Stay Disciplined · Should Investors Follow the Fed? · Can Bitcoin ETFs Be Used in Multi-Asset Portfolios?

Portfolio Advice, Talking Points, and Useful Resources

- Discipline, paired with professional advice, is one of the keys to long-term investment success.

- The Federal Reserve may have some of the best and brightest minds with the best information, but its forecasts are notoriously inaccurate.

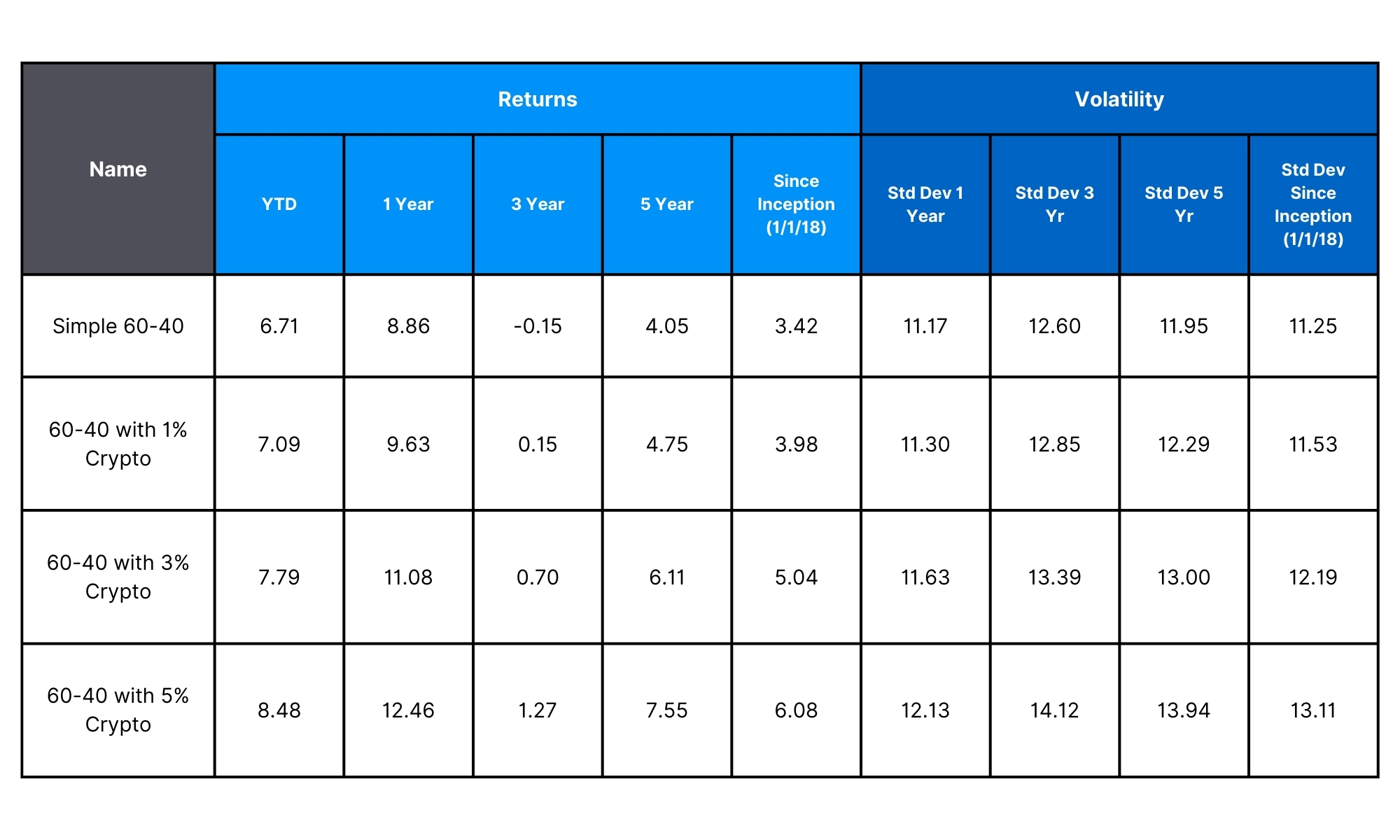

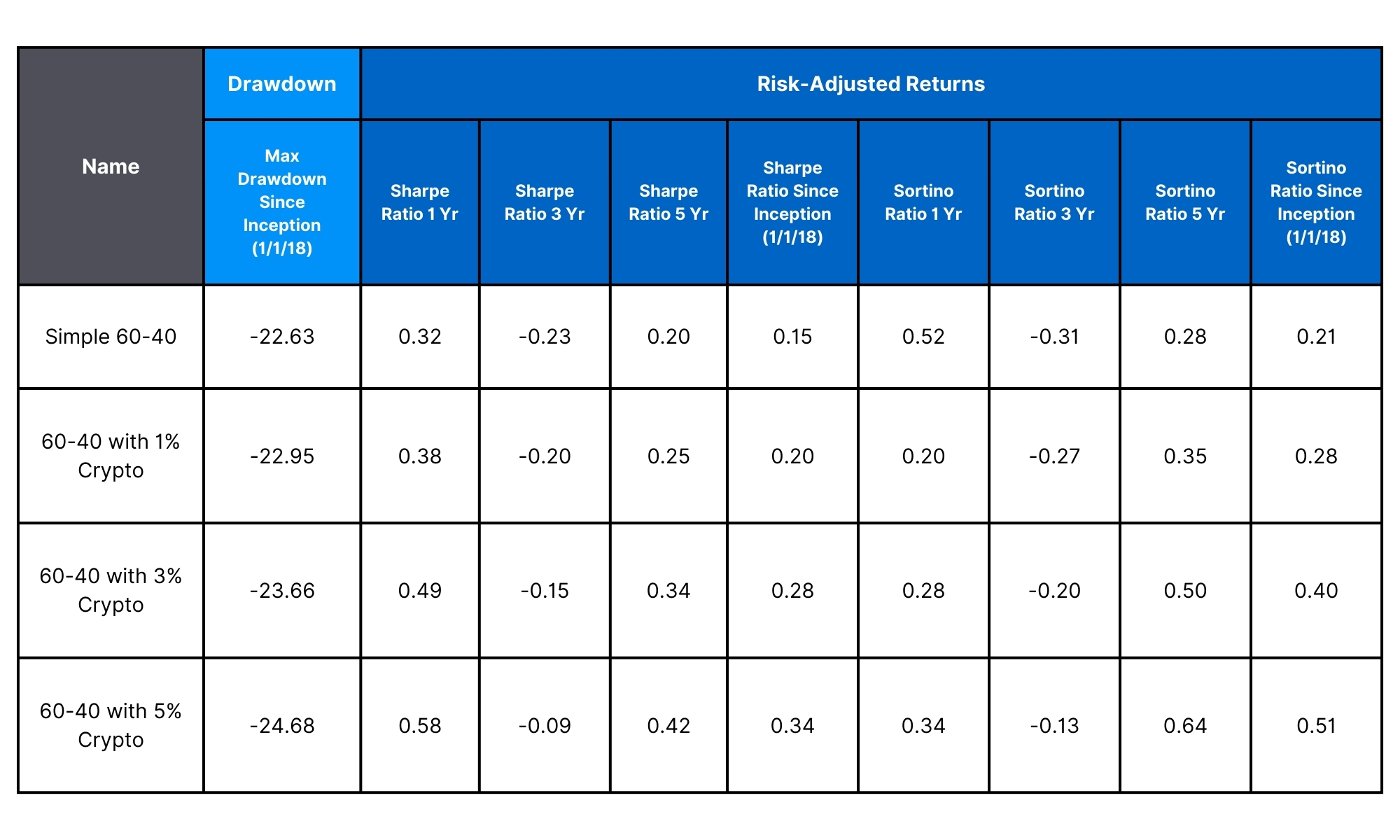

- Bitcoin ETFs are appearing in more professionally managed multi-asset portfolios for valid reasons, despite being an emerging asset with high price volatility.

It’s been a volatile quarter so far, driven by myriad conflicting narratives. Among them are fears of the economy falling into recession, reports of economic expansion outpacing expectations, inflation data that both falls and remains stubbornly high, predictions of a locked presidential race, uncertainty about the election’s outcome, and speculation about the Fed cutting rates sooner and deeper than anticipated or not at all until after the election. Given these mixed signals, the corrections and rallies we’ve experienced, including the best and worst days in the U.S. stock market since 2022, are unsurprising.

Amidst all the market noise and chatter, long-term investors are best served by staying invested, diversified, and disciplined. This month’s commentary includes sections that delve into each of these principles. We hope you find this analysis valuable.

Stay Disciplined

By Rusty Vanneman, CFA, CMT, BFA

The classic comedy Trading Places was released more than 40 years ago, and while some of its content may be dated, it remains one of the best films about investing and trading and one of the greatest comedies of all time. It’s also considered one of the best movies set in Philadelphia, with some, such as the British Film Institute, even ranking it among the top 10 great Christmas films. Beyond its cinematic accolades, Trading Places holds a special place in the investing community for a different reason: It inspired the famous Turtle Traders.

The movie explores the classic question of nature versus nurture, particularly in the context of what makes a good investor or trader. The plot follows brothers Randolph and Mortimer Duke, who own a commodities firm, Duke & Duke Commodity Brokers. After witnessing an encounter between their top employee, Louis Winthorpe III (played by Dan Aykroyd), and a poor street hustler, Billy Ray Valentine (played by Eddie Murphy), the brothers debate opposing views on nature versus nurture. They make a wager and agree to conduct an experiment by switching the lives of Valentine and Winthorpe. If you don’t know what happens next, you’ll have to watch the movie!

This plot led to a real-life experiment conducted by two famous Chicago traders, William Eckhardt and Richard Dennis, who made a similar bet after watching the movie. Dennis and Eckhardt ultimately selected around 20 people, half of whom had no business background, to participate in their Turtle Trader experiment. The name "Turtle" came from Dennis, who believed he could train traders as quickly as turtles were raised on farms.

Michael Covel, author of The Complete Turtle Trader, explains that Dennis and Eckhardt believed markets reflected human behavior and decision-making. “If a market was moving up, you want to follow that trend; if it’s going down, you want to follow that trend,” Covel noted. Was the experiment a success? It seems that successful trading can indeed be taught, but it still takes a certain temperament that includes discipline. It’s not for everyone.

Dennis and Eckhardt were later profiled in one of the most famous books on investing and trading: Market Wizards: Interviews With Top Traders by Jack Schwager. This book is an important (and enjoyable) read, and I often give it to aspiring investment managers or those interested in analyzing money managers.

Key takeaways from Market Wizards include:

- There are Different Paths to Success: The book highlights a variety of successful traders, each with a unique approach to the markets. The key takeaway is that there is no single path to success in trading; what matters is finding a strategy that fits your personality, skills, and risk tolerance.

- Risk Management is Crucial: All traders interviewed in the book emphasize the importance of managing risk. Disciplined risk management is the foundation for long-term success.

- Psychological Discipline: Successful traders and investors are often those who can control their emotions, avoid impulsive decisions, and maintain discipline in the face of market volatility. Psychological resilience and the ability to stick to a well-thought-out plan are key traits shared by the traders in the book.

Each month, we remind our readers to stay invested, stay diversified, and stay disciplined. We invest to participate in the long-term positive growth of the global economy and markets. We diversify because the future is uncertain, and we need resilient, humble portfolios that can weather surprises. Finally, and perhaps most importantly, we stay disciplined — through purpose, planning, and professional advice — so that we can stay invested, diversified and on track to reach our investment objectives.

The Fed’s Projections are Just More Noise

By Nolan Mauk

Twice a year, in February and July, the Federal Reserve submits a Monetary Policy Report (MPR) to Congress. In this report, Fed members express their thoughts on recent economic events and their outlook on monetary policy. They also provide their in-house economic projections, forecasting real GDP growth, inflation, unemployment, and the federal funds rate at the end of the current year and each of the following two years.

In the current environment of heightened uncertainty around a slowing economy, many may look to the Fed for an idea of where we are heading. Those who did so when the July 2024 projections were released may find themselves with a refreshed sense of optimism, as the Fed is currently projecting stable real GDP growth of around 2%, in line with historical averages; stable unemployment of around 4%; and steadily falling inflation, down to its target of 2% in 2026, allowing the Fed to cut rates all the way down to 3%. These projections paint the picture of a resilient economy and a brilliant Federal Reserve masterfully controlling both ends of its dual mandate — a tall order to fill.

Out of curiosity, our research team analyzed the Fed’s MPRs going back to 1996 to see how accurate the central bank’s projections have been and whether evidence exists to support making investment decisions based on the Fed’s forecasts.

Short answer: It does not.

Since 1996, the averages of economic data have been about where most investors would expect: Annual real GDP growth has averaged 2.3%, inflation 2.3%, and the unemployment rate 5.5%. The Fed didn’t start projecting the federal funds rate in its MPRs until 2012, but it has since averaged 2.1%. The figure below shows how well the Fed has done forecasting these data points over time on an absolute basis.

| Data Point | Average Actual Value | Average Fed Error (Absolute Value) | Error as a % of Actual |

|---|---|---|---|

| Real GDP | 2.3% | 1.4% | 60.9% |

| Inflation | 2.3% | 1.0% | 43.5% |

| Unemployment Rate | 5.5% | 0.8% | 14.5% |

| Fed Funds Rate | 2.1% | 1.5% | 71.4% |

Source: Economic data is from the Federal Reserve Bank of St. Louis. For inflation, the Federal Reserve used CPI growth until February 2008, then PCE growth thereafter. Federal Reserve Projections are from Federal Reserve Monetary Policy Reports spanning 1996-2024.

Empirically, the Fed has struggled to make accurate economic forecasts. Interestingly, it has had the most trouble projecting the federal funds rate, which the Fed itself sets! We found that as the projection timeline gets closer to the actual end of the period, the federal funds projections become much more reliable. But in the medium-to-long term, its estimates are extremely unreliable with average errors of around 2%. Investors looking to the Fed’s interest-rate projections to determine their market timing may find themselves paying the price.

We also found that when the Fed does make an error, it tends to overestimate real GDP growth and underestimate inflation, which feels like best-case-scenario planning, likely underestimating the probability of macroeconomic downturns and/or overestimating its ability to guide the economy through them. When projecting out a couple of years into the future, the Fed tends to tell Congress and the American people that it knows what it’s doing and that its monetary policy decisions will consistently produce its intended results.

Sometimes, however, the Fed does turn bearish on the economy and projects worsening economic conditions. Should investors take this bearish signal as a sign to go to cash until projections improve?

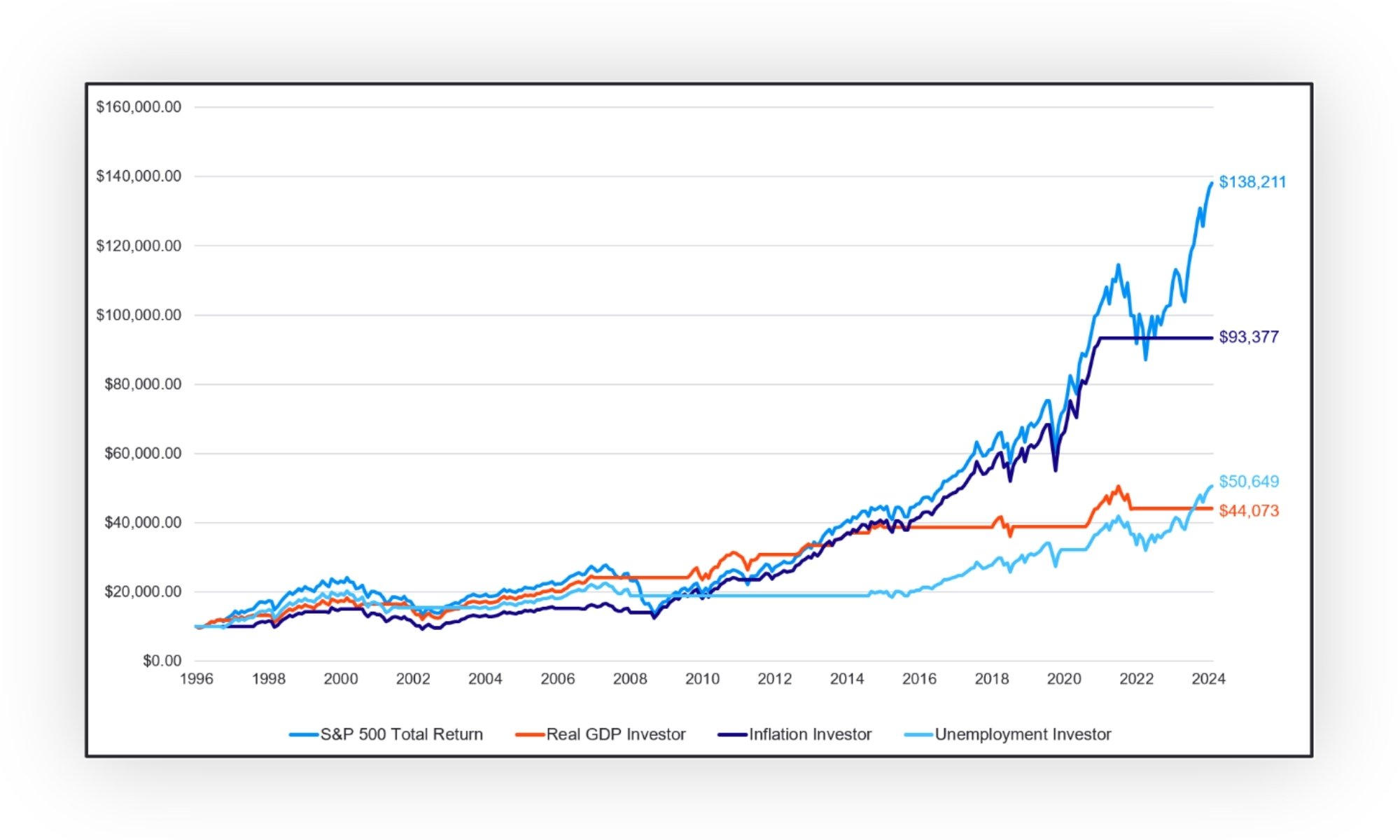

The figure below shows the performance of the S&P 500 since 1996. The blue line shows total return, while the other three lines hold returns flat in times when the Fed is projecting worse-than-average economic conditions for the current year for its specific data point. Once projections improve to better-than-average conditions, the progress resumes.

Source: Return Data is from Morningstar Direct as of July 31, 2024. For informational purposes only. The above chart does not reflect any actual results achieved.

Unsurprisingly, it’s as difficult for the Fed to predict the future as it is for the rest of us, and its projections over time have proved unreliable. The Fed tends to underestimate the likelihood of financial crises and overestimate its ability to navigate them. Investors with resilient portfolios designed to withstand all market cycles will have an easier time staying disciplined and diversified than those looking to the Fed for guidance to lead their decision-making. Long-term investors should treat economic projections as anecdotal noise and focus instead on their long-term strategies and goals.