Hello. Ryan Dressel, senior investment strategist at Orion here with another timely market update.

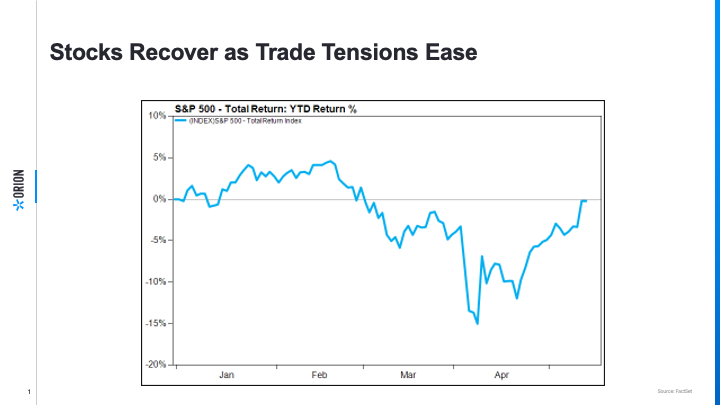

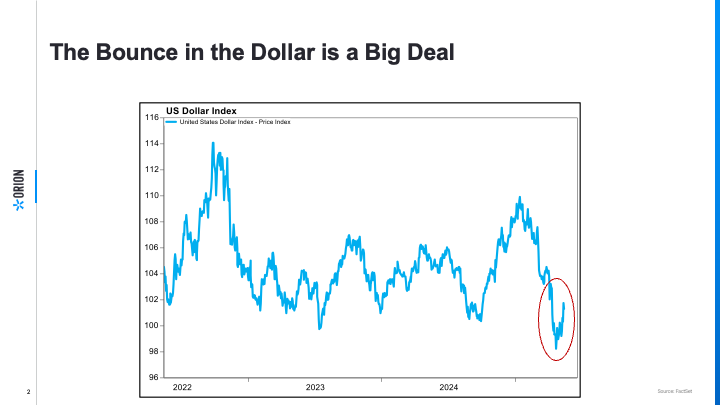

There are two subjects I think worth discussing today. First being the recent rally in US equities and what's driving that. And second, is the US dollar bouncing off of multiyear lows and why we think that's so important going forward.

First, for stocks, major indices are nearly in positive territory on the year, which is an incredible feat considering where we were just weeks ago.

Tariffs and trade policy continue to be top of mind for Wall Street and investors as positive developments were cheered last week with the Trump administration brokering a deal with the United Kingdom. And over the weekend, negotiations took place with China where a ninety day pause was announced between the two countries, and an interim import tariff rate of thirty percent was announced for goods coming into the United States from China. Both were well received by Wall Street as investors are are really looking to get to a place where policy is known, an off ramp, if you will, as the the world's largest and most important economy in the world, continues to play a major part in decisions on behalf of business and businesses and corporations and the international investment community.

So both huge developments there. Additionally, behind the scenes, you had some positive developments coming from earnings coming in better than expected in q one. Inflation could cool just a little bit further. The labor market continues to be, highly resilient, and the US consumer continues to hang in there amidst, elevated inflation and prices.

And then lastly, we think there's the potential for, positive news to come out of DC beyond tariffs in the form of lower tax cuts and announcements around deregulation and pro growth policies for the Trump administration. So potential more good news could be on the way.

For the US dollar, I think that discussion is really interesting because the the international the global international investment community had been selling off the dollar in recent weeks as confidence waned, frustration around, policy uncertainty, and a a potential lower potential potentially lower outlook for the economy here at home waned on sentiment for the dollar.

We think that's really important to keep an eye on as the dollar remains the world's largest and most liquid currency. It's a reserve currency around the world. Businesses continue to transact there.

Capital continues to come into our country, and that's a really big deal. So the fact that, directionally speaking, we moved off of the lows kinda speaks to that that bounce in confidence from around the world, that, you know, we potentially are staving off an existential risk where the global investment community flees the dollar, flees our markets, and, potentially leaves us in an uncertain place over a multiyear period. So that's really important, development, we think, and one worth monitoring going forward.

You know, while the the bounce in stock market is important, we think that one is potentially more important over the long term. So thank you for joining us today. I think these are two really important subjects. If you have any questions, please don't hesitate to reach out. And if there's anything we can do to help conversations on your end, again, please give us a ring. Thanks, and have a great day.