A Journey from Public Accounting to Wealth Management

Rob’s journey into wealth management began during the 2008 financial crisis. At the time, Rob was a young CPA preparing tax returns for clients and working at one of the top international accounting firms. He was on track for a promising career, but a sobering experience made him rethink his path.

There was a seasoned CPA at the firm whom Rob looked up to and aspired to model his own career after. To Rob, he was smart, successful, and looked to have everything in place for a comfortable retirement — with everyone at the firm knowing that he was getting ready for that transition. But when the 2008 financial crisis hit, he had to delay his retirement, by several years. Rob was stunned. “He was everything I wanted to become,” Rob recalls. “But seeing him have to postpone retirement left me scratching my head. Why didn’t he prepare better for this next step in his life?”

This eye-opening experience, combined with Rob’s frustration at watching his clients’ investments plummet while their tax liabilities rose, led him to a realization: there was a huge disconnect between tax planning and financial advising. “I’d talk with their financial advisors and say, ‘What on earth are you guys doing? We need to make sure we’re structuring things in a way that also takes advantage of tax laws,’” Rob remembers. After seeing this lack of coordination year after year, he knew something had to change.

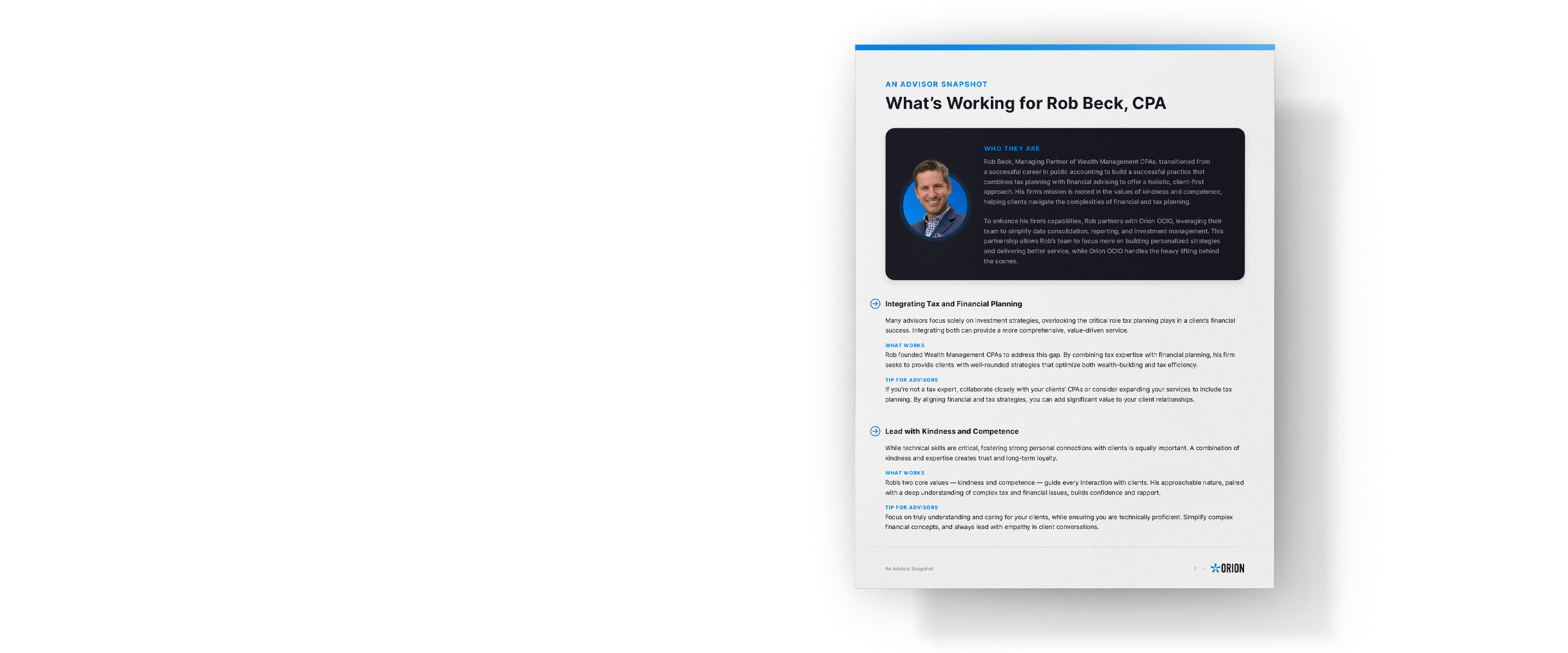

That’s when Rob decided to take action. He combined his tax expertise with financial planning and, in 2010, founded Wealth Management CPAs. “We bring together people’s financial plans along with their tax plans,” says Rob. “That’s how we help people build their wealth.”

The Core Values That Drive Success

At the heart of Wealth Management CPAs are two core values: be kind and be competent. These simple but powerful principles guide everything Rob does, from how he treats clients to how he runs his business.

“Be kind to everyone — your hairdresser, your spouse, your clients,” Rob advises. For him, kindness builds trust and lasting relationships with clients, which are essential for long-term success. But kindness alone isn’t enough. Competence — understanding the complexities of financial and tax issues and breaking them down for clients — is equally important.

One story in particular illustrates how Rob’s approach has made a meaningful difference in his clients’ lives. A longtime client of Wealth Management CPAs had been working with Rob for years, building substantial wealth through careful financial and tax planning. Then, a family crisis struck: the client’s sister lost her home and needed a place to live with her young children. The client, who had always wanted to support his family, was now in a position to do something extraordinary.

Thanks to the wealth Rob’s firm had helped him build, this client had the resources to purchase the house directly behind his own. He invited his sister and her children to move into one half of the duplex, giving them a safe and stable place to live. But the story doesn’t end there. The client saw an opportunity to do even more good in his community. He decided to rent out the other half of the duplex to people facing tough times, as a temporary helping hand to those in need.

They call it the “House of Hope.” The home became a symbol of second chances and generosity, providing a stepping stone for families to get back on their feet. The client’s objective was to empower others, offering an affordable place to live until they could find more permanent housing. The House of Hope is now a place where families can recover from setbacks and regain stability.

Stories like this are what get Rob up in the morning. “That’s the kind of impact I love to see,” Rob says. “It’s not just about growing wealth — it’s about using that wealth to make a real difference in people’s lives.”