Hope you had a great weekend. We finally got some warmer weather in Omaha – it was nice to get outside in less than a heavy winter coat!

The market has a lot to digest to start the new week. Last week’s month-end capped the S&P 500’s best January since 2019 and capped the NASDAQ’s best January since 2001 (Morningstar, Feb. 2023). Investor sentiment seems to be on the rise given these recent gains, though last week’s rate hike and employment report suggested we’re not quite done with inflation. With a slowed rate hike from the Fed and very unexpected strength in new jobs added, it’s looking likely that inflation remains sticky.

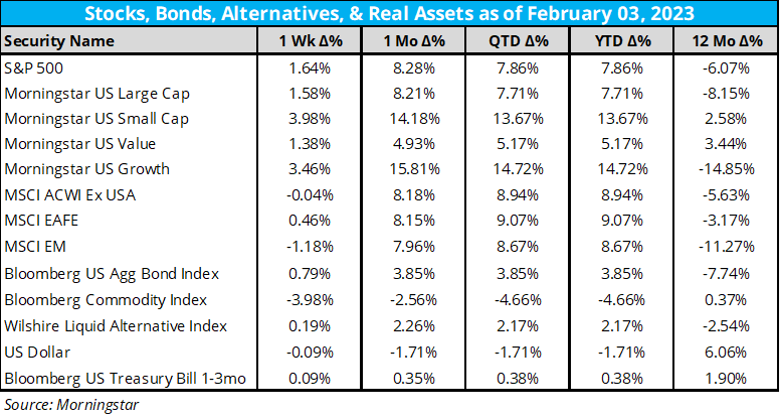

On the back of those economic data releases, domestic markets were broadly positive last week, while international markets were closer to flat. Performance highlights:

- The S&P 500 gained nearly 2% on the week. Up nearly 8% year-to-date (Morningstar, Feb. 2023).

- Bonds gained almost 1% last week, up nearly 4% on the year – balanced portfolios are off to a much better start for 2023 (Morningstar, Feb. 2023).

- As inflation is easing and energy prices come down, broad commodities are down almost 5% year-to-date (Morningstar, Feb. 2023).

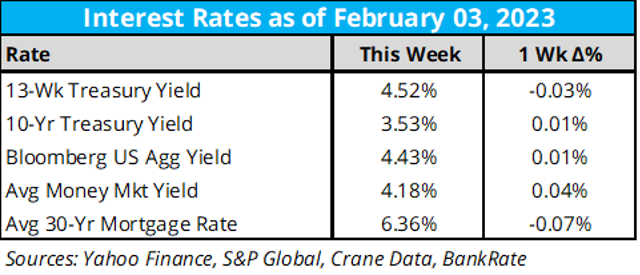

As for key rates last week:

Deeper Dive

It’s nice to see that mortgage rates have continued to decline in the face of other rates rising – this means more savings for new homebuyers, and an easier road to rises in demand for new home sales (Bankrate, Feb. 2023).

Cash accounts have reached all-time high levels (as of January 18, 2023) as noted in the BofA Global Research chart included in an Investing.com article from January 31, 2023, “U.S. Stock Market Has Plenty of Reasons to Rally After Fed’s Decision”. This could be interpreted several ways, but recent bearish sentiment and rising money market yields are the likely culprits. These rapid increases in yields have allowed money markets to once again be a legitimate alternative to stocks and bonds, which is timely given market skepticism (Investing.com, Jan. 2023).

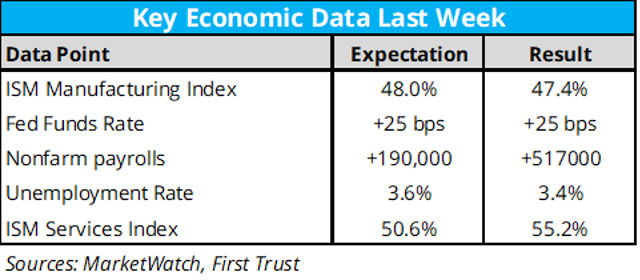

Last week was jam-packed with economic data. Most notable for markets was the increase in the federal funds rate by another 25 basis points, which received a positive response, and a much more positive than expected employment report, which received a mixed, but overall positive response as well (MarketWatch and First Trust, Feb. 2023).

A few more notes on global interest rate movements:

- Wednesday’s 25 basis point hike by the Federal Reserve represented the smallest hike since March 2022, and the Fed signaled that there will be “ongoing increases in the target range…to return inflation to 2 percent over time.” (Federal Reserve, Feb. 2023)

- The Bank of England increased rates by 50 basis points last week but indicated that they may be ready to pause rate increases as inflation cools (CNBC, Feb. 2023).

- The Bank of Canada increased rates by 25 basis points two weeks ago and indicated their intent to pause hikes after eight consecutive increases (CNBC, Feb. 2023).

Unemployment is now at its lowest level since the 1950s, and, according to Bespoke Investments, the current streak of 10 months of nonfarm payrolls beating consensus expectations is double the previous longest streak of five months (Bespoke, Feb. 2023). The labor market continues to show signs of strength (Bespoke, Feb. 2023).

Another look at the severity of the jobs-growth surprise: According to Bloomberg, this is only the second time in 25 years that nonfarm payrolls have exceeded the most optimistic analyst estimate by over 200,000 jobs (Bloomberg, Feb. 2023).

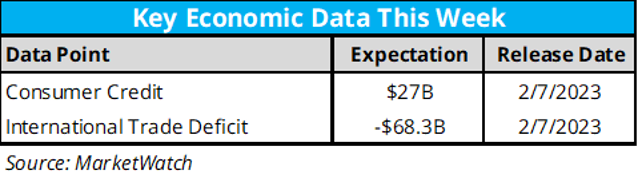

The economic data calendar is light this week:

Atlanta Fed's GDPNow projection for first-quarter GDP remained unchanged last week at just 0.7% (GDPNow, Feb. 2023).

An update on earnings from Factset Earnings Insights on February 3:

- Earnings Scorecard:For Q4 2022 (with 50% of S&P 500 companies reporting actual results), 70% of S&P 500 companies have reported a positive EPS surprise and 61% of S&P 500 companies have reported a positive revenue surprise (Factset, Feb. 2023).

- Earnings Growth:For Q4 2022, the blended earnings decline for the S&P 500 is -5.3% (Factset, Feb. 2023). If -5.3% is the actual decline for the quarter, it will mark the first time the index has reported a year-over-year decline in earnings since Q3 2020 (-5.7%) (Factset, Feb. 2023).

- Earnings Guidance:For Q1 2023, 37 S&P 500 companies have issued negative EPS guidance and six S&P 500 companies have issued positive EPS guidance (Factset, Feb. 2023).

Crypto Corner – Grant Engelbart, CFA, CAIA, Brinker Capital Sr. Portfolio Manager

- Cryptocurrency prices cooled some last week, with Bitcoin dropping 4% to just under $23,000 (CoinMarketCap, Feb. 2023). Ethereum fell less than 2%; Polygon was positive on the week, and Solana dropped 11% (CoinMarketCap, Feb. 2023).

- The UK has outlined a ‘consultation’ for crypto regulation (Arcane Research, Feb. 2023). FTX is asking politicians to return any campaign donations back to the company (Arcane Research, Feb. 2023). Ninety-nine year-old Charlie Munger called for a U.S. ban on cryptocurrencies again via a Wall Street Journal op-ed (Wall Street Journal, Feb. 2023). NFTs can now be minted on the Bitcoin blockchain via what are known as ‘ordinals’ (Galaxy.com, Feb. 2023).

- The Defiance Digital Revolution ETF (NFTZ) will close February 28, 2023 (DeCrypt, Feb. 2023).

Additional Resources

“Leadership begins with your behavior. People gravitate toward the standard you set, not the standard you request.” - James Clear (Goodreads, Feb. 2023).

On this week’s Orion's The Weighing Machine podcast we talk to our very own Eric Clarke, Orion Founder and Board member. In short, Eric, Rusty, and Robyn discuss the holistic vision of Orion and how Orion’s recent acquisitions and new business segments fit together to help advisors. Eric also touches on his opinion of the future of the fiduciary advice business and what he’s most excited about during the upcoming Orion Ascent conference. Certainly, a can’t-miss episode!

Thanks for reading and have a great week! As always, please let us know what we can do better at rusty@orion.com or ben.vaske@orion.com. Invest well and be well.

For financial advisors to get this commentary delivered straight to your inbox, please subscribe at orionportfoliosolutions.com/blog.

0357-OPS-2/7/2023

Orion Portfolio Solutions, LLC, a registered investment advisor, is an affiliated company of Brinker Capital Investments, LLC, a registered investment advisor, through their parent company, Orion Advisor Solutions, Inc.

The CFA is a globally respected, graduate-level investment credential established in 1962 and awarded by CFA Institute — the largest global association of investment professionals. To learn more about the CFA charter, visit www.cfainstitute.org.

The CMT Program demonstrates mastery of a core body of knowledge of investment risk in portfolio management. The Chartered Market Technician® (CMT) designation marks the highest education within the discipline and is the preeminent designation for practitioners of technical analysis worldwide. To learn more about the CMT, visit https://cmtassociation.org/.

The CAIA® is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments. To learn more about the CAIA, visit https://caia.org/.