What About the Debt?

While concerns around the dollar have largely surfaced from investors and Wall Street, the issue of our national debt has made its way from Washington D.C. to nearly every dinner table and water cooler across the country.

The United States national debt stands at a cool $36 Trillion dollars¹ . A truly staggering number for most folks to comprehend. But this isn’t the first time we’ve gawked at such a gaudy number. As a Time article from 1972 shows², we’ve been having this chat for decades.

The size of the U.S. national debt can feel overwhelming, and understandably so. For decades, administrations on both sides of the aisle kicked the proverbial can down the road. The Trump Administration is the latest to do so, with the signing of the sweeping tax cut bill dubbed “One Big Beautiful Bill,” which is expected to add anywhere from $1 trillion - $3 trillion to the deficit over the next ten years.

The debt conversation has a different tone today compared to past decades, thanks to a combination of higher interest rates, fewer tax receipts, and ballooning expenditures… net interest payments are rapidly rising. This poses a budgetary strain as net interest expense bumps up against spending on major categories like defense, health care, and potentially even Social Security in the coming years. Some academics and historians even suggest that America’s debt poses a risk to its superpower status³.

A Few Big Asterisks

Still, the situation, while uncomfortable, remains manageable. The U.S. benefits from the unique advantage of issuing debt in its own reserve currency (as highlighted earlier), within the world’s most trusted and liquid financial markets. Investors across the globe continue to buy Treasuries, and demand for dollar-denominated assets remains strong, even during periods of fiscal stress.

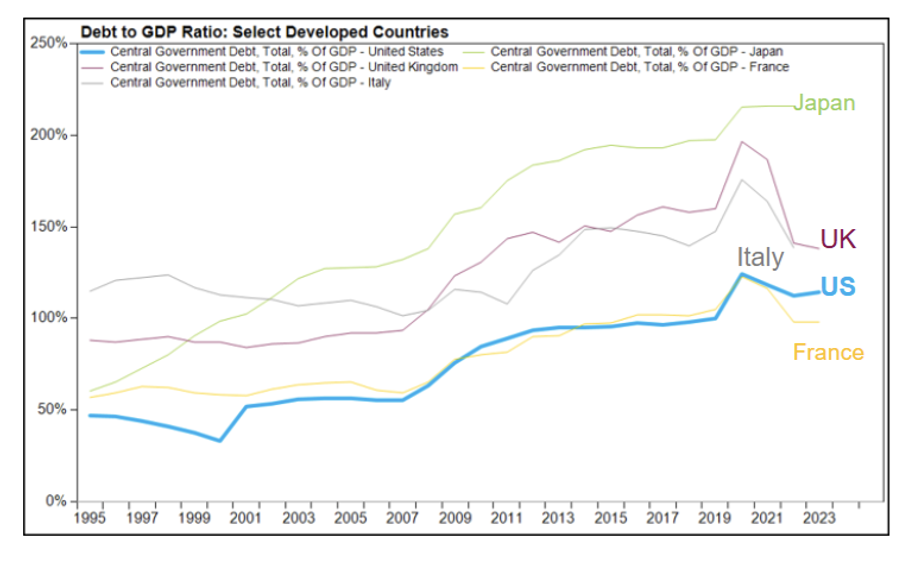

It’s also worth noting that the U.S. is far from alone. Many developed nations are navigating similar or even higher debt burdens. Japan’s debt-to-GDP ratio exceeds 250%, and countries like the U.K., France, Italy, and even China are grappling with aging populations, slower growth, and expansive fiscal commitments.

Source: FactSet

Perhaps most important in the discussion is who owns our debt? Many inaccurately view the US as borrowers beholden to a foreign entity. That is not in fact the case, as approximately 80% of our debt is owned by domestic institutions such as the Treasury, while just 20% is owned by foreign creditors, most notably Japan, the UK, and China⁴. Simply put, we have the tools to solve our own problems.

The Big Picture: Linking the Dollar and the Debt

Since the end of WWII, America established a subtle but important relationship with the rest of the world. That is, the US provided military support for the developed world, while foreign governments and investors bought our debt, fueling a massive, multi-generational wave of investment and economic growth here at home. Our debt ballooned, the world became entrenched with the dollar, Americans imported cheap goods, a long period of relative peace coalesced, and the US economy dominated.

Scary headlines of late shook confidence in this unspoken dynamic, and while the Trump administration may have new policy ideas, perhaps tweaking the calculus on the inputs above, we do not think the relationship will collapse.

This gives us confidence that we can manage our debt load, count on the dollar as the world’s reserve currency and expect the US to continue to lead the world economically and militarily. In other words, keep betting on America.