Hope you had a great long weekend with nice weather, friends, family and, of course, The Masters Tournament! The Masters is always my favorite indication of the start of spring and what a great, competitive tournament this weekend!

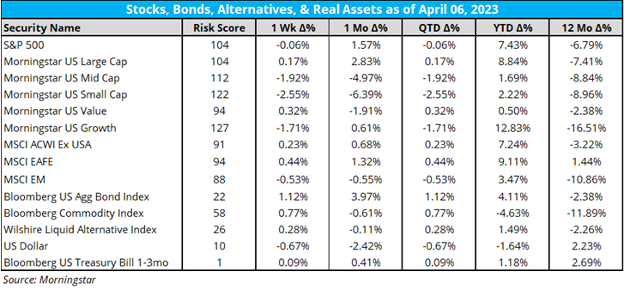

Regarding overall performance last week:

- The overall market was essentially flat last week to start the quarter with gains in large caps and value stocks being offset by losses in small caps and growth stocks (Morningstar, Apr. 2023).

- Bonds were positive on the week and are up nearly 4% just in the last month (Morningstar, Apr. 2023). Balanced portfolios continue to be solid in 2023 (Morningstar, Apr. 2023).

- Commodities saw a near 1% gain, likely driven by recent oil supply news (Morningstar, Apr. 2023).

- Year-to-date, large cap growth stocks have been the dominant equity style, though growth stocks have still underperformed value by over 14% in the last 12 months (Morningstar, Apr. 2023). EAFE stocks, the dollar, and ST treasuries are the only winners over the last 12 months (Morningstar, Apr. 2023).

Deeper Dive

It’s always nice to take a glance at industry flows, especially at the end of a quarter.

- In Q1 2023, the US ETF market saw +$74B of net inflows which represented a 60% drop compared to Q1 2022 (Morningstar, Apr. 2023).

- Additionally, compared to the first quarter of prior years, fixed income flows dominated compared to equities (Morningstar, Apr. 2023). This was also the first Q1 where global equities saw higher flows than domestic since 2018 (Morningstar, Apr. 2023).

A few additional notes on industry flows, according to an April 3, 2023 article from Citywire on ETF Flows:

- “In Q1 2023, US equity and sector equity ETFs bled $2.4bn and $10.8bn, respectively, while international equity ETFs took in $29.6bn of net new money.” (Citywire, Apr. 2023)

- “Active ETFs continued to gain ground and took in $23.4bn in Q1, representing nearly 30% of net inflows. Passive ETFs won $54.4bn of net new money. Last year, active ETFs accounted for 14% of ETF inflows.” (Citywire, Apr. 2023)

There’s a lot of negative headlines in the market these days: inflation, recession fears, geopolitical issues, and bank failures to name a few. Well, it may not be too grim for the market. Go to Jefferies Insights for April 2023 for a nice table graphic, “Historical Financial Crises Over Last Three and a Half Decades”. The table looks at some of the crisis-level issues over the last ~35 years along with their subsequent government response and their 3-and-5-year impacts on the stock market, inflation, and the unemployment rate. Keeping a long-term focus, even when it feels like we’re in crisis mode, is almost always the best way to produce investor success (Jefferies, Apr. 2023).

The value of the dollar skyrocketed to record highs in 2022, but prices are now well off their highs (Bloomberg, Apr. 2023). According to Bespoke Investments:

- “As the dollar has declined, there has been massive outperformance by stocks with greater levels of international revenue exposure.” (Bespoke, Apr. 2023)

- “Part of the underperformance of domestically focused companies has to do with the heavy concentration of Financial sector stocks.” (Bespoke, Apr. 2023)

With the dollar dropping, we find Gold inching toward all-time highs (Yahoo Investments, Apr. 2023).

For more on the markets, check out the new Orion Portfolio Solutions (OPS) Market Commentary section. As always, our goal in these commentaries is to provide general portfolio advice, talking points, and useful resources.

Regarding outlooks, Goldman Sachs surveyed investors and currently found three distinct investor cohorts:

- Sticky Inflation: The first cohort sees "Sticky Inflation" as the key driver of markets going forward. This cohort was the biggest last month, but has now shrunk to 21% of participants. Those investors have the most hawkish Fed expectations (50bps+ of hikes) and are generally quite bearish risky assets. The strongest views are long commodities (both Crude and Gold) and short USD FX and DM equities. (Goldman Sachs, Apr. 2023)

- Recession: This cohort sees the economy already slowing down and a recession highly likely this year. This is now the largest cohort with 36% of participants. Those investors tend to prefer Quality assets, and are equally bearish as the first cohort, but don't see the Fed being as hawkish as the "Sticky Inflation" cohort. Their views are strongest in discount margin (DM) bonds and gold on the long side and DM equities and USD foreign exchange (FX) on the short side. (Goldman Sachs, Apr. 2023)

- Cycle Extension: Finally, the third cohort sees continued strength in the US economy ("US Cycle Extension") or in EM.This cohort is at 24% this month. For these investors, the Fed is not the key driver and they favor long DM and/or EM equities and short USD FX. (Goldman Sachs, Apr. 2023)

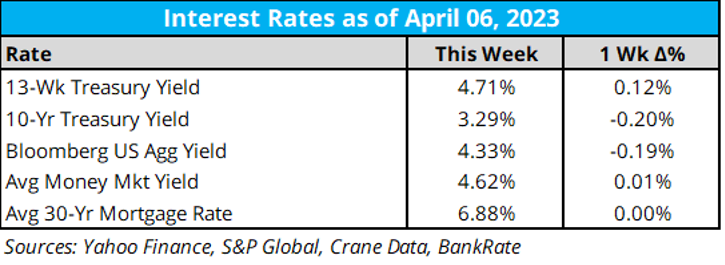

As for key interest rates last week:

- Interest rates saw some movement last week. Short term yields increased while long term yield decreased, deepening the inversion between short and long-term yields (Yahoo Finance, Apr. 2023).

- The average money market and mortgage rate saw no change last week (Yahoo Finance, Apr. 2023).

We’re 23 days out from the next Fed interest rate decision and, as of now, according to the CME Fed Watch tool (which has arguably been one of the key charts to watch this year):

- At a current target range of 475-500, the market is pricing about a 30% change of a pause in rate increases and a 70% chance of another 25 basis-point increase (last week the odds of an increase went back up) (CME Group, Apr. 2023).

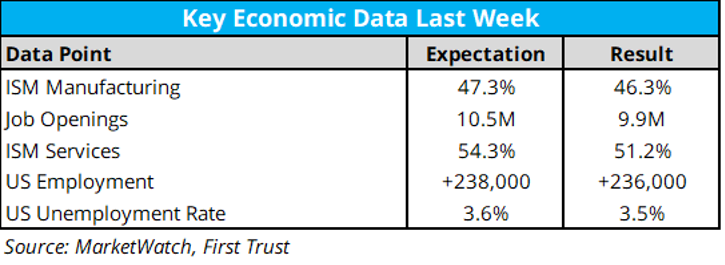

Economic data last week:

- The jobs report came in slightly cooler than expected, though the unemployment rate declined yet again (MarketWatch, Apr. 2023). On the bright side for the inflation fight, job openings and new hirings have slowed (MarketWatch, Apr. 2023).

- The unemployment rate did drop again last month and is back near 50+-year lows (First Trust, Apr. 2023).

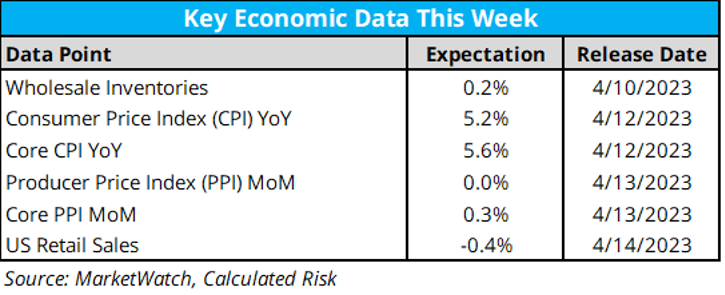

Here is the economic data calendar for this week:

- This week is jam-packed with economic data. The most important indicators for the current economic and inflation situation include the Consumer Price Index and Producer Price Index (MarketWatch, Apr. 2023).

- Expectations are for moderate month-over-month increases in CPI and PPI, but a further reduction in the year-over-year measures (Calculated Risk, Apr. 2023).

Atlanta Fed's GDPNow projection (as of March 31, 2023) for first-quarter GDP is now at 1.5% (down 1% from last week) (Apr. 2023).

- The further reduction (now -1.7% over the last two weeks) came from further decreases in personal consumption expenditures growth and a decrease in real net exports (GDPNow, Apr. 2023).

A June 22, 2014 article from The Dallas Morning News is loaded with nuggets regarding economic data: "Rainfall a better predictor of stock market than GDP."

Housing might be stuck given that many homeowners won’t sell because they have sub-3% mortgages, but that should mean a huge remodeling boom is ahead, according to a February 26, 2023 article in Yahoo Finance.

Strategas on earnings expectations heading into 1Q earnings season:

- “With the first quarter earnings season set to begin in a couple of weeks, 2023 EPS currently sits at $221.44. This figure still remains about 10% higher than our estimate but represents a growth rate of just 1% for the overall index in 2023. The 2024 number of $248.11 suggests that the consensus believes earnings will normalize next year and return back to a 10-12% growth rate. We believe this remains a very optimistic scenario.” (Strategas, Apr. 2023)

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Crypto prices were fairly flat last week, although started to inch higher on Sunday (CoinMarketCap, Apr. 2023). Bitcoin rose 1% to just over $28k, Ethereum rose 4% to $1,860 (CoinMarketCap, Apr. 2023). Many other coins were flat to slightly positive (CoinMarketCap, Apr. 2023).

- News flow was light last week. Elon Musk filed a motion to dismiss a $258 million lawsuit related to racketeering Dogecoin, which promptly rallied (Decrypt, Apr. 2023). Ralph Lauren announced a new concept store in Miami that will accept crypto payments (Decrypt, Apr. 2023). Eighteen different crypto companies raised $250 million in capital last week (Decrypt, Apr. 2023). Bitcoin miners reported their best monthly revenues in over 10 months (Blockworks, Apr. 2023).

- No new digital asset ETF news (ETF.com, Apr. 2023).

Additional Resources

“Everybody’s all surprised every time this stuff happens. It surprises me everybody gets surprised because it happens every year like this that there are surprises. The most surprising thing would be if there weren’t any surprises. So, therefore, in the final analysis, none of it’s really that surprising." - Mike Leach, football coach (GoodReads, Apr. 2023)

In this week’s Orion's The Weighing Machine podcast we talk to Eric Mueller, managing director and model portfolio strategist at Blackrock. The conversation covers the use of ETFs in model portfolios, and specifically covers how to pair investments with the different offerings from Blackrock.

What makes a great investor? Apart from technical skill, it could be boiled down to seven virtues, according to Jason Zweig in his April 4, 2023 post: curiosity, skepticism, independence, humility, discipline, patience and courage.

Speaking of great investors, it’s time to come out to Omaha for the annual Berkshire Hathaway meeting the first weekend in May!

- BRK Shareholder Meeting Visitor Guide (Berkshire Hathaway, Apr. 2023)

- How to get tickets (Berkshire Hathaway, Apr. 2023)

- Another Great Guide to the meeting (Good Investing, May 2022)

- And for fun -- Warren Buffett's first TV interview (7 minutes) “Warren Buffett’s Most Iconic Interview Ever” on YouTube (Apr. 2023).

Warren Buffett is known for his communication/writing style – keeping it simple.

- 10 steps for business writing (Darius Foroux, Apr. 2023)

- More thoughts on business writing - and so much more (Investment Talk, Mar. 2023)

Speaking of writing, here’s ChatGPT on “What is the US stock market forecast for the remainder of 2023?” Pretty generic, but I liked the last two lines.

- Amidst the flurry of numbers and charts, The stock market soars and sometimes falters, With each rise and fall, investor hearts Beat fast, hoping to reap big dividends.

- As 2023 marches on, The forecast for the market remains strong, The bulls and bears, they battle on, And trading continues all day long.

- Though some may fear a sudden slump, And others hope for a meteoric jump, The market moves on, with little thump, As the year progresses, from month to month.

- Tech and healthcare, finance and more, The sectors rise and fall in a score, As new innovations drive growth galore, And investors seek to gain evermore.

- But while the future is hard to predict, One thing is certain, the market won't quit, It's a constant cycle, always in motion, A dynamic force, that defies emotion.

- So keep your eyes fixed on the trends, And know that the market never ends, It's a wild ride, full of surprises, And the rewards can be truly priceless.

A repeat gem from Ben Carlson on A Wealth of Common Sense: “50 ways the world is getting better” (Apr. 2023)

Long article not related to the financial markets but I found it fascinating: “Why Sweden punches above its weight in music” (Escaping Flatland, Mar. 2023). My grandmother Laverne was a proud Swede. She would have loved this article.

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.