Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- A knock on the bull market – and we think we remain in the bull market that got going June 2023 when the S&P 500 closed up 20% from its October 2022 closing low of 3,670 even though the index did correct 21% from its then peak of 6,147 hit on February 19th of this year through April 7th as the index didn’t close down 20%, our criteria for a bear market – is that it has been narrow in scope, driven predominantly – almost exclusively – by large cap US growth stocks (think the “Magnificent 7,” including Nvidia, which to its credit topped $4 trillion in market capitalization last week, the first company to do so).

- And the argument is a fair one…if you look at returns from the Russell 1000 Growth Index, Russell 1000 Value Index and the S&P 500 on a trailing 3-, 5- and 10-year basis, US large cap growth stocks come out on top, and often by a very wide margin. And the same dynamic holds if you look at returns for the more diversified Russell 3000 Growth Index and Russell 3000 Value Index, and the S&P 500, over the same time periods.

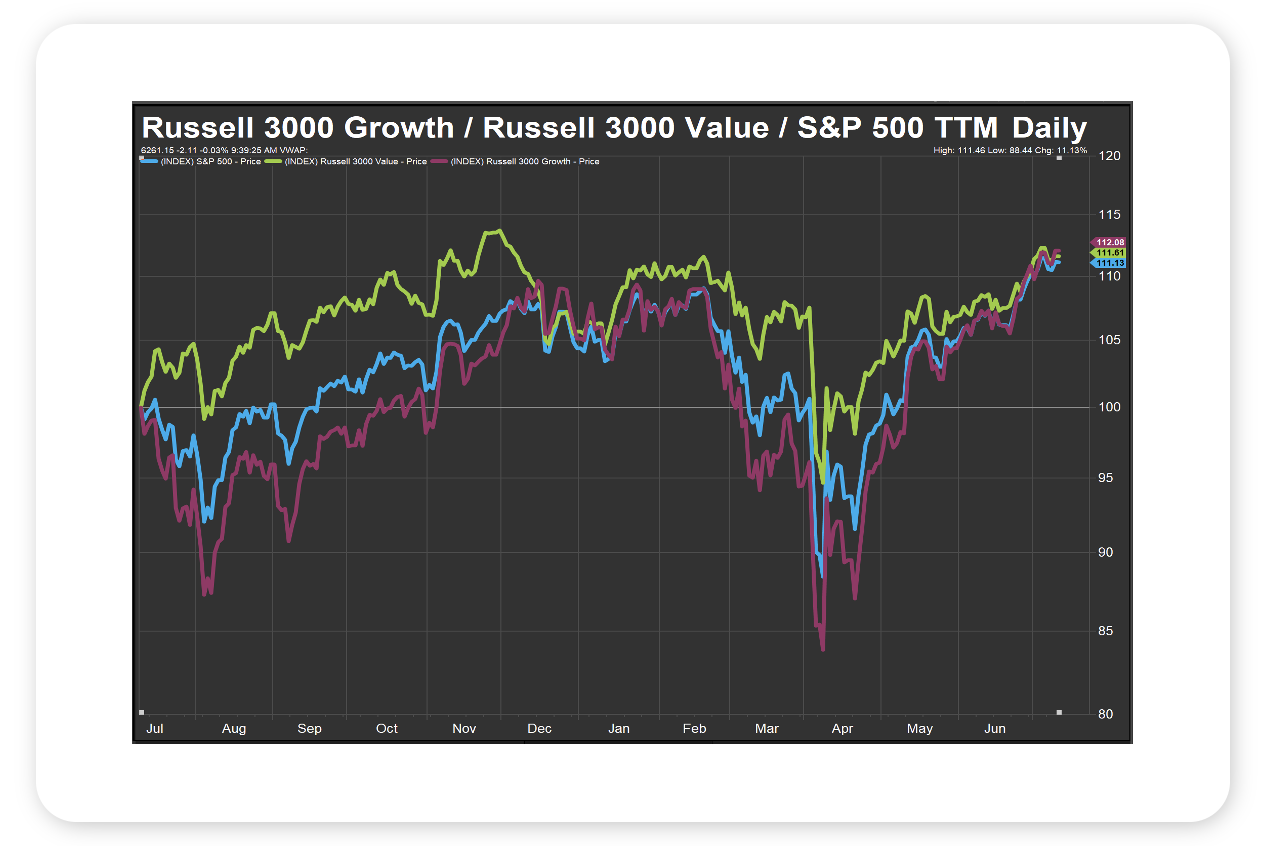

- That said, we are looking at much more of a horse race between growth and value and the broader market on a trailing 1-year basis with the Russell 3000 Growth Index, the Russell 3000 Value Index and the S&P 500 up 12%, 11.6% and 11% respectively over that period (see chart). Said differently, the market, as volatile as it has been, has been broadening out a bit, with gains coming from other sectors than tech, other styles than growth and other sizes than large. Another data point that speaks to this development is that an equally weighted S&P 500 Index is up 6.5% in 2025 vs a return of 7.2% for the traditional market cap weighted S&P. Whether current performance patterns will hold, time will tell. If they do, they should prove to be a powerful tailwind for more diversified portfolios (joining the recent strong absolute and relative returns from overseas markets).

Data Source: FactSet, 7/9/2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Global equities took a breather last week as tariffs made their way back to the headlines. The S&P 500 and NASDAQ 100 lost under half a percent each, while the blue-chip Dow Jones lost about 1% on the week. Longer term interest rates rose, and so did the dollar, pushing bond prices and international equities slightly lower as well. While the week was broadly in the red across asset classes, losses were modest.

Despite the headlines and broad index drawdowns, the Mag 7 posted a positive week, led by a 3.5% gain from NVIDIA, which notably pushed the company to over $4T in market cap – the first publicly traded company to reach such a milestone.

Throughout the week, US President Trump announced new tariff rates on over 20 countries as the end of the initial 90-day pause came to an end – the new unofficial deadline for tariffs to take effect is August 1st. Also notable, the US Treasury announced that tariff revenues allowed the US to post a budget surplus of $27B in June off the heels of a $316B deficit in May.

The economic calendar last week was light, with the small business confidence (NFIB) index and Wholesales Inventories coming in right near expectations.

This Week

As for this week, all eyes will be on the Consumer Price Index (CPI), set to be released on Tuesday 7/15 at 8:30a ET, especially as tariffs are once again front of mind. While we haven’t seen any notable price increases in the hard data to date, many are expecting that tariff duties will put upward pressure on inflation indicators. Additionally, the Producer Price Index (PPI) will be released Wednesday 7/16.

US Retail Sales will be released on Thursday 7/17, giving us a glance at the health of the consumer. Considering that roughly 70% of US GDP is consumption driven, retail sales can serve as a leading indicator to the health of the overall economy, as well as serve as a gauge on consumer sentiment.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.