deviation %

2211-OAT-8/28/2024

Reporting: Report T-Bill Interest Value (8/2)

New Activity Option in Report Settings Allows Reporting of T-Bill Interest Value

- Show Treasury Bill interest value on client-facing reports. Users with report and sub-report builder access are able to display Short Term OID interest value on reports.

- There’s a new option in the Activity Settings to include Short Term OID Interest. If a Treasury Bill is found to have a Short Term Discount Obligation because the owner bought it at a premium, this difference amount is represented at the custodian as interest.

- This new Activity Option is available for client reporting. Use this new setting option to include this as its own transaction type in reporting. It will be bucketed under interest to match how it is taxed.

Additional Note: These interest values are calculated for certain product types along with other factors such as 0 coupon rate and have been populated for all depletion-type transactions historically.

How to get there: Orion Connect> Reporting> Report Settings> Activity > Edit > Find any activity you want to represent this transaction on > check the box to Include Short Term OID Interest1897-OAT-7/31/2024

July 2024

Advisor Portal: Cloud Data – Redshift Data Sharing (7/5)

Exciting News: Payable summary report is available for execution as a custom query via Redshift

Four audit files are created every time you run a bill, whether it's a live or forecast bill. You must review and reconcile them to ensure that the fees calculated are accurate.

Payable summary report is a vital tool for ensuring the financial health and operational efficiency of a financial advisory company. It supports accuracy, compliance, financial management, fraud prevention, operational efficiency, and strategic decision-making.

We are thrilled to announce that now, a payable summary report is available for execution as a custom query via Redshift for all our data sharing consumers.

Eliminate the need for multiple resources of sifting through numerous live bills at the end of each quarter. The new query automates the process of filtering data to your needs across all your firms to determine payouts, saving you significant time and effort.

Key Benefits:

- Effortless Data Consolidation: Streamline the process of consolidating data across various advisors and multiple firms.

- Time Savings: Save hours of manual work with automated, accurate, and comprehensive payables data at your fingertips.

- Improved Efficiency: Enhance your financial operations with easy access to detailed payable summaries, reducing the need for manual data handling.

How to Access:

Go to below link to access AWS Redshift data share data dictionary

https://orionadvisorservices.my.site.com/OrionSupportApp/s/article/Datashare-Data-Dictionary

Go to Custom Queries: Billing Audit -> payable summary report

Stay tuned for updates on our upcoming releases, which will include the remaining audit files soon.

1677-OAT-7/8/2024

Advisor Portal: 3-Dot Menu in Proposed Accounts (7/26)

Three Dot Menu Option in the Proposed Accounts Step

We are introducing a new three dot menu for allocation options on the Proposed Accounts step of the proposal/new account workflow. This will automatically appear for all firms. This is being introduced to save space on the right side of the allocation options to enhance user interface functionality.

Users will find the delete and nickname functions within the three dot menu, along with any other features their firms use that previously lived on the right side.

1818-OAT-7/24/2024

Billing: Simplified Management of Pending Fee Transactions (7/25)

Simplified Management of Pending Fee Transactions

The new entity option, ‘Create Pending Fees’ combines the logic for the 'Create Pending for Direct/Indirect Pay Methods' and 'Create Pending Fees’ entity options, and has four choices:

- None: No pending fee transactions will be created.

- All Accounts: This function replicates the functionality if both 'Create Pending for Direct/Indirect Pay Methods' and 'Create Pending Fees for all accounts' are enabled. It creates pending transactions for both sleeved and non-sleeved accounts.

- All Sleeved Accounts: Creates pending transactions only for sleeved accounts, excluding non-sleeved accounts.

- Managed Sleeves: Creates pending transactions for specific sleeved accounts while excluding certain account types, such as contribution, distribution, or CNX sleeve accounts.

Automated Updates:

- If both previous options were off, the new setting defaults to "None."

- If both previous options were on, it defaults to "All Accounts."

- If only "Create Pending for Direct/Indirect Pay Methods" was on, it defaults to "Managed Sleeves."

How to Get There: Orion Connect > Firm Profile > Billing Section.

How to Enable: To enable the "Create Pending Fees" option, please contact the SME Team for assistance activating your firm's entity option.

1699-OAT-7/10/2024

Billing: Simplified Management of Pending Fee Transactions (7/26)

Simplified Management of Pending Fee Transactions

We’ve developed a new entity option, "Create Pending Fees," to combine the old entity options, "Create Pending for Direct/Indirect Pay Methods" and "Create Pending Fees," into a single, more streamlined user experience.

Automated Updates:

- If your database had both the old options disabled, it has been mapped to the new entity option’s selection as "None."

- If your database had both previous options enabled, it has been mapped to the new entity option as "All Accounts."

- If your database had only the "Create Pending for Direct/Indirect Pay Methods" entity option enabled, it has been mapped to the new option with the selection of "Managed Sleeves."

Options Explained:

- None: No pending fee transactions will be created.

- All Accounts: This option replicates the functionality of both 'Create Pending for Direct/Indirect Pay Methods' and 'Create Pending Fees for all accounts.' It creates pending transactions for both sleeved and non-sleeved accounts.

- Managed Sleeves: Creates pending transactions for specific sleeved accounts while excluding certain account types, such as contribution, distribution, or CNX sleeve accounts.

- All Sleeved Accounts: Creates pending transactions only for sleeved accounts, excluding non-sleeved accounts. This is a new enhancement introduced with the entity option selection.

How to Get There: Orion Connect > Firm Profile > Billing Section.

How to Enable: To enable the "Create Pending Fees" option, please contact the SME Team for assistance in activating your firm's entity option.

1818-OAT-7/24/2024

Eclipse: Transition Model Management to Eclipse (7/5)

Transition Model Management to Eclipse with One Click!

- Clients transitioning their model management from Orion Connect to Eclipse will now be able to do so with one click!

- This process is still facilitated by SME Trading. However, it will take more time to refresh your coffee than for our team to create your Orion Connect Models as Eclipse Security Sets, your Orion Connect Model Aggregates as Eclipse Models, and map the two.

- This allows you to preserve your account assignments and all performance associated with your model aggregates when moving to Eclipse. After this transition, you will continue to manage and create models in Eclipse!

Contact the SME Trading team for more information.

1677-OAT-7/8/2024

Eclipse: Tactical - Equivalent Security Actual Allocation Display (7/19)

Tactical – Equivalent Security Actual Allocation Display for Securities Equivalent to Multiple Target Nodes

Users can now view the actual allocated value for each targeted security when using equivalents that are distributed across multiple targeted securities.

This information is accessible in the existing equivalent security popup by clicking on the blue hyperlink in the “Targeted Ticker” column of holding & trade details.

This enables more accurate trade decisions by providing clearer insights into security allocations, and enhances transparency in model management and rebalancing processes.

How It Works:

- The displayed values are calculated based on your chosen Security In Multiple Areas Of Model Distribution Method (Pro-Rata or Most Underweight).

- These values reflect how the rebalancer distributes allocations among equivalent securities.

How to get there: Tactical > holding & trade details component > find a security that is equivalent to multiple targeted positions > click on the blue hyperlink in the targeted ticker column > see the EQ Allocation $

1770-OAT-7/17/2024

Reporting: Quick Filters in RMD Dashboard (7/12)

Quick Filters Added to RMD Dashboard

Quickly filter each column of the RMD Dashboard by hovering over a column header and clicking on the hamburger menu on that column.

To reset filters you can go to the Actions drop down menu and click on Reset Filters.How to get there: Orion Connect> RMD Dashboard

1699-OAT-7/10/2024

June 2024

Client Portal: Enhanced Client Portal Disclaimer (6/7)

Enhanced Client Portal Disclaimer to Allow for Greater Flexibility

- Enjoy more flexibility in how your disclaimers are displayed in the client portal.

- Create longer disclosures and customize disclosures at various levels (Firm, Broker Dealer, Representative, and Client) for your clients.

- This enhancement significantly helps when you have different books of businesses in one database that need different disclaimers.

How to get there: Orion Connect > Client Portal > Disclaimer at the bottom of the page

How to enable: Orion Connect > Client Experience > Settings > Global > Portal Disclaimer (turns it on/off) and Disclaimer Text (controls the text displayed)

1417-OAT-6/5/2024

Client Portal: Sorting Accounts (6/7)

Ability to Now Sort Accounts in the Left Sidebar

- Easily view and search for accounts in the client portal by sorting them by Name, Account Number, and Value on the left sidebar.

How to get there: Orion Connect > Client Portal > Personal Finances

How to enable: Orion Connect > Client Experience > Settings > Account Sort Order

1417-OAT-6/5/2024

Client Portal: Money Market Performance (6/14)

Show Money Market Performance Setting

- Choose whether to show or hide money market performance details in the client portal.

- Use Case: If clients have a small holding in money markets the performance numbers can be a distraction to the overall performance of the portfolio. The shown/hidden option gives you more flexibility in how you display performance information in the client portal.

How to get there: Orion Connect > Client Portal > Personal Finances > Performance > Performance Details

How to enable: Orion Connect > Client Experience > Client Settings > Portfolio > Show Money Market

1532-OAT-6/20/2024

Eclipse: Paste Values to Filter (6/21)

Paste Values to Filter

- Grid filters will be updated to include a new process to apply filters.

- Previously, after selecting the import icon, you could choose to import a file containing a list of items for filtering. A new section is now included in the import popup to allow you to paste in a list of items for filtering.

How to get there: Eclipse > Accounts > All Accounts > Filter > Choose a column to filter > Import > Paste a list of values How to get there: Eclipse > Portfolios > Filter > Choose a column to filter > Import > Paste a list of values

1532-OAT-6/20/2024

Portfolio Interactions: Enhanced Filtering in Portfolio View (6/21)

Enhanced Filtering and Searching in Portfolio View Grid Cards

- Search now includes underlying groupings (ex: Search for an Asset Class and see underlying assets).

- Right-click in Grid to access Actions.

- Use the hamburger menu in the column header to access additional actions, filtering, and column controls. This is accessible from any column.

- Column Actions menu

- Column Filters menu allows for two filters to be applied to a column vs. the previous filtering, which only allowed for one.

- Column availability menu

How to get there: Portfolio View > Any Detail Grid Card

1532-OAT-6/20/2024

Reporting: Alternative Vintage Year Grouping (6/14)

Alternative Vintage Year Grouping Added for Sub-Reports

- Users with Sub-Report Builder access will see a new grouping available in sub-reports when editing or building a grouping table: Alternative Vintage Year grouping.

- With this new grouping option, show your client's values based on the vintage year of each asset.

How to Get There: Orion Connect > Reporting > Sub-reports > Edit existing or create new sub-report > Grouping Options

1478-OAT-6/12/2024

Reporting: "Portfolio Group Type" Tag (6/14)

New Tag for "Portfolio Group Type" Available for Reports

- Display or filter various types of Portfolio Groups on client facing reports. Users with access to build and edit sub-reports will now see Portfolio Group Type available as a tag.

- When creating a portfolio group, select Composite, Reporting, and/or Trading. For reporting purposes, some users only want to include certain groups and not others.

How to get there: Orion Connect > Reporting > Sub-reports > Create New or Edit existing Sub-Report> Add Table > Add Tag (@portfolio group type)

1478-OAT-6/12/2024

Trading: Eclipse — Run Analytics with Save (6/14)

Eclipse — Run Analytics with Save

On June 14, 2024 there will be an update in Eclipse to run analytics when “Save” or “Save and Close” is selected on the Account Details and Portfolio Details pages.

- Today when updates are made to Account or Portfolio Details, the portfolio gets set to a “Needs Analytics” status, requiring users to run analytics.

- With this change, analytics will run when the account or portfolio update is saved, eliminating the need to manually run analytics to capture account and portfolio updates.

How to get there: Eclipse > Accounts > All Accounts > Right-click an account > Edit Account Details How to get there: How to get there: Eclipse > Portfolios > Right-click a portfolio > Edit Portfolio

1417-OAT-6/5/2024

May 2024

Billing: New Consolidated Billing App (5/28)

Enjoy an enhanced billing experience! The new billing app consolidates core billing functionalities into a single, streamlined platform, significantly reducing manual effort and enhancing efficiency.

- Simplified Processes: Billing processes are simplified with better tools for administrators and advisors.

Automation: Key processes are automated, improving accuracy and efficiency.

Intuitive Tools: Provides user-friendly tools for auditing, bill generation, and management.

User-Friendly Interface: Features a modern and intuitive interface for easy use.

Improved Management: Advisors can manage billing tasks more efficiently, ensuring timely and accurate fee processing.

Key Updates:

- Optimized Bill Generation Wizard and Automation

Audit History Changes

Cash Flow Automation

Billing Compare Tool

Enhanced Grid and Filtering Options

Please Note: Users will continue to be able to access the current Billing experience in addition to the new experience

How to get there: Orion Connect > Billing

How to enable: Turn on the user privileges outlined in the Setup Requirements section in the article below.Knowledge Article: Billing App Overview

1282-OAT-5/22/2024

Client Portal: AXOS Custodial Statements Available (4/26)

AXOS Custodial Statements Now Available in the Client Portal

-

Clients and advisors will now be able to access their AXOS custodial statements in the Orion Client Portal.

-

Clients and advisors will now no longer need to log into the custodian’s site to access things like their monthly statements, tax documents, etc.

-

Allowing clients the ability to access everything they need in one portal is a preferred experience by clients.

How to get there: Orion Connect > Client Portal > Document Vault > AXOS Documents

How to enable: Reach out to the Integrations SME Team to turn this feature on

1074-OAT-5/1/2024

Client Portal: Customizable Report Date Ranges (4/26)

Customizable Date Range Options for Ad Hoc Reports in the Client Portal

- Users can now choose from up to 10 different date range options for clients to be able to run ad hoc reports for in the client portal.

- Additional flexibility around client level reporting makes for an overall better client experience.

How to get there: Orion Connect > Client Portal > Reports > Portfolio Reports

How to enable: Orion Connect > Client Experience > Settings > Portfolio > Date Range Options

1074-OAT-5/1/2024

Communities: Email Notification Capability

Ability to Add Email Address(s) to the Communities Notification Center

Strategists and subscribers now have the ability to add one or more email addresses to notification preferences (emails separated by a semicolon).

By allowing users to opt in/out of individual notification types, this feature allows users to receive Communities notifications via email and the in-app notification system.

How to get there: Communities >Notifications > Cog Wheel > Email Address

How to enable: Communities >Notifications > Cog Wheel > Email Address > Enter Valid Email Communities >Notifications > Cog Wheel > Email tab > Enable/Disable Individual Notifications1348-OAT-5/29/2024

Eclipse: Create Saved Views (5/3)

Eclipse: Create Saved Views in the Tactical Tool

As previously communicated in the March 1st Release Note, we will be adding functionality to create multiple saved views within the Tactical Tool. Similar to how saved views work for other pages in Eclipse, within the Tactical Tool you will be able to set views as public or private, as well as specify a default view that loads when Tactical is launched.

Saved views will be added to the Tactical Tool on May 10, 2024. Please note that as part of this change, existing saved layouts in the Tactical Tool will be reset to the default layout for the Tactical Tool and you will need to re-create the layout and save it as a view. We will also be removing the Portfolio Details button located at the top of the Tactical Tool, as the details shown in that popup are available on the Portfolio Details page which can be accessed using the Portfolio ID link.

If you have a saved layout in Tactical today, please export your existing layout before 8:00PM EDT/5:00PM PDT on Thursday, May 9th to help with re-creating your layout as a saved view beginning on May 10th. Within the Model Tolerance section of Tactical, select one level of the model, go to Actions and select Export. Repeat that process for each level so you can see what columns you have included. Those exports will also include a tab for Holding and Trade Details and Account and Cash Details which you can reference to re-create your layout.

How to get there: Eclipse > Portfolios > right click a portfolio > Trade Tools > Tactical Tool > Views

1074-OAT-5/1/2024

Eclipse: View Account Details in Orion Connect (5/10)

Eclipse: View Account Details in Orion Connect via SSO

We recently added new functionality in Eclipse which allows you to launch Account Details in Orion Connect via single sign on. The new View Account Details in OC link is available from the following locations in Eclipse:

- On the Accounts grid

- Right click an account > View Account in OC

- Select an account on the grid > Actions > View Account in OC

- Within Account Details

- Actions > View Account in OC

- On the Portfolios grid

- Expand a portfolio > right click an account > View Account in OC

- Within Portfolio Details

- Select the Accounts tab > right click an account > View Account in OC

- Within the Tactical Tool

- Account and Cash Details > right click an account > View Account in OC

- Account and Cash Details > select an account > three dot menu > Account and Cash Details

1134-OAT-5/8/2024

Eclipse: In-Line Edits for Account Do Not Trade Status (5/17)

Eclipse: In-line Edits for Account Do Not Trade Status

The Account Do No Trade column on the Accounts grid will be updated to allow for in-line edits for users that are permissioned to edit accounts in Eclipse.

After adding the Account Do Not Trade column to the Accounts grid, selecting the current trade status for an account will put the cell into edit mode, and show the other available statuses for you to choose from.

In addition to in-line edits for this column, we’ve also updated the right click menu for users who are permissioned to edit accounts to include the ability to change the Do Not Trade status. You can select a single account, or multiple accounts on the grid, right click a selected account and mouse to Do Not Trade to change the status.

How to get there: Eclipse > Accounts > All Accounts > add Account Do Not Trade column

How to get there: Eclipse > Accounts > All Accounts > right click an account > Do Not Trade

1193-OAT-5/15/2024

Eclipse: User Experience Updates (5/24)

Eclipse User Experience Updates

Enjoy these updates for a better user experience in Eclipse:

- A new Model Tags column in the Portfolios and Accounts grids.

- Edit directly in the Restricted Plans column on the Accounts grid.

- After adding the Restricted Plans column to the Accounts grid, you can click the cell so that it changes to edit mode, and search for a Restricted Plan, or select one from the list to assign to the account.

- The new “Create account and portfolio notes as display notes by default” firm preference for notes allows Firm Admins to control whether “Display Note” is checked by default when creating new account and portfolio notes in Eclipse.

How to get there: Eclipse > Portfolios > Columns > Model Tags

How to get there: Eclipse > Accounts > All Accounts > Columns > Model Tags

How to get there: Eclipse > Accounts > All Accounts > Columns > Restricted Plans

How to get there: Eclipse > Administration > Preferences > Firm > Notes

1282-OAT-5/22/2024

Financial Planning: PulseCheck Action Steps (5/3)

PulseCheck Generating Action Steps

We've just made goal-setting smarter in Pulsecheck! Now, when you create a goal, our system automatically generates action steps to help either fully fund your goal or remind you to reassess fulfillment within the wellness category that originated the goal upon completion. Start planning with ease and watch your goals take shape with practical, guided actions.

How to get there: Orion Connect > Orion Planning > Goals Input > PulseCheck > Action steps

How to enable: Reach out to the *Financial Planning Service Team * for assistance

1074-OAT-5/1/2024

Financial Planning: PulseCheck PDF Deliverable (5/3)

PulseCheck PDF Deliverable

Streamline your BeFi reporting with PulseCheck's new PDF deliverable. You can now generate a PDF deliverable directly from the PulseCheck interface, perfect for client presentations and record-keeping.

How to get there: Orion Connect > Orion Planning > Print PDF

How to enable: Reach out to the *Financial Planning Service Team * for assistance

1074-OAT-5/1/2024

Financial Planning: Estate Planning Cost Basis Step-Up (5/10)

Estate Planning: Cost Basis Step-up

Cost basis step-ups are a critical component of tax and estate planning. This influences many decisions about portfolio allocation and rebalancing, and can significantly impact the decedent’s heirs. We made this enhancement to provide a more accurate picture of the impact of cost basis step-ups at passing.

This enhancement solves the problem of manually calculating and adjusting cost basis for asset valuation in taxable accounts, which can be complex and time-consuming, especially with differing state laws.

This improves the reporting and modeling process and allows advisors more confidence in presenting estate planning scenarios to their clients.

How to get there: Orion Connect > Orion Planning > Balance Sheet

1134-OAT-5/8/2024

Mobile App: Simplified Navigation Icons (5/20)

Rearrangement of Lower Icon Selection for Future Development

- Orion’s mobile application has simplified the navigation icons at the bottom of the mobile app to maximize the user’s experience

- Newsfeed area can now be found within the overview icon.

How to get there: Orion Wealth Management Portal > Login

How to enable: Automatically in effect for all mobile app users

1348-OAT-5/29/2024

Orion Connect: Global Custodian Field on Custodian (5/17)

Global Custodian Field On Custodian For Enhanced Maintenance Controls

Orion is adding a field for 'Global Custodian' to the list of custodians in Firm Profile to better handle various maintenance and internal metric requirements.

Because each firm can customize a list of custodians unique to their database, being able to associate each local custodian record to a fixed list of Global Custodians allows Orion to better identify a consistent custodian associated with each account, while still continuing to allow Advisors to customize their Custodial list to meet unique advisor needs.

Over the next several weeks, Orion will assign a Global Custodian to the majority of custodian records set up in your database and will require new custodian records that are created to be associated with a Global Custodian. In the future Orion will also require any custodians that are edited to have the Global Custodian field set.

If you need a Global Custodian option listed, please reach out to the SME Products & Prices team with your request.

How to get there: Orion Connect > Firm Profile > Custodian

1193-OAT-5/15/2024

Trading: Model Tags (5/3)

Model Tags

We recently completed new development for Model Tags. Previously, tags could be added to models in Eclipse, and now tags can be added to Model Aggregates in Orion Connect.

- The Model Aggregates grid and Model Aggregate Details page now include a field for Tags

- Tags can be added to models in Eclipse, and are now included in the model reverse sync to Orion Connect.

- For model aggregates tied to an Eclipse Model ID, you can view model tags on the Model Aggregate Details page.

- For models aggregates not tied to an Eclipse Model ID, you can view, add and edit tags on the Model Aggregate Details page.

How to get there: Eclipse > Strategies > Models > View or Edit Model

How to get there: Orion Connect > Models > Model Aggregates > Model Aggregate Details

1074-OAT-5/1/2024

3269-OAT-12/8/2023

-

-

-