With so much pessimism in the headlines, from banks under pressure to legitimate commercial real estate concerns, there are actually a lot of notable positives for investors – massive liquidity back in the system, falling inflation, lower interest rates, record-level cash (“buying power”) on the sidelines, a firming residential real estate market entering the spring season and, perhaps the best signal of all, prices themselves (CNBC, Mar. 2023). Despite all the bad news, the overall stock market’s price chart looks decent and some of the internals (i.e., price relationships within the markets) look encouraging too (CNBC, Mar. 2023). As the saying goes, “A market that doesn’t go down on bad news, is a market to buy.”

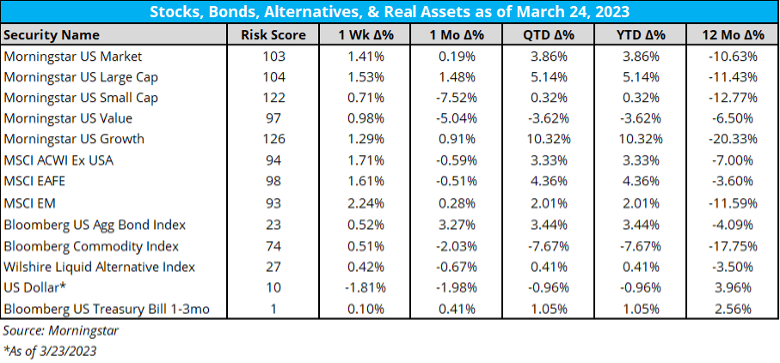

Regarding overall performance last week:

- Despite concerns about the banking sector and an economic recession, the overall stock market was up over 1% on the week and is still higher by nearly 4% year-to-date (Morningstar, Mar. 2023).

- Growth stocks, led by the NASDAQ, continue to rally as we approach the end of the first quarter, gaining over 1% on the week and up over 10% on year (Morningstar, Mar. 2023).

- International stocks saw gains last week after a prior week of losses (Morningstar, Mar. 2023).

(Click on the chart to see a larger view)

Also higher last week, remarkably, was the Financial sector (Morningstar, Mar. 2023). Also remarkable is that, despite the recent losses, the Financial sector has still outperformed the overall stock market since the COVID lows (a week of performance, however, could change that stat) (Morningstar, Mar. 2023).

- It makes sense that if Financials falter, that’s a signal that the economy and stock market might falter too. If banks aren’t lending, for instance, that could negatively impact growth. On this point, Financials did indeed falter in terms of relative performance before two of the biggest bear markets in U.S. history (late ‘90s and again about 10 years later during the Great Financial Crisis) (Morningstar, Mar. 2023). Given that Financials have underperformed the S&P 500 by over 10% in the last four weeks (Morningstar, Mar. 2023), should we be concerned? Perhaps, but it should be noted we have seen this sharp underperformance from Financials five times since 1990 (Morningstar, Mar. 2023). Only twice did the overall market falter afterwards – and Financials typically outperformed moving forward after underperforming so much, so quickly (Morningstar, Mar. 2023).

But, here’s a more encouraging sign for the overall stock market – the performance of semiconductor stocks. They are outperforming and on the verge of new 52-week highs (Morningstar, Mar. 2023). Historically, according to BeSpoke Investments, this is not only a positive for semiconductor stocks (and growth and tech in general), but also a plus for the overall stock market (BeSpoke, Mar. 2023).

A big reason why the stock market is doing well this year is that Large Caps are outperforming (Goldman Sachs, Mar. 2023). Did you know that the top two stocks dominate the market like no other time since the 1970s? Check out the chart posted in a tweet by Carl Quintanilla on March 22, 2023.

Deeper Dive

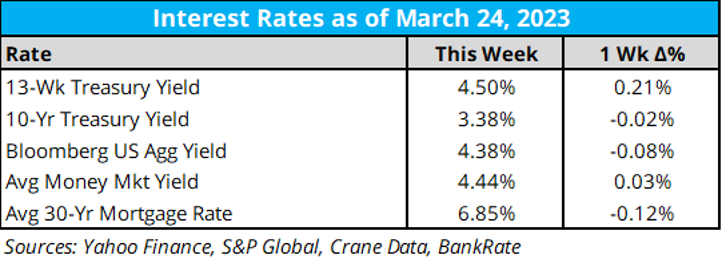

As for key interest rates last week:

- Interest rates were calmer last week, despite a 21-basis point jump in the short-term treasury rate (Yahoo Finance, Mar. 2023).

- The average 30-year mortgage rate declined last week (Bankrate, Mar. 2023).

With money market yields over 4%, it’s no surprise that flows into money market funds are booming (Crane Data, Mar. 2023). Check out “Fed Fund Futures Implied Rate Monthly High-Low Spread” via CME Group’s FedWatch Tool.

There’s more on the money markets in a chart last week from DWS – there’s never been more in money market funds (DWS, Mar. 2023). This is a potential source of buying power for the stock market. It’s a lot of “dry powder”.

We’re 40 days out from the next Fed interest rate decision and, as of now, according to the CME Fed Watch tool:

- At a current target range of 475-500, the market is pricing about a 65% chance of no hike at the next meeting and 35% of another 25 basis point increase (CME Group, Mar. 2023).

Last Monday, we commented on how turbulent the FedWatch readings had been surrounding the Consumer Pricing Index (CPI) release, and the Fed Funds Futures are actually seeing very rare spread levels (Strategas, Mar. 2023). The largest spread in futures we’ve seen prior (since inception in 1994) have been 9/11, the 2008 Global Financial Crisis, and March 2020’s Covid breakout (Strategas, Mar. 2023). It’s notable that the stock market continues to hold up despite this uncertainty.

From the “Goldman Sachs Expects Commodities Supercycle” article on March 21, 2023 in The Wealth Advisor: “Goldman Sachs expects a commodities supercycle driven by China and the capital flight from energy markets and investment this month after concerns triggered by the banking sector, the U.S. bank's head of commodities said.”

Which strategies do the best minimizing the “behavior gap” (i.e., the investor return being lower than the investment return due to performance-chasing): asset allocation funds. Good – and important – article on investor returns on July 13, 2022 in Morningstar: “Are You Leaving Money on the Table From Your Funds’ Returns?”

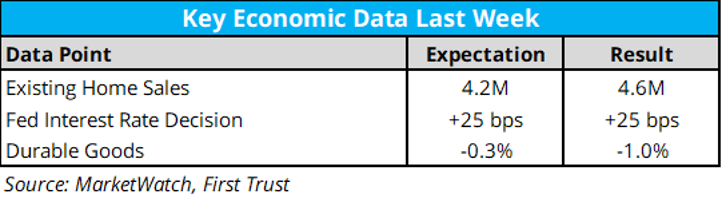

Economic data last week:

- Existing home sales came in above expectation at a monthly rate of +14.5% (First Trust, Mar. 2023). Sales are down 22.6% versus a year ago (First Trust, Mar. 2023). The median price of homes sold rose in February but is down 0.2% from a year ago (First Trust, Mar. 2023).

- Durable Goods orders came in lower than expectation at -1.0% (First Trust, Mar. 2023). Lower orders were led by commercial aircrafts, defense aircrafts, and autos (First Trust, Mar. 2023).

Home sellers are back in control according to a March 26, 2023 article from Yahoo Finance.

- “We have all these pre-approvals lined up, we’re back to getting multiple offers, no concessions from sellers, and buyers back to bidding.” (Yahoo Finance, Mar. 2023)

- The median asking price of newly listed homes is up 1% year over year, Redfin data for the four-week period ending March 19 found (Redfin, Mar. 2023).

- Some 46% of homes under contract got an accepted offer within the first two weeks of hitting the market, the highest level since last June (Yahoo Finance, Mar. 2023).

- And a quarter of homes sold above their final asking price, the highest share in more than three months (Yahoo Finance, Mar. 2023).

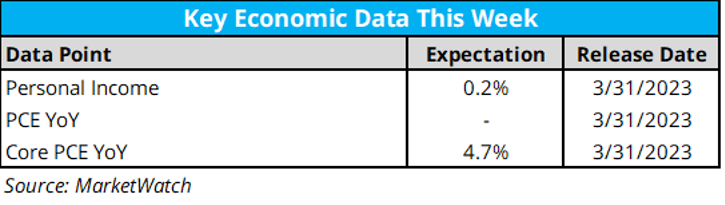

Here is the economic data calendar for this week.

- The Fed’s preferred measure of inflation, Personal Consumption Expenditures Price Index (PCE), will be released this Friday (MarketWatch, Mar. 2023).

Atlanta Fed's GDPNow projection (as of March 24) for first-quarter GDP is now at 3.2% (unchanged from last week).

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Another week (mostly) in the green for cryptocurrency prices. Bitcoin led the way, higher by nearly 19% to hover around $28,000 (Decrypt, Mar. 2023). Ethereum climbed 9%, Ripple jumped 18%, but Polygon, Solana, and Polkadot dropped nearly double digits (Decrypt, Mar. 2023).

- Coinbase was issued a “wells notice” by the SEC regarding portions of their business, despite Coinbase repeated asking formore regulation and clarity (see Coinbase blog post from March 22, 2023). The founder of Terra/Luna was arrested in Montenegro last week (ETF.com, Mar. 2023). Flagstar bank will take over the assets/deposits/operations of Signature bank (ETF.com, Mar. 2023). NYDIG estimates that $23.4 Billion has flowed into crypto since last year, and $16+ Billion of that into Bitcoin alone (ETF.com, Mar. 2023).

- Bitwise launched the Bitcoin Strategy Optimal Roll (BITC) ETF last week (ETF.com, Mar. 2023). The fund’s objective is to better optimize the cost of futures contracts on Bitcoin (ETF.com, Mar. 2023).

Additional Resources

Curious about Bitcoin returns? Check out the chart of Bitcoin annual returns since 2010 as tweeted by Charlie Bilello on March 19, 2023.

“All of history and all of life is stuffed full of the unexpected and the unthinkable.” ~ Peter Bernstein (GoodReads, Mar. 2023)

On this week’s Orion's The Weighing Machine podcast we talk to Orion’s very own Brian McLaughlin, the president of Orion Advisor Technology and the founder of RedTail Technology. The interview was fascinating and fun on many levels. Brian’s emphasis on harmonizing people, culture and technology, and his plans to do so, makes this a must-listen podcast.

The “Age of AI” has begun, according to the Bill Gates article on GatesNotes from March 21, 2023, which has been mentioned a lot of late. From that article, there are 7 quotes from Bill Gates that were tweeted by Olivia Says on March 21, 2023.

Here’s another podcast from Morgan Housel, this time on "Rules of the Money Game" from March 14 2023.

Speaking of investing rules and podcasts, this week I’m interviewing Steve Atkinson from Buckingham Strategic Partners (a former CLS Investments alum from nearly 20 years ago) for the Weighing Machine. Steve not only has an excellent human-centric podcast on financial advising called "The Admired Advisor", but he also wrote a book called “27 Principles Every Investor Should Know” that makes a nice gift to all new (and old) investors.

One more podcast. Leading health experts Huberman and Attia on Huberman Lab podcast? Are you kidding me? Three hours of high-quality content on how to perform and live at a higher level.

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at orionportfoliosolutions.com/blog.

0886-OPS-3/28/2023

Orion Portfolio Solutions, LLC, an Orion Company, is a registered investment advisor.

Orion Portfolio Solutions, LLC d/b/a Brinker Capital Investments under the parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.