What a year it has been in the markets. Not only did we see the fastest bear market in history, but we followed it up with the best 100 trading-day return and quickest recovery of a 30 percent drop in history! The word ‘unprecedented’ is common vernacular at this point. Seeing several stocks, and even whole areas of the market, at all-time highs may leave investors feeling like they missed the boat on what may have been a fantastic buying opportunity. While the past five months have been tremendous for many segments of the market, not all have fully recovered. There are still many attractive areas available to investors.

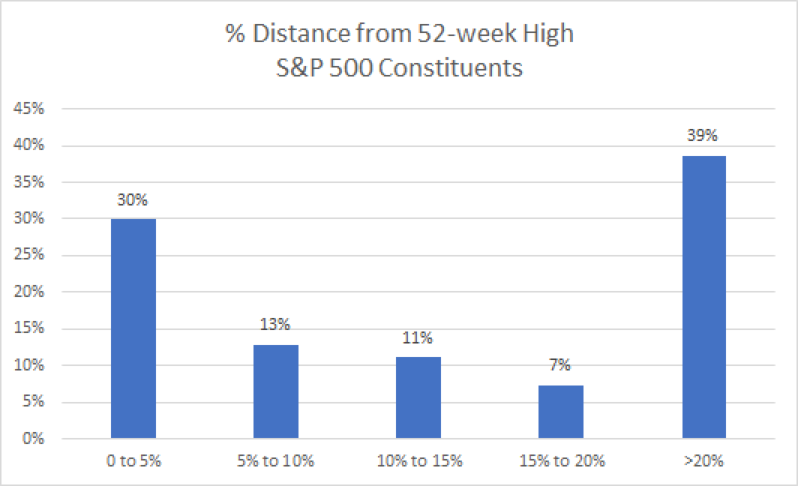

With the news headlines focusing on the broad indices (i.e. S&P 500) hitting new all-time highs, and the likes of Apple, Amazon, Tesla and others showing large positive returns, the chart below may come as a surprise to investors.

Source: Morningstar Direct, as of 09/01/2020

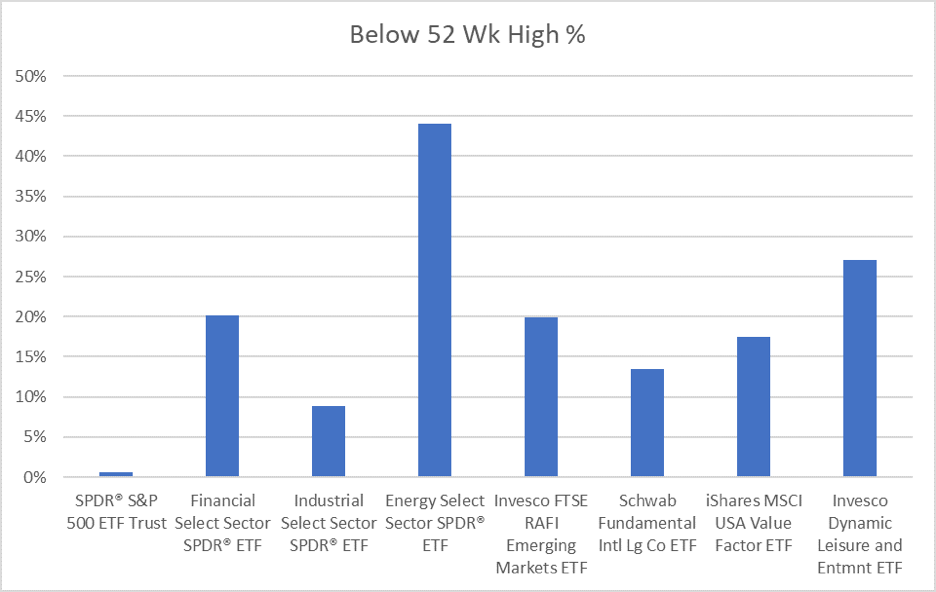

I understand that it has been a narrowly-led market, but I still would not have believed 39 percent of S&P 500 constituents remain more than 20 percent below their 52-week highs. Not only does this point to how few names have surged off the lows, but it also goes to show other names outside of the popular, media-loved names mentioned above have plenty of room left to run in the recovery. The chart below shows a few of the ETFs that provide opportunities. While the S&P 500 is at its 52-week high, these other products are anywhere from 8 percent to even 44 percent off their highs.

Source: Morningstar Direct, as of 09/01/2020

Energy remains well off its previous highs, even considering the rebound we have seen in oil prices. Financials have also struggled in the recovery, given the low interest rate environment. Leisure and Entertainment was hit hard by the economic shutdown, and their stock prices still reflect the ongoing hurt; however, this industry may provide a very attractive opportunity as areas continue to reopen and expand activity.

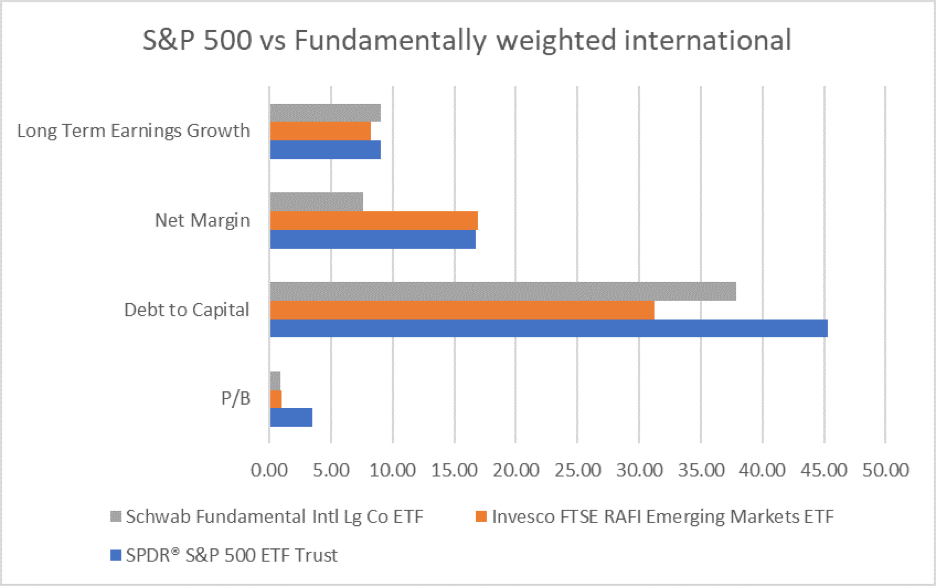

All of these areas of the market have much more attractive valuations, and most have more stable balance sheets and higher growth expectations than the S&P 500. Sounds like a win-win-win, in our view. Diving deeper into a couple international names illustrates this very clearly. Both developed and emerging markets with a value tilt are trading below book value, and also at a fraction of where the U.S. market is trading. As mentioned previously, these steep discounts exist while still having less debt on their balance sheets with similar margins and growth rates.

Source: Morningstar Direct, as of 09/01/2020

As we have seen the dollar continue to sell off, this is another tailwind for international markets and an area that seems to be ripe for outperformance moving forward.

2300-OPS-09/02/2020

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.