This commentary was written the day before our national election. Regardless of the outcome, here is some time-tested counsel: Don’t panic.

If your preferred candidates didn’t win, don’t run to the sidelines. In my 30 years of working with investors, I’ve seen investors bail on the market when their candidates lost, and it hurt their long-term returns. I witnessed it when President Bill Clinton was elected. When President George W. Bush was elected. When President Barack Obama was elected. And when President Donald Trump was elected. Investing on political bias has not been a winning strategy.

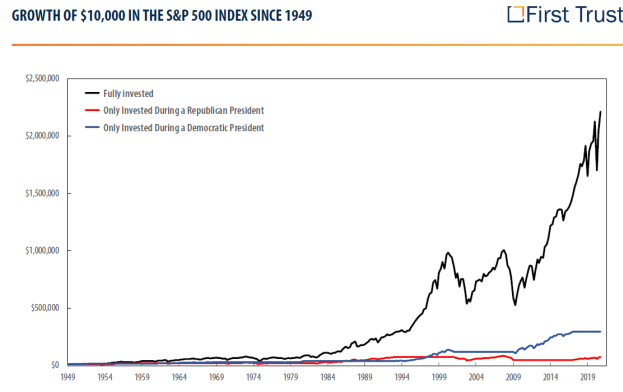

Yes, you can make money if you only invest when a Democrat is president or only when a Republican is president. But as the chart from the investment firm First Trust attests, you will make a lot more money if just let the magic of compounding do its work.

Source: Standard & Poor's via First Trust Advisors, 1949 - Q3 2020

There are many more factors that drive market performance than who sits in the White House or controls Congress. In the short-term, numerous narratives may drive investors’ moods and actions. But over the long run, valuations and fundamentals win out.

Over the years, I have been called an optimist, but I’ve also been called a contrarian. It’s probably a bit nature and a bit nurture. It’s partly how I’m wired, but I’m sure it’s also because of my training, which includes looking up to and learning from past great investors such as Sir John Templeton.

Click here to learn more about Templeton, including these valuable nuggets:

Indispensable wisdom: “Buy at the point of maximum pessimism; sell at the point of maximum optimism.”

Money quote: “If you buy the same securities everyone else is buying, you will have the same results as everyone else.”

I also recognize that from an investment management standpoint, believing in the power of the markets, diversifying, and not buying expensive stuff are keys to long-term success. However, I know from an investment counselor standpoint that the biggest obstacle for individual investor success often boils down to the relationship between greed and fear.

I’d like to close with another quote from the great contemporary financial writer Morgan Housel, who came out with a book earlier this fall that I’m sure will find its way into the Christmas stockings of many investors.

“If someone says that they think everything is always going to be okay, that’s not an optimist. That’s being complacent, whereas a real optimist is someone who understands that the short run is always going to be a mess, always going to be a disaster, both for you and other people, constantly running into problems, running into setbacks, but those things do not preclude long-term growth. And that, to me, is the real optimist.”

Stay balanced and be well.

To find out more and to stay on top of all the exciting things going on at Orion, click here.

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/

2936-OPS-11/4/2020