In a year where headlines have been dominated by macroeconomics, geopolitics, and domestic policy, fundamentals and earnings may have taken a back seat in investors’ minds. As the S&P 500 first quarter earnings season has wound to a close and second quarter reports are set to begin, we wanted to take a moment to review and compile some relevant insights from Q1 and set the stage for Q2. While policy announcements and investor emotions have driven short-term market volatility this year, earnings and valuations are the key fundamental elements that move markets over time.

A Look Back

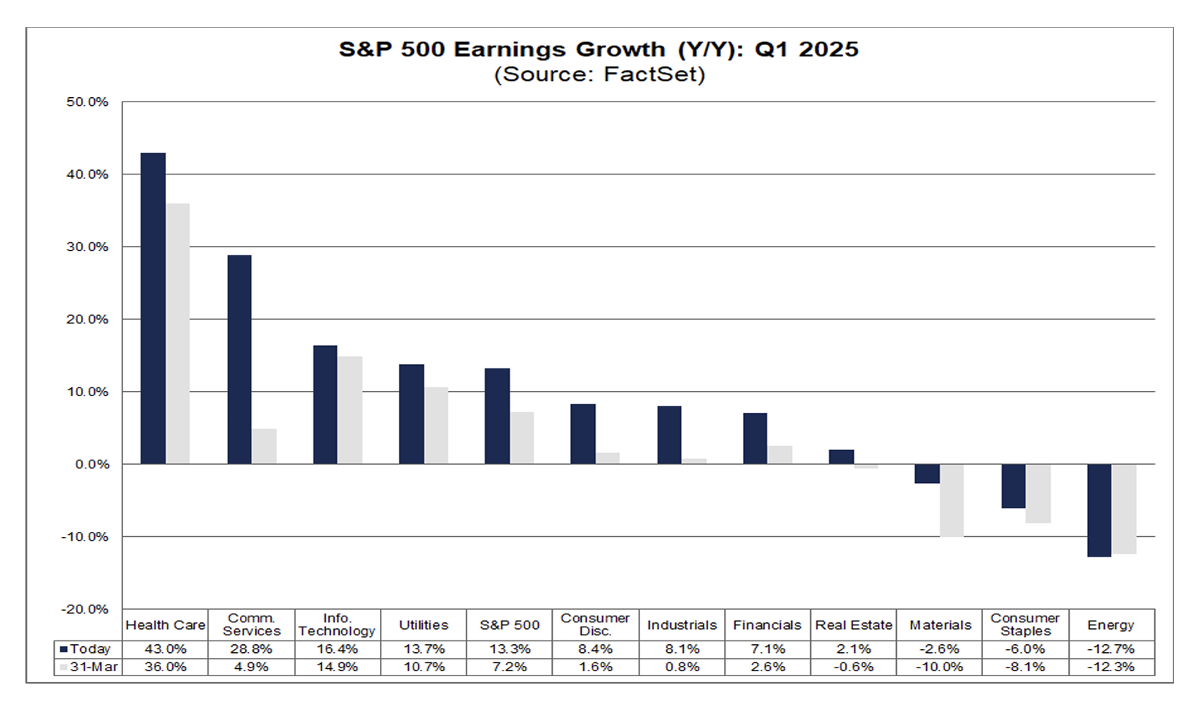

The first quarter earnings season exceeded expectations across most sectors in the S&P 500 relative to analyst expectations. As a whole, the index saw 13.3% year-over-year earnings growth in Q1, compared to 7.2% expected on March 31st. Getting a bit more granular, let’s look at some sector highlights:

- The Health Care sector drove the largest year-over-year increase, growing their earnings by 43% compared to 36% expected. Despite strong earnings growth, the Health Care sector’s performance has struggled year-to-date due to headwinds and uncertainty from Washington, including President Trump’s push to lower drug prices and Health Secretary Kennedy’s intended overhaul of some aspects of the healthcare system.

- The largest surprise came from the Communication Services sector, which grew nearly 29% YoY compared to just 4% expected, led by strong reports from companies like Alphabet, Verizon, T-Mobile, and AT&T. The sector is up nearly 13% YTD as of 6/30¹.

- The Tech sector was able to continue its strength, coming in slightly above expectations with 16% growth. The highlight, as in other recent quarters, was Nvidia, who posted a double beat with 69% revenue growth and 26% YoY earnings growth in Q1.

The chart below provides a visual sector breakdown of Q1 earnings growth (blue) relative to 3/31 expectations (gray).

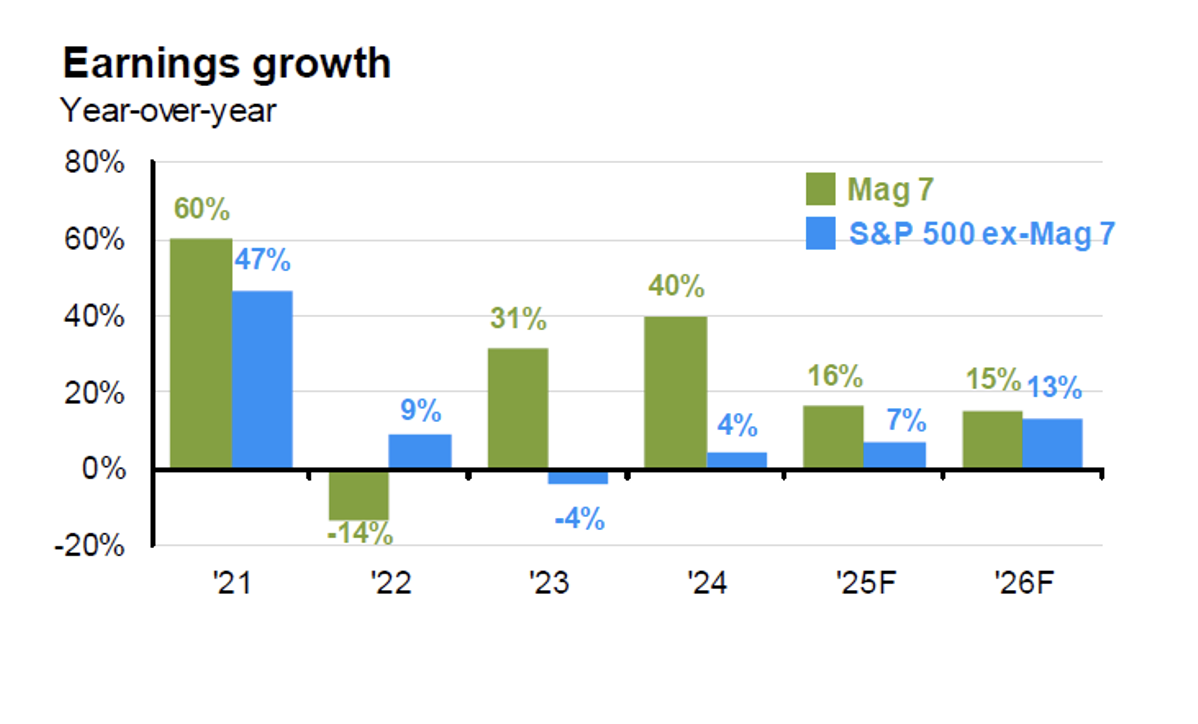

Despite facing more market headwinds in 2025 than the past two years, the Magnificent 7 still posted another strong earnings season, with 6 of the 7 companies exceeding expectations (with Tesla missing). The tech giants reported 28% earnings growth in the first quarter, compared to 16% expected in March. Despite the positive surprise in Q1, analysts still expect Mag 7 earnings growth to slow in the coming quarters, eventually falling in line with the rest of the S&P 500.

Source: J.P. Morgan Guide to Markets

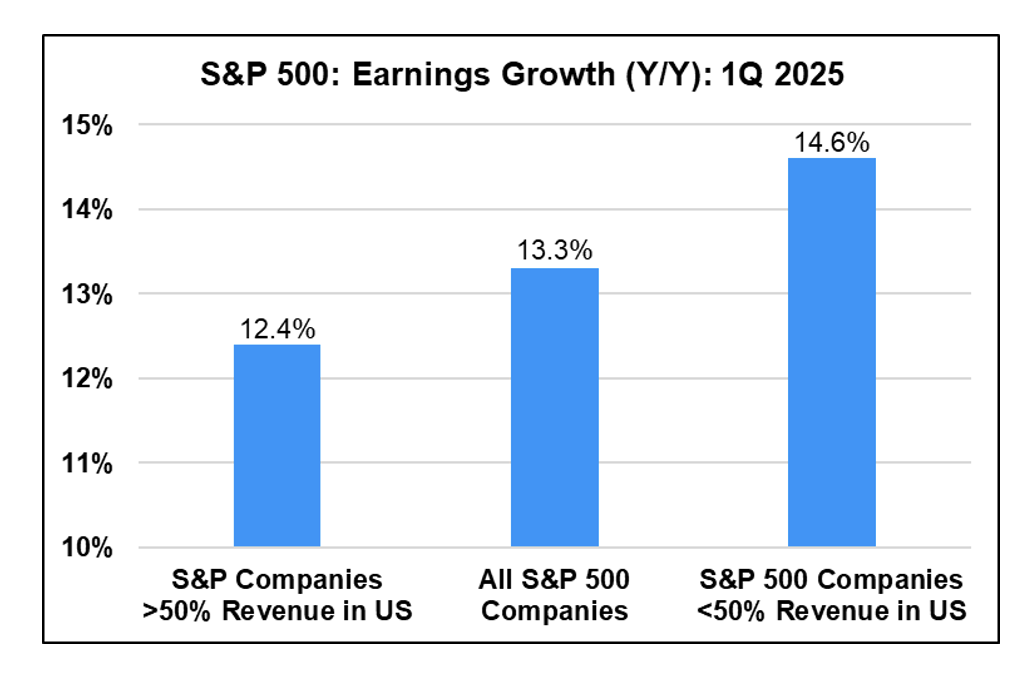

Now, this strong earnings season does not absolve the U.S. consumer, whose strength has been called into question in 2025. In fact, about 40% of S&P 500 revenue comes from abroad, and companies who rely the most on international revenue grew faster in the first quarter than those more reliant on U.S. revenue.

Source: Factset

Looking Ahead

Despite a strong Q1 season, macro conditions and global uncertainty have caused earnings estimates to fall for the remainder of the year. Analyst estimates for Q2 year-over-year earnings growth have fallen from over 9% on March 31st to just 5% as of this writing. Additionally, estimates for earnings growth in calendar year 2025 have fallen to roughly 9% from 11% in March, and down from roughly 15% at the beginning of the year. It is important to note that analyst expectations do tend to decline as reports get closer, and reports tend to beat those lowered expectations. However, estimates have been cut by more than usual for Q2. Looking further out, analysts expect earnings growth to reaccelerate in 2026 and are projecting 14% earnings growth for the calendar year.

A likely catalyst for falling expectations in the short term is continuing uncertainty surrounding tariffs. With managers unable to confidently forecast their cost structures, it’s more difficult for earnings expectations to stand on solid footing. In the Q1 reporting season, more companies cited “tariffs” in their earnings calls than any quarter over the past ten years. As we’ve seen over the past few months, markets are looking for a clear answer on the future of U.S. trade policy and dislike the day-to-day volatility of tariff discussions. As we begin the third quarter, new trade deals are beginning to surface, and the new August 1st deadline is looming. Markets will hope to see favorable deals being made, but more clarity of any sort will be welcomed.

With a backdrop of already lofty valuations, a disappointing Q2 earnings season would require valuations to extend even further to maintain current index levels. American companies have shown resilience and continued strength throughout multiple headwinds but holding international equities and diversifying assets alongside a healthy U.S. equity exposure may be prudent for risk management heading into the second half of 2025.

Takeaways

- The strong first quarter earnings season affirmed a core bull case for US large caps in the intermediate term, which is that despite headwinds such as extended valuations and geopolitical volatility, fundamentals remain strong.

- Despite wavering strength in U.S. consumption, many S&P 500 companies have diversified revenue sources from across the globe, which can help to smooth revenues over time.

- The Magnificent 7 stocks remained magnificent in Q1, but analysts expect their growth to decelerate to levels more in line with the rest of the index. Diversification within the large-cap space remains important.

- Earnings growth for the S&P 500 as a whole is expected to slow in the short term and uncertainty revolving trade policy continues to loom. As valuations remain lofty and expectant of strong growth, diversifying portfolios with international equities and diversifying asset classes may help to reduce risk.

All in all, U.S. large caps remain strong, and we continue to believe in the U.S. market, but slowing growth expectations and global headwinds present the case for diversification going forward.