Since the campaign trail, Main Street and Wall Street alike had been prepping for President Trump’s unprecedented (in the modern era, at least) use of tariffs as a tool in US trade and foreign policy. Market participants expected a degree of uncertainty, but as we now know, consumers and investors alike were not prepared for the breadth of the initially proposed tariffs and the erratic nature of the announcements. As he has shown in prior practices around trade and foreign policy, President Trump uses uncertainty and surprises to his advantage in negotiations, which, unfortunately, may as well be four letter words for investors.

As much research has shown, markets have a strong preference for certainty and stability. As it pertains to US government policy, for example, the preference is for gridlock, which slows the pace of impactful policy changes and prevents abrupt, unilateral shifts, providing a stable outlook on the market environment for business operations and investment.

Now nearing the end of June and approaching the 90th day of the 90 day “pause” in broad tariffs on July 9th, market activity for risk assets has remained relatively stable and even modestly positive. Muted volatility has certainly been welcomed, though, the last several months have been historic, and are deserving of a debrief.

In markets, surprises are rarely pleasant. And over the past few months, tariffs have delivered more than their fair share. This moment serves as a vivid case study in the behavioral side of market reactions; how uncertainty, more than policy and fundamentals themselves, can be the greatest source of volatility.

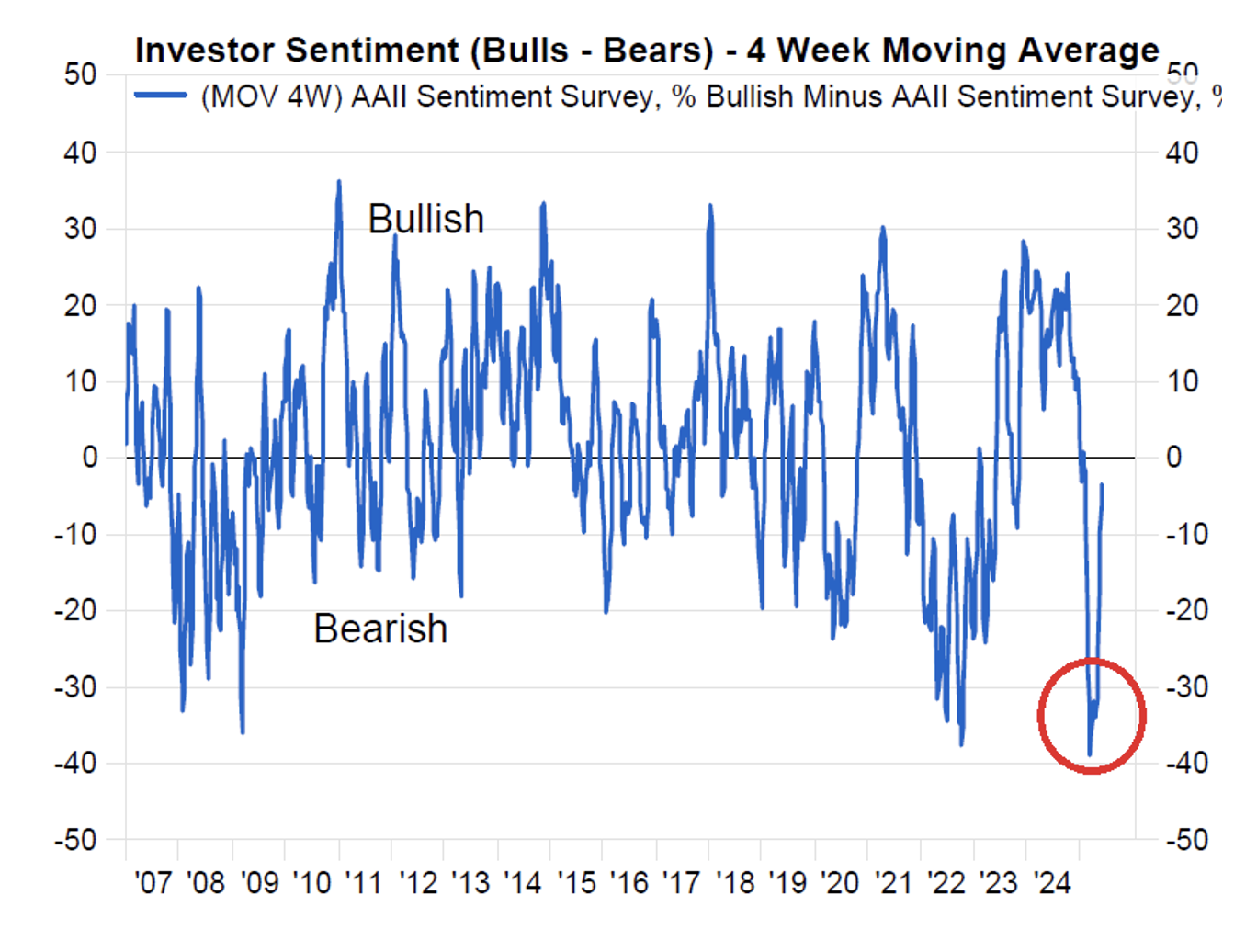

With news cycles surrounding US trade policy moving so rapidly, and much of the announcements being delivered directly to civilians via social media platforms, investor and consumer sentiment have had an outsized influence on market returns. Investor Sentiment, represented by the American Association of Individual Investors (AAII) sentiment survey (Chart 1), reached its 3rd most negative reading in history, and market returns moved in tandem.

Chart 1: AAII Investor Sentiment Survey Data Source: Factset, AAII, as of 6/20/2025

Periods of extreme pessimism have often, in hindsight, represented moments of maximum opportunity for long-term investors. This most recent episode underscores how sentiment itself, often divorced from fundamentals, can act as a market driver. Importantly, this environment created sharp dislocations that weren’t necessarily rooted in earnings or economic weakness but rather headline sensitivity and emotional reactions.

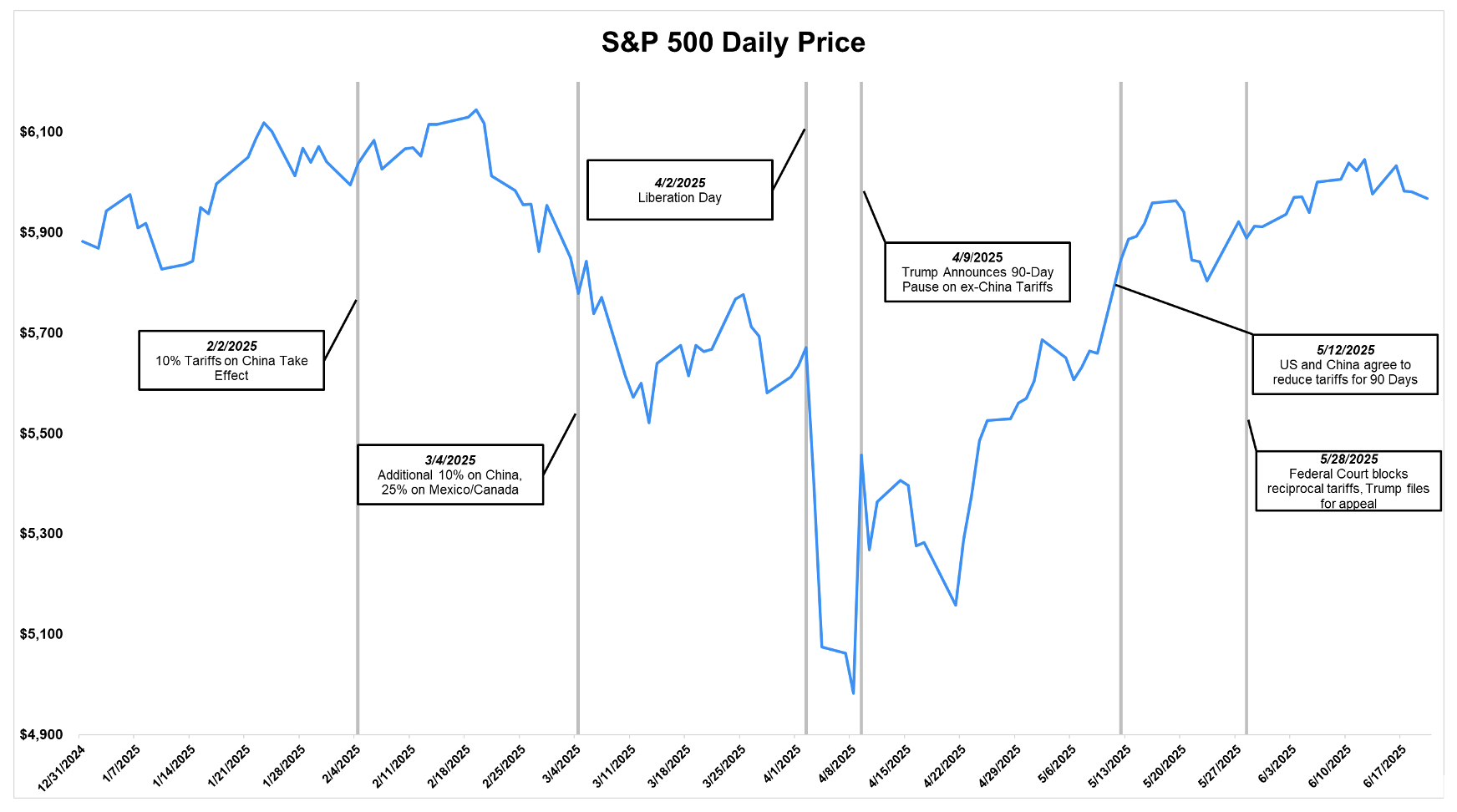

Chart 2 below shows year-to-date price movements overlaid with key tariff announcement dates. What we see, relative to other “typical” markets and cycles of policy announcements, is that many of these actions were not priced in, and therefore created real time, tangible investor reactions that pulled on market returns in dramatic fashion.

Chart 2: YTD S&P 500 Returns with Tariff Announcement Dates Data Source: Bloomberg, as of June 24, 2025

The most notable events, which sparked the heightened volatility and near bear market, came in the first few days of April. Following “Liberation Day” on April 2nd – which announced the sweeping package of US tariffs on countries around the world – came two consecutive days of approximately -5% and -6% returns on the S&P 500 on April 3rd and 4th, one of the worst two day return cycles in recent memory. However, equity market and bond market turmoil likely served as an input in the decision to pause these tariffs on April 9th, prompting a remarkable single-day rally of nearly 10% in the S&P 500.

This sudden reversal illustrates just how reactive markets had become, not necessarily to economic trends or hard data, but abrupt changes in tone from policymakers. When the focus did shift back to economics and corporate strength, however, markets generally caught a bid as fundamental readings have proved resilient throughout market volatility. These sharp rebounds could also raise questions about market breadth and leadership: was this broad rally indicative of market trends to come, or has this shakeup sparked a new regime toward more recently ignored areas of the investible market?

As mentioned, markets have not been whipsawing in this fashion since the S&P 500’s April 21st low, but that doesn’t mean the underlying fragility has been resolved. Going forward, the balance between short-term factors like investor sentiment and long-term factors like economic fundamentals and corporate earnings will be important to watch.