- Thankfully, it appears there has been a tentative debt ceiling deal. The big stories in the markets this week include this Friday’s payroll number (will it surprise to the upside for the 14th time in a row?), the market digesting last week’s economic numbers and yet another shift in expectations for what the Fed might do next (odds now suggest another rate hike at the Fed meeting in 2 weeks), and of course the excitement around artificial intelligence (AI), including last week’s sharp moves in Nvidia stock.

- Last Thursday’s move in Nvidia’s (NVDA) stock was indeed epic. In fact, the one-day gain in NVDA’s market cap was bigger than the entire market caps of companies such as like Disney, Nike, and Netflix!

- The overnight move in NVDA reminds us of the Lenin quote, “There are decades where nothing happens; and there are weeks where decades happen.” Words really can’t describe the move in NVDA overnight. While the company has been public for well over 20 years now, a quarter of its entire market value has come in the last 17 hours! -Bespoke Investments

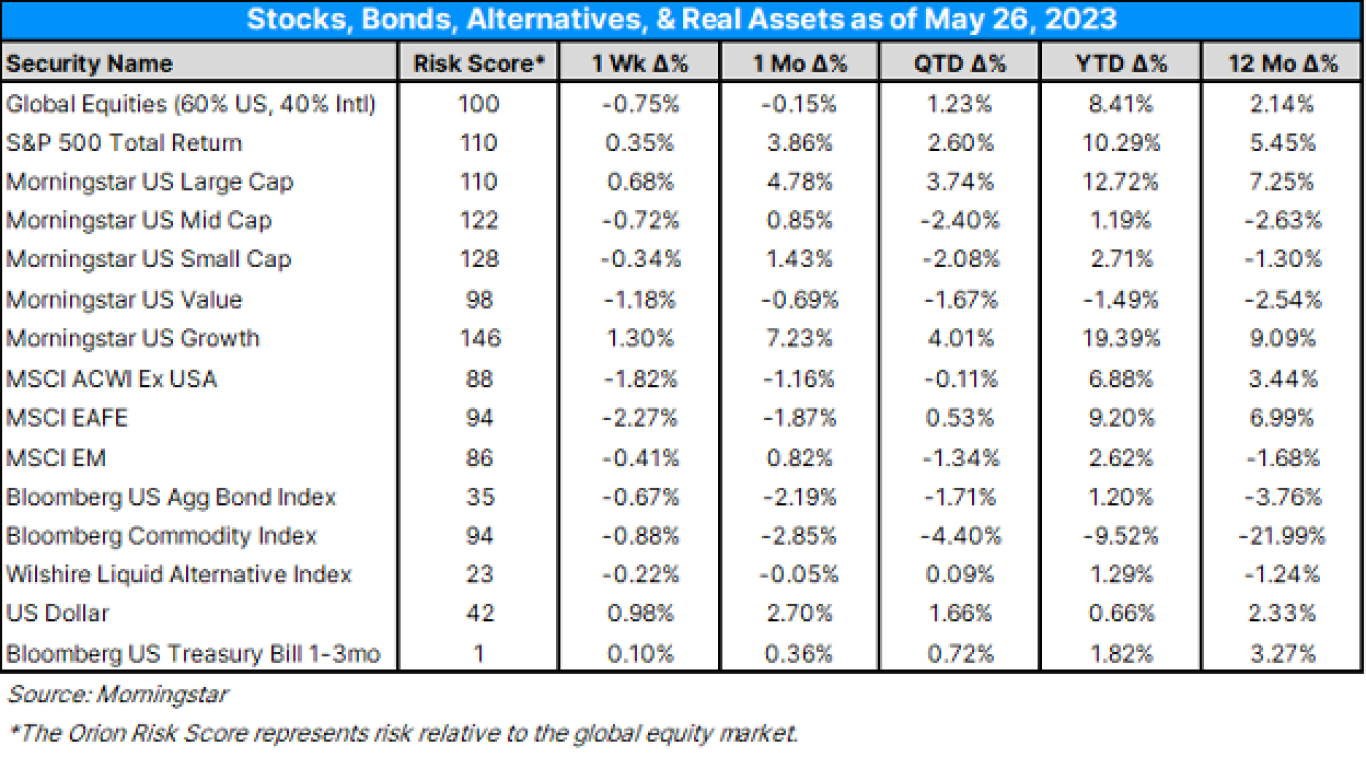

- As for performance last week:

- The overall global equity market lost nearly 1%. With about a month left in the first half of 2023, we’re sitting on solid gains of over 8% in the global equity market, and over 10% in the US. 1

- Bonds lost nearly 1% last week and are holding onto about a 1% gain on the year. 1

- Helped by NVDA, US growth stocks had the largest gain last week at a bit over 1%. 1

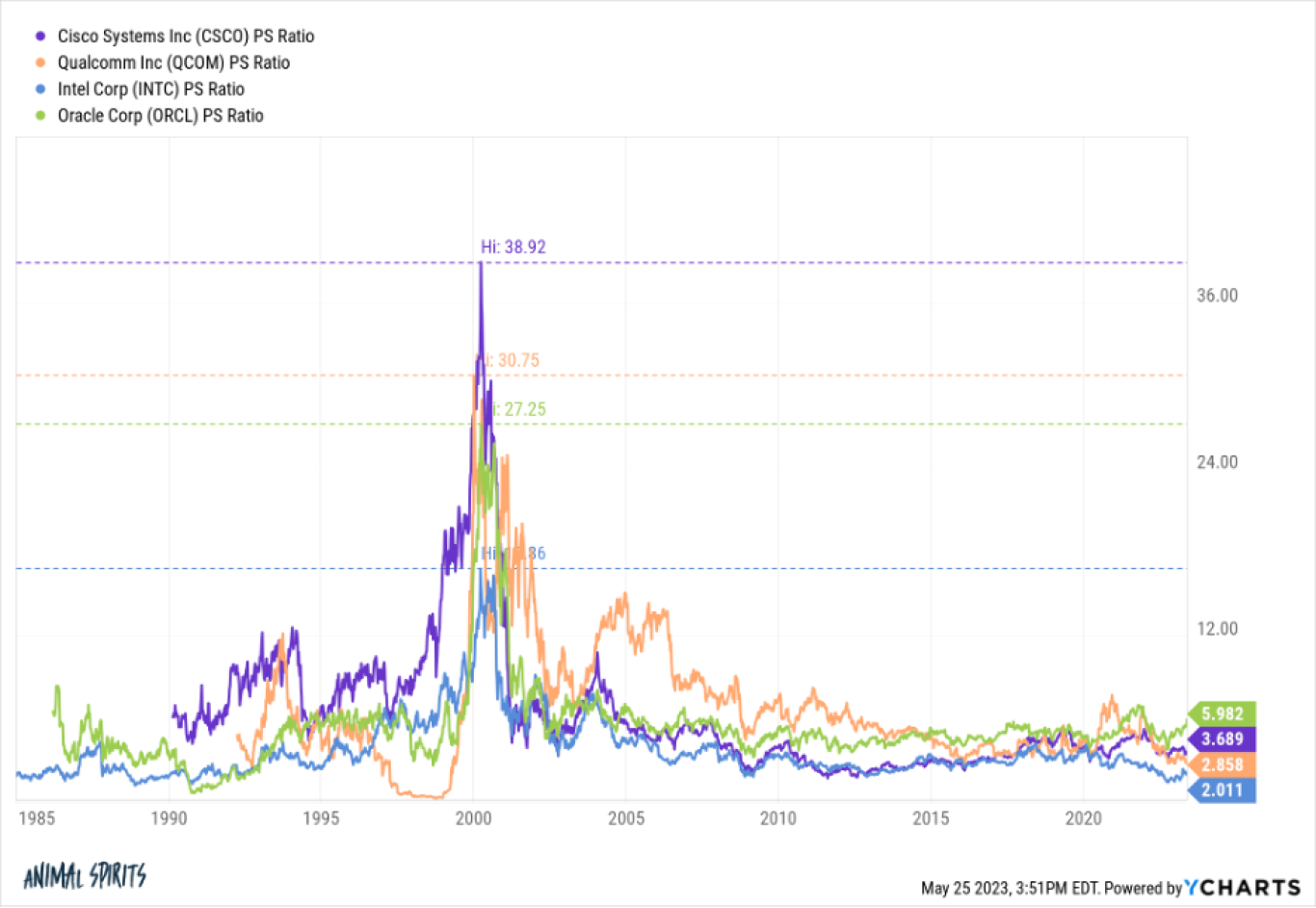

- Is an AI stock bubble inevitable? NVIDIA now trades at 35x P/S – look at dot.com names when they traded near that high (BTW, Cisco is still below its late ‘90s high).

- Speaking of valuations, the Japanese stock market is now at a 33-year high.

- “Some of that has been drawn to the general promise of accelerating governance reform, but a lot of it is because of what is arguably the biggest practical and psychological change in the Japanese economy for decades. A country where an entire generation of consumers, businesses, banks and political leaders knew only flat or falling prices now has sustained inflation.” Hat tip to Whitney Tilson.

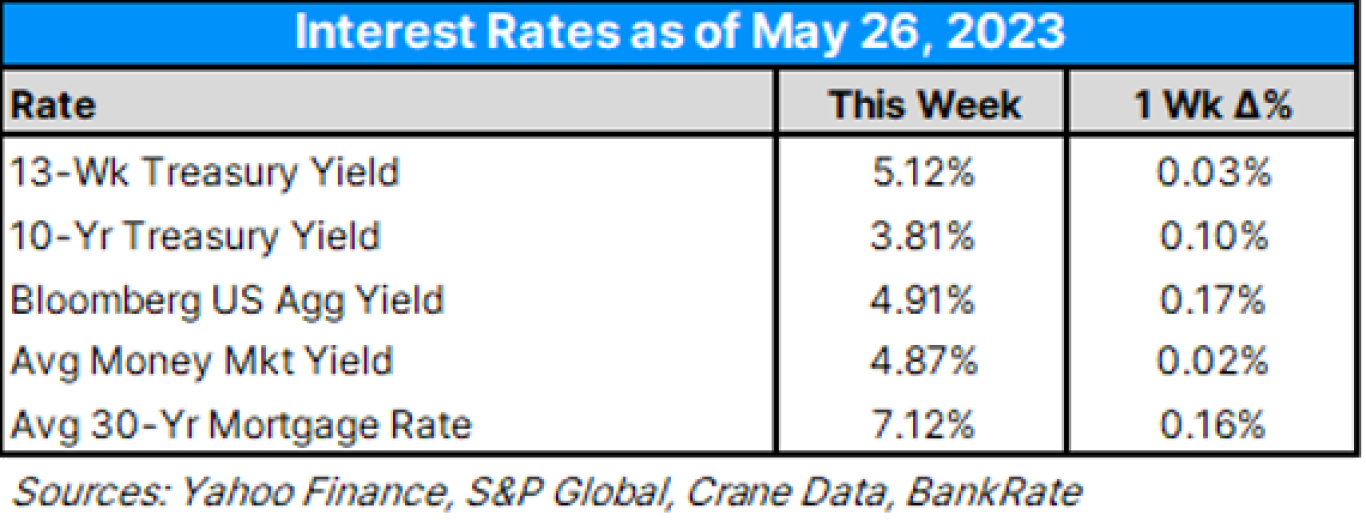

- As for key interest rates last week:

- We’re now 15 days out from the next interest rate decision, and as of now, according to the CME Fed Watch tool:

- There was a crazy swing in market sentiment toward the next rate decision meeting last week. The market is now pricing at 60% with another 25-basis point hike to a target of 525-550. Compared to the reading the week prior which showed about an 80% chance of no hike. 2

- The Atlanta Fed GDPNow Forecast Tool is setting estimated Q2 2023 GDP at 1.9% (down 1.0% from last week), as of 5/26/23.

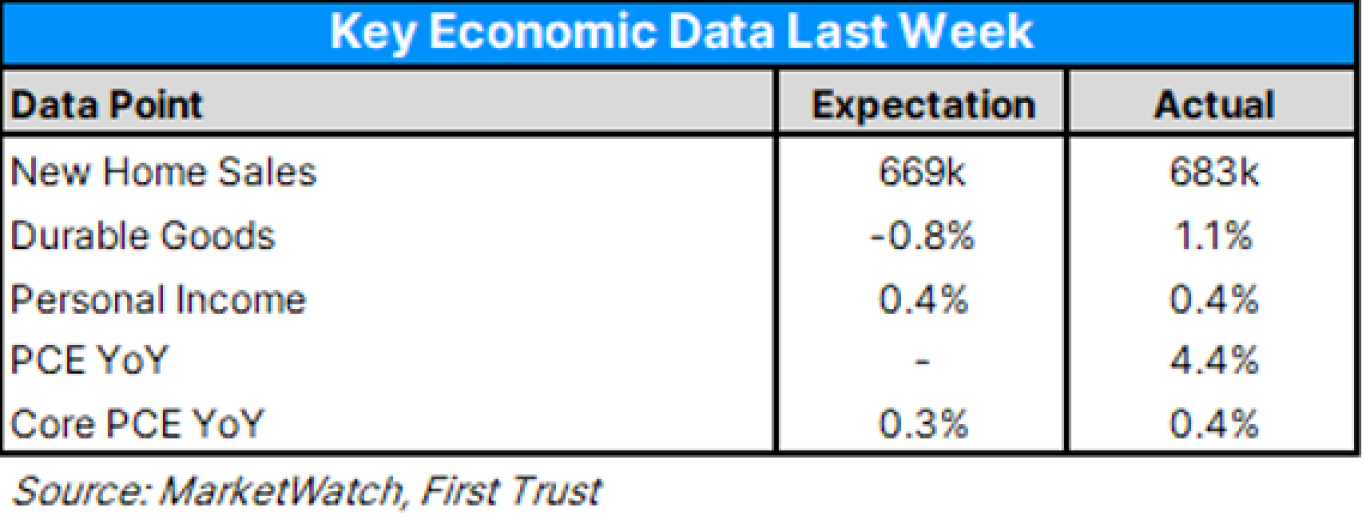

- The economic data calendar last week:

- Growth data moderately surprised to upside

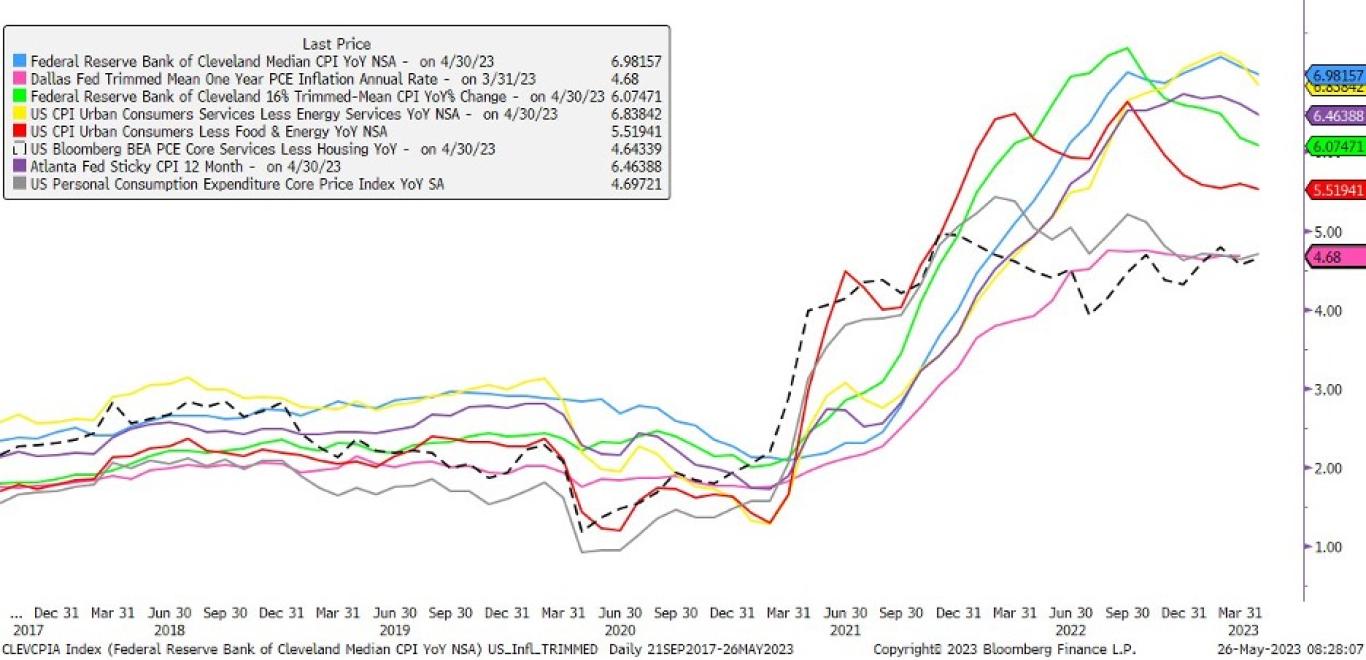

- As did inflation data. The “Dallas Fed Trimmed Mean PCE (Personal Consumption Expenditures)” Inflation metric even hit a new cyclical high at 4.8%. Higher inflation hasn’t died yet. 3

- Speaking of inflation, here’s a chart from Bloomberg (right before the Dallas Fed Trimmed Mean PCE hit a new cycle high):

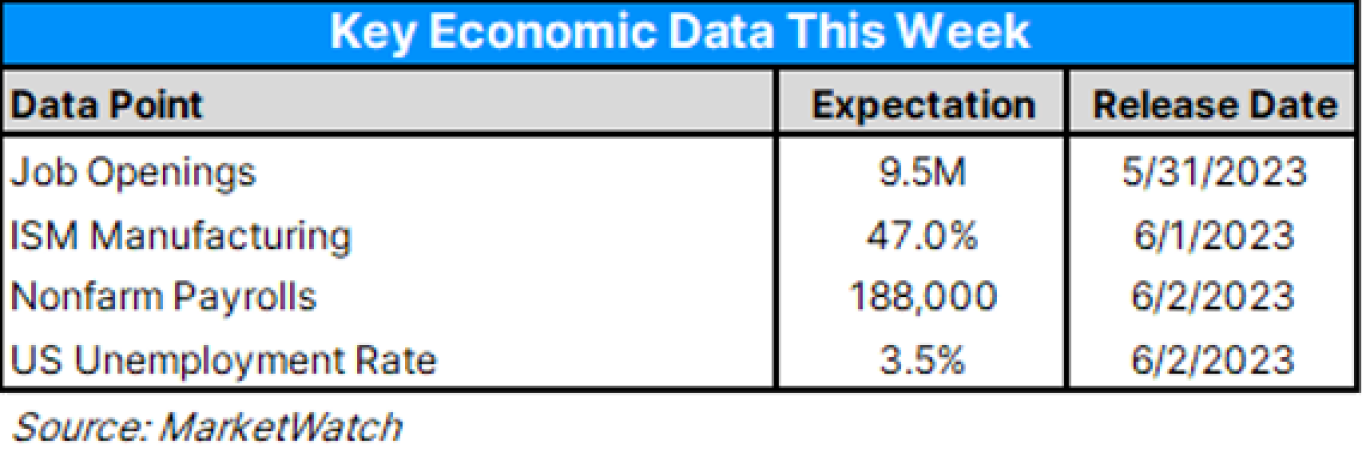

- Here is the economic data calendar for this week.

- The number of the week is Friday’s non-farm payrolls data.

- This week’s Earnings Insight from Factset:

- Earnings Scorecard: For Q1 2023 (with 97% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS surprise and 76% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -2.1%. If -2.1% is the actual decline for the quarter, it will mark the second straight quarter that the index has reported a decline in earnings.

- Earnings Guidance: For Q2 2023, 63 S&P 500 companies have issued negative EPS guidance and 41 S&P 500 companies have issued positive EPS guidance.

- For all of CY 2023: Analysts predict earnings growth of 1.3%.

Crypto Corner with Grant Engelbart, CFA, CAIA, Senior Portfolio Manager

- Cryptocurrency prices rebounded last week, with Bitcoin being higher by 3% to a near $28,000. Ethereum added 4%, while Solana and Polygon tacked on 5%. 4

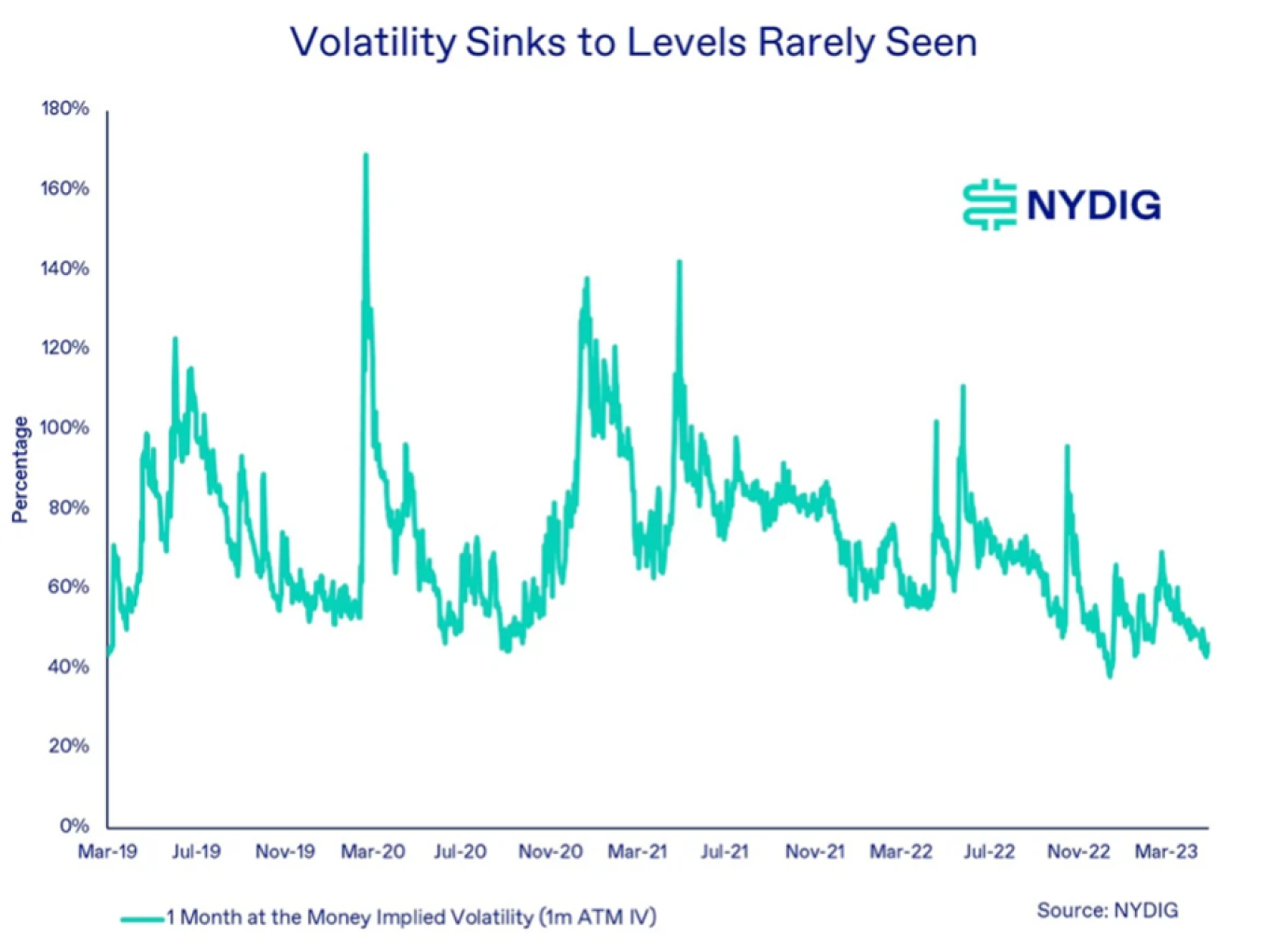

- A week ago, was the infamous Bitcoin Pizza holiday. In 2010, a developer and early Bitcoin supporter purchased 2 pizzas for 10,000 Bitcoin (worth $270 million today, and ~$690 million at Bitcoins peak). Digital Currency Group missed a $630 million payment that Genesis owed creditors. Bitcoin volatility continues to fall, hovering around the lowest levels in recent years (see chart below). The Solana blockchain/network has integrated ChatGPT into the protocol, not the last blockchain to add AI functionality. 4

- No new digital asset ETF news this week.

- “Recessions are not a death sentence to the economy but a natural, transitory phase.” Vitaliy Katsenelson

- On this week’s Orion's The Weighing Machine podcast Robyn and I talk to Philipp Hecker, Co-Founder & CEO of Bento Engine. Passionate about financial planning, behavioral finance, and teaching children about the important concepts of money and wealth, Philipp talks about what advisors need to know about advice beyond investing, why Americans need more advice than just investing, and what Bento's wealth program for children is all about.

1 Source: Morningstar

2 Source: Yahoo Finance

3 Source: MarketWatch

4 Source: NYDIG