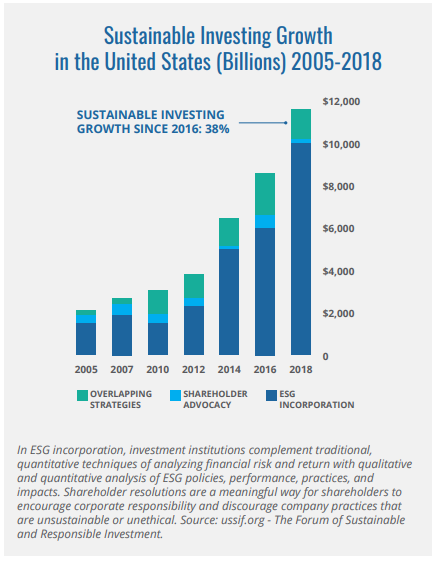

A certain type of investing has been hitting a lot of news headlines recently, as well as growing a lot of assets – values-based investing (see graph below).

What is it? There are many definitions, and it can mean something different to everyone, but I believe these are some unifying classifications:

Socially Responsible Investing (SRI) is the “Old School” or “Traditional” values-based investing strategy. It is referred to as “exclusionary” screening, as the methodology is to exclude stocks from an index. These are typically known as sin stocks, such as tobacco, alcohol, firearms, etc. The strategy dates back decades and really became popular in the 1980s, as investors wanted to avoid South Africa to pressure the government to end apartheid.

Environmental, Social, and Governance (ESG) is the “New School” investing strategy. It is referred to as “inclusionary” screening, as the methodology is to include companies that exhibit favorable traits, such as:

- Environmental – awareness of fossil footprint, wise resource management, pollution avoidance, etc.

- Social – human rights, workplace equality, product safety, community relations, etc.

- Governance – stewardship for shareholders, company leadership, transparency, accountability, etc.

SRI has gotten a bad reputation over the years. One negative connotation with traditional SRI is the notion that you are paying a higher expense for a screen that still leaves you with market-like exposure and thus consistent underperformance versus the broad market. The second issue is that SRI investments tend to be negatively correlated with the energy sector (since many oil companies are screened out). Much of the performance can be explained by moves in oil prices. But it is the purest way to really avoid the companies perceived to be doing harm.

ESG looks to address some of the SRI issues through its inclusionary process. The thesis is that ESG is a risk factor that can be attributable to boosting historic returns. This factor is a component of quality within companies – more stable and profitable companies that 1) have money to spend on bettering the environment, 2) care about their employees, and 3) have a diversified board of directors that have their shareholders in mind, should perform better over time. Particularly, these companies have more confident management, which may be able to weather market downturns and avoid lawsuits from financial and environmental wrongdoing.

Impact Investing, on the other hand, is the easiest way to answer the question, “How are my investments actually helping make the world a better place?” The companies and bonds utilized are striving for that exact purpose.

As you can see, there are many flavors of values-based investing and no one-size-fits-all solution. But it is important to understand the different variations as it becomes increasingly important in the future, for example, as more values-conscious millennials begin saving more for retirement. Ultimately, understanding ESG will help financial advisors and asset managers make the most appropriate investment decisions for their clients.

Find out how you can accommodate your clients’ Environmental, Social, and Governance (ESG) preferences while adding tax alpha to their portfolios using direct indexing. Learn more here!

2555-OPS-10/06/2020

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.