Investors remain extremely cautious. There is a very tall “Wall of Worry,” which is not a surprise given the news regarding COVID-19 and the emotions surrounding the presidential election.

The idea behind the “Wall of Worry” is that the stock market typically moves higher at an above-average pace when investors are overly cautious or negative. This year has been no exception. Those studies have only been fortified (https://www.aaii.com/SentimentSurvey).

Not only have investment flows been strongly negative as of late, but a few sentiment surveys illustrate outsized caution, including Yale’s U.S. Crash Confidence Index, which recently showed all-time-high levels of concern among individual investors. These are contrarian signals and typically a plus for future market returns.

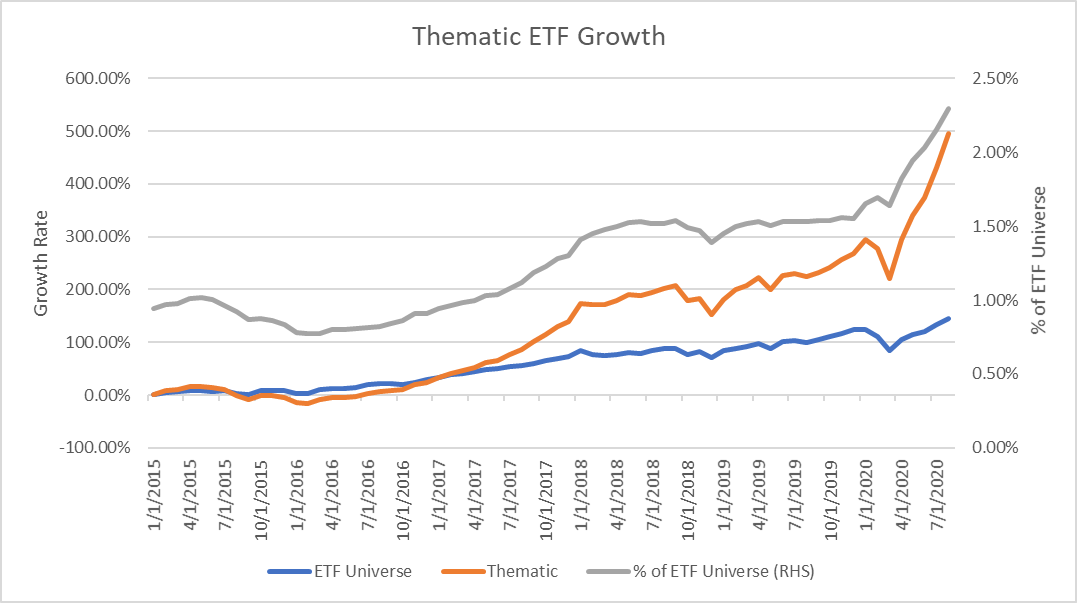

As an investor, this is a bullish sign. As an investment advisor/counselor though, how can we get investors to engage with the market, at least to their appropriate risk levels? One way is investing through investment themes. Thematic ETFs, for instance, have been witnessing 2x the growth since 2015 as the overall ETF industry has (which itself is growing at nearly 20% per year). Further, Thematic ETFs have outperformed the overall U.S. market return by more than 500 basis points on a YTD-basis, as of September 30, 2020.

Megatrends

To build wealth, we need to invest and stay invested (and rebalance or adjust portfolios when appropriate). Yet, many investors are not fully participating in the stock market. Various sentiment surveys and actual investment flows show most investors are extremely cautious. There are plenty of obvious reasons for caution, but I believe one of the most significant is the uncertainty created by the long-term structural and transformational forces changing how we work and live.

Some may call these forces innovation, but that doesn’t capture their psychologically disruptive effects. A more useful term becoming widely adopted is “megatrends.” It is helpful to understand and appreciate megatrends, not only in terms of their impact on our lives but also as potential investments. Investing in megatrends allows investors to participate in their potential upside growth while also hedging against disruptive change.

This is where “thematic” investment strategies come into play. Investment themes are essentially stories that investors can understand and appreciate. They have real-world, relatable examples. Investors can see the changes going on in society and the economy. These changes are structural forces, not cyclical, and they are shaping the future.

Investment themes can be helpful lenses through which to contextualize these changes as they don’t fit into traditional technical boxes. Importantly, and in a good way, they don’t behave like conventional market exposures. It could be argued that megatrend investments could become core positions, i.e., the majority of one’s holdings. For now, they are being initiated into portfolios as satellite positions.

Thematic strategies aren’t just tidy narratives either. They have genuine investment merit, and they typically fall outside of conventional portfolio analysis. They are often unconstrained, typically global in nature, and frequently allocated across several traditionally classified economic sectors.

They also tend to drum to their own beat, meaning they don’t necessarily behave in lockstep with the rest of the market. To get technical, this means they have lower-than-average correlations and thus tend to provide more diversification benefits than many conventional investments. This might even be the case in situations where they have more volatility than the market themselves.

And, of course, it’s not just about overall portfolio risk management. Thematic strategies offer potentially attractive returns moving forward. They have performed well in the aggregate so far this year, but that doesn’t mean all of the juice has been squeezed out of future returns. I believe these structural changes are in the early innings of consumer and investor adoption.

In the ETF world, thematic ETFs are growing fast and taking market share. There are many solid ETF providers in this space, providing both quality portfolios and excellent resources, including educational materials, to accompany them. State Street Global Advisors’ SPDR ETFs (which include their New Economy ETFs, such as KOMP), GlobalX, and the Ark Funds are notable examples. Another is Blackrock’s iShares and their Megatrend ETFs. iShares has even recently expanded its offerings to include a few actively-managed megatrend ETFs.

“Megatrends are driving the world’s economic, social, and technological transformation, presenting tremendous investment opportunities and investor demand. We are still in the early days of growth for these funds. iShares projects that the megatrend category is projected to grow 500%, to $250bn, by 2024,” said head of iShares Americas, Armando Senra.

iShares has identified five megatrends:

In sum, long-term investors can enhance their portfolios or re-engage with the markets through thoughtful and well-designed thematic strategies that participate in the structural economic forces impacting our lives. Orion Portfolio Solutions, for instance, will be launching a co-branded Megatrends strategy with iShares in the months ahead.

To find out more and to stay on top of all the exciting things going on at Orion, click here.

2583-OPS-10/08/2020

The CFA® is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/