Happy Monday! Busy weekend here with high school hockey, baseball and football -- and to make sure I wasn’t the last one watching - Squid Game! Last week, the S&P 500 had its best week since July and the Dow Jones Industrials had its best week since June. Last Thursday was the biggest daily gain since March of this year.

- Gains were partly driven by strong earnings data. Bank stocks led the way in earnings beats, with Goldman Sachs, JPMorgan, Bank of America, Morgan Stanley, and Citigroup among the firms topping expectations. As of Friday, 80% of the 41 S&P 500 companies that have reported third-quarter results have topped earnings-per-share expectations. The blended 3rd quarter earnings growth rate for the S&P is now 30% according to Factset.

- More notable economic data last week included Retail Sales posting a surprising increase in September, rising 0.7%. Economists were expecting a 0.2% decline. Weekly jobless claims totaled 290,000 last week, the first time the figure fell below 300,000 since the first weeks of the pandemic, this beat the estimate of 318,000. Also, there was more evidence of the “The Great Resignation,” the number of job quits rose to 4.3 million in August, this represented a series high rate. The largest number of quits came from the food services industry at 157,000.

- In more ominous news, however, the Consumer Price Index (CPI) increased 0.4% in September, exceeding the consensus expected 0.3%. The CPI is up 5.4% from a year ago. And, it looks like higher inflation numbers could stick around. As First Trust notes, rents rose rapidly in September, in what is likely to be harbinger of future rapid gains in the year ahead now that there is no longer a national moratorium on evictions. Rents for actual tenants rose 0.5% in September, the fastest gain for any month in the past 20 years; owners’ equivalent rent (what homeowners would pay if they rented their homes) increased 0.4%, the most in 15 years. Keep in mind that these two categories of rent make up more than 30% of the overall CPI, and about 40% of the core CPI. Given the huge run-up in home prices under COVID as well as the typical lags between home price increases and rent growth, expect these categories to remain a tailwind for higher inflation in coming years.

- Despite the higher inflation, I believe the near-term stock market outlook still looks good heading into the fourth quarter: trends, real yields, credit spreads, sentiment and seasonality are all tailwinds for the market. The economic backdrop should be supportive too. For example, Renaissance Macro Research (RenMac) forecasts that nominal GDP will likely sharply accelerate in the 4Q21 for a combination of reasons including: Covid/Delta variant fading, services activity reviving and the housing sector picking up steam. RenMac, like First Trust, also believes we’re in an inflationary boom, and we’ll likely see higher inflation in the coming months. Of course, this is the biggest plus: improving COVID data.

- Big number; 5.9%. That’s the increase that retirees receiving Social Security will pick up next year to account for inflation. It’s the biggest jump in 39 years and captures what consumers have been feeling acutely over the past year: Stuff is getting more expensive.

- As for the bond market, Ten Year Treasury Yields moved slightly lower last week, closing at 1.58%. Yields have popped higher Monday morning though, as yields are currently at 1.63%.

- This week’s economic schedule includes a lot of housing data, with reports on Monday, Tuesday and Thursday. Corporate earnings will likely take more of the spotlight though, with a range of companies reporting. This includes Netflix which will be the first Big Tech company to report results for the quarter ended in September on Tuesday.

- The latest on investor sentiment, according to the latest AAII Sentiment Survey, is that it’s back to basically neutral levels after recently hitting bearish extremes. Again, sentiment surveys tend to be contrarian in nature. Historically, when bullish sentiment is low (which it had been for weeks until last week), stock market returns tend to be above average in the months ahead. In my seasoned opinion, this is a plus for the stock market going into year-end.

- Bitcoin prices closed last Friday above $61,000 after nearly hitting $63,000. The all-time high was just under $65,000 on April 14, 2021. Ethereum closed over $3800 Friday. Ethereum’s all-time high was just over $4000 on September 4, 2021. The First Bitcoin future ETF in the U.S. is set to begin trading in the week ahead.

- “If we were having this discussion 3 years from today, looking back at your experience, both personally and professionally, what has to happen in your life for you to be happy with your progress?” This is the “R-Factor Question” or the “Dan Sullivan Question” that Carl Richards refers to in his "Real Financial Planning: Defenders vs Guides" 26-minute video. In short, the R-Factor question gets to the essence of what people buy – relationships. For more, there is the 7-minute One Question to Transform Anyone's Future - Multiplier Mindset by Dan Sullivan himself.

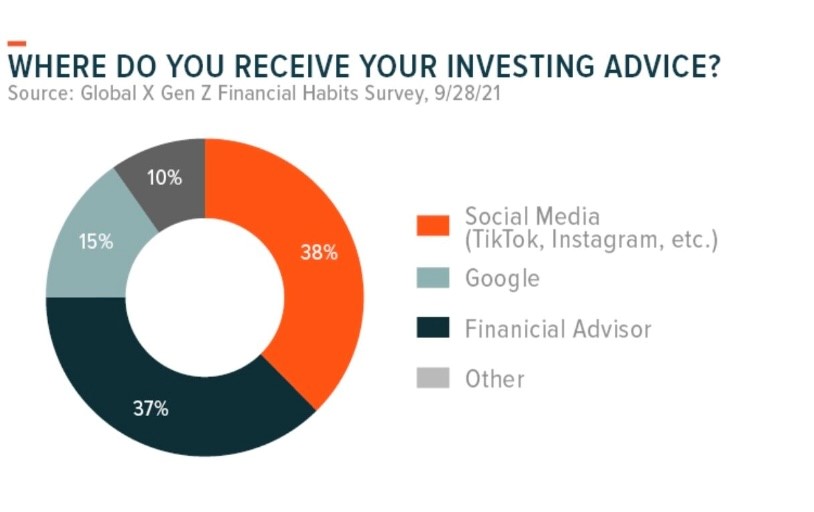

- Here was an interesting graphic from GlobalX on Twitter. In short, it’s interesting where younger investors get their investing advice. More from social media than financial advisors! That will change.

- A recent webinar from Capital Group and Orion reviewed Cap Group’s Advisor Benchmarking Study called “Pathways To Growth”. This 46-minute webinar presented findings from Cap Group’s 1,500 person study that set out to uncover the behaviors and habits of high-growth practices. It lays out the three key focus areas of Always-On Acquisition, Relationship Alpha, and Strategic scale and shares insights on how advisors seeking to grow their practices can shift their behaviors toward higher-value activities. Additionally as part of the webinar, in Fuel Growth with a COI Engagement Strategy, Paul Cieslik, also of Capital Group, will teach about the science of referrals and how to apply it in building professional partnerships among the centers of influence (COIs) of your most engaged clients. Capital Group Practice Lab is loaded with practice management content.

- This week’s guest on Orion’s The Weighing Machine will be Mike Dunlop, the CEO at Intuition College Savings Solutions. It’s a great overview of the 529 and college savings landscapes.

- Orion’s Eric Clarke was on the Model FA podcast last week talking about refining your unique value proposition. Eric describes what makes a powerful value proposition and explains why advisors should focus on creating an impactful brand experience for clients. He also highlights the power of habits and discipline, discusses the value of listening to feedback, and underscores why any business owner should think about their “why.”

- Here’s an “Awesome” picture for this week. It’s from a Huffington Post article, which also includes five cool things about awe.

- For more resources, please check out the Financial Advisor Success Hub, and as always, please let us know what we can do better at rusty@orion.com or benjamin.vaske@orion.com.

- Thanks for reading and have a great week!

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.