The purpose of a well-thought out investment process is two-fold: helping investors reach their goals and, secondarily, making the investment experience a clear, comfortable one.

You may be familiar with Market Cycle Mandates, the three-mandate diversification process we’ve used for years at Orion Portfolio Solutions to help advisors prepare their clients to handle any market scenario. Our belief in that process hasn’t wavered. But through the guidance of our investment committee, we’ve identified an opportunity to better execute the second purpose of the well-thought out investment process: helping advisors communicate three-mandate diversification to their clients to create a more comfortable experience.

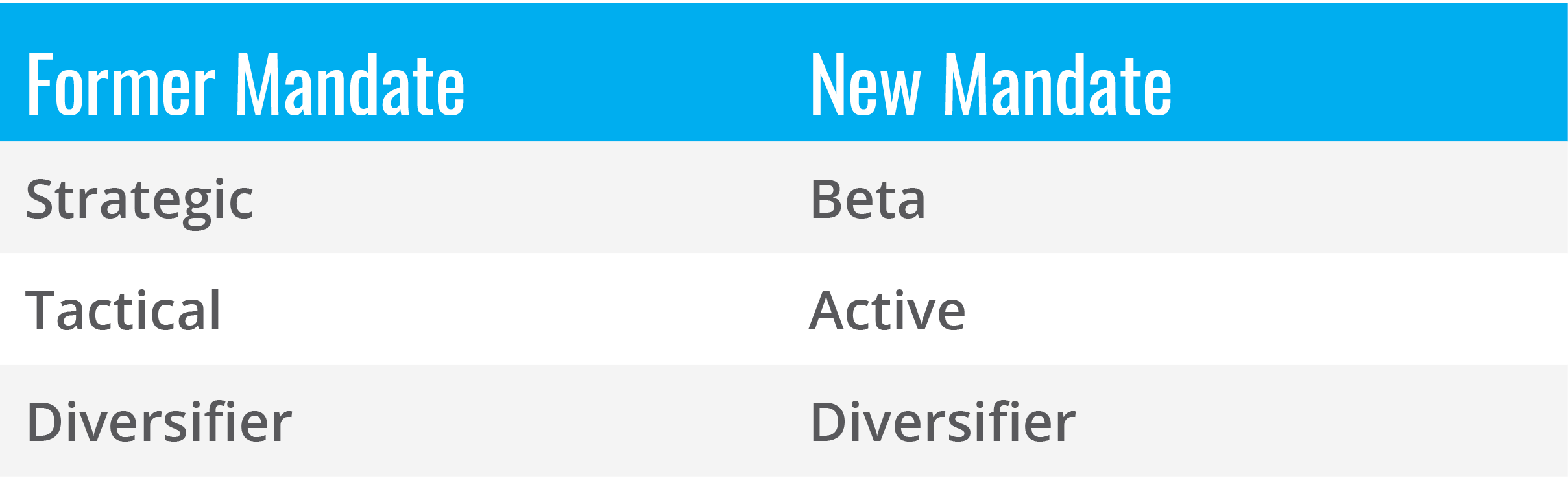

Effective earlier this month, the underlying mandates were adjusted as follows:

- Beta: Strategies designed to capture movement of the markets

- Active: Strategies that adjust for changing market conditions through active management

- Diversifier: Strategies designed to disengage from market movement and provide new sources of potential return and risk

Placing an emphasis up front on the three mandates accomplishes three important things:

- Makes it easier for investors to connect the role each mandate plays with their long-term success

- Helps investors more readily adhere to their objective investment strategy throughout varying market conditions, which often leads to greater investment success

- Provides you with a clear way to continue educating your investors and keep them committed to a well-planned investment portfolio

If you’d like to learn more about Orion Portfolio Solutions, don’t hesitate to contact us!

1847-OPS-07/21/2020