Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

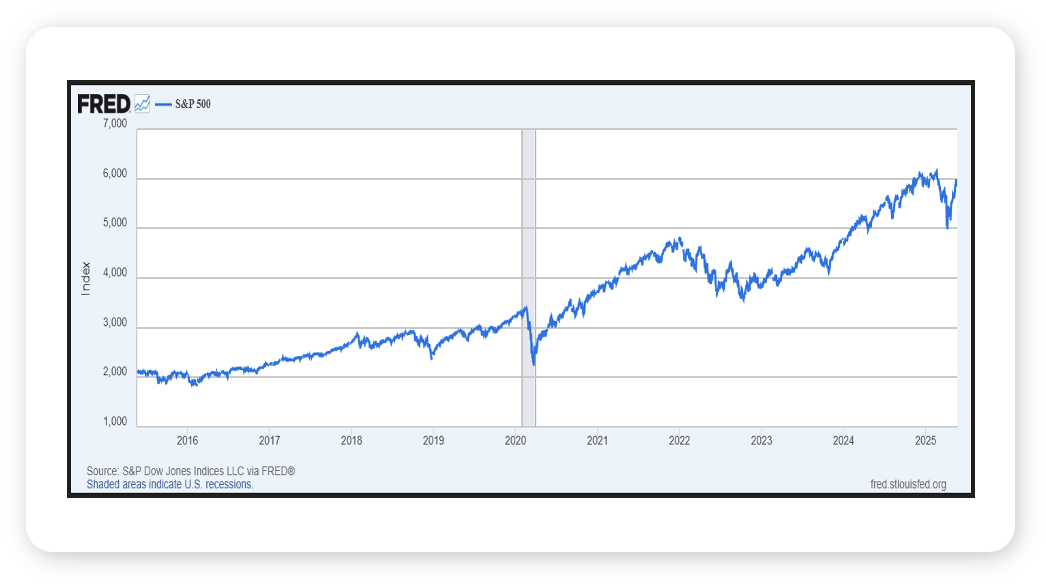

- After hitting its all-time peak of 6,147 on February 19th, the S&P 500 spent the next six weeks falling 21% to 4,835, where it troughed on April 7th. Since then, the S&P 500 has rallied 21% (see chart, lower left). While many Wall Streeters would likely cite President Trump’s April 9th announcement of a 90-day pause on most reciprocal tariffs as the key catalyst for the recent rally, we find it interesting that the stock market troughed a full two days before that news hit (if there is a crystal ball out there that works, we think its risk assets, and the tendency for markets to trough or peak before the fundamental data that justifies such inflection points presents itself). Either way, we will gladly accept the move higher in the stock market.

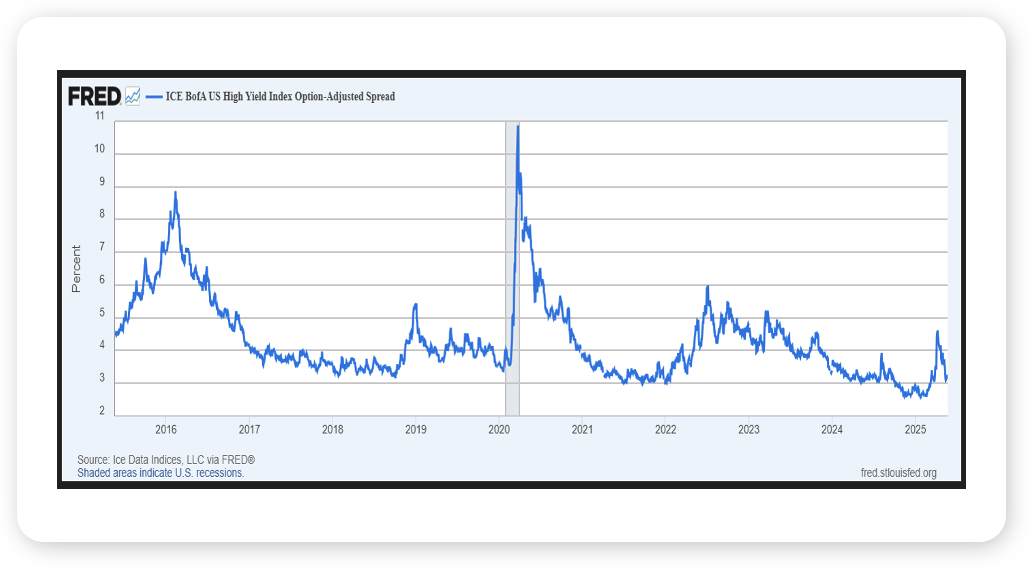

Some prognosticators think the market has gotten ahead of itself, considering trade hasn’t been solved for; Congress has not addressed the expected extension of the 2017 Tax Cut & Jobs Act, and the impact of policy uncertainty on the economy is not yet known. More recently, there are rising concerns over the USA’s fiscal health, and what that might mean for US government bonds (a topic we will dig into over the coming days). And while traditional fixed income has sold off over the past month, it’s been a different story for bonds issued by more levered, and thus in theory, riskier, companies (think high yield, or “junk” bonds). The incremental spread or yield those companies must offer investors to compel them to purchase their bonds spiked in April as trade uncertainty spiked but has since fallen back to near all-time lows (see chart, lower right; interestingly, those spreads peaked the same day the S&P 500 troughed). One way to interpret that move lower in spreads is that – broadly speaking – high yield investors are not, at least as of now, that worried about the outlook for the companies they have lent to, which is another way of saying they are not that worried about the outlook for the economy. Given the still uncertain world we are living in, that is another data point we will gladly accept.

Source: Federal Reserve Bank of St. Louis, May 22, 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Senior Investment Strategist

Last Week

US equity markets took a step back last week. The S&P 500, Dow Jones, and NASDAQ 100 all lost over 2%. On Wednesday, the 20Y Treasury Auction saw very light demand, causing yields to surge as equities and bonds sold off. The S&P 500 lost about 1% for the day, contributing significantly to its weekly loss. More tariff threats came out of Washington as well, with US President Donald Trump expressing a 50% tariff on European Union goods, as well a potential 25% tariff on Apple iPhones not produced in the US. Additionally, markets came into the week digesting the news that Moody’s had downgraded the US’s credit, putting further upward pressure on yields.

This Week

It’s a big week for earnings this week, as NVIDIA is set to release Q1 results after the close on Wednesday. Given the company’s concentration in the S&P 500 and close ties to the AI/tech trade, we expect the release to have a decent contribution to market returns for the day. In addition to earnings, we’ll see the release of the first revision of Q1 GDP, which initially came in at -0.3% and is expected to be unchanged – as a reminder, the first quarter print came in negative due to the negative effect of sharply lower net exports from tariff preparation. Personal Consumption Expenditures (PCE) will also be released this week, giving us, and the Fed, another glimpse at inflation. Coming off a lighter that expected CPI print, doves will be hoping for a lower print on PCE as well to push the Fed toward lower rates.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.