Challenges in Portfolio Construction · A Time for Alternatives? · Invest at All-Time Highs?

Portfolio Advice, Talking Points, and Useful Resources

- Despite the current challenges in portfolio construction, maintaining discipline and diversification is crucial — portfolios should continue to perform as expected.

- Given the challenges facing traditional asset classes, alternatives may play a valuable role in enhancing portfolio performance, particularly in the current environment.

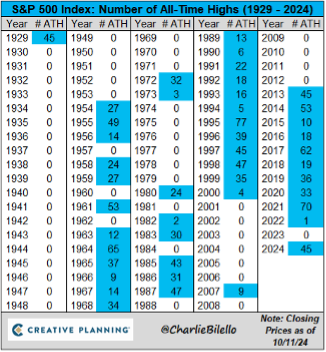

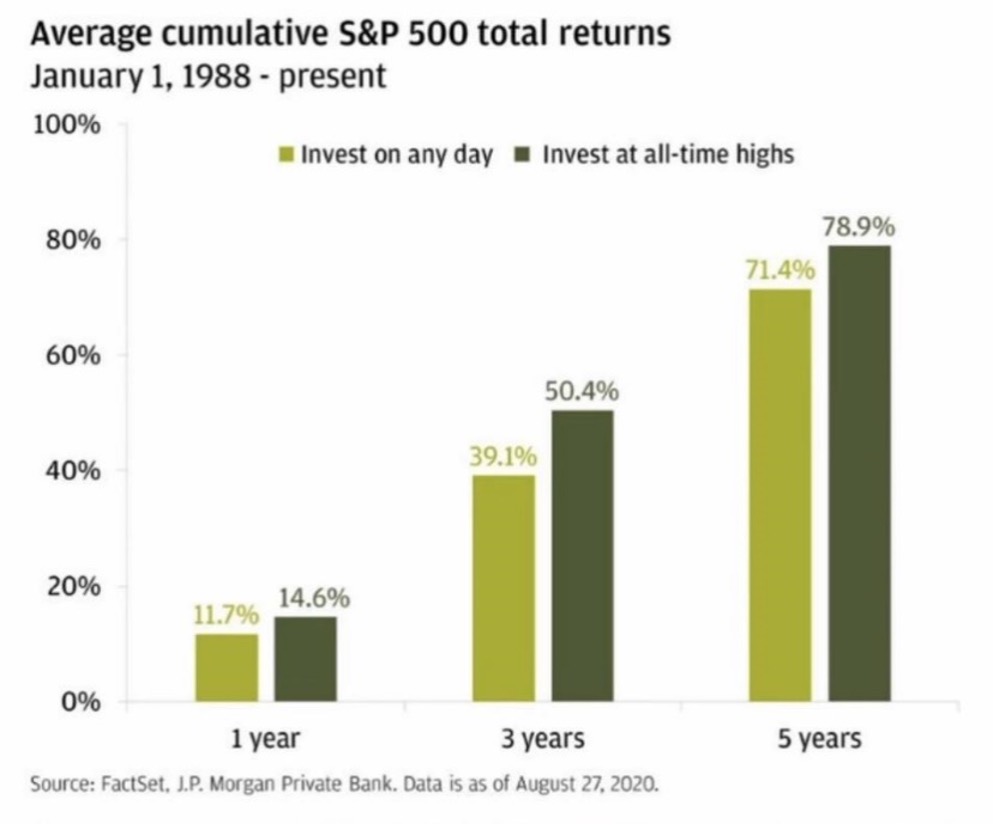

- Is it a good idea to invest when markets are at all-time highs? Surprisingly, yes! Historically, the market tends to outperform in the year ahead, as momentum is often in its favor.

This commentary is being written weeks before the presidential election, and by the time it’s published, the landscape may look quite different. However, some things remain constant. Constructing well-built investment portfolios that align with investors' goals and perform as expected is as critical as ever. Today’s environment presents unique challenges for portfolio construction, influenced by both market dynamics and broader economic factors.

One of the key challenges is the current state of conventional asset classes like stocks and bonds. In this commentary, we’ll explore the topic of investing in the stock market at all-time highs (the insights may surprise you), and we’ll also discuss why alternative investments deserve consideration for well-diversified portfolios.

As we write each month, we believe that long-term investors are best served by staying invested, staying diversified, and staying disciplined. This month’s commentary includes sections that delve into each of these principles. We hope you find this analysis valuable.

Stay Disciplined: Current Challenges in Portfolio Construction

By Rusty Vanneman, CFA, CMT, BFA, Chief Investment Strategist

In October, Orion Wealth Management hosted a two-day Elite Advisor conference in Savannah, Georgia. The event provided a platform to discuss Orion’s strategy, offer insights on the upcoming election, share best practices for growth, and explore investor behavior trends. The conference also featured roundtable discussions addressing the portfolio construction challenges financial advisors face today, given unique market conditions and the aging demographics of both advisors and clients.

The Impact of Wealth Transfer on Portfolio Construction

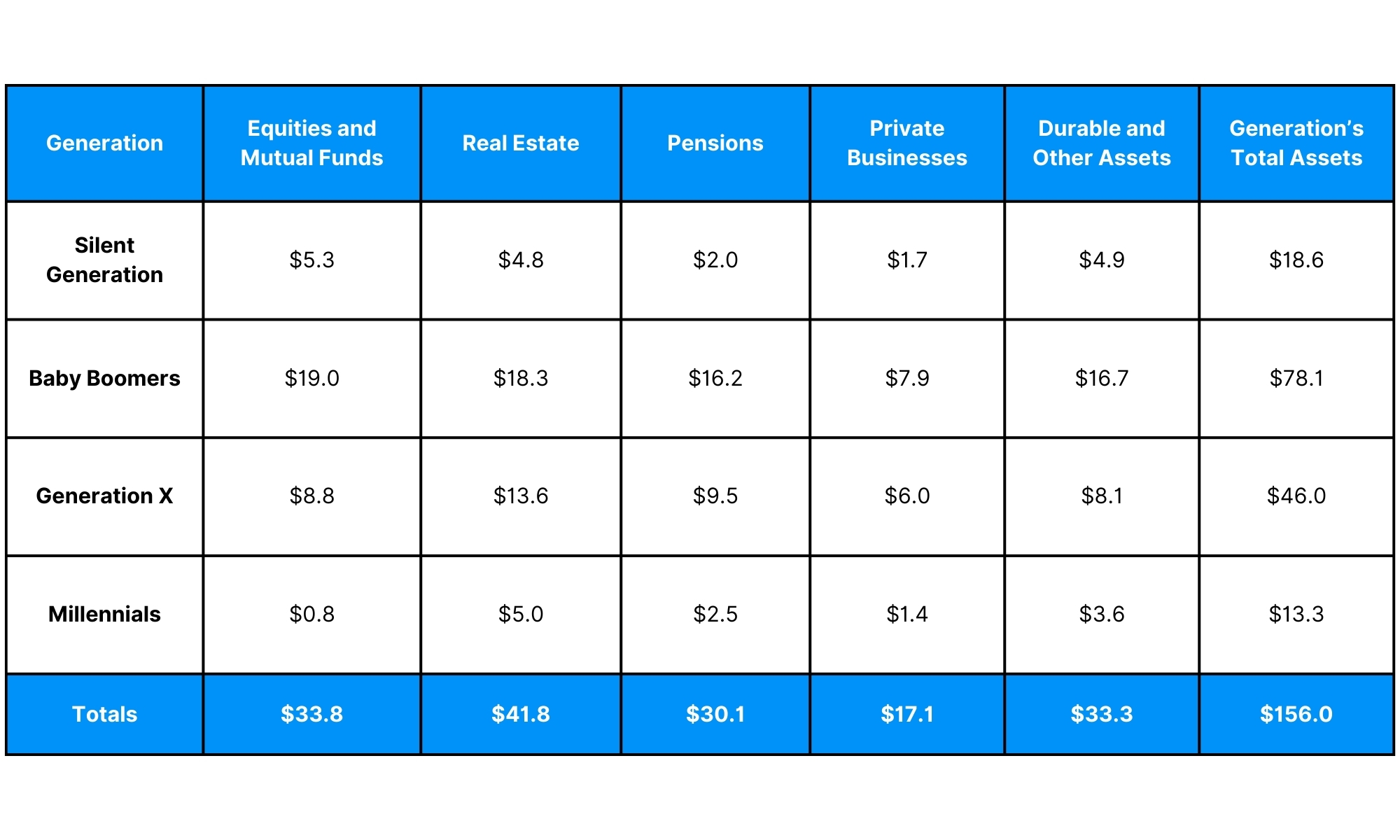

Demographic shifts are a key focus for advisors, especially with an estimated $90 trillion in assets expected to transfer over the coming decades to younger generations, including Gen X (born 1965-1980) and Millennials (born 1981-1996).

Source: Board of Governors of the Federal Reserve System.

This wealth transfer raises important questions:

- How are advisors preparing for this transition? What strategies are they using to help Baby Boomers transfer wealth efficiently to younger heirs?

- Balancing risk tolerances: How are advisors managing different risk profiles across generations, such as Baby Boomers focusing on retirement income, while Millennials seek growth and impact investments?

- Customization for younger clients: As Millennials and Gen Z investors demand greater customization and alignment with personal values, how are advisors tailoring portfolios to meet these expectations?

Aging Advisors and Succession Planning

Another challenge discussed was the aging advisor population. In the next 10 years, nearly 100,000 advisors — managing almost $12 trillion in assets — are expected to retire, representing about one-third of all advisors.

This raises further questions:

- Succession planning: How are advisors planning transitions to ensure continuity in portfolio construction for long-term clients?

- Generational differences in portfolio strategy: Are younger advisors approaching portfolio construction differently compared to their senior counterparts? What strategies are being used to maintain client relationships during transitions?

Navigating Unique Market Conditions

The group discussed various market challenges and their impact on portfolio construction:

- High market valuations: Some participants noted that the stock market is near or at historically high valuations, with market concentration in a few large names driving a lot of the gains.

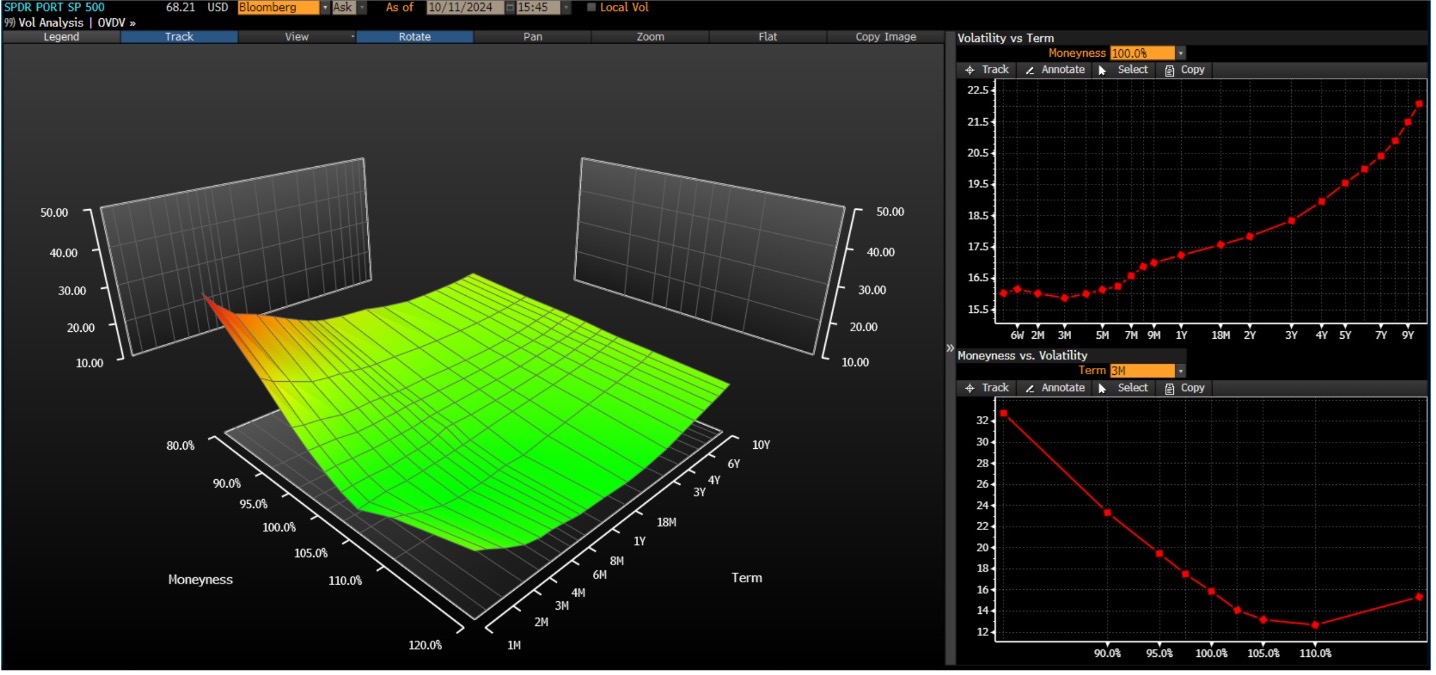

- Fixed income challenges: Despite rising interest rates, core fixed income still offers lower yields than historical averages and is not providing the same level of diversification in equity-dominated portfolios. Additionally, market volatility has increased, causing the traditional 60/40 stock-bond portfolio to experience twice the volatility seen just a few years ago.

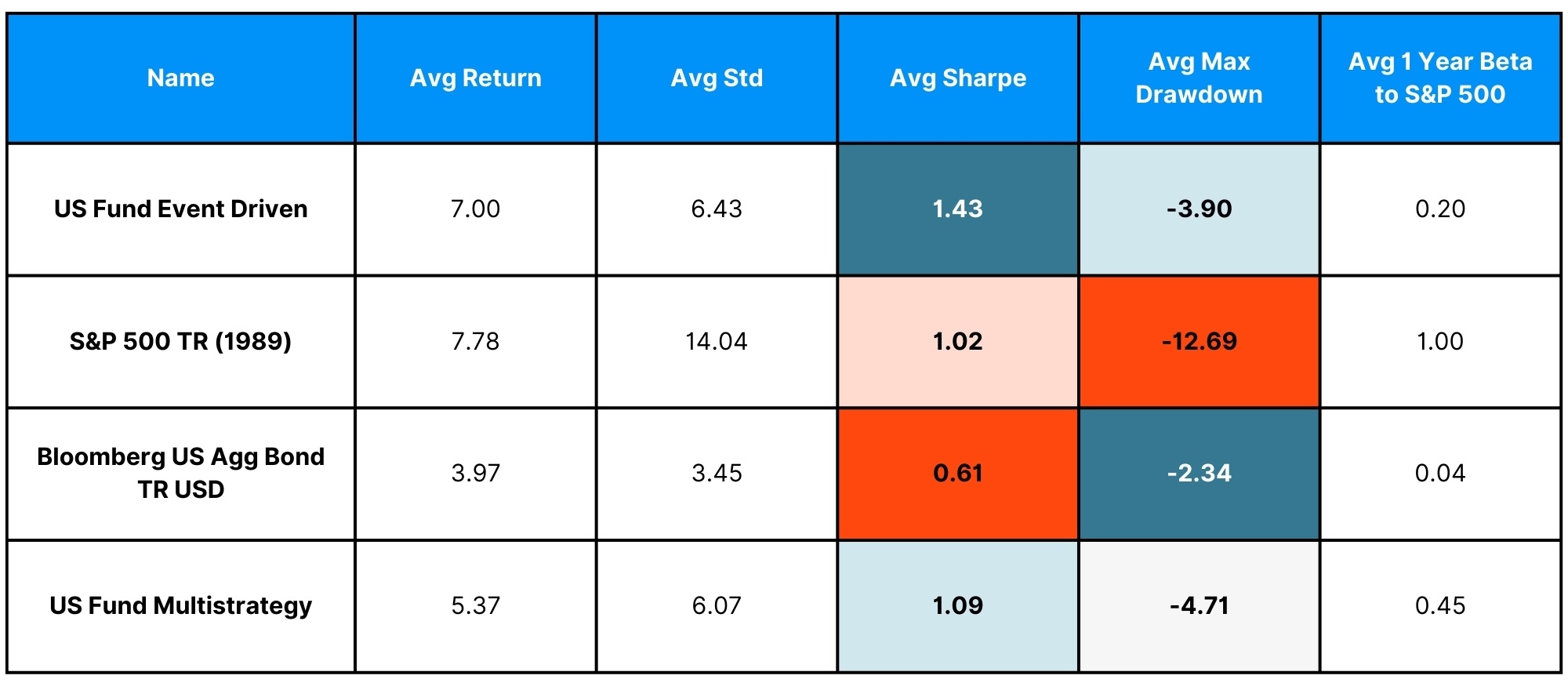

- Increased interest in alternatives: With fixed income struggling to diversify portfolios, more advisors are incorporating alternatives to enhance returns and manage risk. Some of this demand is driven by illiquid alternatives, while others aim to diversify away from traditional stocks and bonds.

Key portfolio construction questions raised included:

- How are advisors building fixed income portfolios to manage today’s lower yields and higher correlations with equities?

- How are non-core fixed income asset classes and alternatives being used? What challenges do they pose?

- Are advisors using tactical strategies to navigate market volatility?

- How are global uncertainties, such as political and economic risks, influencing asset allocation?

Behavioral Finance and Portfolio Construction

Behavioral finance (BeFi) also played a prominent role in discussions. BeFi benefits both clients and advisors, with compelling statistics supporting its value:

- Investors who work with advisors accumulate nearly three times the terminal wealth of those who invest independently, thanks in large part to the behavioral guidance advisors provide.

- Beyond financial outcomes, behavioral advice improves overall well-being — clients experience less stress, better communication, and even improved life satisfaction.

- Advisors who implement specific BeFi tools see significant business benefits, including twice the new client growth and three times the asset flows from existing clients compared to those who do not.

Key behavioral finance questions explored included:

- How is behavioral finance shaping portfolio construction?

- How are advisors using BeFi strategies to improve client outcomes and satisfaction?

Key Takeaways from the Roundtable Discussions

While the roundtable discussions provided many insights, a common theme emerged: “It depends.” While a common thread in discussions was keeping portfolios as simple as possible, portfolio construction must always be tailored to each client’s unique goals, risk tolerance, and personal circumstances.

However, several recurring ideas stood out:

- Discipline is key: portfolios must behave as expected.

- Diversification remains critical to managing risk and enhancing long-term returns.

- Customization and personalization of portfolios continue to grow in importance, offering benefits such as tax efficiency, better risk management, and alignment with client values.

- Behavioral finance tools are helping clients better understand their own risk tolerance and make more informed decisions.

At Orion Wealth Management, we are committed to supporting advisors with portfolio construction solutions. Whether working with high-net-worth clients, offering OCIO services, or helping advisors develop personalized portfolios, our team provides tailored guidance. For more information or assistance on portfolio construction, or really anything on the markets or investment strategies, please reach out to our Investment Strategy team at OPSResearch@orion.com.