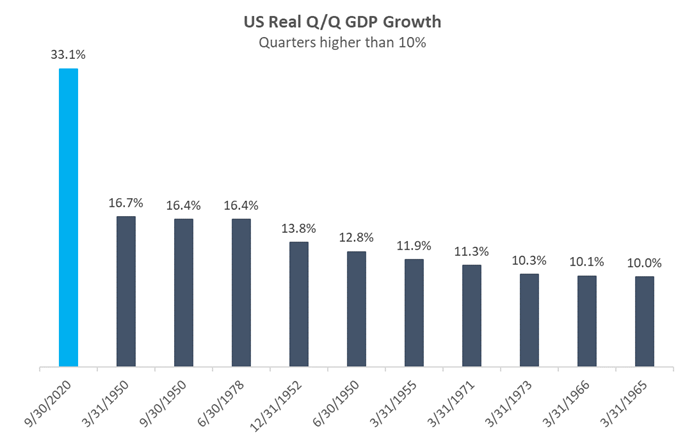

Lost in the flurry of election and pandemic headlines last week was a remarkable stat: U.S. GDP grew 33% in the third quarter of 2020!

There are a couple of “issues” with this stat (like most stats, let’s be honest). It comes after the largest decline in GDP in recorded history (the Great Depression likely had a bigger or comparable decline but the stats aren’t great), and the number is annualized. However, it is still an important feat as we dig out of the economic hole from the first half of the year. Historically speaking, this quarter sticks out like most 2020 economic statistics do, nearly double the second-largest quarterly growth recorded in the 1950s. Interestingly, only two other quarters shown below followed negative quarterly GDP growth, showing just how strong some of these periods were, and also how much more economic volatility the economy used to show before heavy Federal Reserve involvement.

Source: Bloomberg

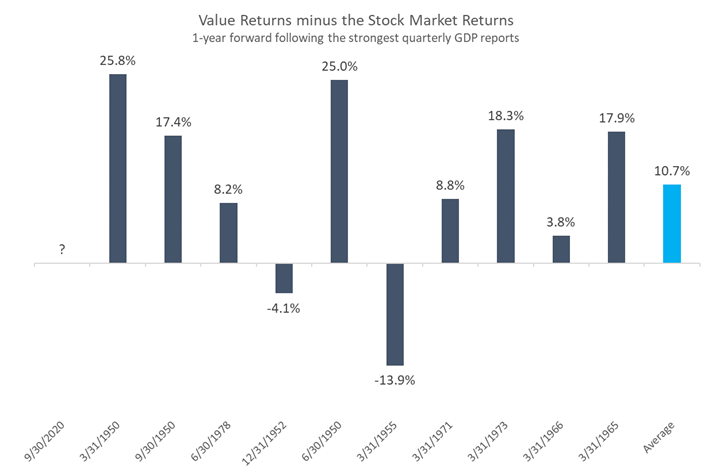

As we’ve discussed before, economic growth is typically priced in by stocks, and this year is no exception. What is interesting going forward, is how this will affect value stocks. Traditionally, value benefits from stronger economic growth and sometimes accompanying inflation. Looking back at history, returns of value stocks versus the market in the year after these double-digit quarters have been quite strong. Outperformance has averaged double-digits above and beyond that of the broader stock market, and has been positive following each of these quarters depicted, with the exception of two.

Source: Bloomberg

It feels like history is being re-written here in 2020, but we of course can’t ignore it (insert your favorite quote about history here). The parallels and behavior of the market in the past still holds true today, although there are always slight differences. Value will likely be back soon.

For additional market insight, visit the Orion Portfolio Solutions Advisor Communication Command Center, your single destination for resources from Orion’s Investment Management Team and our strategist partners.

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

2989-OPS-11/09/2020