- Here’s an amazing stat. Though the stock market is now 7 months away from the bear market lows from last October, investor sentiment remains stubbornly negative. In fact, using the AAII Sentiment Survey weekly data, there has only been 2 weeks over the last year and only 3 weeks since the beginning of 2022 (71 weeks of data) that there were more bulls than bears. That’s extraordinary.

- This data series goes back to 1987 and there has never been a stretch like this of such persistent negative sentiment -- not during COVID, not during the Great Financial Crisis (’08-09) nor any other time in the 36 years of weekly history.

- This bearish sentiment hasn’t paid off either -- over the last year, the S&P 500 is up 7% and international stocks are up over 10%.

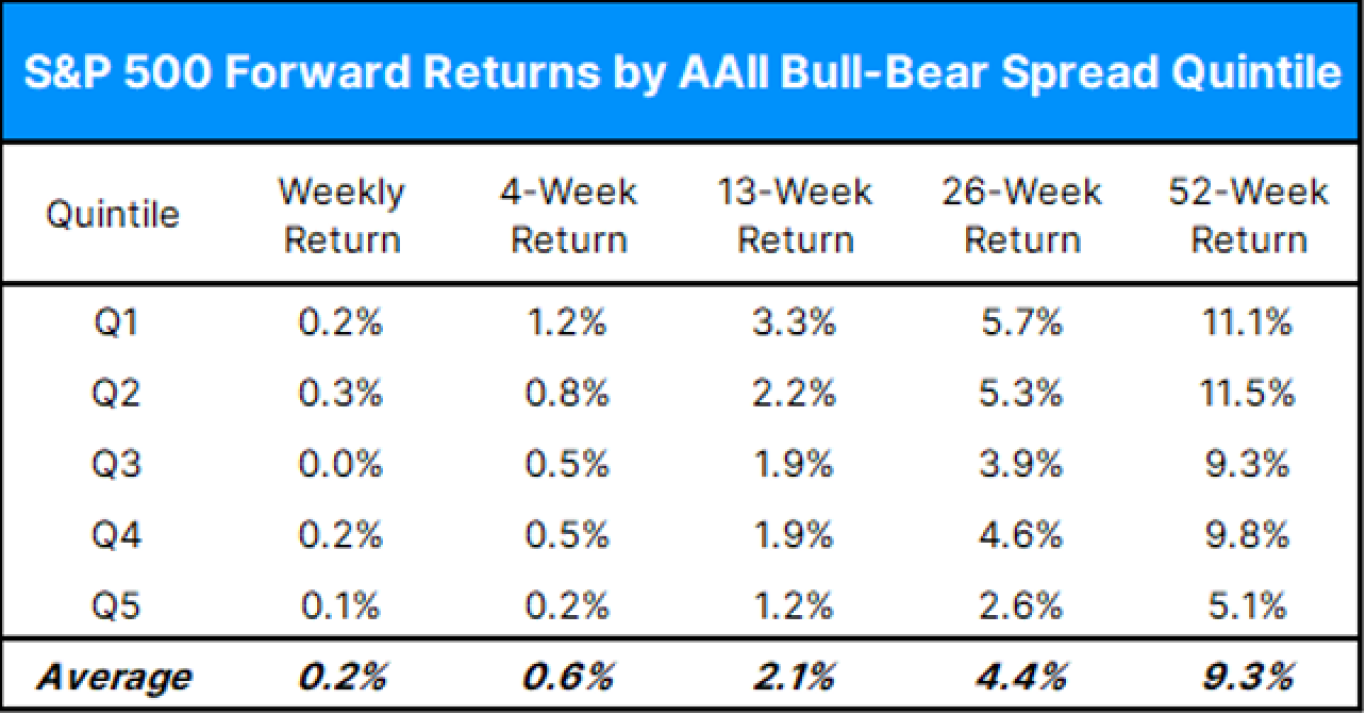

- Historically, bearish sentiment tends to lead to above-average returns in the stock market 1-, 3-, 6-, and 12-months later (see chart below).

- Currently, sentiment is in the most bearish quintile (Q1)

Source: American Association of Individual Investors

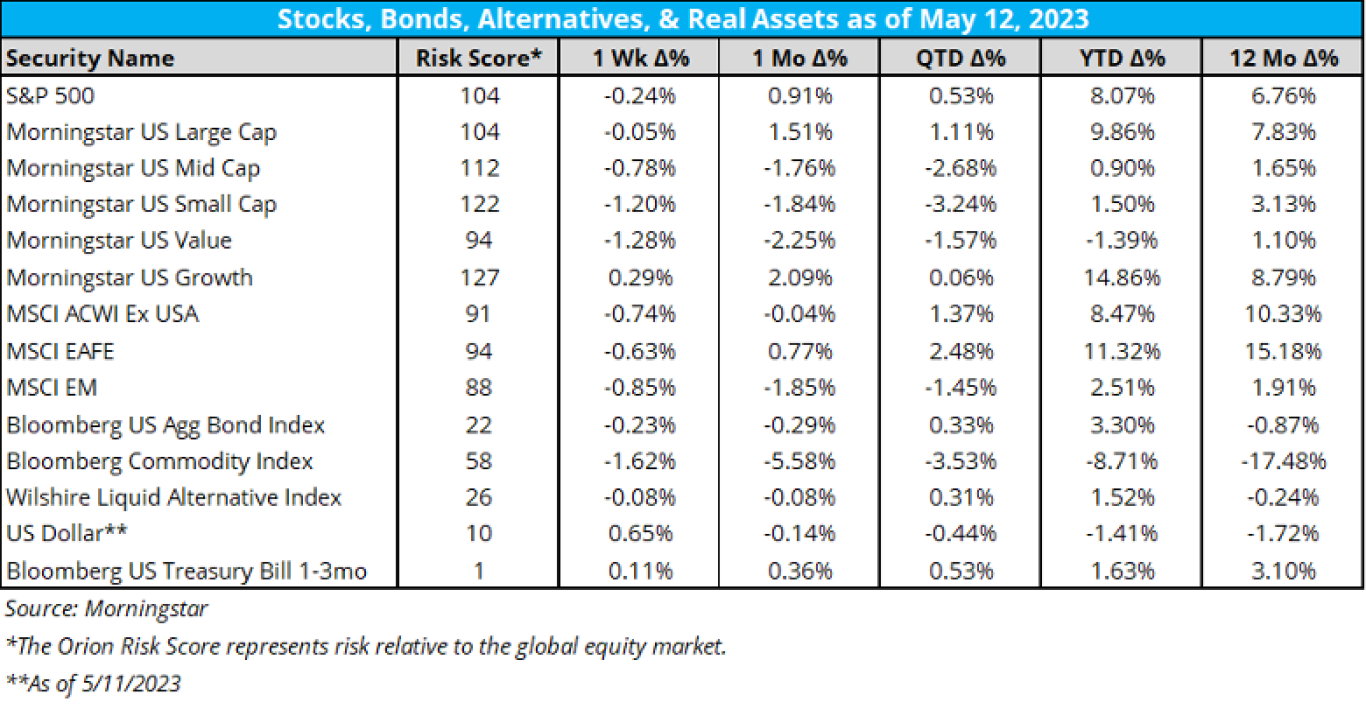

- As for performance last week:

- The overall US market was generally flat on the week. Small caps and values continued to struggle, as they have for the month of May thus far.

- So far for the Second Quarter, US large caps and international stocks have been outperforming other major equity sectors, while bonds have been about flat.

- YTD, large caps are still holding onto a near 10% gain, led by growth stocks. Value stocks have fallen short and are now down over 1% on the year after their major outperformance over growth last year.

- Value stock indices are still being dragged down by the financial sector. According to Bespoke Investments, “Despite being out of the headlines for a few days, the selling hadn’t stopped. [Early last week], the SPDR Regional Banking ETF had its second-lowest close of the year.”

Source: Bespoke Investments

- Large cap growth – namely the top FAANG names – are leading the charge this year. According to RenMac, “Does it matter its only 5 or 7 names driving the index? We don’t think it matters and sounds like more of just an excuse. AND, although it is definitely a very narrow market here, it’s not ALL just 5 names.

- Homebuilders are doing well.

- Health Care services are improving.

- Smaller software names are looking good.

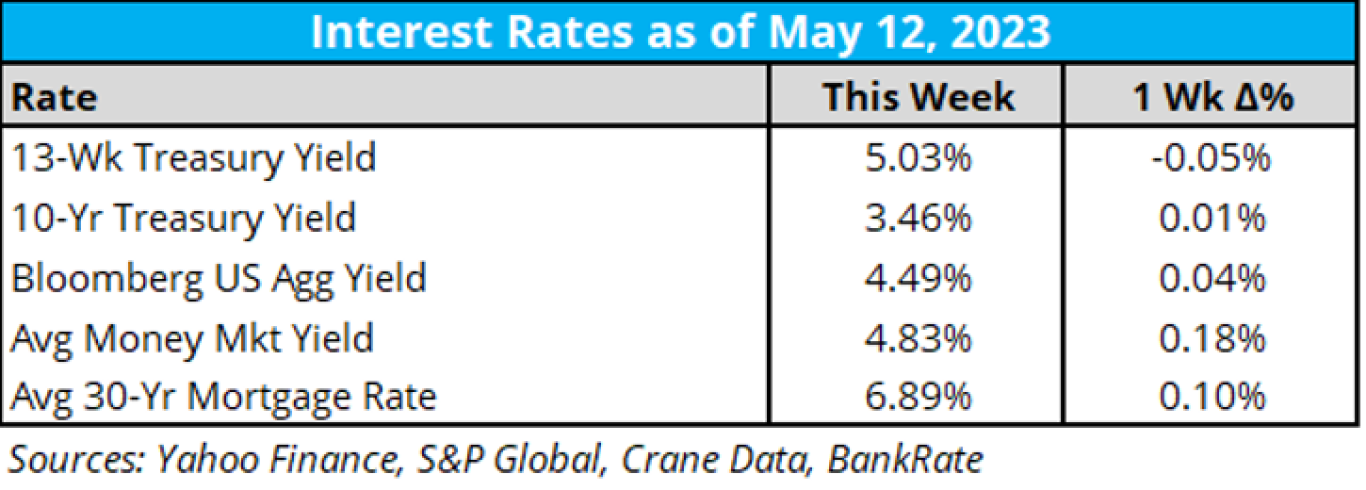

- As for key interest rates last week:

- Interest rates broadly continue to rise as the benchmark rate continues to be increased. The 3-month T-Bill came down slightly last week, but it still sitting at over 5%.

- We’re now 29 days out from the next interest rate decision, and as of now, according to the CME Fed Watch tool: (which has arguably been one of the key charts to watch this year):

- At a current target range of 500-525, the market is now pricing nearly an 85% chance of no rate action at the next Fed meeting on June 14th.

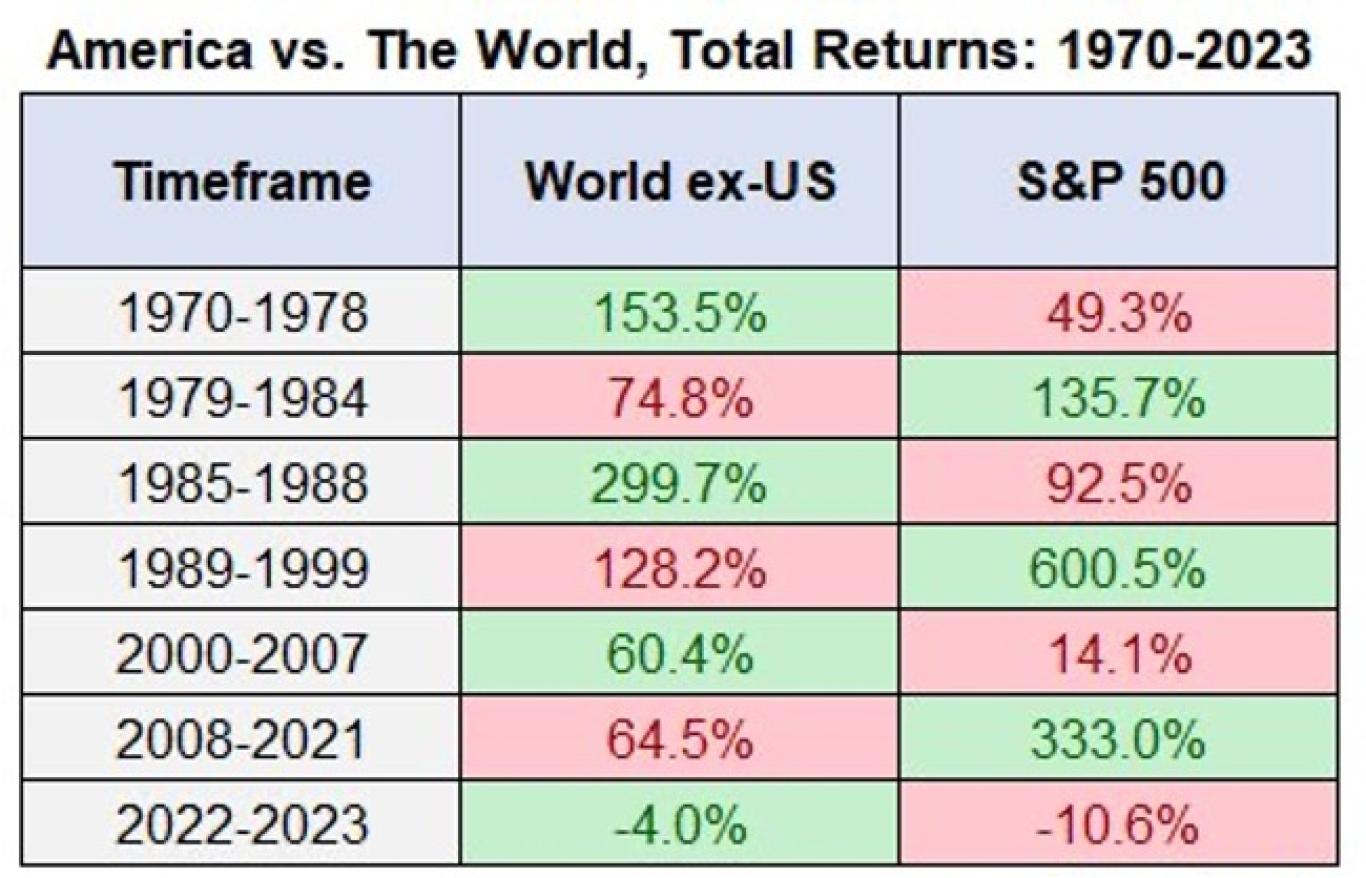

- “What’s the point of owning international stocks if the U.S. is the only game in town?” Well, over the long run, US stocks haven’t shown quite the blowout over international stocks that we’ve seen in the last decade or so. For example, over the last 53 years, international stocks have had higher returns than US stocks 25 times, (that’s about 47% of the time).

- Turns out, since 1990, much of the outperformance of US stocks comes from relative value expansion over international stocks. From 1990-2022, US equities outperformed the MSCI EAFE index by about 4.6% year, BUT, once controlled for valuation expansion, the figure drops down to about 1.2%/year, much less significant.

- Moral of the story, US equities are expensive relative to the rest of the world, and diversifying globally not only provides valuable diversification to portfolios, but it can be done at a discount to a US portfolio. (hat tip to Ben Carlson, A Wealth of Common Sense).

Source: CME Group

- Here are 12 pages from AQR why international diversification. “The case for international diversification remains strong. Both theory and long-run evidence underscore benefits of diversification, particularly for active investors.”

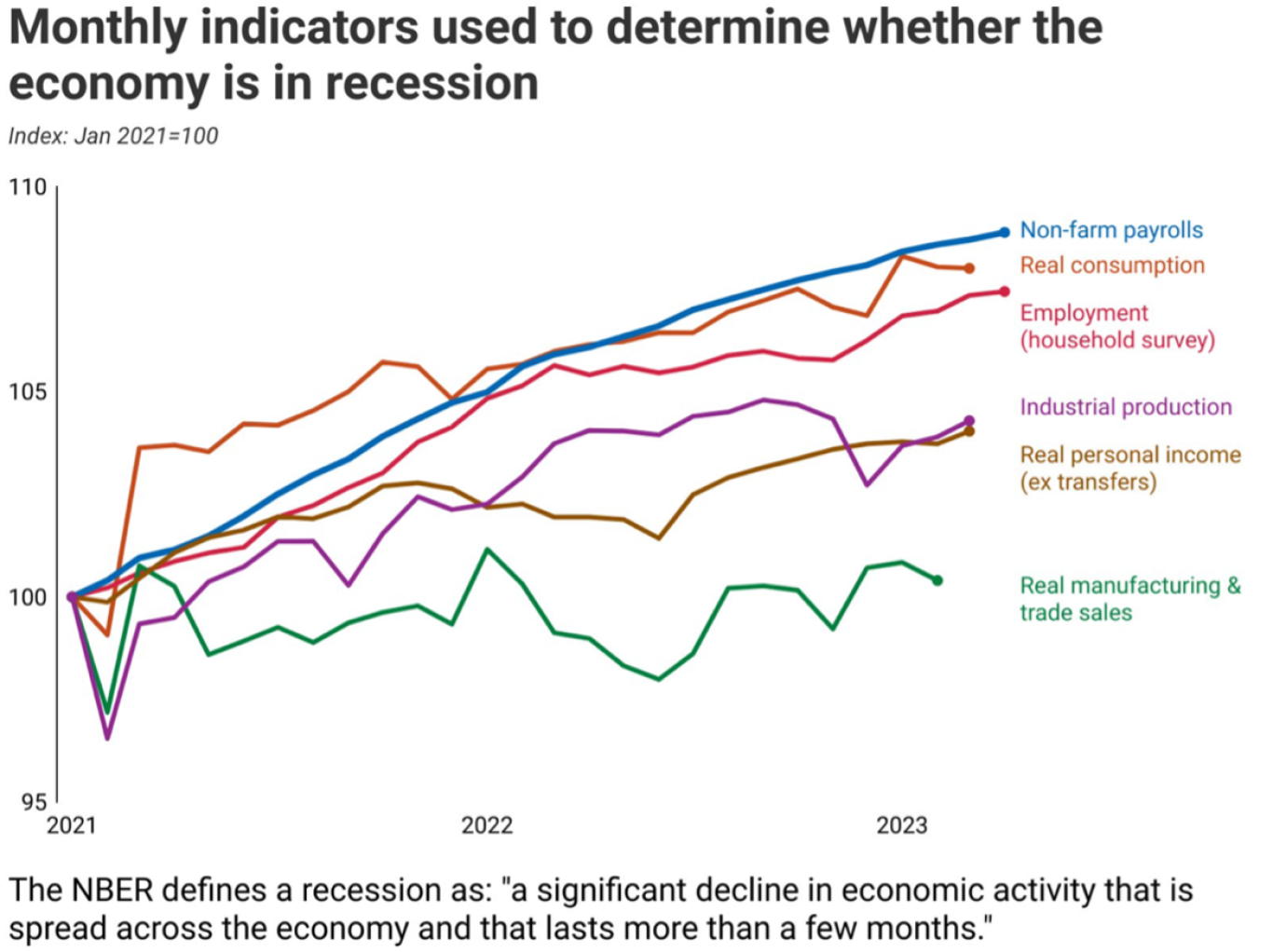

- The word “recession” has become part of the 2023 market lexicon at this point. However, many of the indicators that are used by the NBER to determine recessions are holding, and positively trending:

Source: AQR

- The Atlanta Fed GDPNow Forecast Tool is setting estimated Q2 2023 GDP at 2.7%, as of 5/8/23.

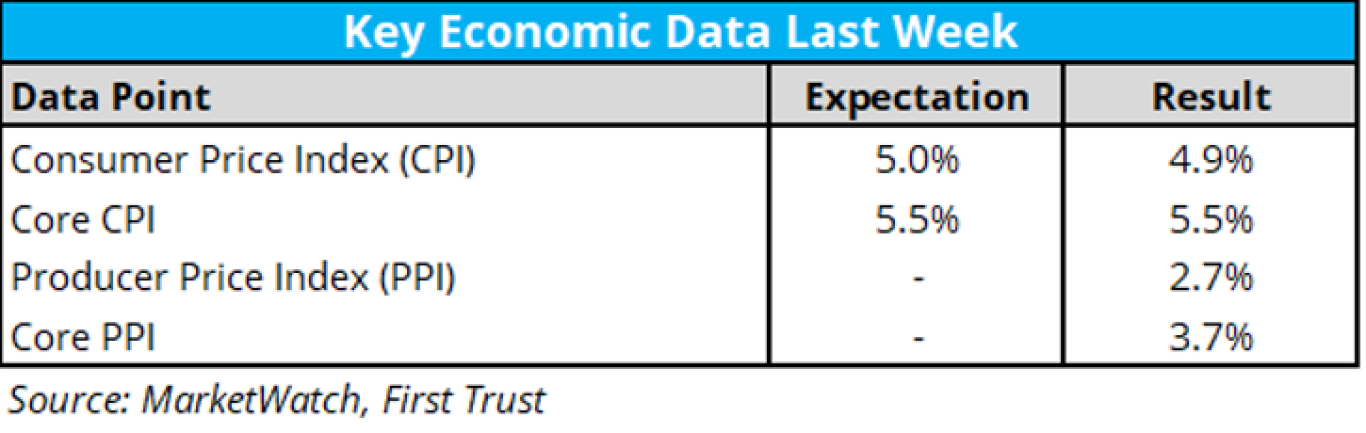

- The economic data calendar last week gave us some (modestly) positive news on inflation:

- The Consumer Price Index (CPI) came in just slightly below expectations at 4.9% over the last 12 months. This reading likely solidifies that the Fed will pause its rate hiking cycle from here, as we are finally seeing meaningful reductions in inflation. Unfortunately, however, areas like transportation and shelter are still holding onto near double digit increases over the last 12 months.

- The Producer Price Index also came in slightly below expectations in April. Coupled with the CPI print, it’s clear that there is progress being made on inflation, but the fight is not yet over.

- Housing is looking better. According to RenMac, “Housing is turning up. New home sales, which represents signed contracts, are at a one-year high. New homes sold, but not yet started, are running at a 13-month high. Comments from publicly traded home builders point to continued growth into April and mortgage loan applications for purchase rose modestly.”

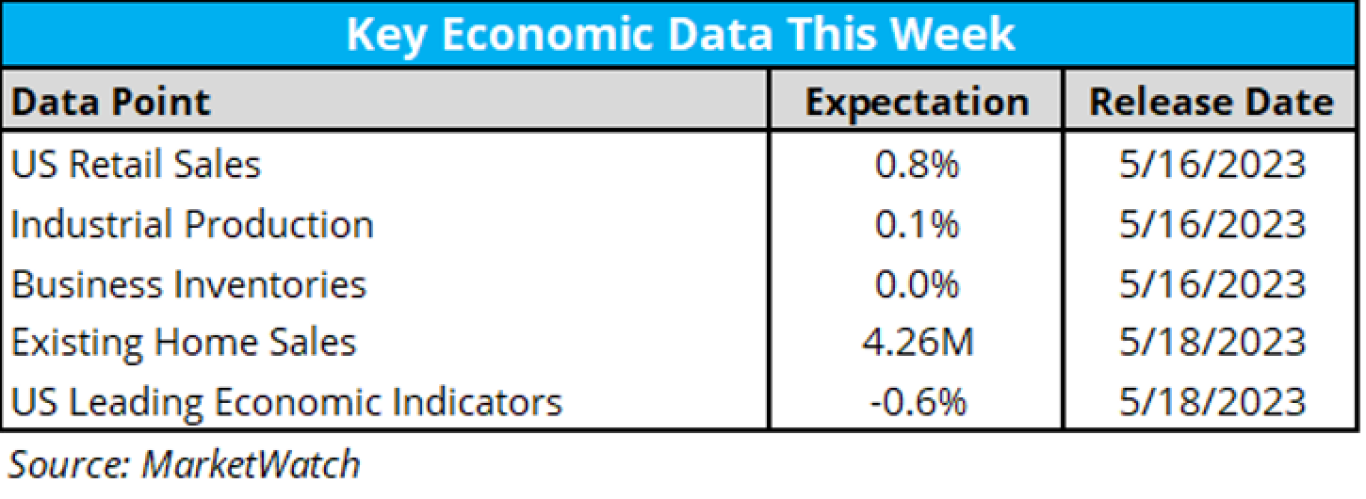

- Here is the economic data calendar for this week.

- While there are no major economic data releases, we will hear conferences, testimonies, or panels from nearly 10 Fed presidents this week.

- The most attention will likely go to retail sales on Tuesday and existing home sales on Thursday.

- This week’s Earnings Insight from Factset:

- Earnings Scorecard: For Q1 2023 (with 92% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS surprise and 75% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -2.5%. If -2.5% is the actual decline for the quarter, it will mark the second straight quarter that the index has reported a decline in earnings.

- Earnings Guidance: For Q2 2023, 50 S&P 500 companies have issued negative EPS guidance and 37 S&P 500 companies have issued positive EPS guidance.

- For all of CY 2023, analysts predict earnings growth of 1.0%.

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Cryptocurrency prices fell alongside stocks last week, with Bitcoin dropping 7% to just under $27,000. Ethereum fell 6% to just below $1,800. Polygon and Avalanche dropped double-digits.

- Macro headlines were a lot of the story in the digital asset space this week. The somewhat cooler than expected CPI on Wednesday propped up prices, but continued weakness in other risk assets and a strengthening dollar put pressure on crypto. Bitcoin transaction fees spiked to a 2-year high due to network congestion arising from ‘ordinals’ – Bitcoin’s version of NFTs. Despite this, Liechtenstein will soon accept Bitcoin as payments for government services. Coindesk has launched a Bitcoin Trend Indicator displaying the trend in the cryptocurrency on the below scale. We had been in the green but moved back to neutral last week.

- No new digital asset ETF launches, but Grayscale filed for 3 new ETFs. The Grayscale Ethereum Futures ETF, Grayscale Global Bitcoin Composite ETF, and Grayscale Privacy ETF.

Source: CoinDesk.com

- “There’s one investment that supersedes all others: Invest in yourself…Nobody can take away what you’ve got in yourself, and everybody has potential they haven’t used yet.” Warren Buffet

- On this week’s Orion's The Weighing Machine podcast, Robyn and I talk to Bryan Keller, Chief Strategic Officer at Dakota Wealth Management Bryan literally sat next to me for 3 years and now he’s leading the charge on M&A activity for Dakota Wealth. Bryan is a multiple tool investment professional who not only knows the markets and industry but is an outstanding communicator as well. It was a real treat to have Bryan on the podcast.

- Worried about AI? Is it part of our addiction to fear? This article argues “ People in power have used fear to control the thinking of the population since time immemorial. The antidote to fear is courage. (AI) will surely change the world but our place in it is probably more in danger from each other than from machines.”