Weekly Notes from Tim

By Tim Holland, CFA, Chief Investment Officer

- Several macro topics have been of great interest to Wall Street this year: the conflicts in Eastern Europe and the Middle East; global trade; US debt and the outlook for the US dollar, which has fallen 10% year to date, it’s worst start to a year since 1973, and the subject of this week’s note.

- Accurately forecasting foreign exchange markets is a very difficult undertaking. As it concerns what drives the value of a nation’s currency, many economists would likely point to, among other factors, interest rates (higher rates should be bullish for a currency; lower rates bearish); economic growth (a strong economy should be bullish for a currency; a weak economy bearish) and government finances (a budget surplus should be bullish for a currency; a budget deficit – which necessitates more borrowing – bearish). What we find interesting is that interest rates and bond yields are higher here at home than in most developed countries and the US economy is performing as well as if not better than most major economies around the world, yet the US dollar has still tumbled in 2025. In looking for catalysts for that sell-off, many on Wall Street have pointed to the likely persistency of significant US fiscal deficits and ever-increasing US debt, and uncertainty around US trade and defense policy.

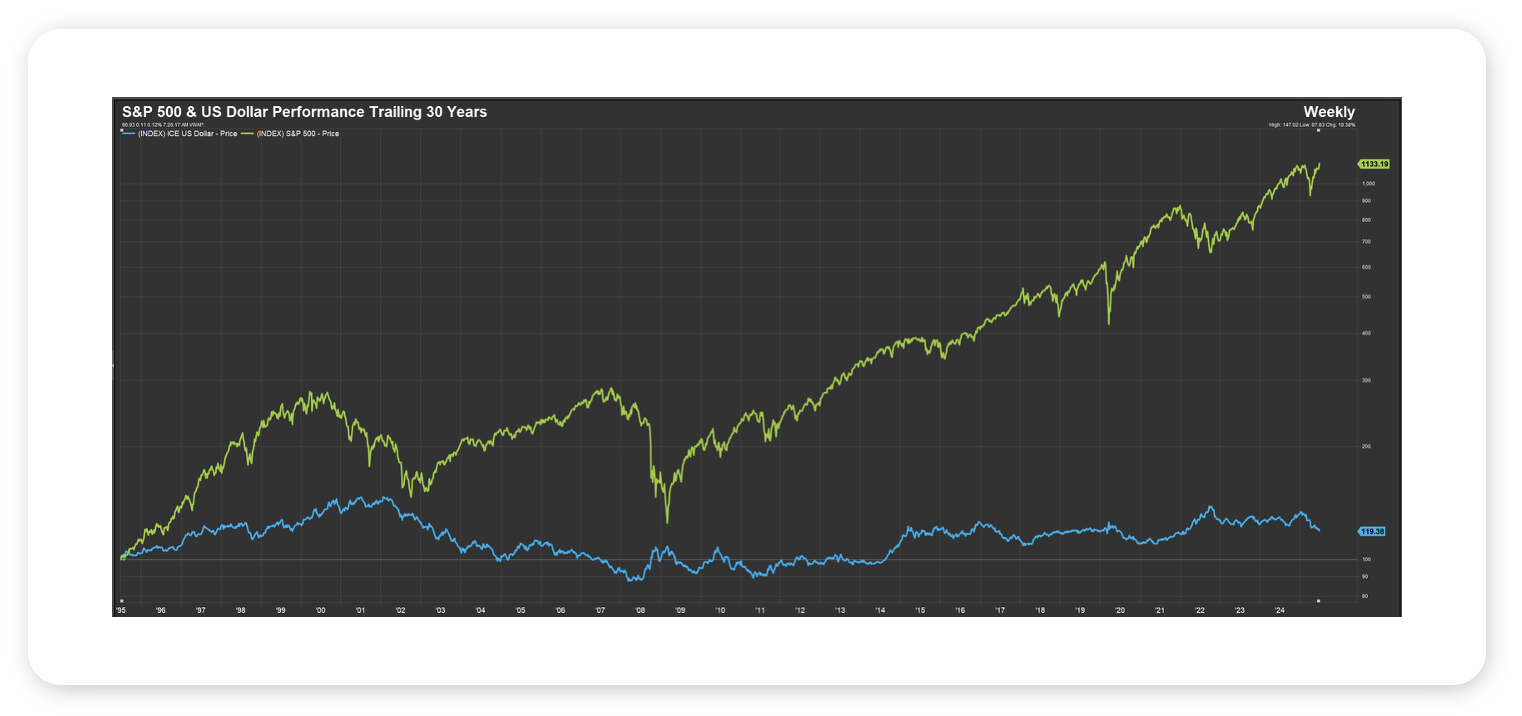

- Regardless of the cause of dollar weakness, and which way the greenback is headed from here, we think it is worth pointing out that US equities – over the long-term – have managed to move higher when the US dollar was gaining ground, losing ground or moving sideways. To put a finer point on that point, consider that over the past 30 years, US equites, as measured by the S&P 500, have gained about 1100% while the US dollar, as measured by the ICE US Dollar Index, has gained about 20%, while enduring meaningful rallies and corrections (see chart).

- At the risk of being too confident, we are confident US equities can continue to do well regardless of which way the US dollar is headed, with their fate ultimately driven by corporate profits and interest rates.

Data Source: FactSet, 7/2/2025

Looking Back, Looking Ahead

By Ben Vaske, BFA, Senior Investment Strategist

Last Week

Despite the short trading week in observance of the 4th of July, US equities continued their gains to reach new all-time highs. The S&P 500 gained over 2%, while the tech-heavy NASDAQ 100 gained just under 1%. US small caps caught a stronger bid and gained over 3% on the week. While small caps have their share of headwinds – notably higher rates – they are only lagging the S&P 500 by just less than 2% over the last 12 months. International gains were more modest without the currency effect of a declining dollar on the week (DXY was about flat) but are still outperforming US equities by double digits. The ADP employment report came in much weaker than expected early in the week, raising suspicions that we would see more exaggerated cracks in Nonfarm Payrolls, but that report beat expectations on Thursday – the US unemployment rate fell to 4.1%. Off that stronger-than-expected report, treasury yields rallied higher as expectations for rate cuts from the Fed fell. Expectations of a cut at the July meeting fell from 23% to 6% on Thursday, according to the CME FedWatch Tool. Also notable out of Washington was the signing of President Donald Trump’s sweeping legislation, “The One Big Beautiful Bill” on Friday.

This Week

On Sunday, the US administration confirmed that the 90 day reciprocal tariff pause that was set to expire this week (July 9th) was pushed August 1st to allow a few more weeks for trade deal negotiations – any country that has yet to make a deal with the US by then will have their Liberation Day tariffs reinstated. We will also be watching for any market reaction to the signing of the Big Beautiful Bill, as the legislation was signed while markets were closed on Friday – though our expectation is that any market effects would have been priced in. Q2 earnings will begin later this week, with the only notable release coming from Delta Air Lines. The economic calendar is otherwise light, with small business optimism (NFIB) and Consumer Credit being released.

We hope you have a great week. If there’s anything we can do to help you, please feel free to reach out to ben.vaske@orion.com or opsresearch@orion.com.