Can a sitting US president reshape the Federal Reserve’s independence, and what would it mean for markets?

The Federal Reserve Act of 1913 established the U.S. Federal Reserve, now recognized as one of the world’s most influential financial institutions. The Act, along with subsequent reforms, outlines the central bank’s role and incorporates mechanisms, such as staggered terms for its Board of Governors, to safeguard its independence from political influence. A pivotal moment in this independence came with the 1951 Treasury-Fed Accord, which freed the Fed from its wartime obligation to support Treasury borrowing, enabling it to prioritize economic stability. Before the Accord, the Fed often coordinated with the Treasury on monetary and fiscal policy, particularly during the Great Depression and World Wars. Since 1951, the Fed’s autonomy has generally been upheld, though challenges, such as the inflationary pressures of the 1970s, highlight the consequences of any erosion in its independence.

Fast forward to today - the US Dollar’s global reserve status is being questioned, US government debt is increasing at a formerly unimaginable rate, and interest rate policy is more directly controlled by the Central Bank, rather than by the market, since the shift to an abundant reserve model¹ in 2008. Against this backdrop, the Fed is facing political pressure to lower rates at a magnitude we haven’t seen in decades. The question is, would forcing the Fed Chair out serve to the help the dollar or the US’s fiscal position in any meaningful way?

The Fed’s independence is rooted in its unique structure. Unlike executive branch agencies, the Fed operates as a quasi-independent entity with a twelve-member Federal Open Market Committee (FOMC) ultimately voting on any adjustments to the Federal Funds rate – monetary policy is not solely dictated by The Chair. The Chair themself, currently Jerome Powell, serves a four-year term and answers to Congress, not the President. The Chair can only be removed from their position for cause - think misconduct, inefficiency, or neglect of duty, not policy disagreements. For further context, it’s important to remember that the Fed has a clearly defined role within the US economy, shaped by its dual mandate:

…maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.²

At times, preserving this mandate requires the Fed to go against the wishes of the President or Congress. While political leaders may advocate for easier monetary policy to boost short-term growth (perhaps ahead of a re-election cycle) the Fed must remain focused on long-term economic stability. As we touched on earlier, President Nixon put immense pressure on former Fed Chair Arthur Burns to promote expansionary monetary policy ahead of his run for re-election in 1972. This misguided policy decision amid already rising inflation resulted in one of the worst stagflationary environments in history, serving as a lesson on separation between The Fed and the Executive Branch or other politically motivated actors.

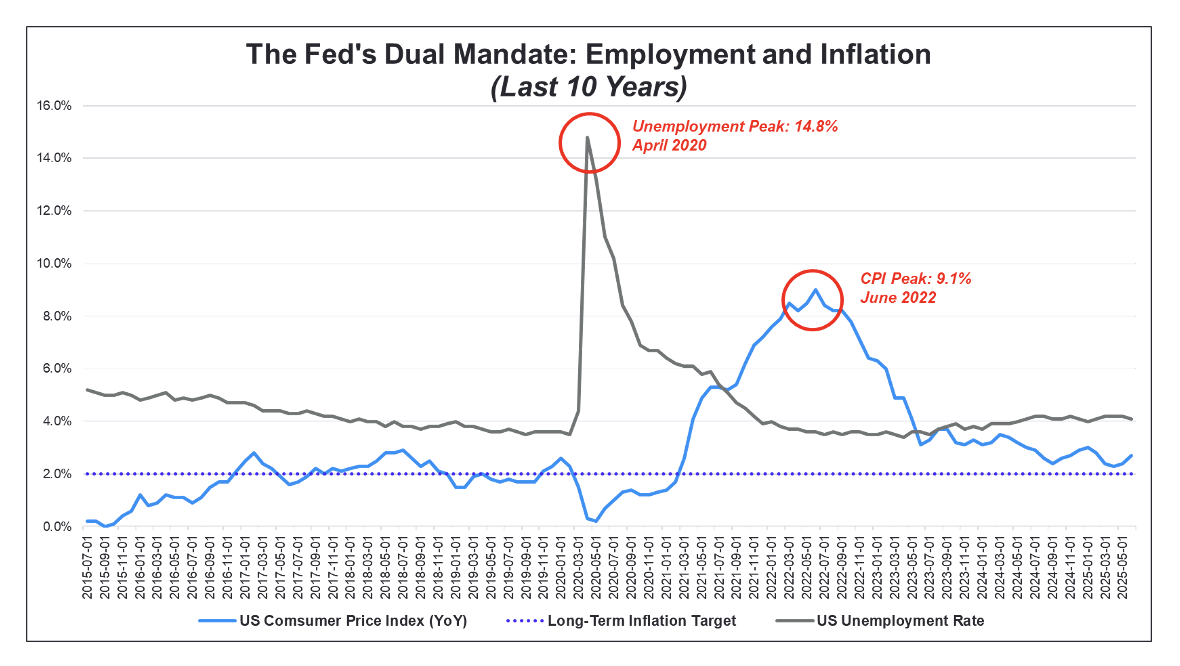

More currently, this dual mandate, maximum employment and stable prices, guides the Fed’s cautious approach. Powell’s stance reflects a commitment to balance job growth, which has remained healthy at 4.1% current unemployment, with inflation control, which has been coming off its highest level since the early 1980s, and remains wary of tariff-induced price spikes re-igniting runaway inflation.

Source: FRED Federal Reserve Bank of St Louis

Current skeptics, most notably President Donald Trump, argue that the Fed’s reluctance to lower interest rates amid more recently lower inflation readings borders on negligence. Trump has publicly criticized Fed Chair Jerome Powell for maintaining higher rates to curb “yet-to-be-seen” tariff-driven inflation. Trump’s threats to remove Powell have once again thrust The Fed’s independence into the spotlight. But can a president legally oust a Fed Chair, and what does this mean for investors?

Historically speaking, presidents have pressured Fed Chairs on policy decisions, but never crossed the legal line into removal, respecting the Fed’s autonomy. Trump’s current push, however, risks eroding this precedent, potentially destabilizing investor confidence.

For investors, the implications could be profound if Trump’s pressure undermines Fed independence, potentially causing market volatility. A politicized Fed might prioritize short-term growth over inflation control, lowering short-term rates but spiking long-term Treasury yields, disrupting bond and equity portfolios. With the 10-year Treasury yield already at about 4.4% in July 2025, unchecked inflation fears could push it higher, with longer-term yields, which are more sensitive to market dynamics, facing even greater upward pressure. That being said, our outlook on the importance of diversified portfolios remains the same, as we believe that volatility from more isolated “Fed drama” should be short lived relative to more fundamental market dynamics at play, and the odds of any legitimate threat to The Fed’s independence are likely overblown.

The Federal Reserve’s century-long role as an independent steward of monetary policy, anchored by its dual mandate, remains critical to economic stability. Trump’s challenge to Powell tests this foundation, but legal protections and historical norms suggest the Fed will hold firm. Financial advisors must stay vigilant, educating clients on the Fed’s importance and bracing for market ripples if political pressures persist, especially amid the current sensationalized headline cycle. The Fed’s independence is not just a policy cornerstone; it’s a shield for market stability.