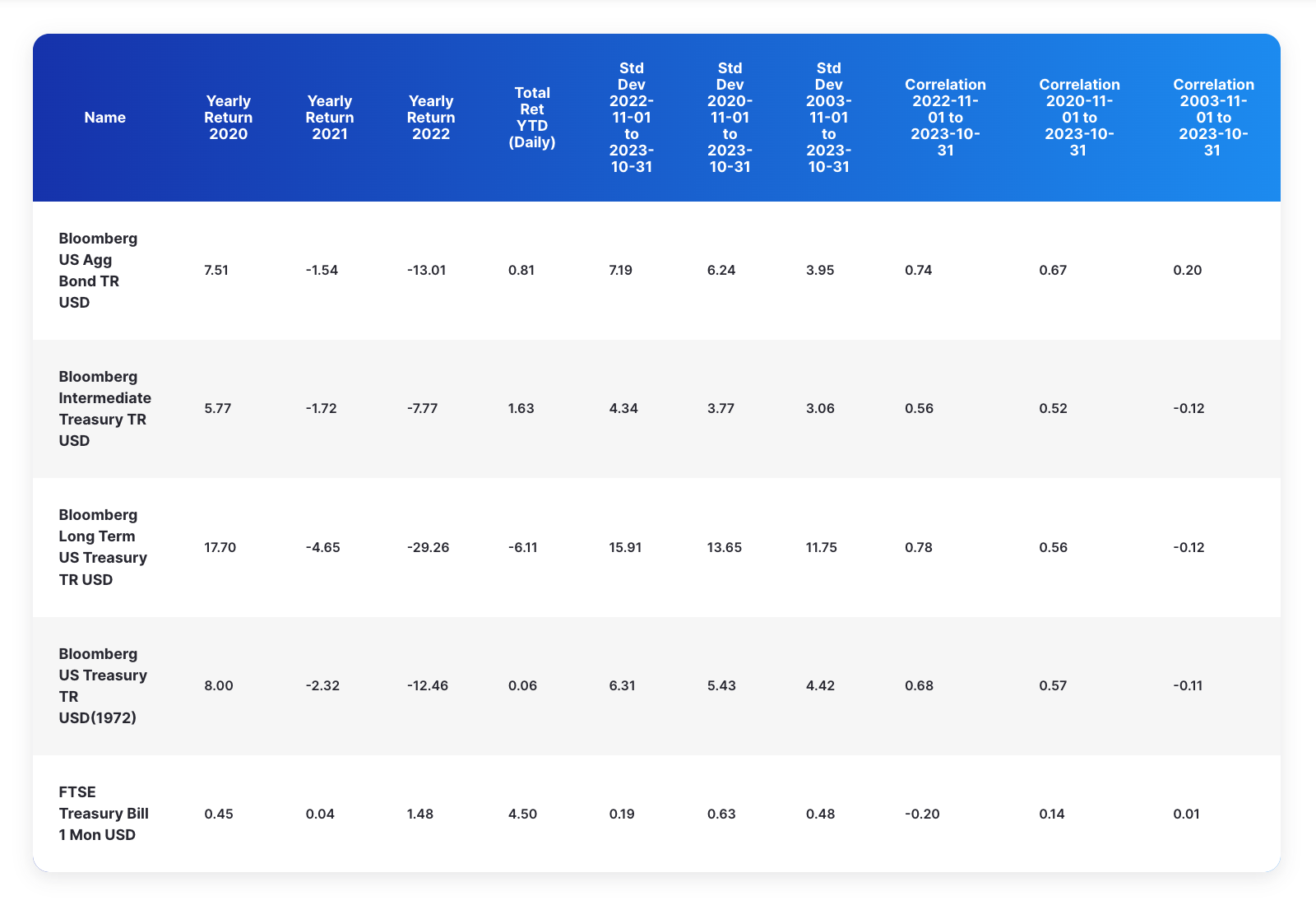

It is no secret that bonds have had a tough couple of years. They experienced back-to-back negative returns in 2021 and 2022, while exhibiting higher volatility and higher correlations with equity markets. Altogether, it raises the issue of whether they can continue to serve their historic role: a low-volatility ballast within a portfolio that diversifies away from equities. Even heralding 2023 as the "year for bonds," as many did, seems in retrospect premature, if not outright wrong.1

The one standout is ST bonds/cash, represented by the FTSE Treasury Bill 1-3 M TR, eking out positive returns the last few years and up a strong 4.5% year to date. With short-term Treasury yields peaking 5% through the 1-year, it is tempting to dump the whole fixed income allocation into cash, clip the coupon, and have a good day.

To be sure, we at Brinker Capital Investments are not recommending avoiding cash but rather only allocating a portion of the fixed income allocation to cash. Much as adding variation to one’s gym workout aids muscles' growth and strength, adding the following three features to the fixed income portfolio will improve resiliency and returns.

- Barbell low duration and high duration assets

- Dollar Cost Average (DCA) into longer duration fixed income securities to mitigate timing risk

- Diversify the assets invested within the barbell

Like adding new lifts that introduce wider ranges of motion into a workout regimen, implementing a barbell in the portfolio will improve resiliency and flexibility, empowering the portfolio to better respond to different changes in rates. While it is true ST bonds and cash securities do not have much interest rate sensitivity, they do have a much higher reinvestment risk — the risk of not being able to reinvest their cashflows at the security’s rate, because as they mature the investor can only access securities at the prevailing rate. Thus, an allocation to cash transforms interest rate risk into reinvestment risk.

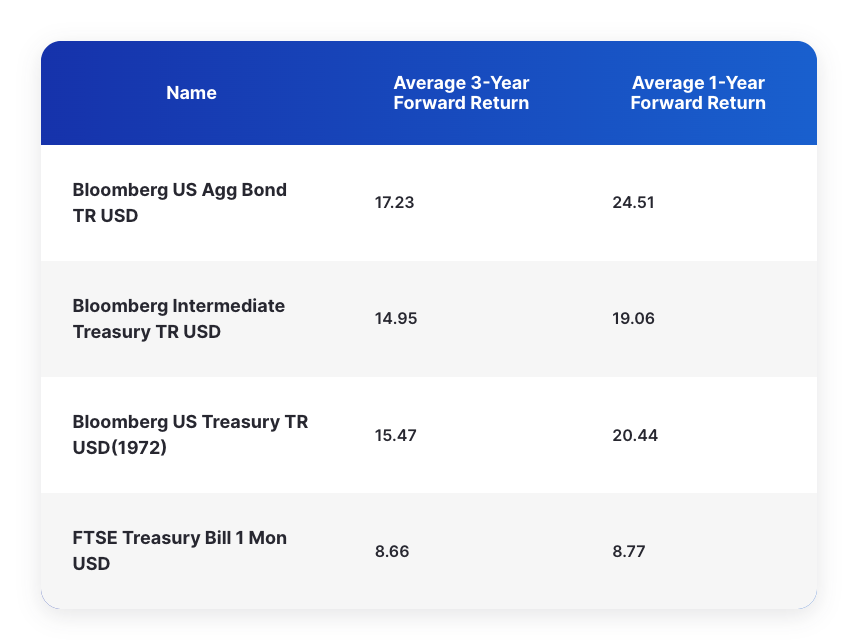

A classic scenario to illustrate this point occurred in 1982. According to government data, the 3-month Treasuries peak auction yield was 10.69%, and the following year it peaked 2% lower at 8.63%. The 10-year Treasury topped out at 13% in ’82 and experienced a similar 2% decline in ’83 to peak at 11.10%. However, reviewing forward returns for the bond market, longer duration asset returns were more robust. The average forward 1-year and 3-year rolling returns for various fixed income assets appear below.2

While cash behaved similar to prevailing rates, the forward returns for the longer duration bonds were superior. From this data it could be argued that cash and short-term bonds have a higher sensitivity to interest rates, because in aggregate, the linked returns of those instruments end up matching the prevailing rate, even if each individual security has a low sensitivity to said rates.

Hopefully, the case for why longer duration fixed income assets belong in an allocation is an easy lift, however the more meaningful issue is when. Figuring out the exact time can be difficult as evidenced by anyone who bought the US AGG at the beginning of this year: compared to cash they have underperformed by 3.7% year-to-date!