Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- Several clients have brought up gold of late, specifically its very strong performance in 2025…the commodity is up 40% or so year to date. Given its long history as a medium of exchange and a store of value, I find gold a fascinating topic from an investment point of view, though like many investors I struggle to determine its worth as it generates no earnings, cash flow or dividends (which makes it difficult for me to value).

- By most accounts one of the major tailwinds for gold this year has been a declining dollar…since gold is priced in dollars as the dollar weakens relative to other currencies it becomes cheaper to purchase in those currencies, boosting demand. And if the dollar is dropping due to concerns about the macroeconomic or geopolitical environment gold’s status as a “safe haven” asset can also put a bid under the commodity.

- But the focus of this week’s note isn’t on gold but on another asset class that has historically benefitted from a falling dollar and seems to be doing so again this year, international stocks (for a deeper dive on gold, I suggest the excellent blog post by my colleague Nolan Mauk…you can find it here… ).

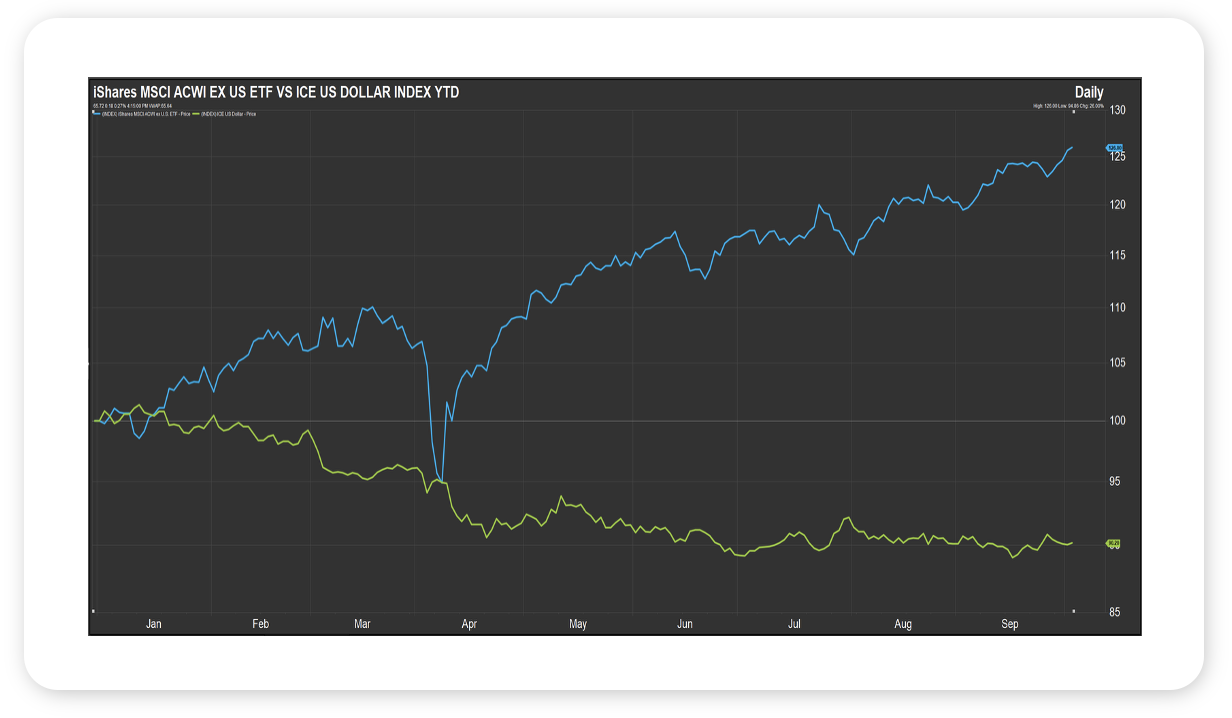

- Year to date, the iShares MSCI ACWI EX US ETF (an ETF of large and mid cap international stocks) is up 26% while the ICE US Dollar Index is off 10% (see chart). A declining dollar is a boost for international markets in two ways…for those countries that borrowed in dollars, debt service becomes less expensive, and for US investors holding ex-US stocks, those positions are worth more in dollars as the dollar drops, which likely pulls more US capital into international stocks, pushing those markets higher still (for a deeper dive on international markets, I suggest the excellent blog post by my colleague Ben Vaske…you can find it here… ).

- Our team upgraded and went overweight international equities earlier this year. There is more than one way for US investors to benefit from a declining US dollar.

Source: FactSet, September 2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Manager, Investment Strategy

Last Week

Markets held firm despite ongoing political turbulence in Washington. The federal government officially shut down after lawmakers failed to reach a funding deal. Still, global equities gained nearly 2% on the week, with emerging markets leading at +4%. Major U.S. indexes were also positive, led by small caps, which are now up more than 10% year-to-date. Bonds and real assets were modestly higher, and Bitcoin surged to a new all-time high as confidence in the U.S. government softened.

September closed out a strong stretch for diversified portfolios. Silver gained 15% for the month and 28% for the quarter, while Gold rose 11% and 16% over the same periods. Chinese equities added 10% in September, continuing their recovery. Tech stocks also performed well, with the Mag 7 gaining 8% for the month and 17% in Q3.

Economic data last week was mostly positive, but there were some signs of weakness. The ISM Manufacturing Index came in at 49.1, slightly below expansion but still improving, while ISM Services fell to 50.0, signaling flat growth. Comments in both surveys noted that tariff uncertainty is weighing on orders, though underlying demand remains stable. Due to the shutdown, the official Employment Report was withheld but the private report, ADP Payrolls, came in negative once again and well below expectations.

Interest rates were mixed on the week. Long-term yields declined slightly, while mortgage rates rose again. According to the CME FedWatch Tool, markets are pricing a 95% chance of another 25 bp rate cut at the Fed’s October 29 meeting, up from 88% last week. Odds of two additional cuts by year-end have climbed to 85%. The Atlanta Fed’s GDPNow model shows Q3 growth tracking at 3.8%, just below last week’s 3.9%.

This Week

With the shutdown extending into its second week, economic data releases are expected to remain limited. The U.S. Trade Deficit report is unlikely to be published as scheduled. Fed commentary will take center stage, including remarks from new Governor Stephen Miran, who dissented at the last meeting in favor of a deeper 50 bp cut. Markets will be watching for any signs of a policy shift heading into the final quarter of the year.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.