The Bright Side of Quarter-End Billing

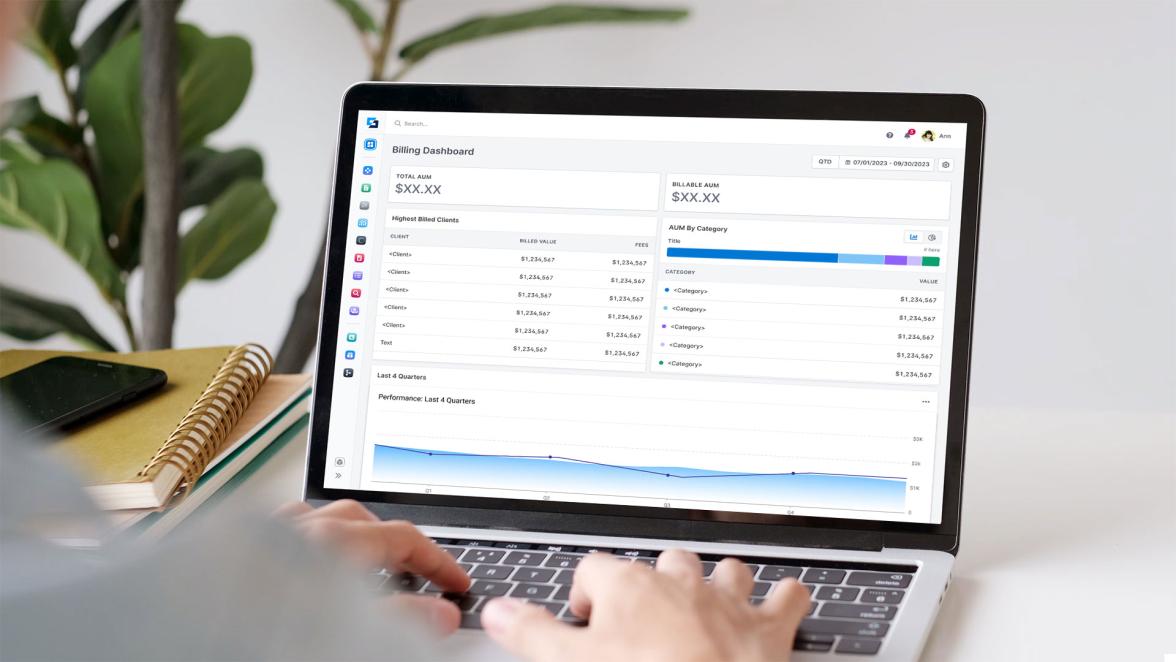

Everything in One Place

Billing at the end of the quarter aligns perfectly with your other quarter-end tasks, like client reporting and performance reviews. It's like hitting the "combo deal" button on your processes - super convenient and tidy!

Predictable Revenue

Just like your favorite Netflix series drops a new season on a schedule, quarter-end billing ensures you know when revenue is coming in. This consistency makes planning (and sleeping at night) much easier.

Builds Transparency with Clients

Quarter-end is a natural time to talk numbers, whether it's performance metrics or fees. Clients appreciate having everything wrapped up in one neat bow, and it's a great moment to remind them of all the value you've delivered.

Chance to strengthen Relationships

Believe it or not, billing can actually be a relationship-builder. It's a touchpoint that opens the door for conversations about performance, goals and new opportunities for growth.

The Not-So-Bright Side

Operational Overload

Picture this: your team juggling client reports, fee calculations, and other quarter-end tasks all at once. It's a recipe for stress - and mistakes. Nobody wants a billing error to be the reason for an awkward client call.

Timing Troubles

Quarter-end billing comes right after clients have seen their porfolio performance. If it's not what they hoped for, those fees might sting a little more. Cue the uncomfortable conversations.

Cash Flow Pinches

Waiting until the end of the quarter to collect fees can create gaps in your revenue flow. It's a bit like holding your breath until payday - not ideal!

Tech Hiccups

If your billing system isnt' up to the task, quarter-end can turn itno a tech nightmare. Outdated tools or manual processes slow everything down and increase the risk of errors.