- Welcome to May, most of the world is off today for the celebration of May Day. The week is starting off with fresh news on the banking front: First Republic Bank has been seized and sold to JPMorgan. FRB’s failure represents the second largest bank failure in US history behind Washington Mutual’s failure in 2008. It’s also another big week in the markets with key earnings and economic data (including employment data), as well as what the Federal Reserve will do with interest rates. Entering the month, however, despite April being another positive month for the overall market (which is still supporting a nice year-to-date gain), investors remain quite bearish according to the latest AAII sentiment readings. While there are plenty of reasons for caution (there always are), when individual sentiment is this negative, that typically means positive returns, and above-average ones at that, in the next 1-, 3-, 6- and 12-months ahead.

- As for performance last week, the overall market modestly rose last week.

- There were sub 1% gains in the S&P 500. Mid and Small Caps were slight detractors to performance, and growth and value both had slight gains.

- The month of April posted nearly 2% gains for the overall market. In contrast to the first quarter of the year, April’s gains were led by value stocks.

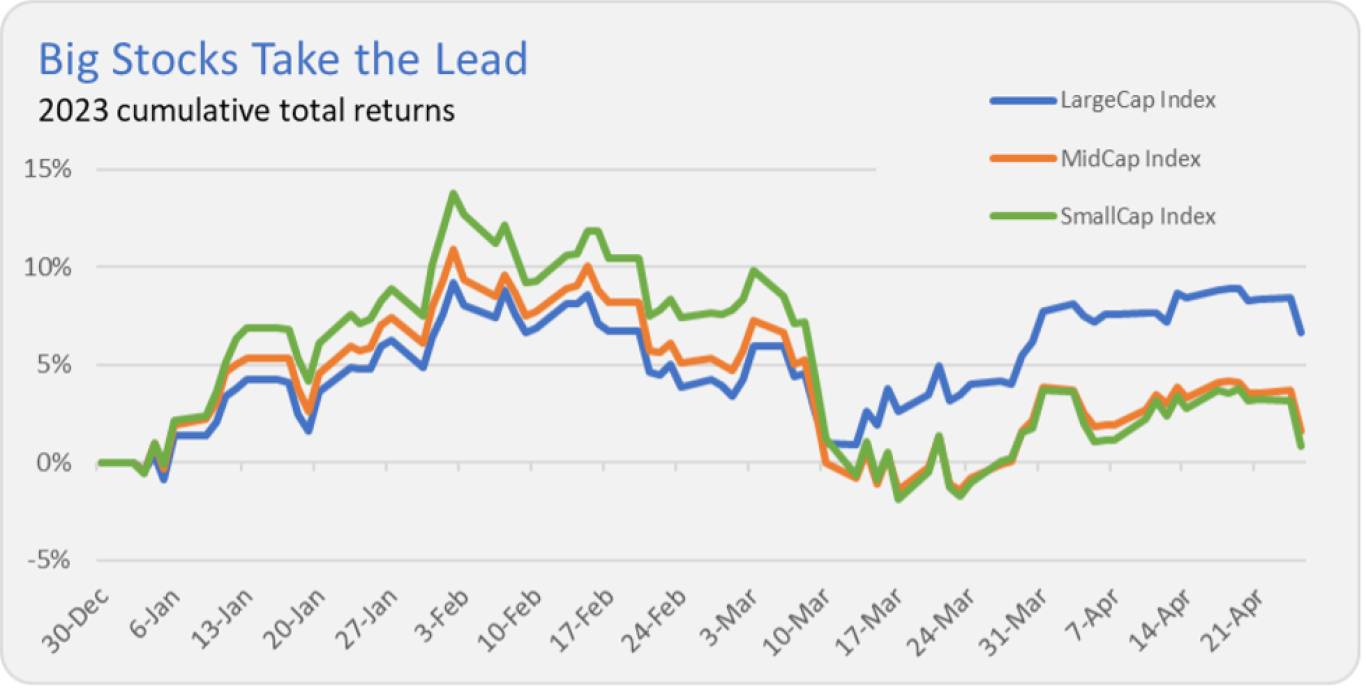

- Some notes on Large Cap outperformance from Vanguard

- From March 10 through April 25, Large Cap Index’s 5.6% gain has left Mid Cap Index (up 1.6%) and SmallCap Index (down 0.4%) in the dust.

- What this tells us is that early in the year, a lot of stocks were generating gains—the inside-baseball terminology would be that the market had good “breadth.” Since then, breadth has narrowed as fewer and larger stocks have carried returns higher.

Source: Vanguard

- And just a tid-bit on Small Caps: did you know that the total market cap of the Russell 2000 is less than the market cap of Apple (AAPL)?

- There are lots of pros and cons to pay attention to in the current market, and Bespoke Investments laid them out nicely this week.

Source: Bespoke

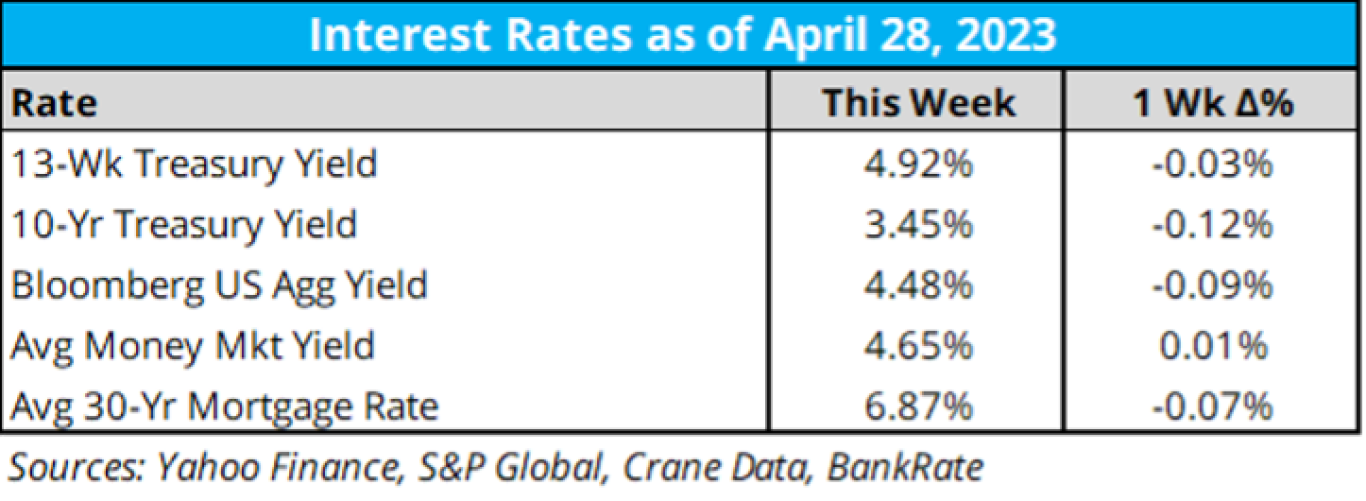

- As for key interest rates last week:

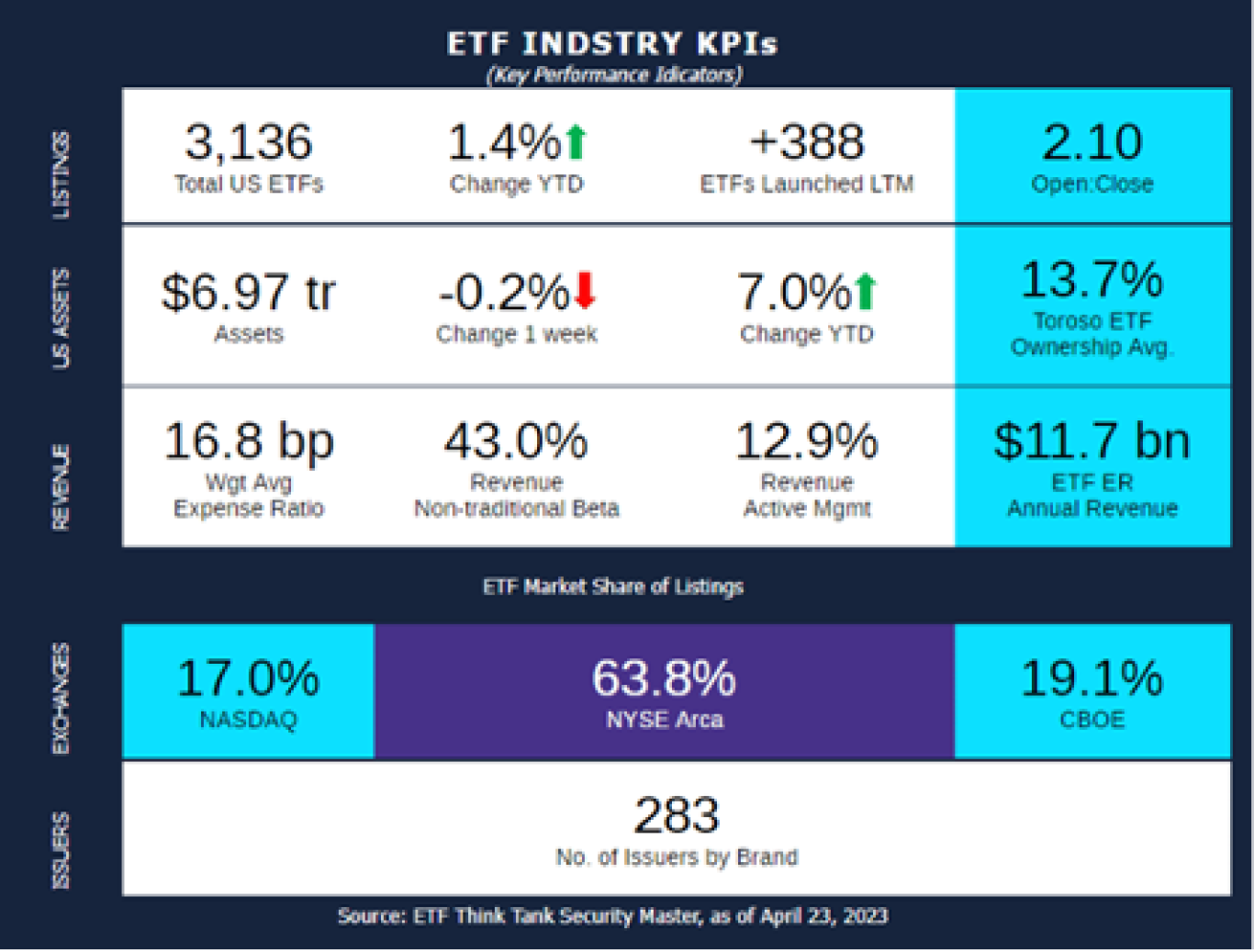

- ETF flows continue to show strength compared to traditional mutual funds as the industry shifts toward the low-cost, more tax advantaged products. YTD:

- “At this time last year, the open-to-close ratio for US ETFs was 5.79, the highest ever recorded since we started our weekly KPIs back in 2018. Today, it is 2.10, the lowest it’s been since June 2021 due to the trimming of funds (closures) in the industry.”

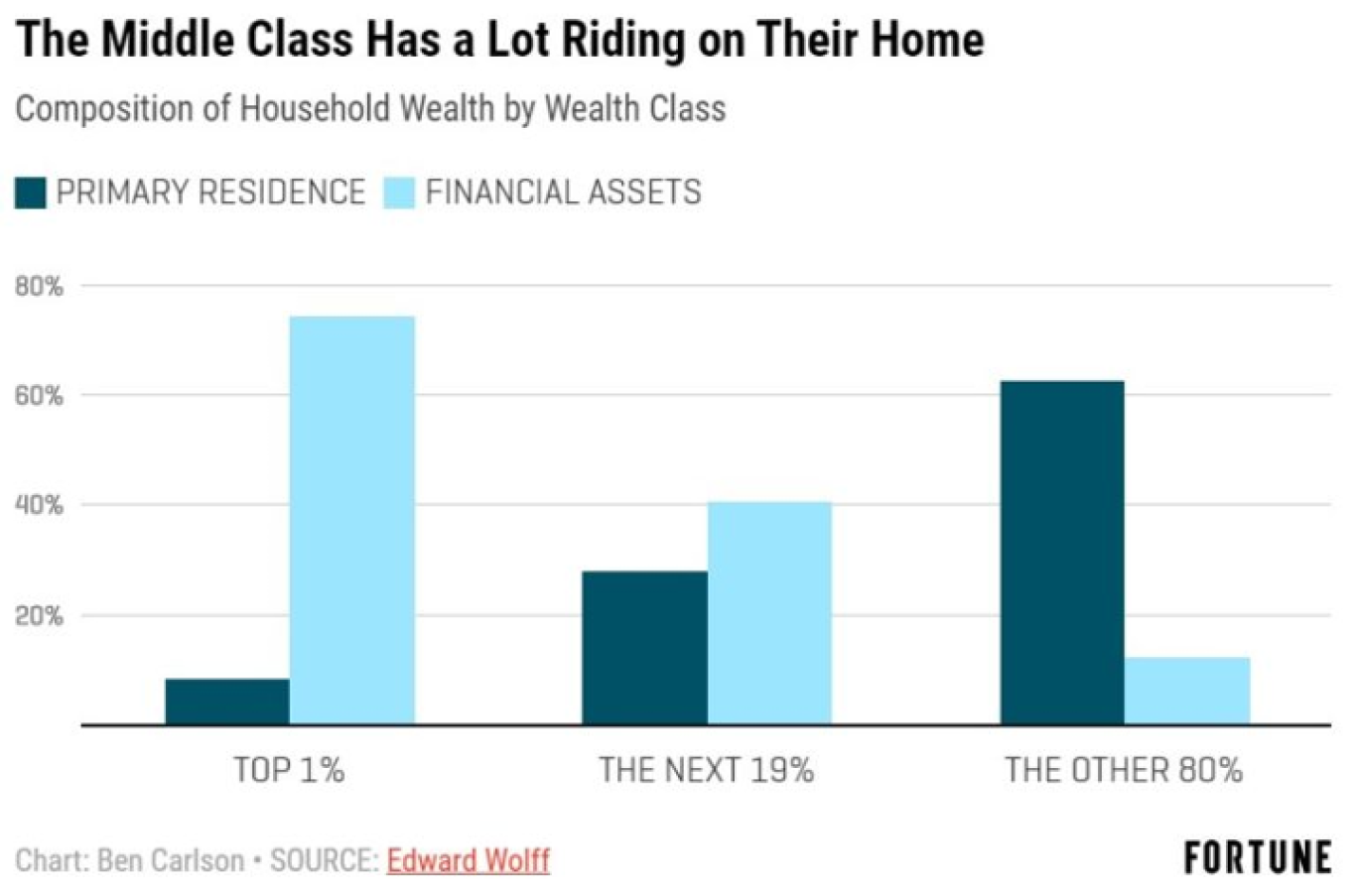

- As mortgage rates have risen and housing supplies have been in the headlines, it’s nice to take a different view on the housing market. One positive for existing homeowners is the overall wealth gains that their homes have generated over the last 5, 7, 10, and 15 years. However, according to Ben Carlson, this relationship does present an issue, mostly for the US middle class. While housing gains are always welcomed, it has left many families with a heavy majority of their wealth tied up in their homes. Here are a few comments on options for tapping into your home’s equity:

- You could open a home equity line of credit or do a cash-out refinance but that requires borrowing more money.

- You could use your equity as a down payment for a new home but that also means paying the now higher housing prices.

- You could sell your house to either downsize or become a renter but you’re always going to have to live somewhere.

- You could perform a reverse mortgage when you retire but that’s a complicated process.

- You could live somewhere else and rent out your home to provide some income but there are still a lot of costs and potential headaches involved in that process (and again you must live somewhere).

- Amid the retail trading frenzy over the last handful of years, many traders have become more like gamblers than investors. According to this Bloomberg article, Day Traders have been losing about $358,000 everyday gambling on these short-term market movements.

- We’re only days away from the next Fed interest rate decision, and as of now, according to the CME Fed Watch tool: (which has arguably been one of the key charts to watch this year)

- At a current target range of 475-500, the market is now pricing in an 87% chance of another 25 basis-point increase at the May Fed meeting. While still very likely, this probability has come down slightly from above 90% over the last week or so.

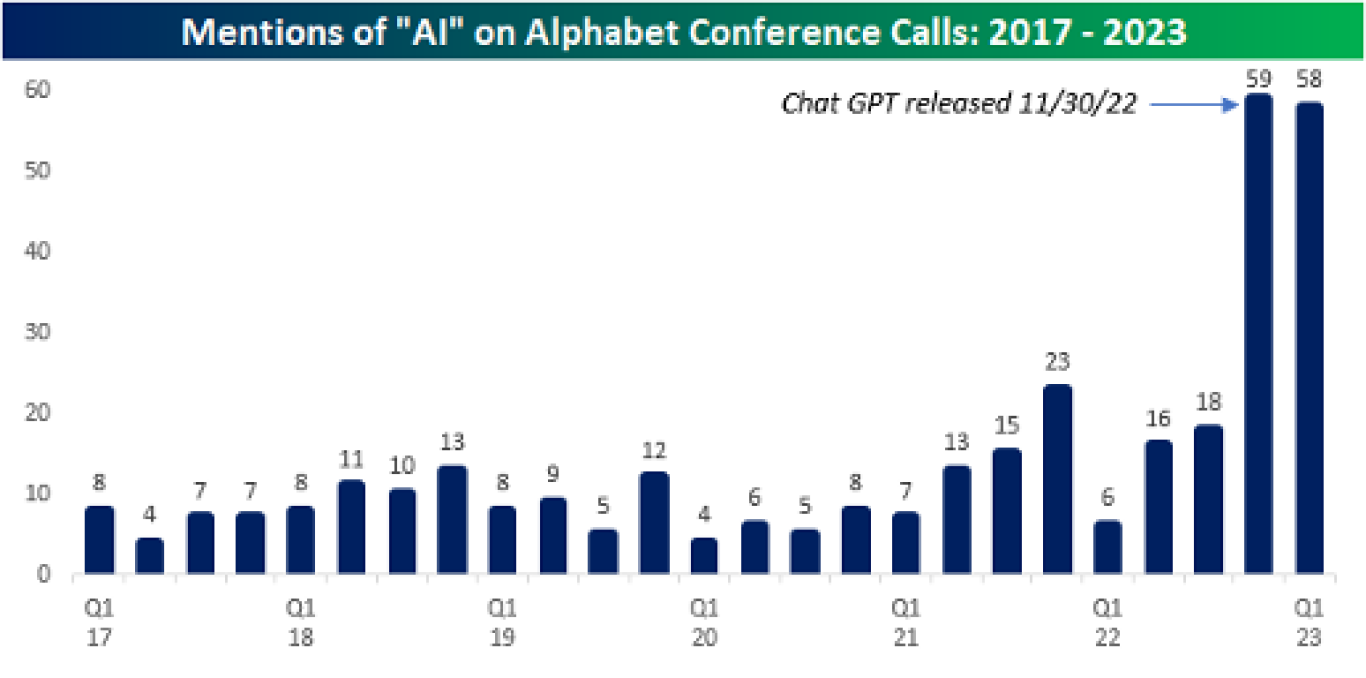

- We have included content on AI in these bullets in one form or another almost every week this year as ChatGPT and the like have taken the news and workforce by storm. Check out this chart on the number of times AI was mentioned in Alphabet conference calls since 2017… Certainly a dramatic spike since the release of ChatGPT. If you aren’t already incorporating AI into your workflow, it’s time to start!

Source: Bespoke Investments

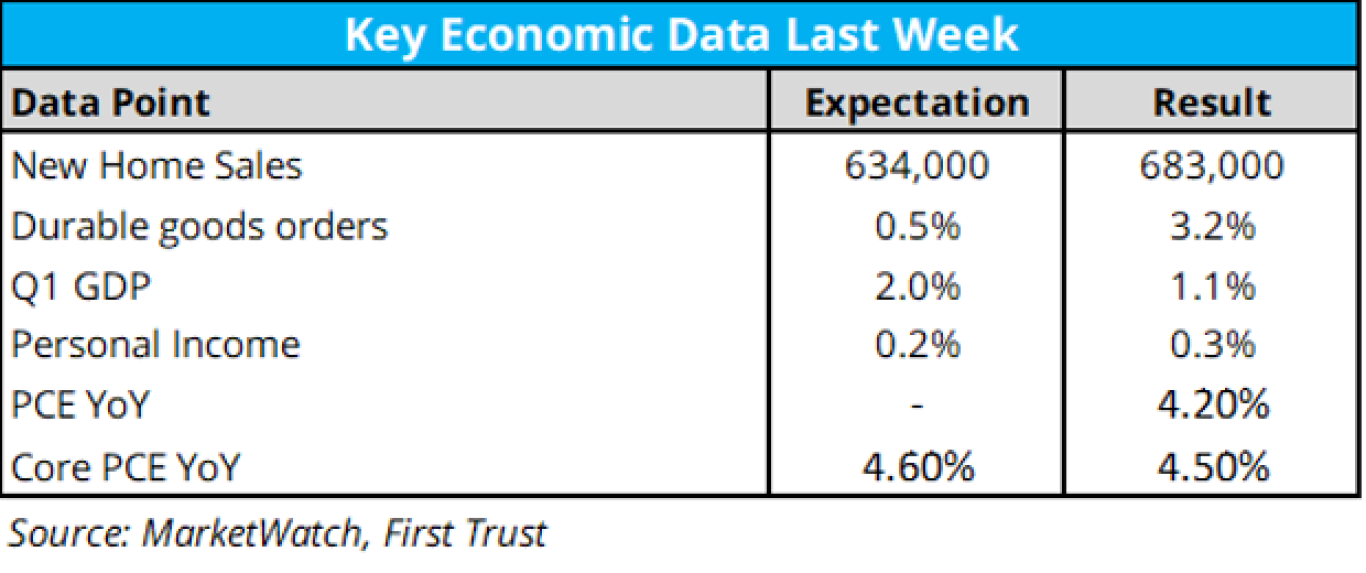

- The economic data calendar last week was packed:

- New home sales increased 9.6% in March to 634,000. According to First Trust, this may signal that the housing market hit just a temporary bottom in Mid-2022 as sales continue to recover.

- Durable goods orders rose 3.2%, compared to an expectation of just 0.5%.

- Real GDP increased just 1.1% in the first quarter of 2023, compared to a consensus expectation of 2.0%. According to First Trust, the biggest contributors to Q1 GDP were personal consumption and government purchases. Inventories were a drag on GDP.

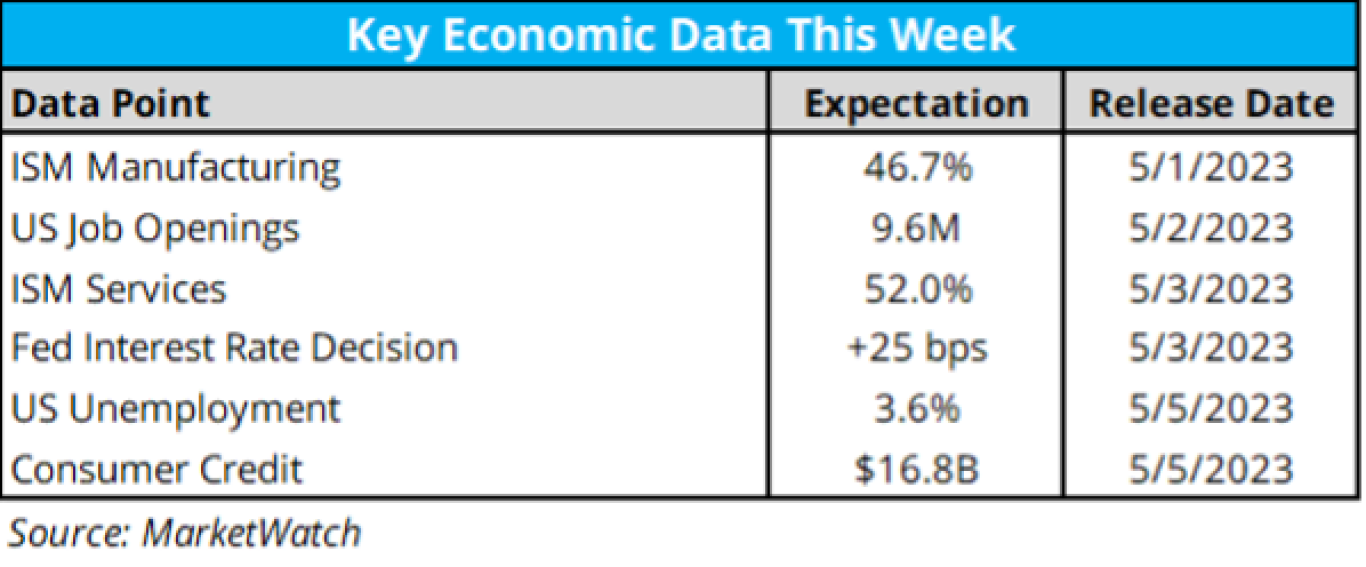

- Here is the economic data calendar for this week.

- The most attention this week will go to Wednesday’s Federal Reserve interest rate decision. The market is pricing a high probability of another 25-basis point increase to the Fed Funds rate, which would be the 10th consecutive rate hike since the first increase in March 2022. This 25-basis point increase would result in a total of 5% in increases since the hiking cycle began. Many are speculating that this may well be the last increase we see this year.

- We will also get data insights into manufacturing and services from the ISM surveys, along with the US employment report later in the week.

- This week’s Earnings Insight from Factset:

- Earnings Scorecard: For Q1 2023 (with 53% of S&P 500 companies reporting actual results), 79% of S&P 500 companies have reported a positive EPS surprise and 74% of S&P 500 companies have reported a positive revenue surprise.

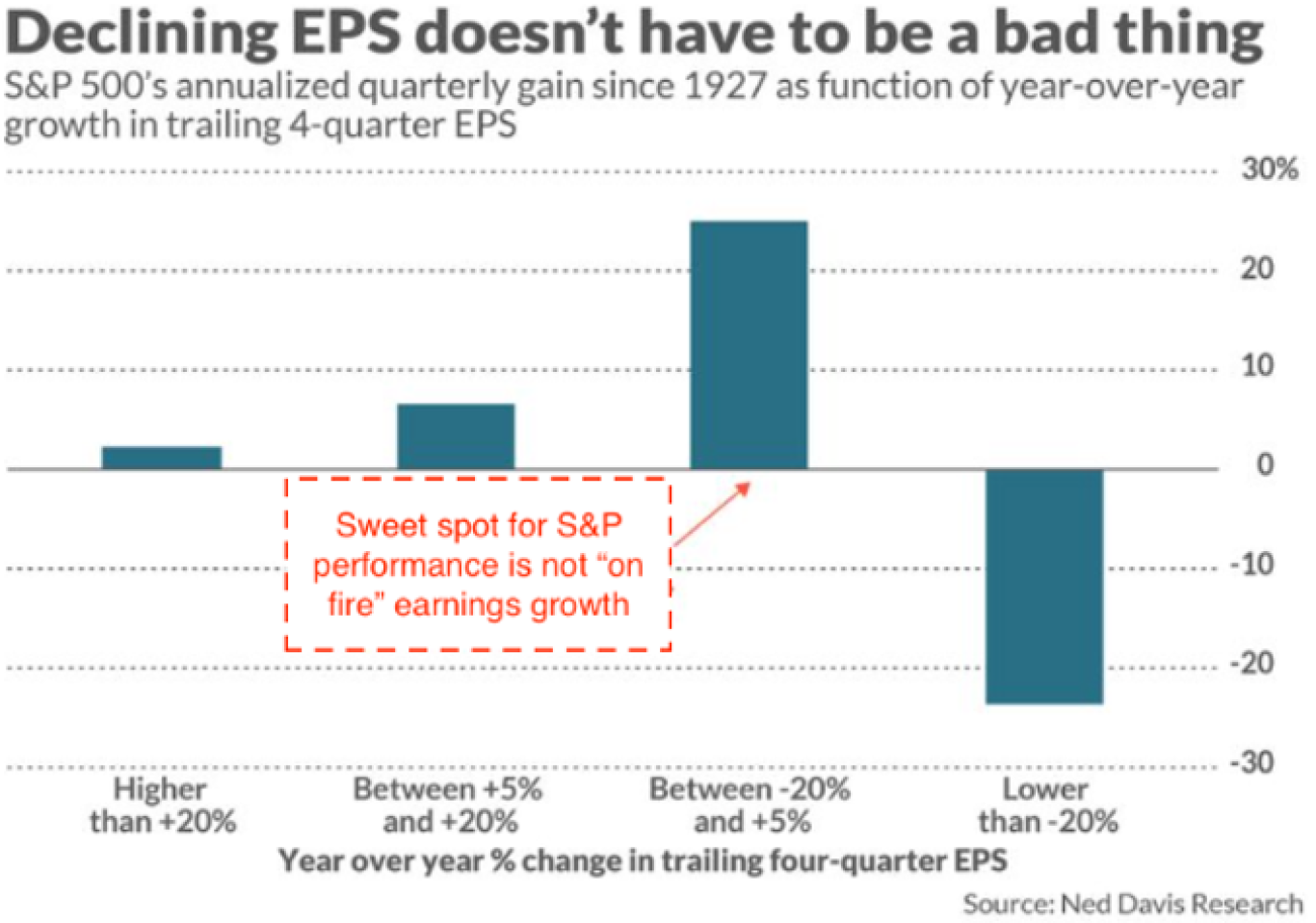

- Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -3.7%. If -3.7% is the actual decline for the quarter, it will mark the second straight quarter that the index has reported a decline in earnings.

- The chart below shows the relationship between S&P 500 earnings and different earnings growth rate buckets. It may surprise you to see that “on fire” earnings growth is not the most ideal environment for strong forward market returns. A slowdown in earnings growth may have a net positive effect on the markets going forward.

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Cryptocurrency prices resumed their upward trajectory last week, with Bitcoin leading major gains, up 8% to near $30,000. Ethereum added 4% to around $1,900. Solana bounced 10%.

- Last week’s gain in crypto nearly all have come in the past 24-48 hours as another U.S. bank (First Republic) appears to be headed for FDIC receivership (remember, Bitcoin and therefore all crypto was born out of the 2008 financial crisis). Coinbase is active again, this time suing the SEC requesting they respond to a petition made in the summer of 2022 for clarity around regulation. Mastercard is working on a project known as the “Mastercard Crypto Credential” to enhance verification related to digital asset transfer from wallet to wallet. Binance dropped a deal to buy the assets of bankrupt Voyager digital, not the first time Binance has withdrawn from similar propositions.

- One of the largest crypto asset management firms in the US, Galaxy digital, is partnering with DWS to launch crypto-ETPs in Europe. ARK and 21Shares have teamed up again to file for their third spot bitcoin ETF, maybe this time will be a charm.

- A few quotes from a recent interview with Mario Gabelli:

- “If you don’t ask, you don’t get.”

- And on advice to young professionals, “One less White Claw per day, one less Starbucks, and put that in a fund and calculate…how much that money will be 40 years out at an 8, 10, 12% return.”

- Additionally, he said he “only hires PhD’s: Passionate, Hungry, and Driven.”

- In this week’s Orion's The Weighing Machine podcast we talk to Steven Atkinson, EVP at Buckingham Strategic Partners. Rusty, Robyn, and Steven discuss what makes the truly great financial advisors great.