Hope you had a wonderful weekend and, if you made it to Orion’s Ascent conference in Orlando last week, that your travels were safe coming home, and your email inbox wasn’t too swamped!

The market narrative has been changing in recent weeks, as inflation and economic data continues to surprise to the upside (Morningstar, Mar. 2023). Interest rates have moved higher as a result (Morningstar, Mar. 2023). This week we will get the latest crucially important monthly unemployment report (non-farm payrolls) and more commentary from the Federal Reserve.

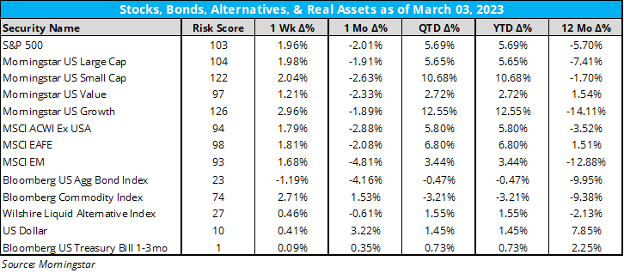

Regarding performance last week:

- The S&P 500 gained nearly 2% last week off a strong Friday rally, primarily led by growth stocks (Morningstar, Mar. 2023).

- Growth stocks are outperforming by over 10% this year, but still trail by 15% over the last 12 months (Morningstar, Mar. 2023).

- International stocks also gained nearly 2%, and broad commodities gained nearly 3% (Morningstar, Mar. 2023).

- Year-to-date, small caps and growth stocks have double digit gains and bonds are now negative (Morningstar, Mar. 2023).

- One thing that stands out this year – International is outperforming despite the US dollar moving higher (Morningstar, Mar. 2023).

- That doesn’t happen often, but it also happened last year (Morningstar, Mar. 2023)! Last year you could explain the US underperformance by the dramatic underperformance of growth stocks and technology, but that’s not the case this year (Morningstar, Mar. 2023). Is this more proof that the secular trend has likely shifted back to non-US stock outperformance?

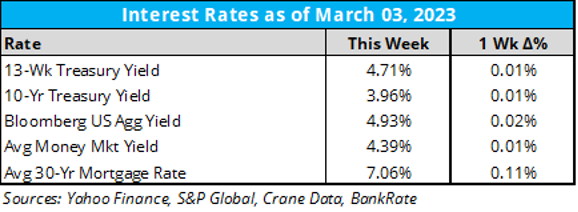

As for key rates last week:

- Interest rates were mostly unchanged for the week, though the average 30-year mortgage rate is back over 7% (Bankrate, Mar. 2023).

- Mortgage demand dropped to a 28-year low last week as rates continue to rise (Yahoo News, Mar. 2023). The average rate for a 30-year fixed mortgage is now 6.71% (Yahoo News, Mar. 2023). February 2022 rates were at 4%; the year before that, you were looking at under 3% (Yahoo News, Mar. 2023). Even with the higher rates, home prices are up 6% year-over-year, as inventory is so slim (Yahoo News, Mar. 2023).

Are mortgage rates really high by historical standards? Not really. Charlie Bilello of Creative Planning tweeted a chart showing the history of 30-year mortgages on March 2, 2023.

As for the changing market-based expectations of what the Federal Reserve will do with short-term rates, here is the handy-dandy CME Group Fed Watch tool:

- No change in expectations last week for the Fed meeting on March 22 (CME Group, Mar. 2023). There is now a projected 70% chance of a 25 basis point increase and 30% chance of a 50 basis point increase (CME Group, Mar. 2023).

- It’s still mostly expected that the Fed will stop after increasing another 75 basis points from current levels (CME Group, Mar. 2023).

- That said, there are increasing odds for rates to still go up another 150 basis points (CME Group, Mar. 2023).

- Bottom line, expectations are shifting to the Fed moving rates higher than earlier expected, holding them at higher levels longer than expected, and not cutting rates until later (CME Group, Mar. 2023).

- “For the corporate sector in contrast the threat of higher rates is actually spurring a wave of bond issuance, which is running at a record pace for the first two months of 2023 at $301.55 bln for investment grade credit, and we are yet to see demand for this paper weaken, with returns still just about positive for 2023, even if the average annual total return over the last 5 years of the Bloomberg US Aggregate Bond index is a dismal 0.5% through the end of February.” (Marketfield, Mar. 2023)

Strategas on expected returns for the S&P 500 using the earnings yield:

- The earnings yield is the reciprocal of the P/E ratio (Strategas, Mar. 2023).

- So, for example, if a P/E is 20, the earnings yield would be 5% (Strategas, Mar. 2023). That’s about where we are.

- Thus, with valuations this high for the S&P, expect below-average (albeit positive) returns over the next 10 years (Strategas, Mar. 2023).

Seema Shah is the chief global strategist at Principal Asset Management (Principal is launching three strategies on OPS this month) and was interviewed for Insider magazine last week. Here are a couple of questions and answers from the March 4 article, “Moving On From Stocks” posted by Insider on LinkedIn.

- How do you think investors should approach stocks in the current landscape?

- SS: One of the key things would be decreasing equity risk. Just as stocks were a key beneficiary of the last era, they will be one of the key losers for the period going forward as long as central banks keep policy very tight.

- If you don't like stocks for the new era, what kind of investments would you recommend?

- SS: Real assets, like commodities and natural resources.

Some interesting stats from Bespoke Investment Group’s recent reports:

- Homebuilders Ignore the Headlines – As housing-related economic data points have been falling to multi-decade lows, homebuilder stocks have actually been rallying (Bespoke, Mar. 2023). As of February 22, 2023, the S&P 500 Homebuilder group was up 6.9% YTD and 11.6% over the last 12 months (Bespoke, Mar. 2023). That compares to the S&P 500's YTD gain of just 3.95% and its decline of 7.3% over the last year (Bespoke, Mar. 2023). Rusty’s comment: Prices lead the economy.

- High Income Renters – High-income earners are increasingly opting to rent versus buy (RentCafe, Jan. 2023). According to RentCafe, from 2015 to 2020, the number of US households earning more than $150,000 per year that rent increased by 82% (RentCafe, Jan. 2023). Cities experiencing the largest percentage increases include Boston, Chicago, and Seattle (Bloomberg, Feb. 2023). Rusty’s comment: Expect more of this until housing drops more or rents get too high.

- Don't Tell Mom... – The national average hourly rate for a babysitter increased 9.7% in 2022 to $22.68 following an 11% increase in 2021 (Axios, Feb. 2023). Cities with above average hourly rates include San Francisco ($25.24), Seattle ($24.60), Austin ($22.81), and LA ($22.74) (Axios, Feb. 2023). The only major city to see a decline was New York where the average hourly rate dropped from $23.45 to $22.18 (Axios, Feb. 2023). Rusty’s comment: Inflation among services remains high.

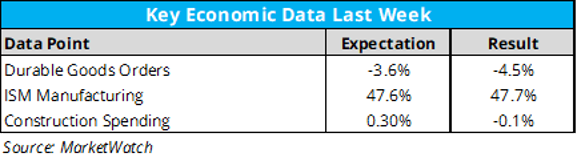

Economic data last week:

- While on the quiet side last week, the numbers are still generally surprising to the upside (MarketWatch, Mar. 2023).

- However, arguably the big number last week was that China’s PMI came in at 52.6 vs. 50.1 in January; it was expected to come in at 50.5 (MarketWatch, Mar. 2023). The reading was at a level not seen since 2012, and the expansion was helped by China’s reopening (MarketWatch, Mar. 2023). As of March 6, we expect an increase in the US’s PMI number, but it should still be in contraction mode, as analysts expect it to come in at 48 (MarketWatch, Mar. 2023).

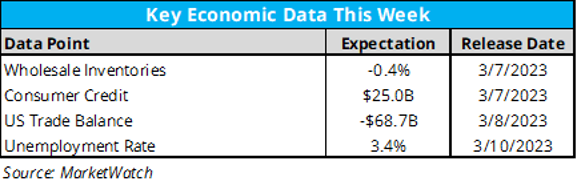

- The big data release for this week will be the jobs report on Friday (MarketWatch, Mar. 2023).

- The unemployment rate is expected to remain unchanged at 3.4% (MarketWatch, Mar. 2023). If so, the unemployment rate will remain at multi-decade lows.

Atlanta Fed's GDPNow projection for first-quarter 2023 GDP is now at 2.3% (down 0.4% over the last week).

The market narrative is changing. For instance, it appears that “recession fears have peaked”, at least according to the latest BofA Global Fund Manager Survey included in a February 14 article on MarketWatch, “Fund managers and corporate executives have sharply reduced their recession expectations”.

An update on earning growth from the latest Factset Earnings Insight on February 24, 2023:

- Earnings Scorecard: For Q4 2022 (with 99% of S&P 500 companies reporting actual results), 69% of S&P 500 companies have reported a positive EPS surprise and 65% of S&P 500 companies have reported a positive revenue surprise (Factset, Feb. 2023).

- Earnings Growth: For Q4 2022, the blended earnings decline for the S&P 500 is -4.6% (Factset, Feb. 2023). The fourth quarter will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%) (Factset, Feb. 2023).

- Crypto prices dropped last week, as Bitcoin fell 4% to $22,500 and Ethereum dropped 3.8% to near $1,570 (Decrypt, Mar. 2023). Most other large coins dropped 5-10%, and there were very few in the green (Decrypt, Mar. 2023).

- Shares of crypto-focused bank Silvergate collapsed near 60% last week, as the company delayed their annual report, fresh worries surfaced about the banks FTX exposure, and Coinbase (amongst others) cut ties with the company (Bloomberg, Mar. 2023). Repayments from the Mt. Gox exchange are set to start soon; the company went bankrupt nearly 10 years ago (Coindesk, Mar. 2023). Coinbase also announced it was delisting the Binance stablecoin BUSD after various problems with the issuer of the coin, Paxos (Decrypt, Mar. 2023).

- No new digital asset ETF news.

“Happiness is not a matter of intensity but of balance, order, rhythm, and harmony.” ~ Thomas Merton (as quoted by Dr Daniel Crosby at Ascent!)

On this week’s Orion's The Weighing Machine podcast we talk to the head of due diligence at Orion, Chris Hart. This podcast is a keeper. If you want to know about institutional money manager due diligence, especially how Orion does it differently than others, this is a podcast to listen to, to favorite, and to forward.

Speaking of podcasts, one of the great financial writers of our time, Morgan Housel, has started his own podcast. The first episode is a good one: “The Art of Spending”.

If you want more Housel, and you probably should, he’s been a guest on Dr. Daniel Crosby’s podcast twice, including September 15, 2022.

And speaking of the prolific Dr. Crosby, here’s another website you should strongly consider to study, favorite and forward: Orion's Behavioral Finance website. This site is loaded with important goodies, not only for investors, but for advisors and anyone powering advisors to help investors win.

Last week we published the latest “Weighing the Risks” podcast. It was with KraneShares CIO Brendan Ahern. The topic was the potential of China’s re-opening on the global economy – good timing. China had some way above-expected economic numbers last week (CNBC, Mar. 2023).

The average retirement account is only $100k (A Wealth of Common Sense, Mar. 2023). Now to be fair, I’m betting most investors have multiple retirement accounts. The data should be by household. Nonetheless, the numbers aren’t great.

According to The Inflation Guy Michael Ashton of E-piphany: “Now, because airline miles are money, your best strategy is to spend them as quickly as you can. They don’t earn interest, so they are a wasting asset in real space.”

Earlier this year, I finally got around to reading the book “No One Would Listen” by Harry Markopolos. It’s the story about one of the biggest crooks ever in Wall Street history: Bernie Madoff. I never really had a huge urge to read it – I mean the guy was a crook and why would I want to waste my time reading about him? But a good friend says he reads it every year or two because it has so many lessons. It was indeed an extremely fascinating read, and it did contain many lessons, though I may not read it as frequently as my good friend did.

- Trivia: I do know the author of the book, Harry Markopolos. When I used to work at Fidelity, with a cool office overlooking Boston Harbor, Harry would often visit the office and hang out. His girlfriend at the time, and now his wife of nearly two decades, used to have the office next to me.

- Coincidentally, there is now a Netflix series called “Madoff”. It was also good.

- More trivia. The theme music for the Madoff series was by Serj Tankian (known from his work in his band System of A Down. By the way, how has their song “Chop Suey” not made The Weighing Machine Walk-Up Songs Playlist on Spotify yet?)

- Anyway, Serj years ago purchased a song from a good friend of mine and recorded it. That song was the one I had commissioned my friend to write! The song was an instrumental and had used an original poem that I had written to be used as source material, but when the song was released, it had some other poem that Serj wrote! The song was "Song of Sand".

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at orionportfoliosolutions.com/blog.

0681-OPS-3/7/2023

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.