In the world of men’s professional tennis, it is impossible to have a GOAT (Greatest Of All Time) discussion without bringing up Roger Federer. Over the course of his career on the ATP Tour, he won 1,251 matches and lost just 275. He touts 20 Grand Slam titles, including eight Wimbledon trophies, and spent a record 237 consecutive weeks as the number one tennis player in the world between 2004 and 2008. The Swiss legend became synonymous with the sport for over two decades and is inarguably one of the best to ever play the game.

The reason I bring up Federer and his career accolades is because this past summer, he gave a viral commencement address at Dartmouth College which contained a key takeaway that applies to investing and our mantra of “stay invested, stay disciplined, and stay diversified.” During his speech, Federer pointed out that in his career, he won over 80% of his matches, but just 54% of his points, on his way to being one of the greatest tennis players of all time. His message was to treat each metaphorical “point” in our lives with extreme importance, but, win or lose, quickly leave it behind and begin to focus on the next point.

This is a profound message, but for our purposes I find the math behind his statement far more interesting. All Federer had to do was win just barely more than he lost on a point-by-point basis and do it consistently for his entire 25-year career, and the cumulative effect of this very slight edge made him an all-time great.

Federer’s success came from consistently capitalizing on small advantages, not from winning every point. This same principle drives some of the biggest industries in the world. Take casinos and sportsbooks, for example — an industry worth over $100 billion. The “house edge,” or the amount by which the casino is more likely to win than the bettor, ranges from 0.5% to 1.5% in popular games like Blackjack and Baccarat up to 4%–5% in sports betting and slot machines. Just by winning 51%–55% of the bets they make, casinos and sportsbooks continue to come out ahead and churn out profits year after year. And, from a bettor’s standpoint, the longer you play, the more likely you are to lose.

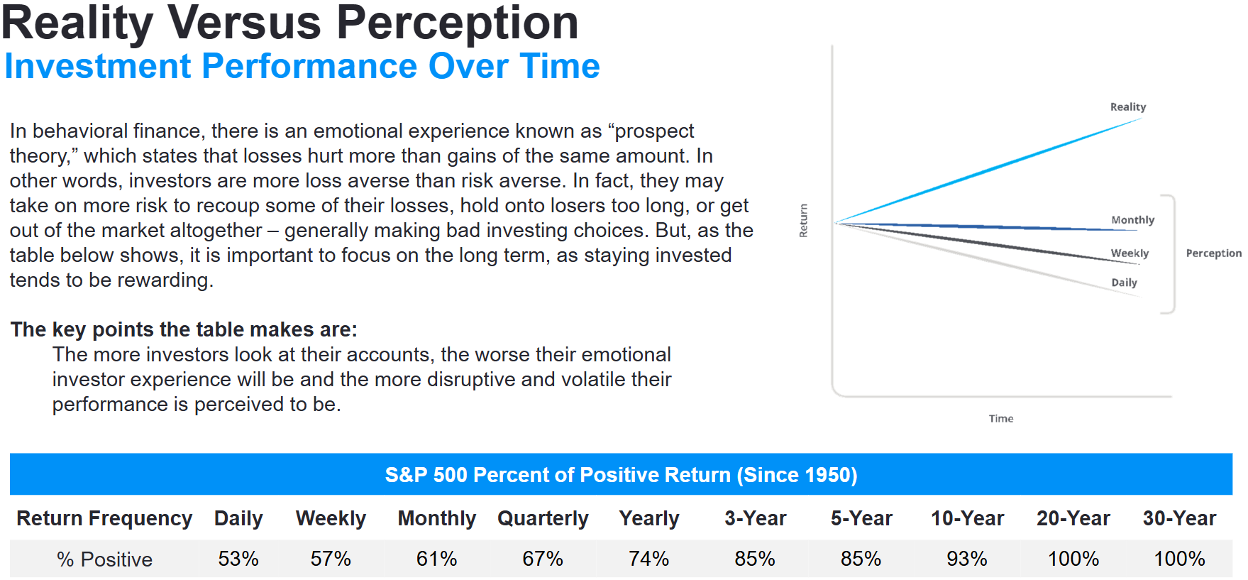

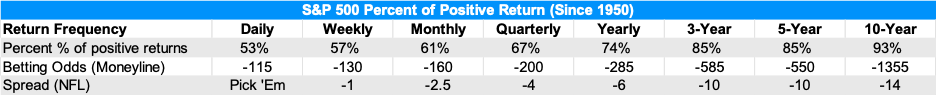

Luckily for us, there’s a place we can go where we can have the same edge that Roger Federer did against his opponents and that casinos and sportsbooks have against their bettors: the stock market. Where, unlike at casinos, the longer we play, the more likely we are to win.